Last week, a concierge customer asked me an excellent question. Having correctly called the top in this market to the hour, what would it take for me to go all in on the long side and get maximum bullish?

With everyone now laser-focused on downside risks, which was really a last February game, I thought I’d take the opportunity this morning to examine the upside possibilities, if there are any at all.

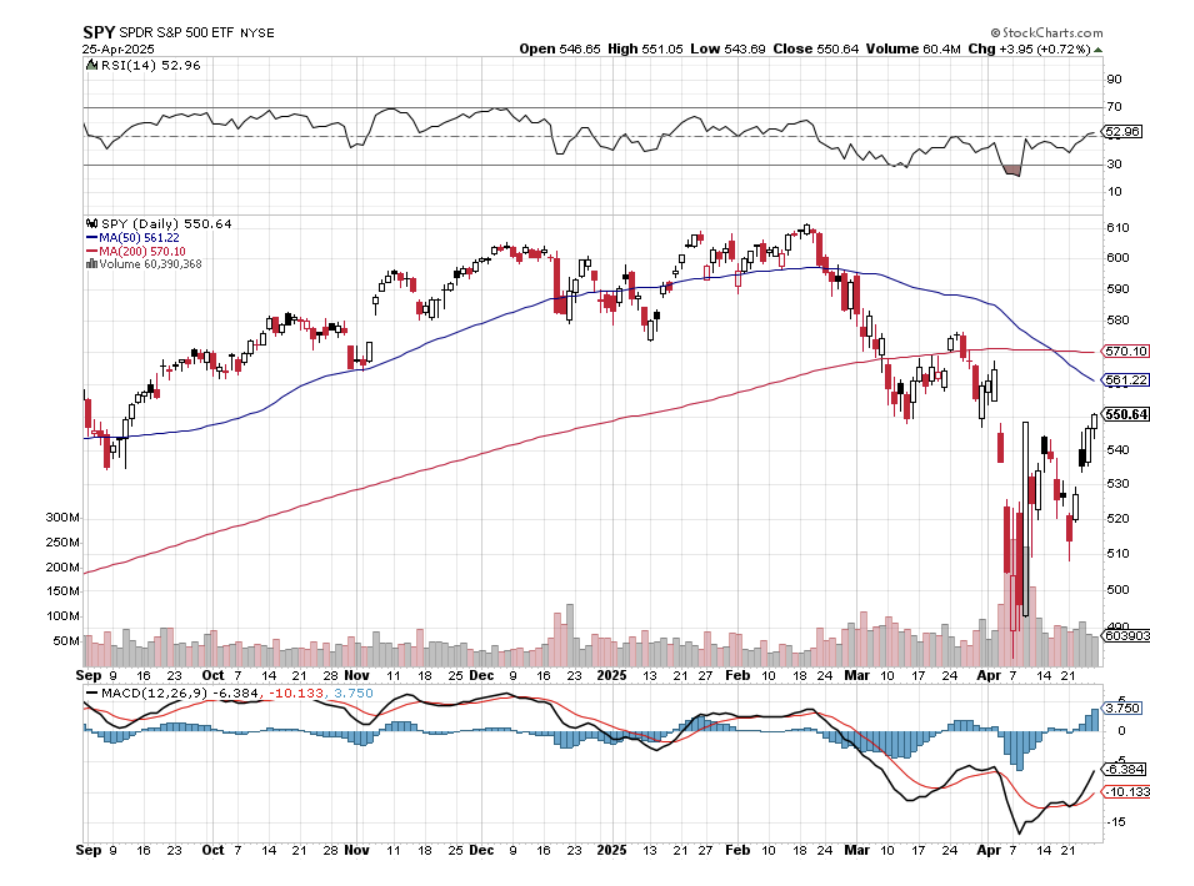

Let’s say that the trade war ends before the ninety-day deadline is up on July 9, and the Chinese tariffs are reduced from a trade embargo of 145% to, say, only 20%. Markets will instantly rally 10%, with possibly half of that move happening at a market opening, so you can’t participate.

That is in effect, as what happened last week, with investors willing to look through the trade war to a less onerous business environment sometime in the future. A 20% tariff still takes the US growth rate down to zero, but it at least takes a recession off the table. Problem number one: Zero-growth economies don’t command high earnings multiples.

The problem with that scenario is that we hit a wall of selling above 5,800, where the late entrants came in but are now trying to get out, at close to cost. To get above that level, we need a really powerful fundamental bull case, which is now nowhere on the horizon. That’s why it’s unlikely that the stock market will see any positive returns for 2025.

The reality is that the trade war is not the only place where the economy has been driven off the rails. Even a 20% tariff brings substantially higher prices. International trade is falling off a cliff. Massive cuts in government spending are highly deflationary. Deporting large numbers of immigrants reduces demand and shrinks the labor supply. Unless Congress can pass a budget bill soon, we are on track to see an automatic $5 trillion tax increase by yearend. The budget deficit will hit a new record for this year.

Needless to say, companies will continue to sit on their hands with this amount of uncertainty and wait for the many unknowns to play out. None of these commands higher multiples for equities, let alone the near record S&P 500 multiple at 20X that prevails now.

To really get maximum bullish like I was for most of the last 15 years, the economy would have to return to the conditions that took stocks to record highs like we had until three months ago. That would be a globalized free-trading economy with the US playing a dominant role. That’s an economy that deserves high earnings multiples.

We won’t see that for at least four more years, but markets may start to discount it in only three years as we run up to the next presidential election in 2028. Imagine a future presidential candidate who campaigns on a zero-tariff regime and a return to globalization.

To get a sustainable multi-year bull market in stocks, it would help a lot if we started from a much lower base first. New bull markets don’t start at 20X multiples. A 16X multiple is much more likely, or 20% lower than we are now. We may get that.

The government is currently trying to break up three of the Magnificent Seven with antitrust actions, which led the march to higher stock markets for years. Corporate earnings are now rapidly shrinking, but we won’t see the hard numbers until August. Until then, we only get forecasts. Lower earnings command much lower multiples. That leaves on the table my 4,500 forecast low for the (SPX).

We could well be stuck in a trading range for years. Stocks could continue to bump their heads up against a (SPX) 5,800 ceiling but also get talked up by the administration whenever it collapses towards 4,800. Some 1,000 (SPX) points is quite a wide trading range to play with and plenty enough to make money on.

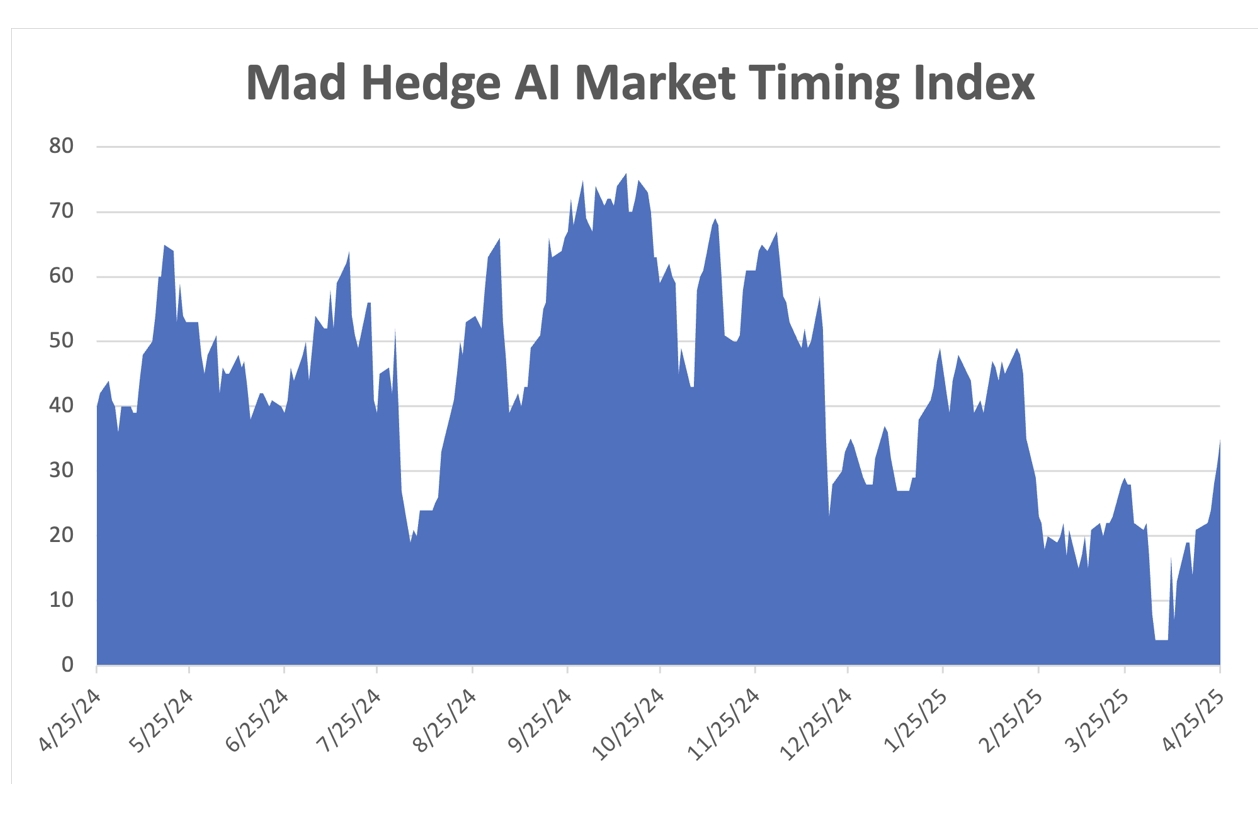

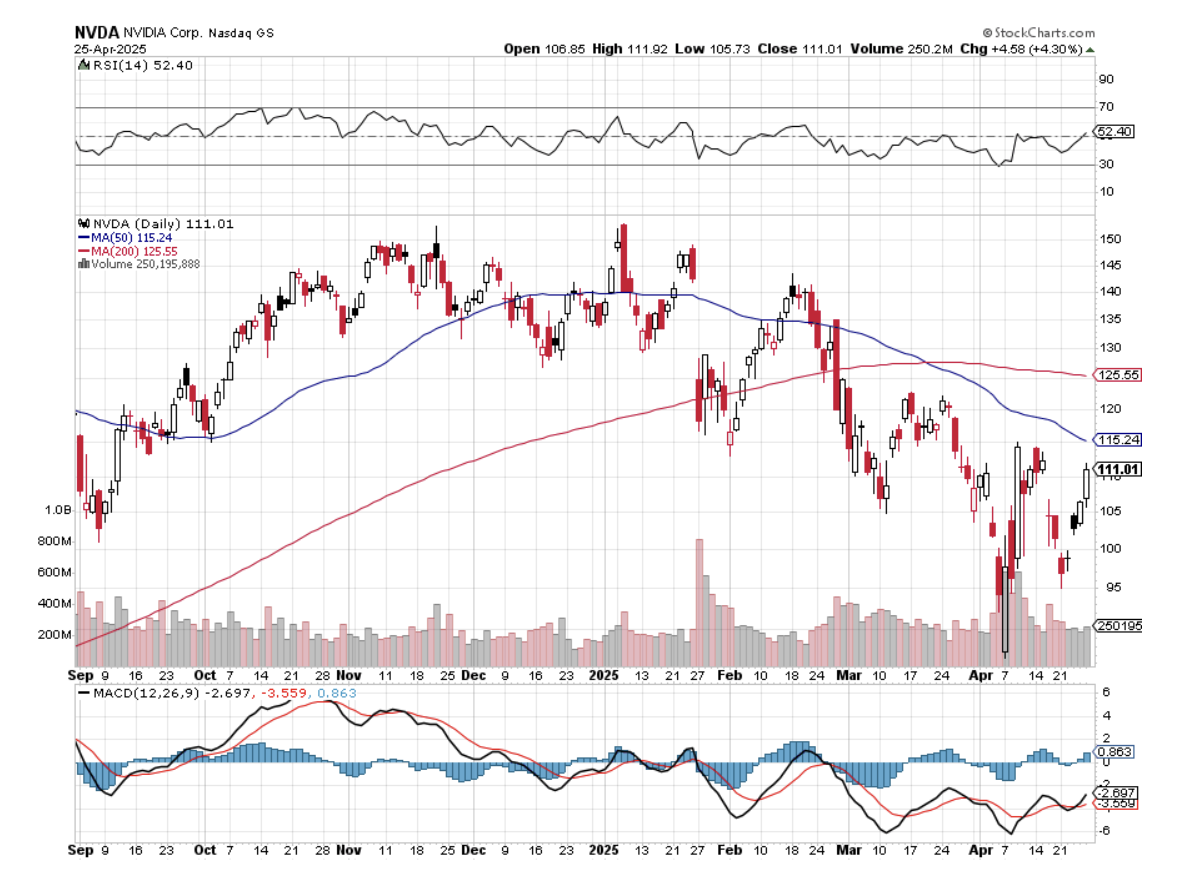

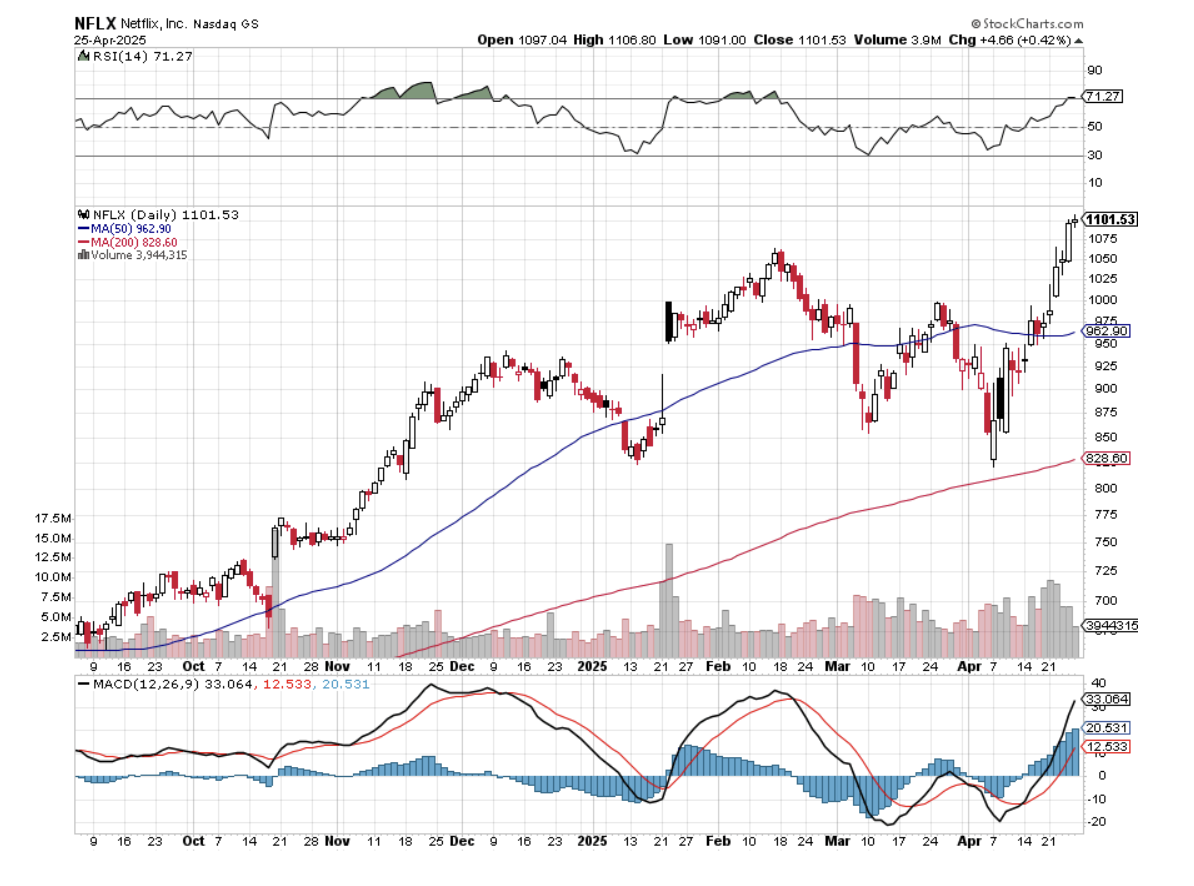

I did it only last week. You have to ignore the news flow and use the volatility index ($VIX) for your market timing. When the ($VIX) hit $54 last week, I piled on longs in (NFLX), (NVDA), (MSTR), and (JPM). By Friday, I gained 8.12% in new performance, my best weekly return in the 17-year history of Mad Hedge Fund Trader.

What if you just want to take a long-term view and not have to check the ($VIX) in between every putt on the golf course?

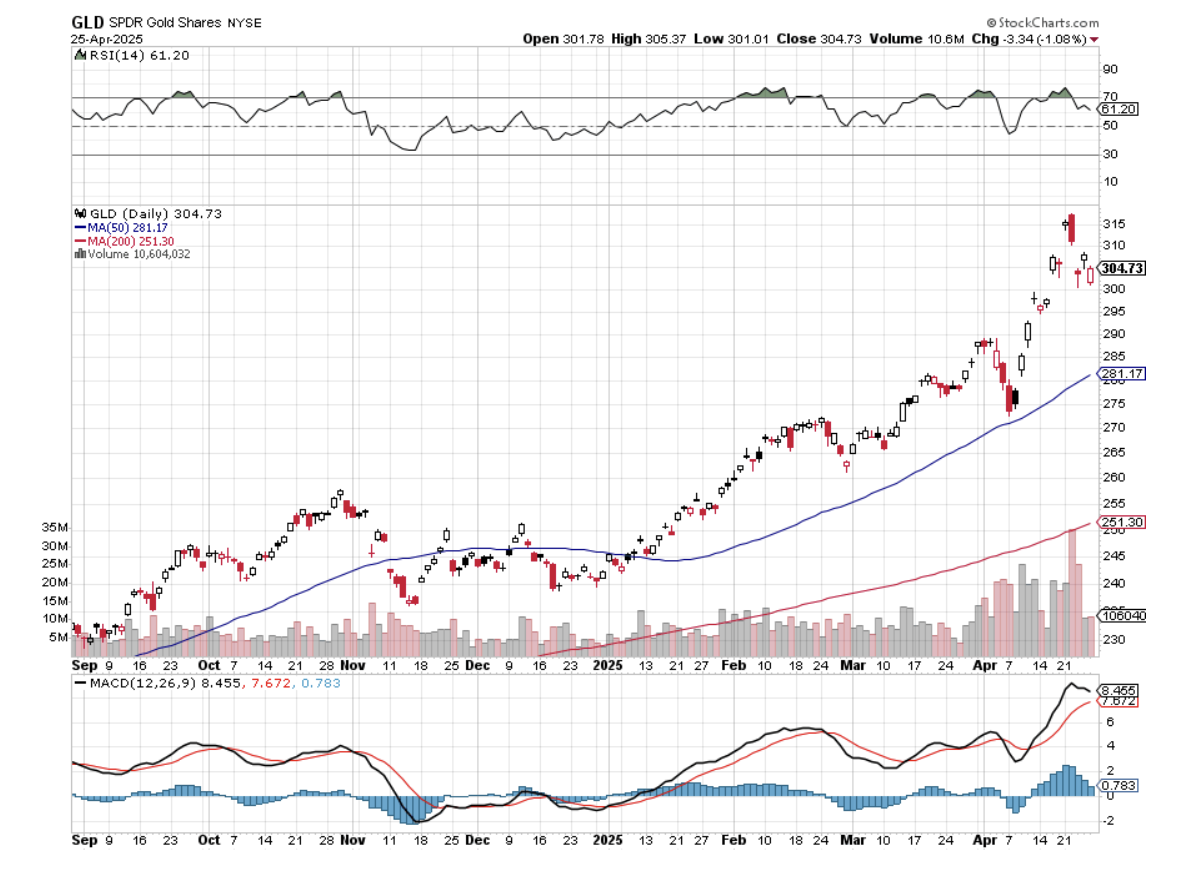

Gold (GLD) is looking pretty darn good right now. With the collapse of the US dollar ongoing, flight to safety assets is in short supply. American economic conditions will get worse before they get better. Central bank accumulation has continued at its torrid decade-long pace. And gold seems to have broken the link with interest rates that held it back for so long, eliminating opportunity cost as an issue. Even ultra-cautious JP Morgan expects the barbarous relic to reach $4,000 an ounce this quarter.

The great mystery in the sector has been the lagging performance of the gold miners. While gold doubled, the shares of Barrack Gold (GOLD) went nowhere.

Gold miners have yet to be taken seriously by mainstream institutional investors, as they are often the subject of excessive promotion, scams, and outright fraud. Token or non-existent dividends are another impediment. Millennials have clearly gravitated towards crypto instead. Miners also got a bad rap from the ESG investment trend as they are considered a “dirty” industry. Anything US dollar-denominated is being dragged down by the weak greenback. That’s why gold only accounts for 0.54% of global portfolios today, versus 2.48% in 1998.

That may all be about to change.

Last week, Barrack Gold, which mines gold at a cost of $1,600 an ounce and sells it at the recent $3,500, completed a monster 23% move in the shares. Newmont Mining (NEM) completed an incredible 32% move. Gold attractiveness is such that only a 5% decline was enough to pull me back in on the long side last week.

High prices atone for a lot of sins.

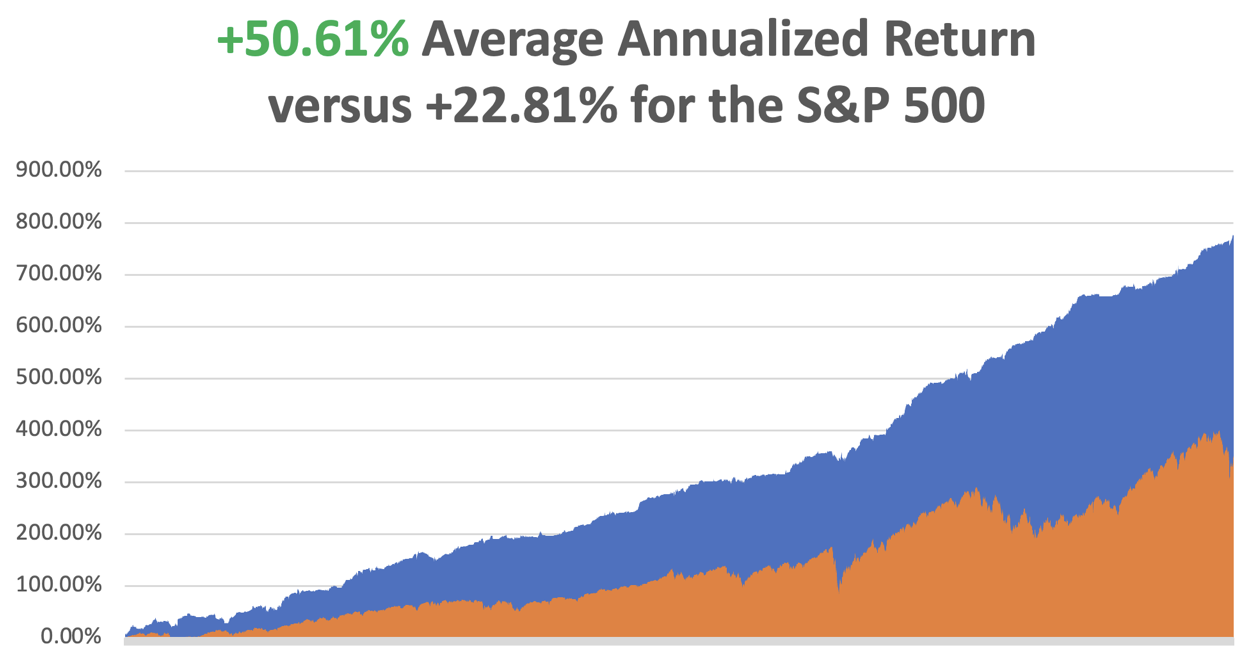

April is now up by a spectacular +10.31%. That takes us to a year-to-date profit of +24.14% so far in 2025. My trailing one-year return stands at a spectacular +84.47%. That takes my average annualized return to +50.61% and my performance since inception to +776.03%, a new all-time high.

It has been another wild week in the market. I used the 1,200-point meltdown in the Dow Average on Monday to add longs in (NFLX), (JPM), and (MSTR). I also quickly covered a short in (MSTR). After the market rallied 2,000 points, I added shorts in (TSLA), (SPY), and a new long in (GLD). That leaves me 40% long, 30% short, and 30% cash. If everything goes our way on the May 16 options expiration day, we will be up 30% on the year.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Stock Market Suffers the Worst Start to a Year in History. April was the worst since 1932, and lower lows beckon. The Real “Trump Trade” was a “Sell America” trade, with stocks, bonds, energy, and the US dollar all collapsing.

Fed Beige Books Point to Stagflation. Prices are rising and economic activity has begun to slow across parts of the nation as businesses and households try to adapt to Trump’s erratic rollout of sweeping tariffs aimed at reshaping global trade, a report Wednesday from the Federal Reserve showed. Uncertainty around international trade policy was pervasive across reports, the U.S. central bank said.

Leading Economic Indicators Plunge, published Monday by research group The Conference Board, fell 0.7%, to 100.5, in March, following an upwardly revised 0.2% decline in February. Economists polled by The Wall Street Journal had expected a 0.5% decline for March. The recession is here, you just don’t know it yet.

Europe Lowers Interest Rates, down 0.25% to 2.25%, to head off a recession caused by Trump tariffs. The bank’s rate-setting council decided at a meeting in Frankfurt to lower its benchmark rate by a quarter percentage point to 2.25%. The bank has been steadily cutting rates after raising them sharply to combat an outbreak of inflation from 2022 to 2023.

Netflix Earnings rocket, setting the stock on fire, as an indication that the stock may be recession-proof. Netflix reported first-quarter adjusted earnings of $6.61 a share on revenue of $10.54 billion. Analysts surveyed by FactSet expected earnings of $5.67 a share on revenue of $10.5 billion. The stock climbed 3.4% in after-hours trading. As of the market close Thursday, it has risen 9.2% this year. Buy (NFLX) on dips.

IMF Cuts US GDP forecast for 2025 from 2.8% to 1.8%, and they are a deep lagging indicator. The prediction is part of a wide-ranging reduction in global growth. Tariffs are to blame.

US Dollar Hits Three-Year Low, as the flight from American trade accelerates. No trade with the US means no need to buy the greenback.

Gold Tops $3,424, the 1980 inflation-adjusted all-time high. A shortage of “Sell America” trades is driving everyone into gold all at once. The (GDX) gold miners ETF hit a 13-year high. Gold imports are now a major contributor to the US trade deficit.

JP Morgan Targets Gold at $4,000 in Q2, as the “Sell America” trade gathers steam. Central banks are the big winners here, which have been hoovering up the barbarous relic for years.

Tesla Bombs, with Q1 earnings down a gob-smacking 71%, a four-year low. Sales are in free fall globally. Tesla’s cost of making and selling vehicles dropped over 17% year over year, driven by lower raw material prices and reduced expenses of ramping up Cybertrucks production. Automotive gross margin for the period, excluding regulatory credits, was 12.5%, down from 30% a year ago, compared with expectations of 11.8%. Tesla short sellers have earned $11.5 billion so far this year, including myself, with the stock down 55%. The shares rose $10 on news that Elon Musk will spend significantly less time with DOGE. Buy only the biggest dips in (TSLA).

Record Funds are Pouring into Japan. Overseas investors have bought a net ¥9.64 trillion ($67.5 billion) of the Asian nation’s debt and equities so far in April, according to preliminary weekly figures released by the Ministry of Finance on Thursday. That level is already the most for any month on record, based on balance-of-payments data going back to 1996. What was the only thing Warren Buffett was buying last year? Japanese trading companies.

Existing Homes Sales Hit 16-Year Low. Sales of previously owned US homes fell 5.9% in March to an annualized rate of 4.02 million, the weakest March since 2009. The median sales price increased 2.7% from a year ago to $403,700, a record for the month of March and extending a run of year-over-year price gains dating back to mid-2023.

Apple to Move All iPhone Production to India. It is a move that has been underway for some time due to China’s soaring labor costs. Since I began covering China in the early 1970s, China's average annualized income has risen from $300 a year to $16,000, up 5,300%.

Alphabet (GOOG) Beats, after the company topped Wall Street estimates and showed growth in its advertising and search business. The company suggested that it’s too soon to tally the impact of Trump’s tariffs, but the ending of the de minimis loophole could create a “slight headwind” to its advertising business. The really interesting number was Alphabet’s estimate of a potential market size of 4 billion rides a year for its Waymo autonomous driving taxi service.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, April 28, at 8:30 AM EST, the Dallas Fed Manufacturing Index is announced.

On Tuesday, April 29, at 3:30 AM, the S&P Case Shiller National Home Price Index is released. We also get the JOLTS job openings report.

On Wednesday, April 30, at 8:30 PM, the Q1 GDP growth rate is published, as is the CPI for April.

On Thursday, May 1, at 8:30 AM, the Weekly Jobless Claims are disclosed.

On Friday, May 2, at 8:30 AM, we get the Nonfarm Payroll Report for April.

As for me, when I was shopping for a Norwegian Fjord cruise a few years ago, each stop at a port was familiar to me because a close friend had blown up bridges in every one of them during WWII.

During the 1970s at the height of the Cold War, my late wife Kyoko flew a monthly round trip from Tokyo to Moscow as a British Airways stewardess. As she was checking out of her Moscow hotel, someone rushed up to her and threw a bundled typed manuscript that hit her in the chest.

Seconds later, a half dozen KGB agents dog piled on top of Kyoko. It turned out that a dissident was trying to get her to smuggle a banned book to the West. She was arrested as a co-conspirator and bundled away to the notorious Lubyanka Prison.

I learned of this when the senior KGB agent for Japan contacted me, who had attended my wedding the year before and filmed it. He said he could get her released, but only if I turned over a top-secret CIA analysis of the Russian oil industry.

At a loss for what to do, I went to the US Embassy to meet with Ambassador Mike Mansfield, whom, as The Economist correspondent in Tokyo, I knew well. He said he couldn’t help me as Kyoko was a Japanese national, but he knew someone who could.

Then in walked William Colby, head of the CIA.

Colby was a legend in intelligence circles. After leading the French resistance with the OSS, he was parachuted into Norway with orders to disable the railway system. Hiding in the mountains during the day, he led a team of Norwegian freedom fighters who laid waste to the entire rail system from Tromso all the way down to Oslo. He thus bottled up 300,000 German troops, preventing them from retreating home to defend from an allied invasion.

During Vietnam, Colby became known for running the Phoenix assassination program. It was wildly successful.

I asked Colby what to do about the Soviet request. He replied, “Give it to them.” Taken aback, I asked how. He replied, “I’ll give you a copy.” Mansfield was my witness, so I could never be arrested for being a turncoat.

Copy in hand, I turned it over to my KGB friend, and Kyoko was released the next day and put on a flight out of the country. She never took a Moscow flight again.

I learned that the report predicted that the Russian oil industry, its largest source of foreign exchange, was on the verge of collapse. Only a massive investment in modern Western drilling technology could save it. This prompted Russia to sign deals with American oil service companies worth hundreds of millions of dollars.

Ten years later, I ran into Colby at a Washington event, and I reminded him of the incident. He confided in me, “You know that report was completely fake, don’t you?” I was stunned. The goal was to drive the Soviet Union to the bargaining table to dial down the Cold War. I was the unwitting middleman. It worked.

That was Bill, always playing the long game.

After Colby retired, he campaigned for nuclear disarmament and gun control. He died in a canoe accident on the lake in front of his Maryland home in 1996.

Nobody believed it for a second.

William Colby

Kyoko

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader