Get With The Times

Brad Gerstner is the Founder and CEO of Altimeter Capital, a tech investment firm based in Silicon Valley and a big shareholder of Meta or Facebook.

On Monday morning, Gerstner wrote an “open letter” to the CEO of Meta Mark Zuckerberg essentially telling him that he has no idea what he’s doing and to get with the program.

Of course, the letter used a polite and courteous tone, but the content was damaging to say the least.

Some of his thoughts also back up exactly what I’ve been preaching.

Innovation in Silicon Valley has come to a screeching halt, and many of these incremental projects aren’t looking too attractive, like Metaverse.

Zuckerberg is also wildly out of step with the current times as bond yields have exploded, and tech stocks have been crushed. Yet the CEO has ramped up spending and getting very little bang for his buck.

He seems oblivious to all of it.

Gerstner wants juicing up of free cash flow through the existing platforms which focus mainly on digital ads, because they are still highly profitable.

He also criticized the amount of money used to develop the Metaverse and called for an imminent reduction in costs.

He later complains that META has increased its headcount from 25,000 to 75,000 heads in the past three years, but META is not squeezing out more productivity by this.

Gerstner recommends cutting the staff budget by 20% which would bring down staff costs to last year’s levels.

He didn’t say that the extra $40 billion in savings would go to shareholder returns, but one might conclude that he is lobbying for that decision that would benefit his wallet.

Essentially, “recommending” to invest $1-$2 billion is a direct show across the bow to Facebook management signaling not good enough at the top level.

Investors believe this technology is not only akin to a pet project, but also a failure of long-term strategic significance.

Remember that Zuckerberg is investing $30 billion in the metaverse in 2022 and wants to ramp up in 2023,.

My guess is that Zuckerberg adopts a defiant stance since he believes he’s the smartest guy in the room at all times.

He hates to be doubted and has an impulse to prove people wrong.

Even if the metaverse is the future, Zuckerberg is wildly early and investors want him to milk profits now from the ad business before he goes full steam into monetizing the metaverse.

Zuckerberg has super voting rights and is unable to get fired from the company he co-founded and investors gave him a pass for this situation for quite some time.

Now, moving forward, it appears as if Zuckerberg doesn’t care about Meta’s stock price anymore and will do anything to make this metaverse project work even if it doesn’t mesh with the balance sheet or the current cost of capital.

He doesn’t care because he views his legacy as intertwined with the prospects of the metaverse which is a dangerous path to choose.

It’s irresponsible for a CEO to crowbar a public company into a binary decision on a speculative technology when there’s no need for it.

Volunteering for high risk is a sign of bad leadership.

A CEO that cannot get fired is dangerous and it is coming back to haunt investors.

My guess is that Zuckerberg will double hiring, double investments and capital spending, double artificial intelligence engineers and triple down on this metaverse project because he views it as an existential proposition.

From an individual investor's point of view, reckless leadership means avoiding the stock.

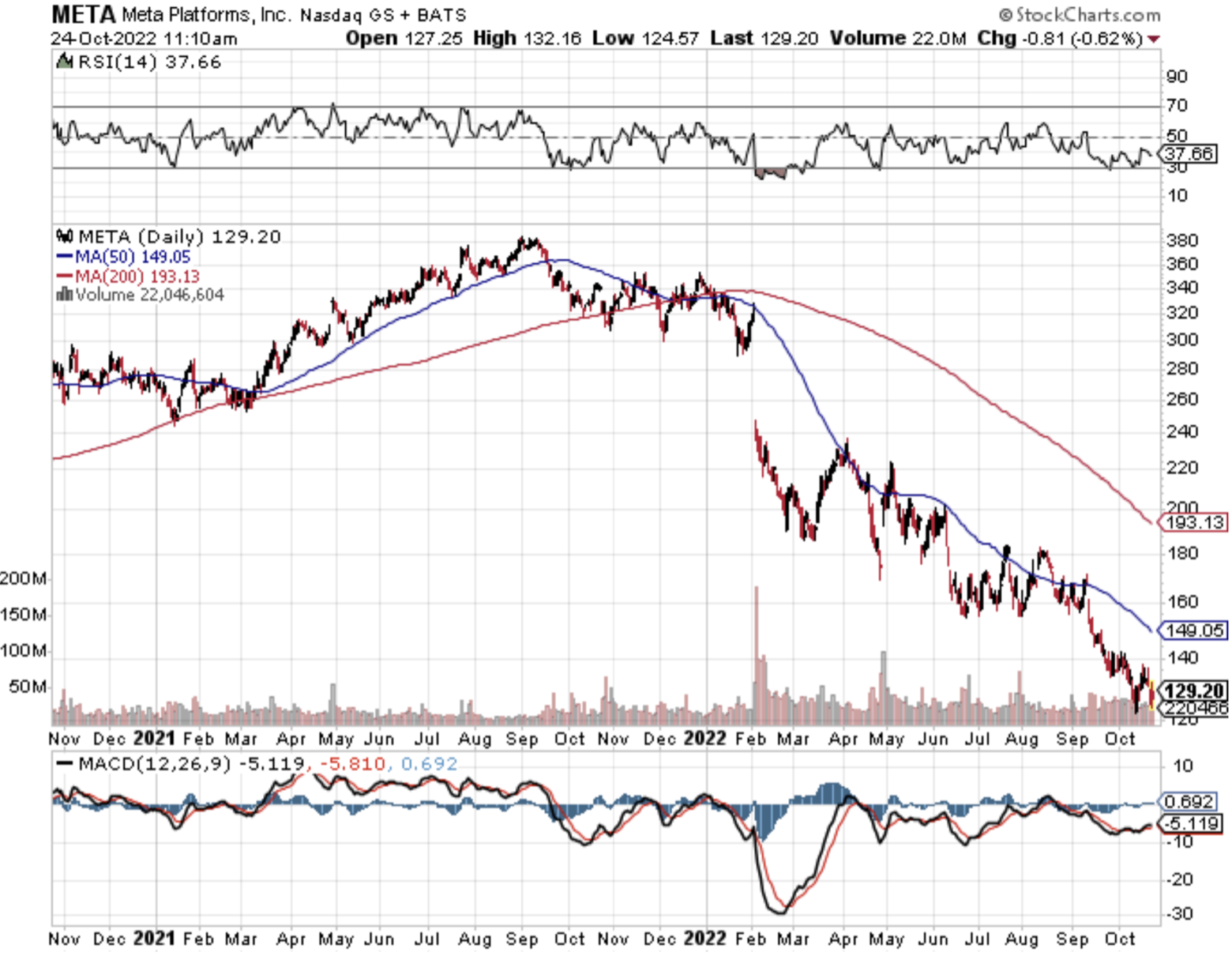

I believe META’s stock is due for a terrible earnings report, poor forward guidance and I would sell any rally in META stock.