Global Market Comments for January 12, 2009 Featured Trades: (FLS) 1) If you had any doubt where the next equity play is going to be, take a look at the chart below, which I lifted from The Economist. It shows that by the end of this year, 80% of GDP growth will be generated by emerging economies, while only 20% will come from developed ones. Time to brush up on your Portuguese, Russian, Hindi, Mandarin or Cantonese, and for good measure, Korean. Forgetting you know where Wall Street is might also help.

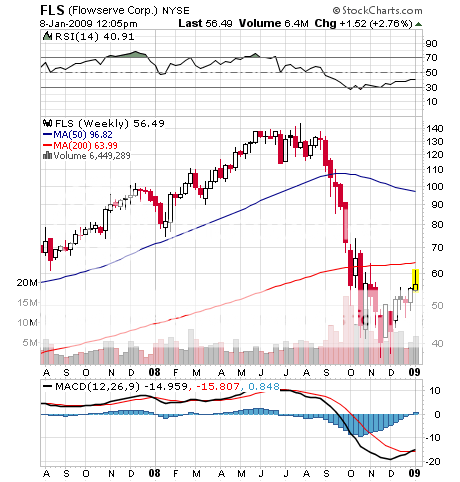

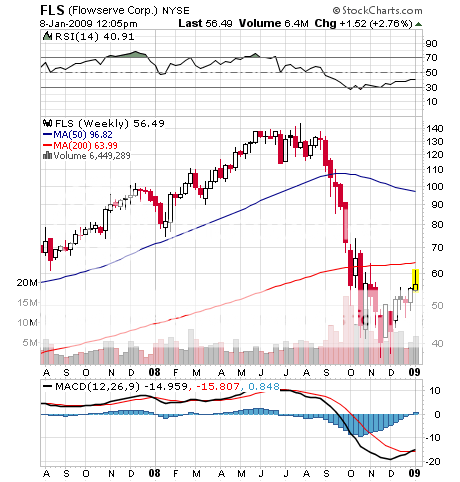

2) Hennessee Group says that hedge funds lost an average 18.9% in 2008, the worst year ever. Despite all of the moaning, I think this is pretty good for a year when all known asset classes, except Treasuries, dropped by half. And the jungle telegraph tells me that there are thousands of disciplined, risk controlled, low leveraged traders out there who used the volatility to generate great years, but are keeping a low profile. Making tons of money has suddenly gone out of fashion. 3) War sure has changed in the Internet age. Israelis are coming home from work, setting up lawn chairs outside, and making videos of incoming missiles. They then post these on YouTube to be viewed by cheering supporter in the US. The closest explosions are getting the most views. 4) Many economists believe that the Great Depression?? was only ended by the massive spending brought on by WWII, which cost $4 trillion in today's dollars. So when Obama says that we are looking at trillion dollar deficits as far as the eye can see, he is not kidding. 5) I continue to like buying key oil infrastructure stocks here at throw away prices, as cheap undated calls on the future resurgence of crude prices. Flowserve (FLS) is a global supplier of pumps, valves, seals, automation, and services to the power, oil, gas, and chemical industries. After a 75% drop in the stock, it now sells at a PE multiple of 7 X, giving you a return on equity of 33%. It's a perfect case of a baby being thrown out with the bath water. Remember my call eight months ago to buy airline stocks as cheap puts on crude before their 400% rise? Same thing. You are getting free leverage on multiple fronts with no expiration date.

5) Governor Blagojevich was impeached, the vote coming in at 114-1. Thank you, thank you, People of Illinois, for making California no longer appear as the worst run state in the country!

5) Governor Blagojevich was impeached, the vote coming in at 114-1. Thank you, thank you, People of Illinois, for making California no longer appear as the worst run state in the country!

2) Yesterday, Morgan Stanley led a jumbo 30 year, 7% bond issue for GE credit which was oversubscribed. This is 400 basis points through Treasuries, and is good news for all corporate borrowers. The credit thaw continues, even though stock traders can't see it. 3) The real estate disaster once known as Las Vegas, where 27,000 homes are for sale, continues to probe new lows. Hotel vacancy rates have hit 18%, and you can now get a four day weekend at a top hotel there, including flights from San Francisco, for $200! Construction has halted on the $5 billion Echelon Resorts for lack of financing, leaving a major eyesore on the city's skyline. MGM Mirage's massive City Center complex continues, only because of credit from Dubai. Sitting pretty is the Palms, which is just being completed, but sold out all of its condos two years ago when the market fever was still alive. While 10% of the buyers have walked away from their deposits, the owners are converting these to luxury hotel rooms. 4) The crude market continues to reel after yesterday's stunning inventory figures, with prices down another 5% to $40. The US should buy the fleet of tankers at sea storing crude, and add it to the Strategic Petroleum Reserve at these prices. With unlimited financing, the government is the only entity which can exploit the incredible 40% contango now present in the crude market. While this opportunity is screaming out to every junior trader in the energy pits, it is oblivious to Washington, where, in any case, we are leaderless. It was government buying for the SPR at $140 which put the top in for the crude market.

2) Yesterday, Morgan Stanley led a jumbo 30 year, 7% bond issue for GE credit which was oversubscribed. This is 400 basis points through Treasuries, and is good news for all corporate borrowers. The credit thaw continues, even though stock traders can't see it. 3) The real estate disaster once known as Las Vegas, where 27,000 homes are for sale, continues to probe new lows. Hotel vacancy rates have hit 18%, and you can now get a four day weekend at a top hotel there, including flights from San Francisco, for $200! Construction has halted on the $5 billion Echelon Resorts for lack of financing, leaving a major eyesore on the city's skyline. MGM Mirage's massive City Center complex continues, only because of credit from Dubai. Sitting pretty is the Palms, which is just being completed, but sold out all of its condos two years ago when the market fever was still alive. While 10% of the buyers have walked away from their deposits, the owners are converting these to luxury hotel rooms. 4) The crude market continues to reel after yesterday's stunning inventory figures, with prices down another 5% to $40. The US should buy the fleet of tankers at sea storing crude, and add it to the Strategic Petroleum Reserve at these prices. With unlimited financing, the government is the only entity which can exploit the incredible 40% contango now present in the crude market. While this opportunity is screaming out to every junior trader in the energy pits, it is oblivious to Washington, where, in any case, we are leaderless. It was government buying for the SPR at $140 which put the top in for the crude market.