Will the Tech IPO Market Thaw?

I wouldn’t say that the IPO market is back - hardly not.

There is still a long way to go before the floodgates open, but the ARM IPO is a good start and its successful debut is a good example for others that are sitting off the fence.

British chipmaker Arm (ARM) debuted on the public markets jumping 25% in trading.

The chipmaker's go-public is the most high-profile IPO that the Nasdaq has seen since 2021's IPO boom, which cycled into a bust in 2022.

However, just because these IPOs are moving doesn't mean their valuations are not a sticking point. In Arm's case, the company reportedly sought a valuation of between $60 billion and $70 billion.

Likewise, Instacart — valued at $39 billion at the close of its 2021 funding round — is reportedly now seeking a $9.3 billion valuation.

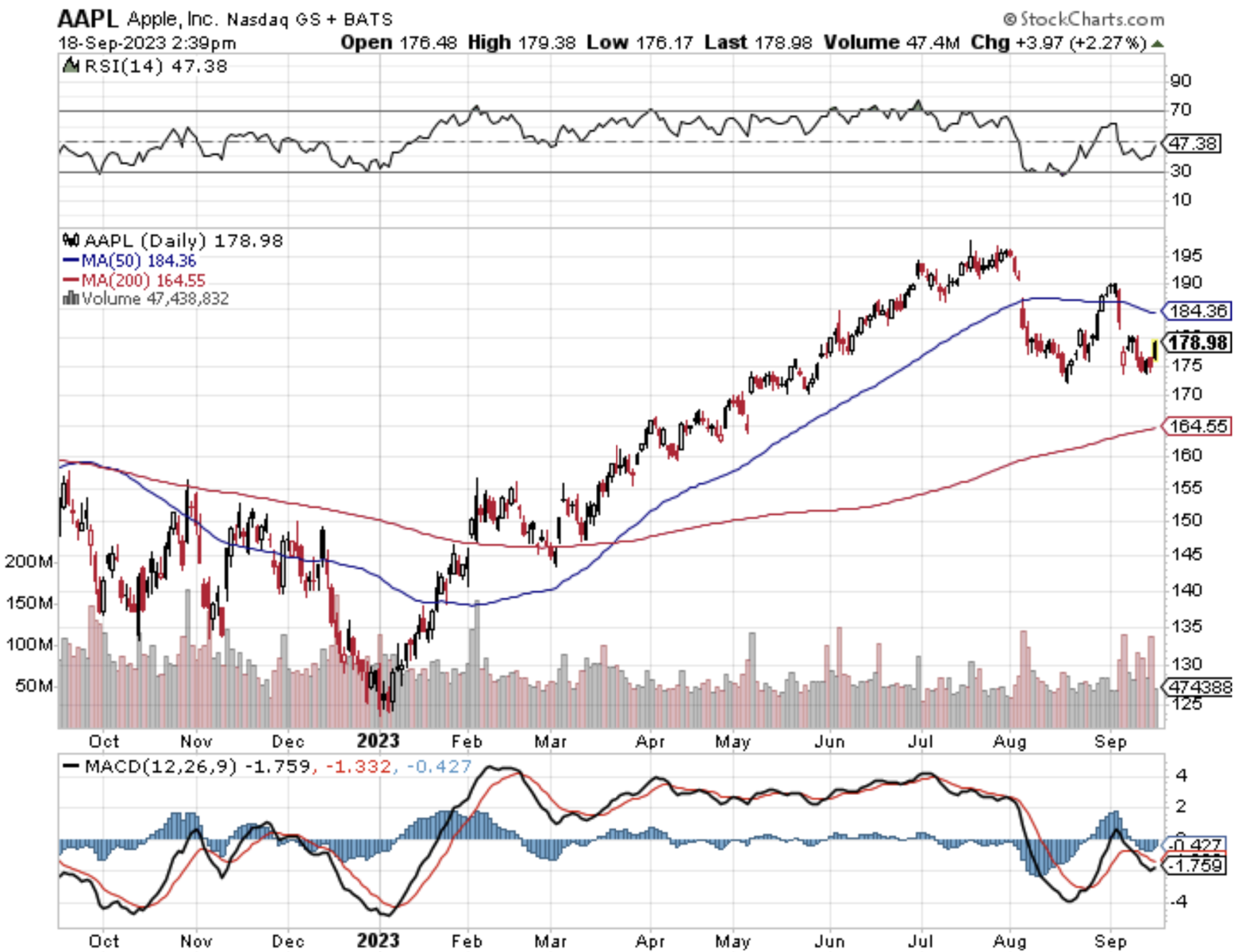

Arm is a unique company, especially among tech companies. As a chip designer, Arm's customers include some of the biggest names in tech, including Apple (AAPL).

The company has been through a number of transitions over the last several years. In 2016, SoftBank acquired Arm, taking it private for around $30 billion. In 2021, Nvidia (NVDA) attempted to acquire Arm in a deal that failed after regulatory tussling for almost a year and a half.

Recently, Arm has sought to shift its revenue model, altering pricing and rolling out a changed customer licensing strategy.

In short, Arm's return to the public markets was a pivotal moment.

The positive response to this IPO won’t thaw the IPO market completely but will set the stage for 2024 such as payment processor Stripe and computer software provider Databricks.

I will say that the bar has risen significantly for tech firms who want to go public.

Before, many could go public with just hope and dreams with promises of a pot of gold at the end of the rainbow.

This usually meant paltry revenue and massive cash burn at the time of IPO.

Moving forward, it’s obvious that tech companies will need to be more mature to go public and there will be more emphasis on quality management than any time before.

This is because interest rates are still highly elevated and management teams won’t be able to tap the debt markets so easily for a bailout.

Artificial intelligence-related IPOs will also be in an advantageous position to do well post-IPO because that is where the hot money is targeting.

Instead of a slew of capital chasing the new IPOs, I do believe we default back into a rotation of big tech being the safety trade.

Higher bond yield and accelerating tech stocks is an odd couple that appears to be working like clockwork in 2023.

The next spike up in yield could happen soon with the catalyst being the price of a barrel of oil hitting that $100 per barrel mark.

As for ARM, it’s sitting at $56 per share which is down from the $65 per share.

Once the euphoria subsides, wait for a dip in the $40s to buy into ARM, at that price, ARM would be valued at around $50 billion and I would call that a steal for the long-term buy-and-hold readers.