Why You Will Lose Your Job in the Next Five Years, and What to do About it

Yes, it’s happening.

And if you lose your job to AI in five years you will be one of the lucky ones.

It’s possible that your job is already gone, they just haven’t told you yet.

The shocking conclusion I am getting from dozens of research fronts is that artificial intelligence and automation are accelerating far faster than anyone realizes.

It is all extraordinarily disruptive.

This will cause corporate profits to rocket and share prices to soar but at the price of higher nationwide political instability.

A big leap took place at the beginning of the year when suddenly it appeared that everything got a lot smarter.

My local Safeway has started using self-checkout scanners to enable customers to avoid the long lines still operated by humans.

I hate them because I can never get them to scan pineapples correctly.

Soon, Amazon (AMZN) opened a supermarket in Seattle where there is no checkout stand at all. You simply just pick up whatever products you want, and it will scan them all on the way out to the parking lot.

Once the software is perfected (it is self-learning), and the consumers are educated, 5 million checkout clerks will be joining the unemployment lines.

Uber has been testing self-driving taxis in Phoenix, AZ, with sometimes humorous results. It seems that other human-driven cars like crashing into them. There has been one fatality so far when the human safety driver was caught texting.

When they figure this out, probably in two years, 180,000 taxi drivers and 600,000 Uber and Lyft drivers will have to hit the road.

Some 3 million truck drivers will be right behind them.

Notice that I am only a couple of paragraphs into this peace and already 8,780,000 jobs are about to imminently disappear out of a total of 150 million in the US.

Two decades from now, only vintage car collectors or the very poor will be driving their cars if Tesla (TSLA) has anything to do with it.

I let my Model X drive me around most of the time. It has reaction time, night vision, and a 360-degree radar system that are far better than my 71-year-old senses.

However, all new Teslas now come equipped with the hardware to use it. They are all only one surprise overnight software upgrade away from the future.

And it's not just the low-end high school dropout jobs that are being thrown in the dustbin of history.

Automation is now rapidly moving up the value chain.

A rising share of online news is machine-generated and is targeting you based on your browsing history. You just didn’t know it.

It was a major influence in the last election.

Blackrock (BLK), the largest fund manager in the country, has announced that it is laying off dozens of stock analysts and turning to algorithms to manage its vast $8.6 trillion in assets under management.

As the April 15 tax deadline relentlessly approaches, you are probably totally unaware that an algorithm prepared your return, particularly if you use a low-end service like H & R Block (HRB) or Intuit’s (INTU) TurboTax.

Because of the simultaneous convergence of multiple technologies, half of all current jobs will likely disappear over the next 20 years.

If this sounds alarming, don’t worry.

We’ve been through all of this before.

From 1900 to 1950 farmers fell from 40% to 2% of the labor force. The food output of that 2% has tripled over the last 60 years, thanks to improved seed varieties and farming methods.

The remaining 38% didn’t starve.

They retrained for the emerging growth industries of the day, automobiles, aircraft, and radio.

But there had to be a lot of pain along the way.

More recently, some 30% of all job descriptions listed on the Department of Labor website today didn’t exist 20 years ago.

Yes, disruption happens fast.

And here’s where it gets personal.

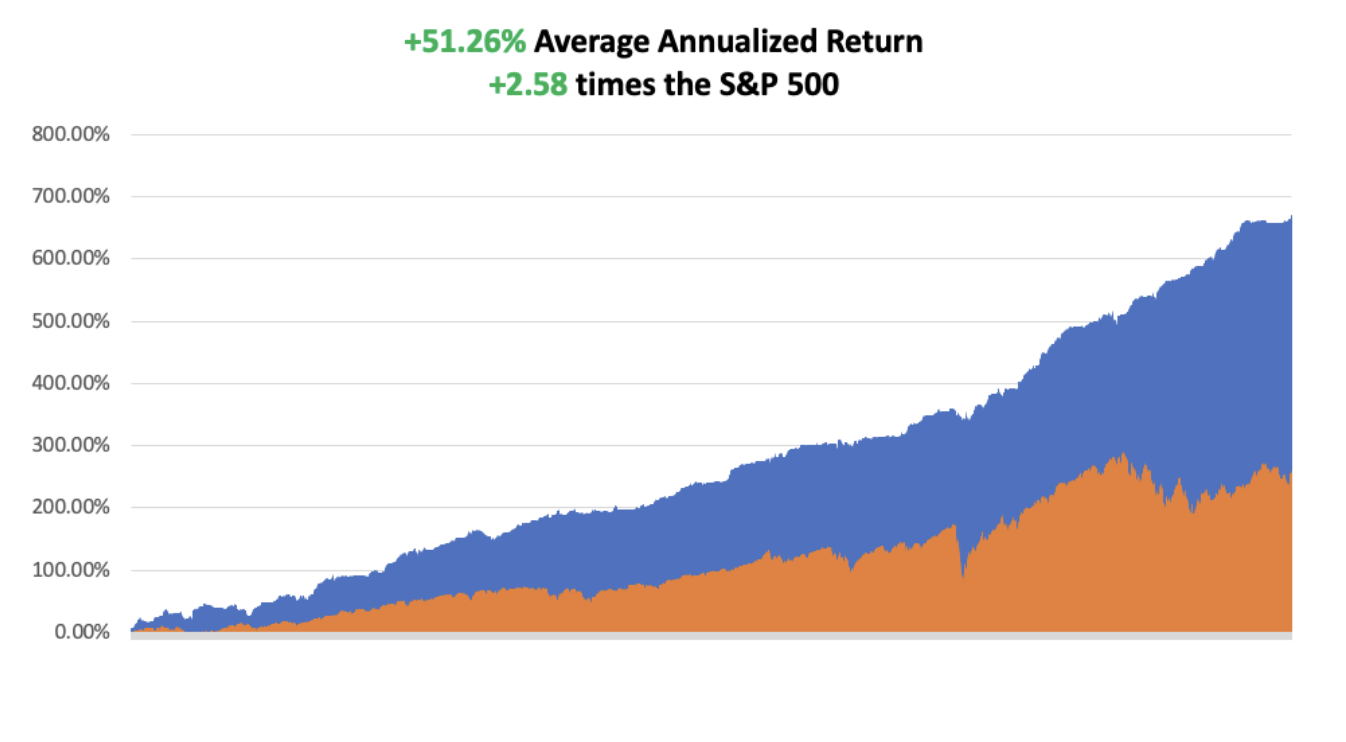

Since I implemented an AI-driven, self-learning Mad Hedge Market Timing algorithm to assist me in my own Trade Alert service six months ago, MY PERFORMANCE HAS ROCKETED, FROM A 21% ANNUAL RATE TO 51%!

As a result, YOU have been crying all the way to the bank!

The proof is all in the numbers (see chart below).

Those trading without the tailwind of algorithms today suddenly find the world a very surprising and confusing place.

They lose money too.

The investment implications of all of this are nothing less than mind-boggling.

Wages are almost always the largest cost for any business, especially the labor-intensive ones like retailing, fast food, and restaurants.

Reduce your largest expense by 90% or more, and the drop through to the bottom line will be enormous.

Stock markets have already noticed.

Maybe this is why price-earnings multiples are trading at a multi-decade high of 19.5X.

Perhaps, the markets know something that we mere humans don’t?

It also is the largest budgetary item in any government-supplied service.

I bet that half of the country’s 7 million teaching jobs will be gone in a decade, taken over by much cheaper online programs.

Today, my kids do their homework on their iPhones, complete class projects on Google Docs, and get a report card that is updated and emailed to me daily.

They’re probably to last generation to ever go to a physical school.

(That’s life. Just as the cost of driving them to school every day becomes free, they don’t have to go anymore).

You can always adopt a “King Canute” strategy and order the tide not to rise.

Or, you can rapidly adapt, as I did.

The choice is yours.