Why Lithium is About to Replace Oil

The current nuclear winter in the EV industry is the worst in the history of the industry and there has been no worse affected supplier than the lithium industry.

Flattening sales and increased competition have smashed the share prices of companies like Tesla (TSLA) and many smaller entrants are unlikely to make it out alive.

But conditions can’t remain this horrible forever and there are some fantastic long-term bargains to be had among the big lithium miners for the patent and the discipline.

Would you be interested in buying a commodity that will become the basis for the global economy for the second half of the 21st century?

How about a commodity that is about to see a 100 times increase in demand. It will also become the world’s most widely traded commodity.

The market for Lithium (Li) is about to explode. What we are witnessing now is nothing less than the transition from a carbon to a lithium-based economy. This is a big deal.

I mention this now because we have just been blessed with a great entry point for the entire sector. The government of Chile has raised its lithium mining quota by 400%, causing all shares in the sector to crater.

But this is just a temporary setback. Global demand should handily grow into the new supply.

This is not a new trade for us. I first started writing about lithium in 2009, piling readers into Chile’s Sociedad Quimica Y Minera (SQM), bringing in a handy 440% pop-off the lows (click here for “The Skinny on Lithium” ).

After that, the stock was demolished by the peaking in 2013, and the subsequent collapse of oil prices which took down the entire lithium, rare earth, solar, and alternative energy space. At the end of the day, it’s all one trade about energy.

We saw an almost perfect double bottom in 2015, and since then, the stock has tacked on another perfect 440% gain. We are now plumbing new lows.

Except that this time, it’s different.

Back in 2009, when (SQM) began its first springboard move, the global electric car industry was but a twinkle in Elon Musk’s eye. Lithium demand was limited to use in cell phones with tiny batteries.

Fast forward 15 years, and it’s a different world.

Tesla total car production since inception has topped an eye-opening 6 million. It is ramping up to produce 20 million units a year. And dozens of other major car manufacturers also have all-electric models in showrooms.

And here’s the real kicker. A cell phone uses a miniscule average of seven grams of lithium. A Tesla Model-1 uses 10,000 times that quantity!

In the coming years, we will transition from a global lithium glut to a structural shortage. That is great for share prices….everyone’s.

Tesla brought online its lithium-ion battery-producing Gigafactory in nearby Sparks, Nevada, a joint venture with Japan’s Panasonic. A second Gigafactory has already been completed.

It gets better.

Ten states and countries will eventually ban the sale of new internal combustion engines, and the list is growing.

The Netherlands starts in 2025, followed by Germany in 2030, and Britain and France in 2040.

Norway, which ironically is a major oil exporter, wants to go all-electric as soon as possible.

California, which accounts for 20% of all US car sales, is demanding 100% of new car sales be zero emission by 2035. China has a similar phase in.

Adding together the lifetime cost of operating a vehicle, and averaging out the cost per year, Tesla’s are cheaper than running a conventional car TODAY! It will be the market that dictates that all new sales of vehicles go electric, not some government edict.

You just pay for all of the lifetime need for fuel up front, and make it back over time through a zero cost of maintenance.

Add all this up, and total lithium demand should soar to 470,000 by 2025. That’s a lot of lithium.

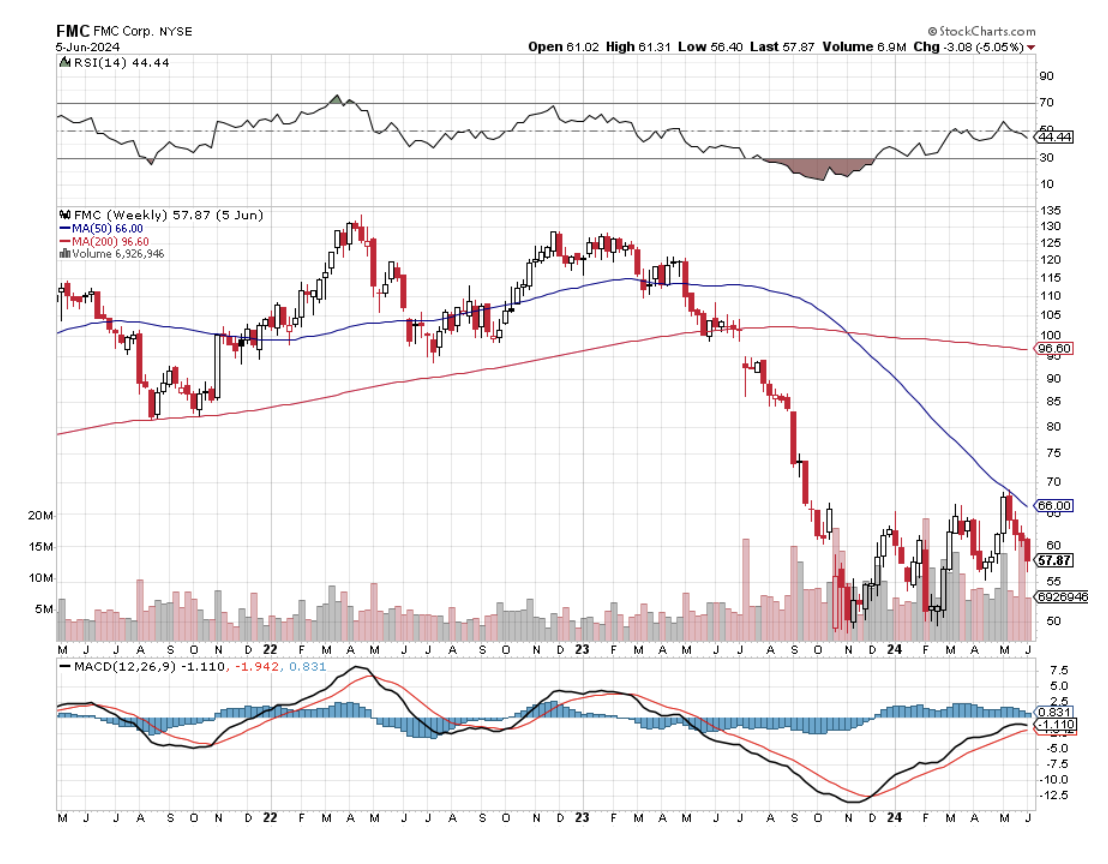

Until now, the bulk of the world’s lithium is produced by three companies, (SQM) mentioned above, North Carolina-based special chemical maker Albermarle (ALB), and Pennsylvania-based (FMC) Corp.. The rest of the listed lithium-producing companies are all penny stocks.

All three of these companies obtain their lithium supplies in the same corner of Chile, Bolivia, and Argentina which has the unique geology to cheaper surface mine this white, highly reactive metal.

These are referred to as “lithium brines” where the target metal can be easily obtained through a simple crystallization process.

And here’s the dirty little secret of lithium mining. What do these three countries have in common? Cheap labor and the virtual absence of environmental controls. This is why you will never see competitors emerge from the US or Australia.

What could upset the apple cart for lithium? A totally new battery technology based on other elements could emerge to replace lithium.

There are many on the drawing board. This list includes graphene supercapacitors, redox flow, aluminum graphite, solid state, and biochemical batteries, powered roads, and high-output thin film solar panels.

Several of these also use lithium, but not to the extent that existing lithium-ion batteries do.

But some have come close to challenging lithium’s advantages in cost and scale production.

But then in the tech business, you never say never.

I worked on my first electric car at UCLA 50 years ago as part of a graduate engineering project, and I’m surprised that it has taken this long to get this far.

But then massive government subsidies for the oil industry are a hard thing to run against for anyone.

There is a Future in Lithium

The Gigafactory in Sparks Nevada