Why Warren Buffet Hates Gold

Those in the investment business are well used to the Armageddon crowd. These are the guys who are perennially predicting the collapse of the dollar, the default of the US government, hyperinflation, and the end of the world.

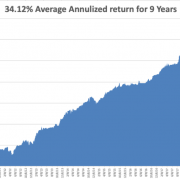

Maybe after 11 years of rising, stocks are finally expensive on a relative basis?

Their perennial recommendations are to keep all your assets in gold and silver, store at least a year’s worth of canned food, and keep your untraceable guns well-oiled and supplied with ammo, preferably in high capacity magazines.

If you followed their advice, you lost your shirt.

I have broken many of these wayward acolytes of their money-losing habits. But not all of them. There seems to be an endless supply emanating from the hinterlands.

The “Oracle of Omaha” Warren Buffet often goes to great lengths to explain why he despises the yellow metal.

The sage doesn't really care about the gold, whatever the price. He sees it primarily as a bet on fear. I imagine he feels the same about Bitcoin, the modern tulips of our age.

If investors are more afraid in a year than they are today, then you make money on gold. If they aren't, then you lose money.

The only problem now is that fear ain’t working.

If you took all the gold in the world, it would form a cube 67 feet on all sides, worth $5 trillion. For that same amount of money, you could own other assets with far greater productive earning power, including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*Two Apple’s (AAPL), the largest capitalized company in the world at $3 trillion.

Instead of producing any income or dividends, gold just sits there and shines, making you feel like King Midas.

I don't know. With the stock market at an all-time high, and oil trading at $70.49/barrel, a bet on fear looks pretty good to me right now.

I'm still sticking with my long-term forecast of the old inflation-adjusted high of $2,300/ounce. But it might be very long term.

It is just a matter of time before emerging market central bank buying pushes it up there. And who knows? Fear might make a comeback too.