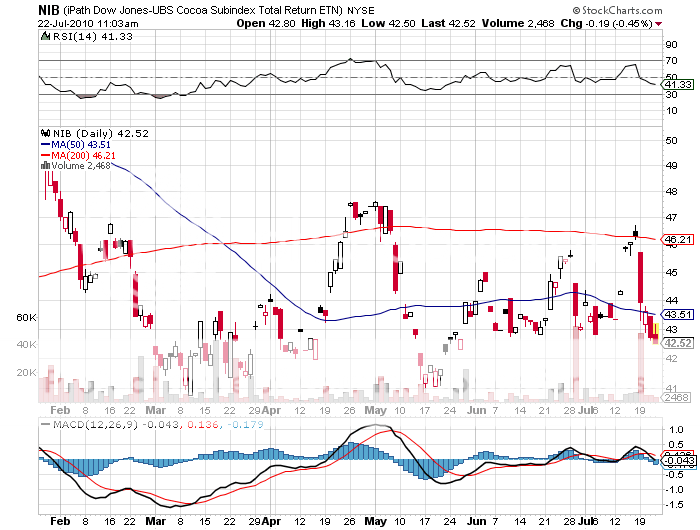

Featured Trades: (FXI), (COCOA), (CHOCOLATE), (NIB)

iPath Dow Jones-UBS Cocoa Subindex Total Return ETN

2) Hedge Fund Corners the Cocoa Market. That Hershey bar you've been sneaking out to buy on breaks is about to cost you a lot more. London based Anthony Ward's Amajaro hedge fund built up a billion dollar long position in the cocoa futures market, which traders expected him to unwind going into expiration. To the absolute shock of investors and industry insiders alike, he took physical delivery instead of 240,000 metric tonnes of the delectable soft commodity, about 7% of the world supply.

The move triggered some extreme volatility in the markets. The difficulties of transporting and storing this quantity of a perishable commodity boggle the mind. Ward, a long time successful cocoa trader, is clearly taking advantage of a poor crop this year in the Ivory Coast, a major producer, betting on a price rise. The move was so unexpected that traders and big consumers, like Cadbury and Nestle, have been caught short. Although these giants hedge their requirements years in advance in the futures markets, no one expected this amount of product to be taken off the market so quickly.

Speculation is rife about secret hedges, under the table contracts, or other back room deals. Ward was able to accumulate such a large stake because the UK's LIFFE lacks the position limits in force in the US markets. The affair takes one back to the days of Jesse Livermore in the 1920's, whose shenanigans earned him the sobriquet of 'Mr. Cotton', as well as the Hunt Brothers' maneuverings in 1980 which took silver to a staggering $50 an ounce (today it is $17.85). The fabled economist John Maynard Keynes once rented all the available warehouse space in London to avoid taking delivery of a bad position in copper.

Traders are now split as to whether Ward can join this illustrious company by pulling it off, sending prices through the roof, or failing miserably, and see his position dumped in the market at distressed prices. His investors are certainly praying that the newfound penchant for chocolate by the rising Chinese middle class continues to grow. If you want to get involved, and you might consider taking a long nap before you do, you can trade the cocoa ETN (NIB). Come to think of it, I better start stockpiling a hoard of chocolate boxes for next Valentine's Day while prices are still low.