Why I?m Covering My Bank Short

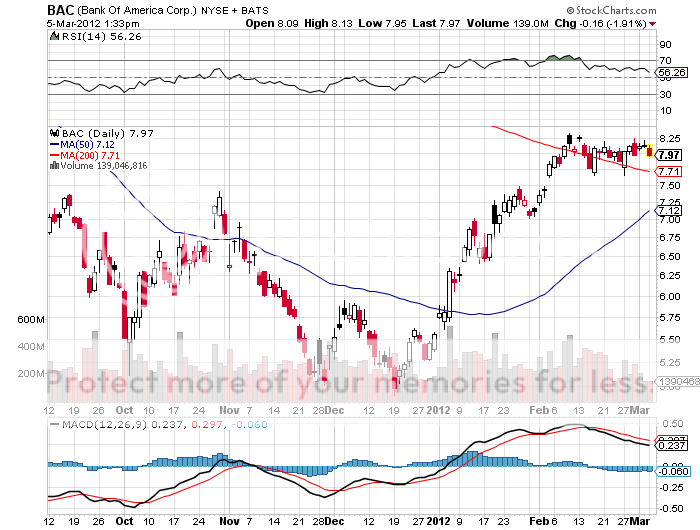

I am going to use the weakness in Bank of America shares today to cover my short position through selling my existing position in the (BAC) May, 2012 $7 puts at $0.24 cents or best. There is such minimal volatility in the market these days that when a little bit comes along, you have to grab it with both hands.

The poor performance of these puts illustrates well the general malaise of the market. Despite catching a five cent drop in the share price, the value of these April puts fell from 40 cents to 24 cents. This is what happens when option time decay is added in with falling market volatility. This is why many option strategies are failing to work now.

When I recognized that this could become a prolonged problem, I responded with a rash of short volatility positions which have proved highly profitable. These include running deep in the money bull call spreads in Microsoft (MSFT) and Apple (AAPL), and naked sales of deep out of the money Apple calls.

I could have sold the (BAC) puts twice over the last 19 days for a profit as high as 30%. I held on both times hoping that the long overdue downward momentum would develop. That never materialized. The shares only made it down to $7.66, well short of my $7 target. The lesson here is that in these market conditions you have to keep your time frames as short as possible. Taking the money and running is the winning approach.

There are other reasons to punt on this position. The February non-farm payroll that comes out this Friday is expected to be good, possibly over 200,000. That could trigger another rally in (BAC) shares. Weekly jobless claims are at new lows for this cycle.

New housing sales are also showing a glimmer of life. Any good news on real estate is also positive for banks, no matter how ephemeral it might be, because it suggests that their bad loan portfolios may recover a bit. So it is better to sit on the sidelines on this one and take advantage of better entry points that may come along higher up.