Global Market Comments

December 14, 2009

Featured Trades: (BAC), (C), (SKF), (HCBK), (WABC), (BOH), (TBT), (PST), (BERNIE MADHOFF)

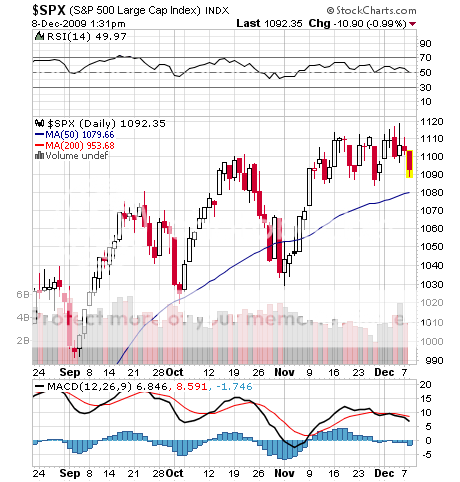

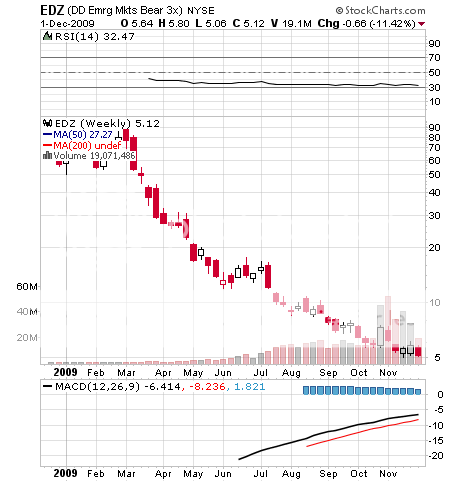

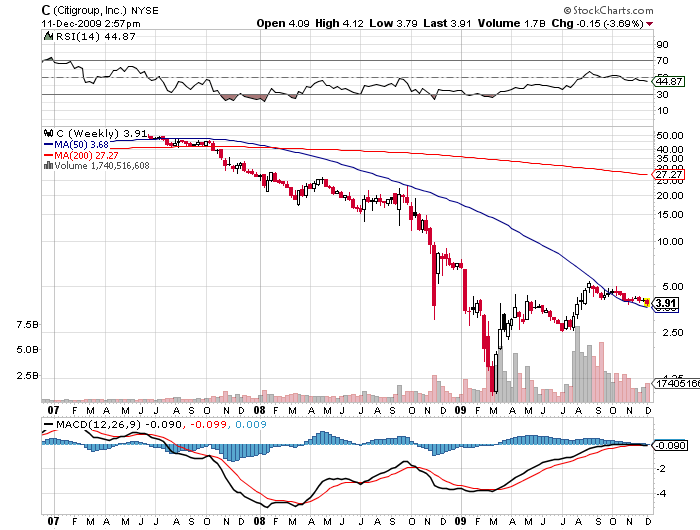

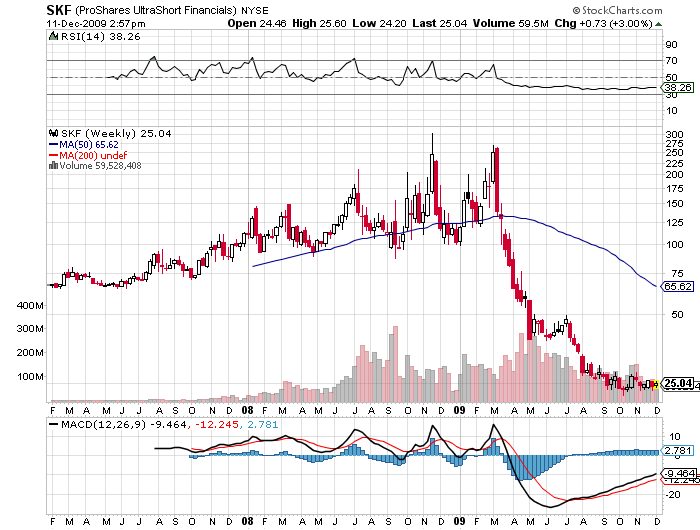

1) Feed the ducks when they're quacking. That's the refrain I heard endlessly on the trading floor at my alma mater, Morgan Stanley. If the clients want something, give it to them in spades, whether it makes any sense or not. So the sky must be darkened with uncountable flocks of our flying friends when I see two of the biggest equity issues in history in the same week, $25 billion for Bank of America (BAC) and $20 billion for Citigroup (C). Besides diluting the daylights out of the existing shareholders, the great problem I have with these issues is the terrible fundamentals that still bedevil the industry. You know these guys are engaging in blatant window dressing to get this paper out the door, extending and pretending until their noses grow to Uzbekistan. Their willing co-conspirator is the Federal Reserve's Ben Bernanke, who used the almighty weapon of zero interest rates to engineer one of the greatest stock rallies in history to get bank shares off the floor. Revenue quality is terrible, earnings visibility is nonexistent, home foreclosures are still accelerating, and commercial defaults may not crest for another three years. You know whatever capital they are raising now will be consumed by write offs next year, and more capital raisings will have to follow. Napoleon's 1812 retreat from Moscow comes to mind. If someone is pointing a gun at your head forcing you to buy bank shares on pain of death, only look at the small ones, like Hudson City Savings (HCBK), Westamerica (WABC), and Bank of Hawaii (BOH). Given the dreadful fundamentals, you'd think traders would be flooding to the leveraged short financials ETF (SKF) by now, which is down a humbling 92% from its high. You can still buy it for a hat size, which is ironically, where the bank shares themselves were trading in March. With the stock market possible at the top of a multiyear range, I'm afraid that the investors in these big issues will end up as dead ducks.

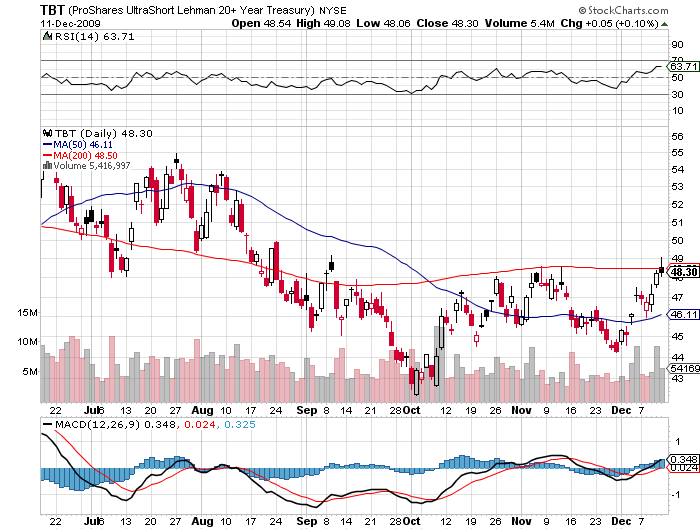

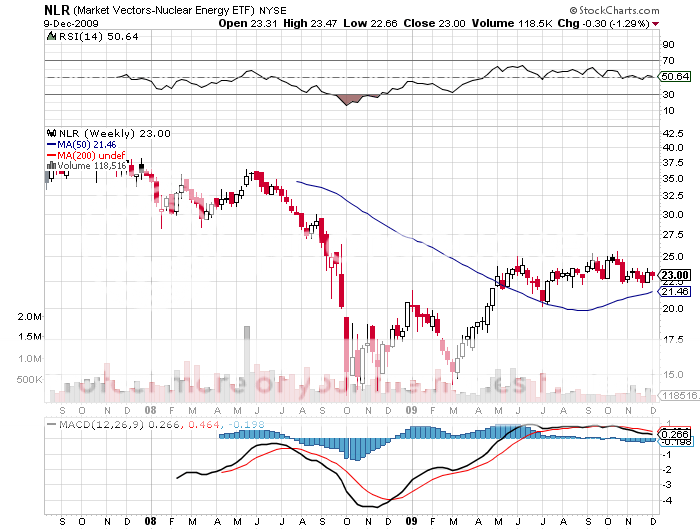

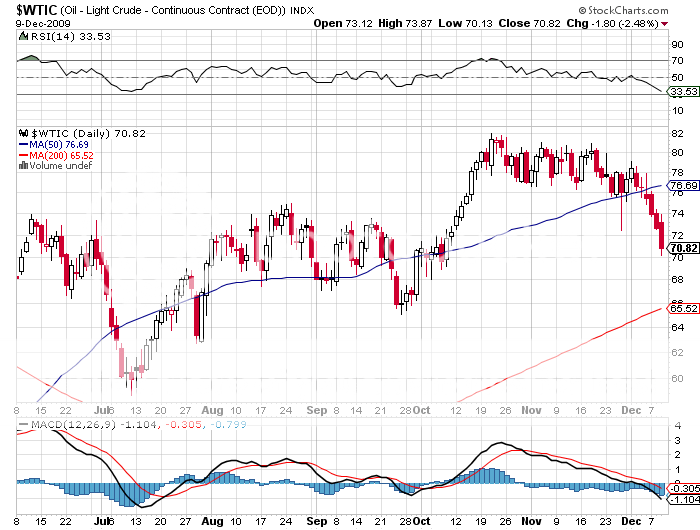

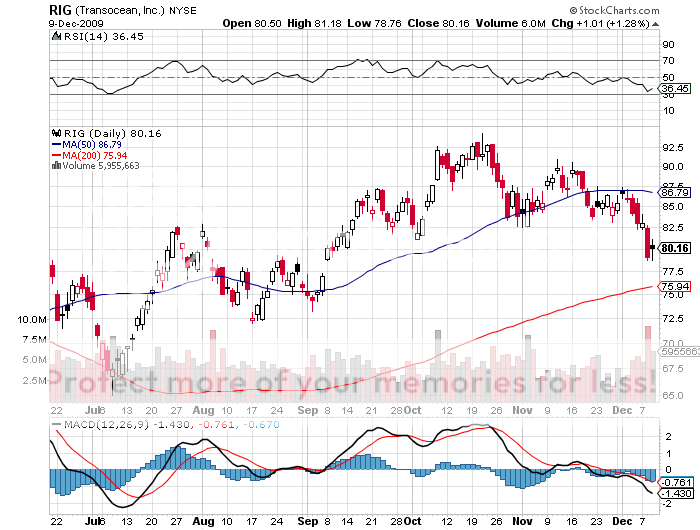

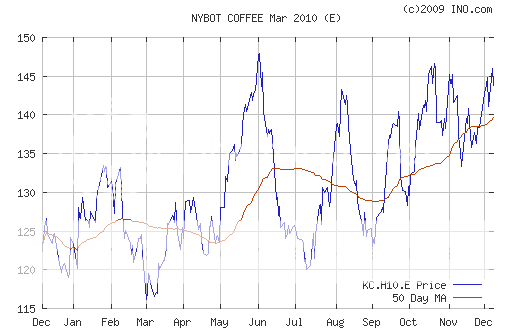

2)It's been at least a week since I poured abuse on US treasury bonds, the world's most overvalued asset, so I'm overdue for another go. In the wake of jitters about sovereign debt in Dubai, Greece, Spain, Ireland, Japan, and Portugal, Moody's is actually talking about a ratings downgrade for the US. Not that we should give that disgraced institution any credibility whatsoever. But the numbers are adding up. It's just a question of how many sticks it takes to break a camel's back. The Federal debt ceiling has to be raised again, requiring a Congressional vote, which will no doubt bring on much bloviating and hand wringing about our profligate ways. Last week's ten year auction went over like a wet blanket, bumping the yield up to 3.49%. That inspired the TBT, short Treasury ETF, to rise above its 50 day moving average, and now the shorter dated ETF for short Treasuries, the PST, is starting to look interesting. I bet John Paulson's cockles are warming.

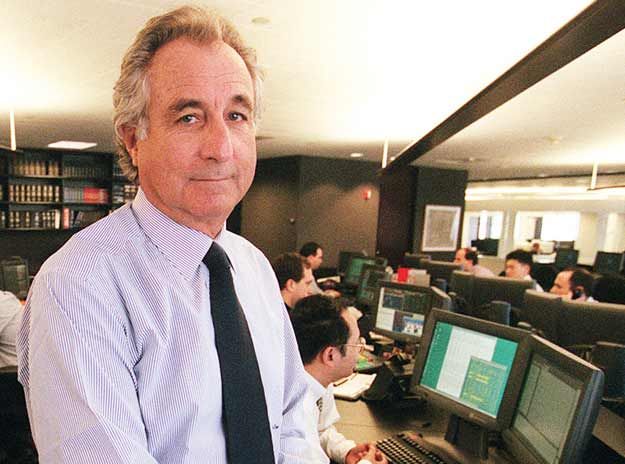

3) Having trouble raising capital for your new hedge fund? Just list Warren Buffet as your 'Honorary Chairman.'That's what California prison guard Ottoniel Medrano did. To help his marketing efforts, he also claimed that he had $4.8 billion in assets under management as well as massive real estate holdings in Asia. Medrano's International Realty Holdings managed to raise $700,000 from individuals?? with this scam, which he promptly shipped to offshore bank accounts, before the Feds shut him down. When you think you've heard everything, something like this pops up. Unbelievable. You would think that people have heard of 'due diligence' by now. It all brings back unpleasant memories on the one year anniversary of the Bernie Madoff discovery.

'You hand us a plate of food that is on fire, and now you complain that the meat is overcooked,' said Austan Goolsbee, an administration spokesman on the Economic Recovery Advisory Board.