Global Market Comments for February 20, 2009

Featured Trades: (POT), (PBR), ($COPPER), (SCHW)

1) Gold blasts through $1,000 to a new high for the year. Need I say more?

2) Here is another thought about Obama's mortgage bailout plan. It is so small, and helps so few, it isn't really a bail out at all. It doesn't help those with mortgages over $625,000, a second home, investment properties, and those who have no mortgages (20% of the US total). Those who do qualify will have to run a gauntlet of qualifications and paperwork. No wonder the market for mortgage backed securities completely shut down! The plan does enable Obama to satisfy the left wing of the Democratic Party crying out for some government relief of their constituents, like Nancy Pelosi. It also makes a nice headline.

3) Here's another one for the unintended consequences file. The bankruptcy of Lehman Brothers could lead to up to 50 of London's better restaurants going under. The defunct investment bank was a profligate spender of expense accounts, corporate events, and bonus payments, racking up huge bills. Restaurateurs?? are coping by cutting staff costs, offering cheaper cuts of meat and more chicken dishes, bargain wines like Argentinean malbec and Spanish rioja, and great value for money prix fix menus.

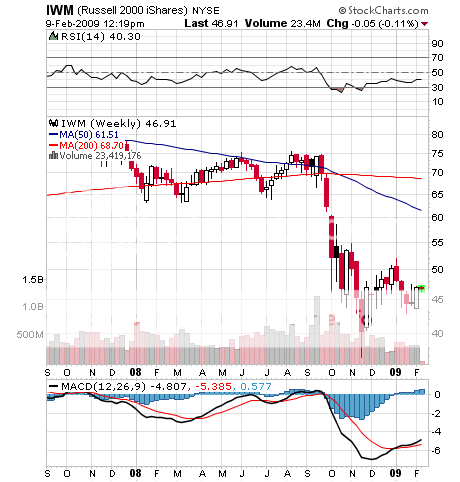

4) Exchange traded funds, or ETF's, were one of the hot financial products of 2008, and enable investors to go 100% or 200% long or short any number of indexes, sub indexes, industry groups, bonds, currencies, and commodities. The largest issuers have been Barclay's iShares, State Street's StreetTracks SPDR's, Rydex, and PowerShares. Sponsors of ETF's have filed for registration of another 850 such products, including ETF's for many new single country funds for Columbia, Egypt, Argentina, Peru, and the Nordic countries. Charles Schwab (SCHW) has also announced that it is entering this field for the first time. These will allow fund managers to make more narrow and specific bets in the capital markets. But they will also increase market volatility, as they obviously did last year.

5) Someone recently bought a portfolio of performing home loans with an average FICO score of 698 for 14 cents on the dollar, giving a current yield of 45%. This shows you how shabbily these illiquid assets are being treated. It also tells you what the world is going to look like without leverage. Everything is going to be a lot cheaper for a long time.

6) Legendary investor George Soros has substantially increased his investment in Potash (POT) and Petrobras (PBR), two stocks I love. Potash is the Saskatchewan based world's largest miner of potassium carbonate, which is in heavy demand for fertilizer from China. The stock is only just recovering from a melt down from $240 to $50. Petrobras is Brazil's oil major, which has made a sting of offshore oil discoveries. PBR gives you a triple play on the recovery of crude prices, a long in the Brazilian currency, the Real, and the high growth rate of this emerging economy. All three offer great entry points right now. A classic 'George' play.

7) In 2007, global urban dwellers surpassed rural ones for the first time. Some 90% of all new urban dwellers are in emerging markets. By 2015 three out of four urban dwellers will be in emerging markets, according to the UN. Half of all emerging market urban dwellers do not have access to clean water, nor have their garbage collected. This has major implications for long term investment themes. Buy copper ($COPPER).

QUOTE OF THE DAY

'Pass this package by tomorrow, or we won't have an economy on Monday,' said Fed chairman Ben Bernanke at the Treasury's emergency meeting in October.