10 Reasons Why Digital Economy is Thriving

The outlier out there is inexorably linked with technology because, since early 2020, we have experienced a renaissance in efficiency and productivity, largely driven by our weaponization of technology that strongly feeds into the overall economy.

This drove the United States economy to higher growth rates in 2021, and the market isn’t expecting close to 6% of US economic growth in 2022 after the Build Back Better bill was thrown in the dustbin by the Senate.

The truth is that America has never been better at creating quality growth, and that largely flies in the face of mercantilist economies who build inefficient ghost cities or spew out pollution to register growth.

There has never been a better time to be employed in the United States, and the pandemic brought on a revelation of newly formed companies offering highly specialized services in droves.

If you travel abroad, many countries have in fact lost services in aggregate and have largely not replaced because many emerging cities don’t have the spirit of entrepreneurship, access to robust digital infrastructure, or access to cheap capital like in the US.

Although working remotely is not entirely unique to the United States, the U.S. has integrated this phenomenon into the social fabric of daily work life better than almost any other country.

Japanese workers are still required for in-person office time to use the office fax machine and Europe has made inroads to working remotely but workers often don’t push back on their bosses because of the nominal lack of jobs on the European continent.

Here is a list and explanation of the new type of economy we are thriving in in 2022 and the present synergies that could lead the US economy to surprise to the upside for the foreseeable future.

- Increased Efficiency and Productivity

Technology has always been a catalyst for efficiency.

Adopting modern technology like the cloud, mobile devices, big data, and analytics help businesses achieve higher levels of efficiency and productivity.

Supplementing these platforms is the ability to sprinkle in AI to supercharge the performance by harnessing data to make predictive decisions in real-time.

- Optimal Resource Management

Firms need to maximize their resources for optimal growth, from capital and labor to suppliers and inventory.

Cloud computing has been adopted widely to support resource sharing across different departments within organizations from an IT standpoint.

The internet of things (IoT) is helping businesses track their resources in near real-time, offering greater visibility into how they are being used and where improvement is needed.

- Added Resiliency and Agility

Technology is an enabler for business agility. Companies can leverage new technologies like IoT and blockchain to develop highly resilient business ecosystems.

- Enhanced Digital Presence

Every company is turning into a digital company if they like it or not. This means having a well-designed website and being easy to navigate, active on social media platforms, and engaging with customers online. The end game here is being able to bypass retail and communicate directly with customers.

- Improved Customer Engagements

To overperform, businesses need to engage with their customers meaningfully.

Technology can help businesses do this by providing tools to understand their customer’s needs and wants. Data analytics and AI, for example, can be used to create customer profiles, which can then be used to provide personalized customer experiences.

- Increased Responsiveness To Business Needs

Top companies today deploy IT systems with built-in flexibility and scalability, which deliver instantaneous service when need be.

These AI-based technologies can perform repeatable tasks, freeing employees to focus on more valuable work requiring human intelligence. Also, robotic chatbots can assist human employees in providing high-quality customer service.

- Cutting Edge Innovation

Today’s employees are technologically savvy, and they expect to use technology in their work.

New technologies like IoT and AI can help harness hidden knowledge within data and transform it into actionable business insights. Such insight-driven companies can make smarter decisions and identify new revenue streams.

- Shorter Time To Deliver A Product

Today’s market is full of innovative startups who are able to harness technology so well that they can deliver new products in days if not hours. Businesses need to be able to sense emerging threats and opportunities early on, and being able to bring products to market faster than the competition is crucial to staying ahead.

- Increased Revenue Opportunity

Businesses can use big data analytics to identify new market opportunities and potential customer segments. They can also use data-driven marketing techniques like predictive analytics to create targeted marketing campaigns.

- Increased Transparency and Visibility

To make informed and timely decisions, businesses need accurate and up-to-date information.

Digital technologies can offer a better understanding of the current realities of the industry and how that translates onto a balance sheet. This allows for better decision-making, more effective business processes, and a more robust overall company culture.

In a Yahoo Finance interview with hedge fund manager Jeffrey Gundlach, Gundlach espouses that he has benefited big by betting the ranch on the American economy up until now, and he pauses to say that emerging economies’ equities are cheap, and he likes to buy assets that are cheap.

But he fails to realize that these economies are cheap for a reason, and even if the quality of life has improved drastically in places like Central Europe and Southeast Asia in the past 30 years, it does not mean the foundations are there for a catch-up trade, let alone a tech catch up trade, that relies on momentum investing.

In fact, America has extended its lead as the place everyone wants to invest in, which is why sovereign wealth funds of all sorts have been looking to get into American single-family homes since the pandemic started.

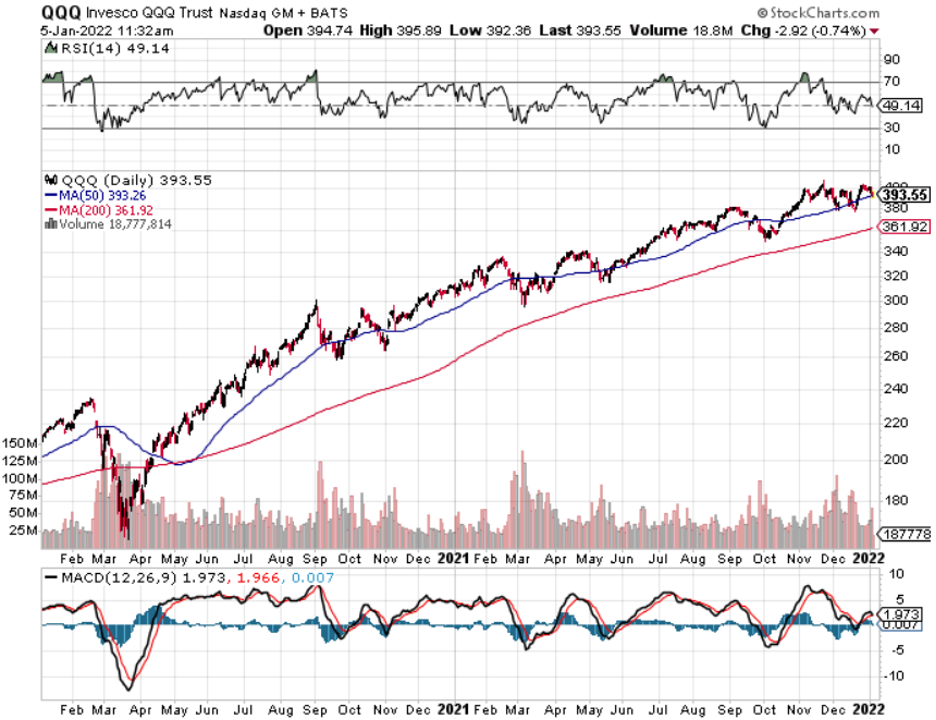

I believe there is a nice surprise to the upside when it comes to tech stocks because companies are using the 10 different ways listed above to supercharge their business models.

Of course, this also depends on the Fed pulling back from its aggressiveness which isn’t guaranteed.