November 12, 2009

Featured Trades:

(SUPER FREAKANOMICS), (BERLIN WALL)

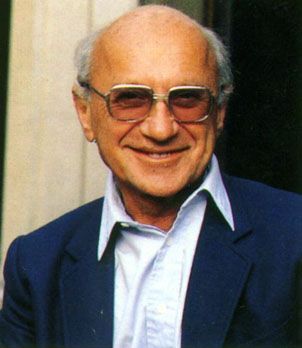

2) I spent a delightfully entertaining evening with University of Chicago economics professor Steven Levitz and journalist Stephen Dubner, authors of the wildly popular Freakanomics, and the just released 'frequel' Super Freakanomics. I love these guys, because they do the same thing as I for a living, looking at raw data, absent of preconceived notions, and drawing iconoclastic, out of consensus conclusions that cause a huge public ruckus. No surprise that they are pals with New Yorker magazine columnist, Malcolm Gladwell (see my interview with him by clicking here ). I learned that Chicago prostitutes are like department store Santa's because they greatly raise prices during periods of seasonal high demand, like around the fourth of July. And while on that theme, I also learned that pimps add far more value than real estate agents, about 25% more. Furthermore, Ford Motors fought mandatory seat belt legislation in the fifties because they were afraid it would advertise the dangers of driving. Drunken walkers suffer eight times more injuries and five times more fatalities than drunk drivers. Also, child car seats offer no safety advantage over conventional seat belts whatsoever, and are just a racket created by the sellers of such seats. The safest thing you can do with a baby is simply place them on the floor of the back seat (They did the crash dummy tests to bear this out). While 100% of hospital doctors admit they should wash their hands, only 73% admit to doing so, while covert monitoring reveals that a scant 9% actually do it, leading to untold numbers of often fatal infections. The evening brought home a truth that I have been pounding into my trainee research analysts for decades; that raw data and facts will trump opinion and spin every time.

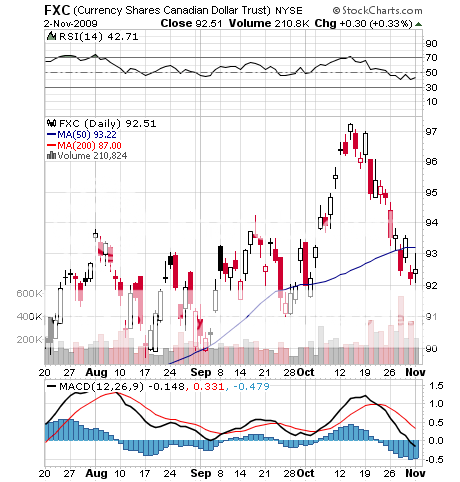

3) The anniversary of the fall of the Berlin Wall, the 20th of which passed yesterday, has always been an emotional time for me. I lived in the American Sector in Tiergarten, a mile from the hated wall at Brandenburg Gate, and recall with some dread being kept awake at night by the angry growl of AK 47's wasting desperate, but helpless families as they attempted to flee to the West. To make extra money, I used to escort small groups of nervous Americans across Checkpoint Charlie into East Berlin for a day of lunch, a visit to Queen Nefertiti at the spectacular Pergamon Museum, and the opera, all paid for with Ostmarks purchased at a huge discount on the black market, and smuggled in my boots. That was my first currency arbitrage, and led to a pattern of ever greater risk taking that could eventually lead nowhere else but the hedge fund industry. About one third of East Berlin still awaited reconstruction from the Allied bombing and the 1945 Russian invasion that laid waste to the city, with every East facing wall still standing absolutely pock marked with bullet holes. That was at least until the Stasi caught me trying to sneak in a copy of the banned Berliner Zeitung, which landed me in the communist lock up for a day. The hapless people I met there!?? Thank goodness they let me out because I was only 16! Some 21 years later, tears streamed down my cheeks as I watched the wall fall on a TV at a Swiss Bank Corp trading desk in London. As much as I wanted to fly over and join in the party, I was running a pretty sizeable book then, and if you recall, 1989 was a year with some pretty awesome volatility. It turned out to be the first domino that led to the end of the Soviet Union, and two thirds of the world's population joining the global economy. That created the peace dividend, which contributed to the nineties dotcom bubble, and opened up new international trading opportunities on which hedge funds feasted to the point of gluttony. Ahhh! Those where the days.

'I'm dating Debbie Downer. Our country is about to experience a transformation from a country with debt growing faster than incomes, to a nation with incomes growing faster than debt,' said Doug Kass of Seabreeze Partners Management, in his take on the future of the stock market.