Why Doctor Copper is Waving a Red Flag

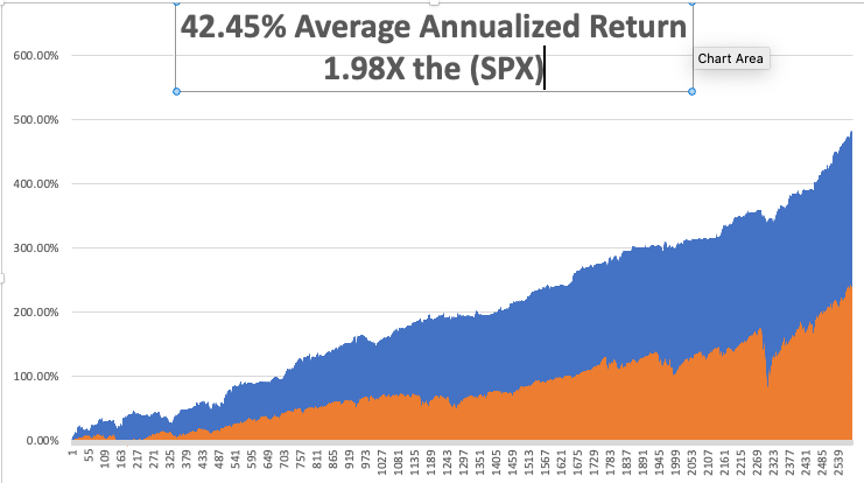

One of my responsibilities as a global strategist is to talk about how cheap stocks are at market bottoms, and how expensive they are at market tops. In all honesty I have to tell you that 9 ½ years into a bull market, we are now much closer to a top than a bottom.

If Dr. Copper has anything to say about it the global economy is already in a recession. Since the June peak, trade wars have taken the red metal down a gut-punching 22.7%. The world’s largest copper producer Freeport-McMoRan (FCX), a Carl Icahn favorite, is off an eye-popping 30.6% during the same period.

Should we be running around with our hair on fire? Is it time to throw up on our shoes? I don’t think so…not yet anyway.

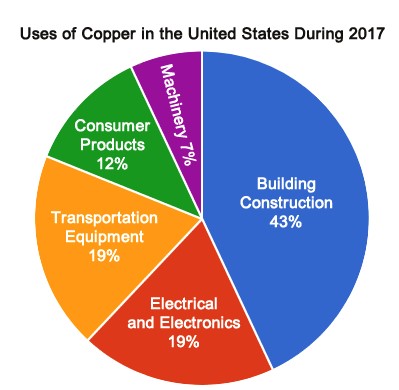

Dr. Copper achieved its vaunted status as a leading indicator of economic cycles for the simple reason that everyone uses copper. Building and construction took up 43% of the supply in 2017, followed by electronics (19%) and transportation equipment (17%).

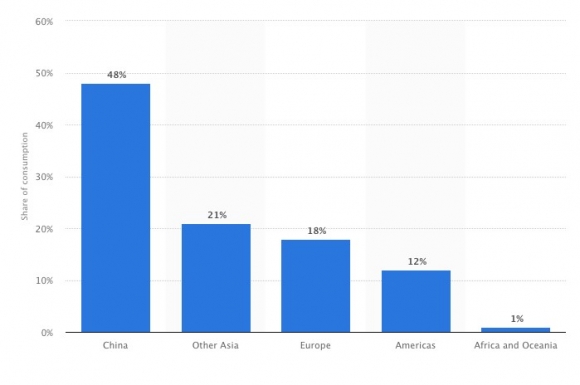

China is far and away the world’s largest consumer of copper. In 2017, it bought 48% of total world output. However, red flags there are flying everywhere.

Back in the 2000s, when China was building a “Rome a Day,” demand for copper seemed limitless. Since then, Chinese construction has fallen to a low ebb as the greatest infrastructure build-out in history came to completion.

China has steadily moved from an export-oriented to a services-driven economy, further eroding the need for copper. I warned investors of this seven years ago. That is why the Mad Hedge Fund Trader has issued virtually NO commodities-based Trade Alerts since then.

Before the last financial crisis Chinese banks accepted copper ingots as collateral for business loans. That practice is now banned.

In the second quarter, nonperforming loans at Chinese banks notched their biggest rise in more than a decade, according to research from Capital Economics. Corporate bond defaults are on the rise, and earlier this week, official reports showed Chinese investment growth, which has long been a driver of the economy, fell to its lowest level since the late 1990s.

The pressure on the Chinese economy is beginning to take its toll in other places, too. China’s currency, the renminbi, has fallen more than 9% against the dollar in the past six months, and China’s CSI 300 index of blue chip stocks is off 19% this year.

The net effect of all of this has been to dilute the predictive power of copper. Copper may no longer deserve its PhD in economics, perhaps only a master’s degree or an associate of arts.

Copper is not alone in predicting imminent economic disaster. Oil (USO) has also been shouting the same. Texas tea has fallen by 15.8% since copper began its swan dive two months ago.

For sure, oil has been falling for its own reasons. Iran has sidestepped American sanctions by selling its oil directly to China, and there is nothing the U.S. can do about it. Every year, global GDP growth needs less oil to grow than before thanks to alternative energy sources and conservation. A recent bout of OPEC quota cheating hasn’t helped either.

As any market strategist will tell you, falling copper and oil prices are not what sustainable bull markets in stocks are made of. I’m not saying a crash will happen tomorrow.

Personally, I believe that the bull market should spill into 2019. But when corporate earnings growth downshifts from 26% to 5% YOY, as it will in Q1 2019, watch out below!