June 22, 2009

Featured Trades: (NATURAL GAS), (UNG), (FCEL), (BRK/A), (GS)

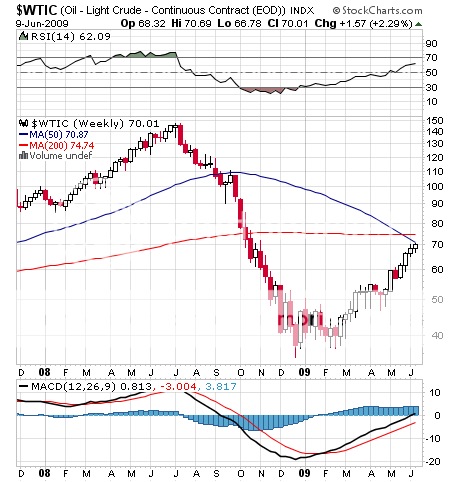

1) The Potential Gas Committee of the American Gas Association published a report that US reserves have jumped by 35% to 1,836 trillion cubic feet, thanks to the huge discoveries of new shale fields since 2006. Also contributing are the new fracturing technologies, which I had a hand in pioneering myself ten years ago. That means our natural gas reserves can now meet 100 years of current consumption, and are roughly equivalent to Saudi Arabia?s crude reserves on a BTU basis. Natural gas futures dove 26 cents to $4.23, and the ETF (UNG) gave back 4%. A buddy of mine close to the committee warned me that something like this was headed down the pike, which is why I sent readers a warning two weeks ago to cash out at $4.30. When you only see chart driven traders buying a commodity and the industry insiders selling the Hell out of it, you want to stay away. Bewildered technicians were last seen feverishly searching for Hainesville on Google. It was their models that sucked $3 billion into UNG over the last three months. This is great news for the big consumers of NG, like the utility industry and the petrochemical industry. It will also give a shot in the arm to Boone Pickens? plan to shift our transportation system to NG (see my March 30, 2009 Newsletter). Even the ratio, pairs, and mean reversion traders have been burned by NG this year. As cheap as NG is, a Saudi Arabia?s worth of supply hitting the market could easily knock the price down by half from here. As extreme as the move in the oil/gas ratio is at 18:1, we could be breaking new ground.

2) While searching for beneficiaries of lower natural gas prices, I stumbled across an interesting little company in Connecticut called FuelCell Energy (FCEL). It sells onsite power plants which are basically giant lithium ion batteries that run of NG as well as biomass, wastewater, propane, and landfills. Think of a cell phone battery that pumps out 50 megawatts of electricity, enough to power a small city. Since the NG is soundlessly electrochemically reacted and not burned, there are no greenhouse gases produced. I have been following this technology for 35 years, and you used to only find things like these at remote industrial sites well outside the power grid, like on Pacific islands or in Northern Canada, where the only alternative was a diesel generator expensively shipped in. While the technology created warm and fuzzy feelings with environmentalists, a cost of four times the market was usually buried in a footnote on page 247. Not true anymore. Their net cost is 16 cents a kilowatt hour, which looks good in high cost states like Hawaii and California. But if you throw in the abundance of state and Federal subsidies now available for alternative energy, that cost drops to 12 cents. Imagine what a halving of NG prices would do? The Golden State accounted for 40% of FCEL?s orders last year, you can find them at several Marriot Hotels in San Francisco, but a South Korean utility has become a large customer, boosting the stock by nearly triple from the March lows.? This is a classic example of why old fossils like myself have to more frequently clear out the cobwebs from our brains in order to root out the new trading opportunities.

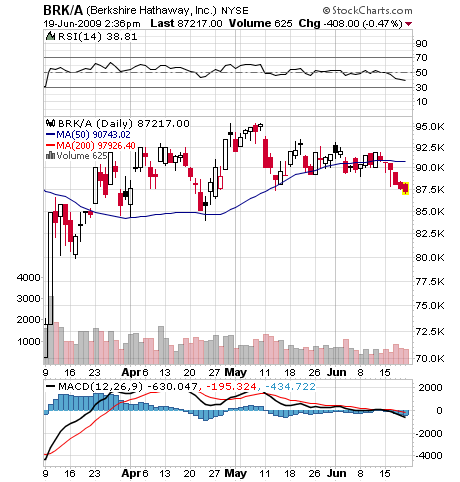

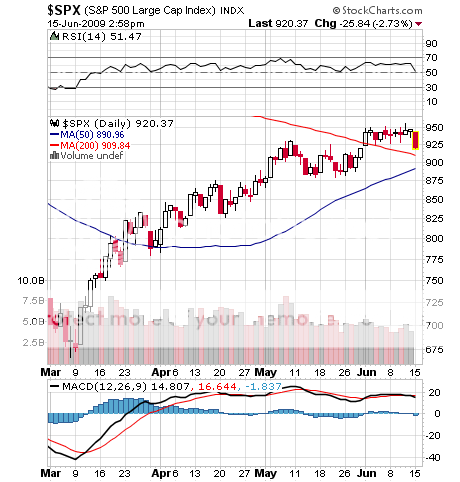

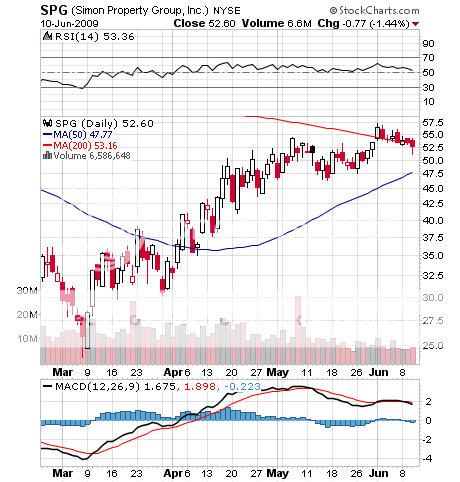

3) A lot of people like to follow Warren Buffet?s Berkshire Hathaway (BRK/A) as a leading indicator for the market. What better guide than a portfolio of the best of the best, run by the world?s great investor? Recently the news has not been good. If you wonder what a stock looks like when it is rolling over on diminishing volume, this is it. The only question is how big, how fast. As much as I worship the avuncular, chocolate milkshake loving, Sees Candy eating Oracle of Omaha, memorizing his annual letter to investors?? and hanging on his every spoken word, he hasn?t been doing that well lately. Since March, his main investing vehicle has only managed a 35% gain, compared to a 40% pop for the S&P 500; despite heavy weightings in such best of breed financials like Goldman Sachs (GS). Better keep his ticker on your desk top, because what BRK/A does, the world will follow.

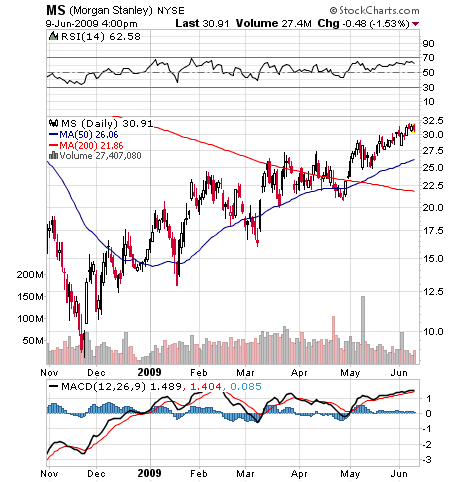

4) I have really been avoiding financials for the last few months after they had their dead cat bounces. However, I had to listen to Midsouth Bank CEO Rusty Cloutier when he spoke on CNBC. His 24 branch bank, with a market cap of only $103 million, is based in Lafayette, LA, one of my old stomping grounds and home of the world?s greatest ??touff??e and shrimp gumbo. He says that ?Unless we break up the big banks and get back to sound banking principles we are going to relive this over and over again??.Free enterprise has to have the right to fail??.Allan Greenspan and his administration have some problems they have to ??fess up to.? With the current system of megabanks ?they get the gain and we get the pain??.I?m regulated now by 13 agencies of the US government and I don?t know that I need a 14th.? There?s no one who can read you a riot act like a Southern regional banker.

QUOTE OF THE DAY

?We?re trying to fix everything in four months that took place over 100 years, said Jack Welch, retired CEO of General Electric (GE).