Featured Trades: (POT), (BHP), (VALE), (MOS), (AGU)

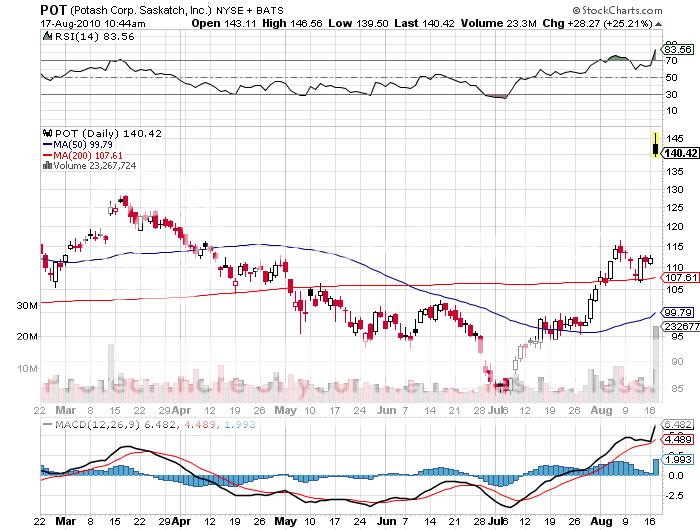

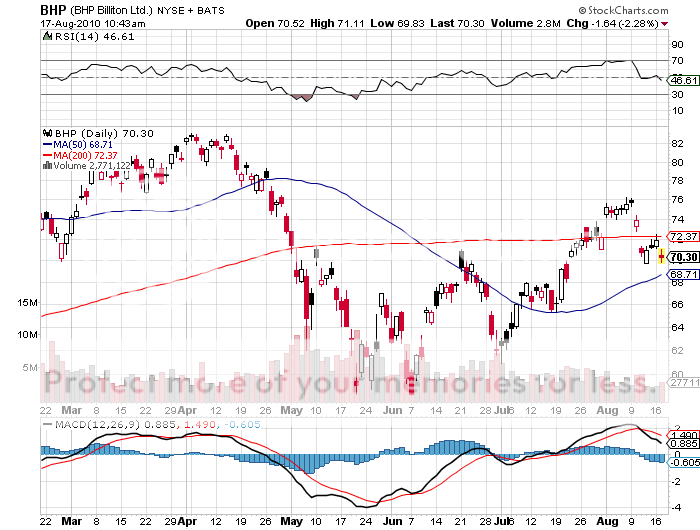

1) BHP Billiton Develops an Appetite for Potash. BHP Billiton's (BHP) low key, South African CEO, Marius Kloppers, has announced that he is making a hostile takeover bid for Potash (POT) for $39 billion, or $130 a share, a multiple of a mere 13 times earnings. POT immediately shot up to $147, a 32% premium to yesterday's close. POT's CEO described the bid as grossly inadequate, which it obviously is, and said he would take whatever measure necessary to deflect the bear bug.

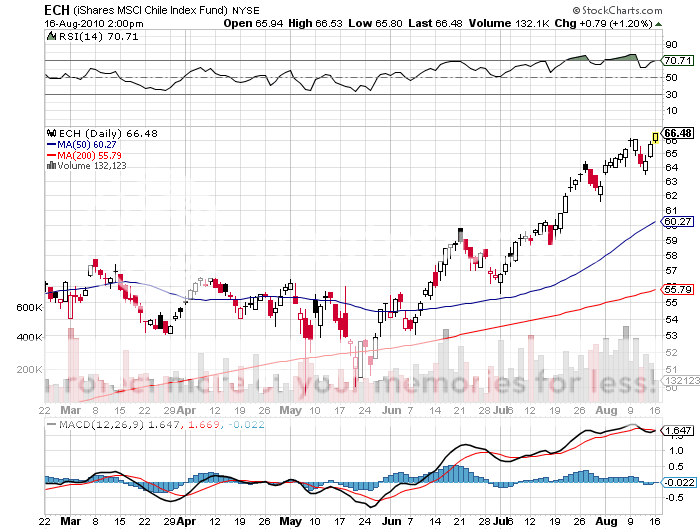

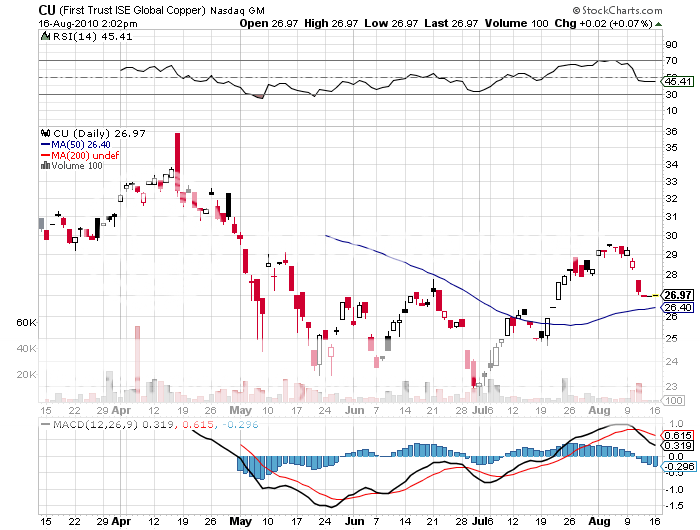

BHP follows Vale (VALE) as the world's second largest iron ore producer, and is attempting to use a cash mountain earned from its massive and hugely profitably sales to China. Why not buy another product that the Chinese are voracious consumers for? POT is the world's largest fertilizer producer, and with the global population expected to grow from 7 billion to 9 billion over the next 40 years, they decided this would be a great area to diversify into.

BHP is no doubt attempting to position itself for the secular long term bull market in food which I have been detailing at great length in these pages (click here for 'The Bull Market in Food is Only Just Starting' ). The recent doubling of the price of wheat in a mere eight weeks has been a shot across the bow of investors everywhere that it is time to get on the train before it leaves the station (click here for 'Going Back Into the Ags' and click here for the follow up piece 'The Best Trade of the Year').

During economic downturns, people don't need to buy steel, but they still have to eat. BHP actually explored setting up its own potash operation in Saskatchewan next door to POT, but decided that buying the Canadian company was the cheaper and faster route. At the height of the last commodity boom, POT peaked at $240.

I have mixed feelings about the deal. I have been recommending POT since the inception of this letter, and it's always nice for the old P&L to get a shot in the arm in an otherwise dull summer. On the other hand, it means that BHP is going to make all the money going forward, robbing me of a core holding. POT is probably going to be worth $1,000/share someday.

BHP's move suddenly makes other ag companies I have been recommending takeover bait, like Mosaic (MOS) and Agrium (AGU), which have both seen serious pops today. Expect BHP to raise their bid, and everyone else to raise their exposure to this key sector. Hey, Marius, why don't we split the difference and pay to $185 for my POT shares?

Is it Worth $130 a Share, $185, or $1,000?