Why It's a "Sell the News" Market

It could have been the 3.0% print on the yield for the US 10-year Treasury bond yield (TLT).

It could have been the president's warlike comments on Iran.

It could even have been rocketing commodity prices that are driving consumer staple stocks out of business.

No, none of these are the reason why the stock market melted down 700 points intraday yesterday.

The real reason is that we have had too much fun for too long.

Some nine years and 400% into this bull market, investors are starting to take some money off the table.

Not a lot mind you, but enough to make a big difference on a single day.

The Fed was seen carrying off the punch bowl, and the neighbors have called the police. Clearly, the party is over. At least for now.

If you had to point to a single cause of the Tuesday rout in share prices it had to be Caterpillar's (CAT) rather incautious prediction that its earning peaked for this business cycle in Q1, and it was downward from here.

Traders, being the Einstein's that they are, extrapolated that to mean that ALL companies saw earnings peak in Q1, and you get an instant 700-point collapse.

I think they're wrong, but I have never been one to argue with Mr. Market. You might as well argue with the tides not to rise.

In a heartbeat, investors shifted from a "sell earnings on the news" to "sell NOW, earnings be damned."

All of this vindicates my call that markets would remained trapped in a wide trading range until the November congressional elections.

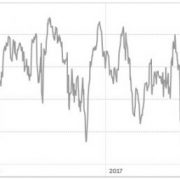

This has been further confirmed by the three-year chart of my Mad Hedge Market Timing Index.

For the second time this year, the Index peaked in the 40s, instead of the 80s, which is what you normally get in a bull market. The new trading strategy for the Index is to buy in the single digits and sell in the low 40s.

This is why I have been aggressively taking profits on long positions and slapping on short positions as hedges for the remaining longs. The Global Trading Dispatch model portfolio went into this week net short.

My Mad Hedge Technology Letter has only one 10% position left, in Microsoft (MSFT).

While a 3% 10-year is neither here nor there, the rapidly inverting yield curve is. The two-year/10-year spread is now a miniscule 53 basis points.

The 10-year/30-year spread is at a paper thin 18 basis points. To show you how insane this is, it means investors are accepting only an 18-basis point premium for lending money to the US government for an extra 20 years!

This is a function of the US Treasury focusing its new gargantuan trillion dollar borrowing requirements at the short end of the curve. This is the exact opposite of what they should be doing with yields still close to generational lows.

What this does is create a small short-term budgetary advantage at a very high long-term cost. This is constant with the government's other backward-looking Alice in Wonderland economic policies.

When the yield curve inverts, watch out below, because it means a recession is near.

If the stock market continues to trade like this, as I expect it will, you can expect the next stock market rally to start in two months when we ramp up into the Q2 earnings reports.

Until then, we will probably just chop around. Enjoy your summer.