May 6, 2009

Featured Trades: (BAC), (WFC), (1688.HK)

1) Volatility alert! Volatility alert! The ADP employment report showed 491,000 in job losses for April. Whoopee! We are only losing 16,000 jobs a day instead of 20,000! But the consensus for the Friday's nonfarm payroll is -650,000. The divergence is sure to boost market volatility, either pushing the market up or down big. Winner to be announced at 8:30 am on Friday, East coast time.

2) The other shoe is dropping in the commercial real estate market. Sector delinquencies on securitized loans have jumped from 0.5% last fall to 2.45% in April, the most rapid acceleration in history. Foreclosures are spreading, knocking valuations of properties down as much as 70%, wiping out the equity investors, the mezzanine debt holds, and a good chunk of the primary debt owners. The General Growth Properties (GGWPQ) bankruptcy last month, the largest on record, is further clouding the picture. The firm is trying to bring remote special purpose entities normally immune to these proceedings into the general bankruptcy. If the judge rules in their favor, it will shake the foundations of the whole industry, and send lenders into a long hibernation. Whatever the result, the commercial real estate industry that rises from the ashes years down the road will be unrecognizable. Watch the shares of Bank of America (BAC) and Wells Fargo (WFC), two of the biggest lenders in the sector. Is it any wonder that BAC disclosed today that they need another $35 billion in capital, on top of the $40 billion in TARP money they have already taken, and that WFC needs and additional $15 billion?

3) The real estate tracking firm Zillow.com estimates that 30% of all US homes are now underwater on their mortgages, equivalent to 27 million homes. There is a 'shadow inventory' of a further 30 million homeowners who want to sell their houses on the any improvement in prices. Newly tightened lending criteria have permanently knocked another 10 million potential buyers from the market. Some five million of the nation's 90 million houses are either for sale, in foreclosure, or held in bank inventories. I have a question. With 72 million on the sell side, who is going to power the much heralded rebound in prices? It could be a veeery long wait. I realize there is a lot of double counting here, but you get my meaning. It all bodes for an 'L' shaped recovery in the real estate market, which means no recovery. Keep that rental. No principal risk, no property taxes, and just a phone call unclogs the toilet.

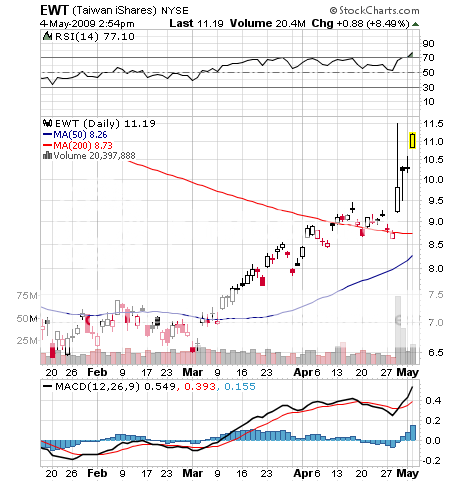

4) Chinese Internet 'B to B' firm Alibaba.com (1688.HK) is the place you go to make those T-shirts, cell phones, computer parts, and pretty much anything which you then sell to the rest of the world. The company is one of the Middle Kingdom's spectacular growth stories, with users growing from 5 million to 8 million in the last three quarters, including 1.2 million in the US. In Q1 the company dropped fees and managed to pull in another 50,000 users. It believes that the recent quarter was the bottom of this economic cycle and that we are now in an upturn, with the fastest growth seen in Brazil and India (hint, hint). Given that their business gives them a unique peak into future business flows, it is a call you should take seriously. You should also look at the Hong King listed stock, which has risen 75% to $10.50 since February. With $1 billion on the balance sheet, it is also the most cash rich Internet firm in China.

'The reason loan documents are thick is because when they were skinny, someone lost money,' said Tom Fink, senior vice president of Trepp, a commercial real estate securities data firm.