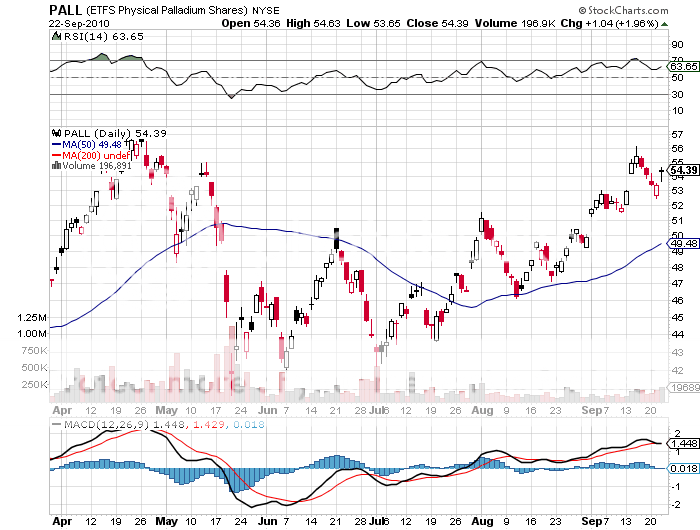

Featured Trades: (PALLADIUM), (PALL)

ETFS Physical Palladium Trust ETF

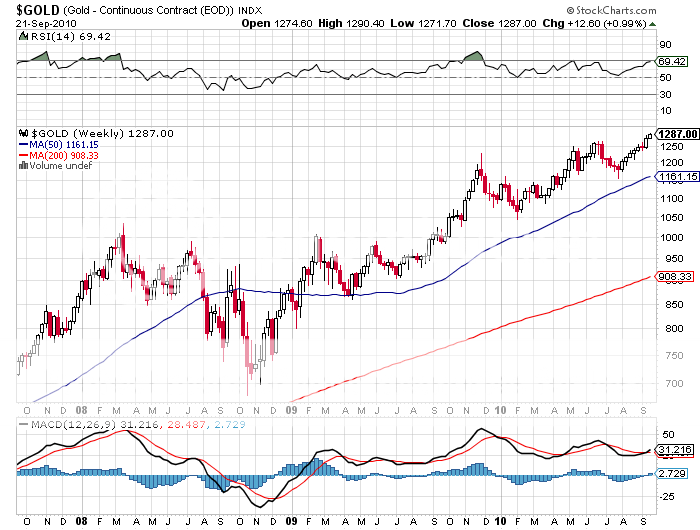

2) Palladium Explodes to the Upside. If you are thrilled about the recent performance of gold, you have to be absolutely ecstatic about the ballistic rise of palladium, which has soared by 33% in the past two months. Double dippers beware! Moves like this by industrial commodities do not occur in the face of a collapsing economy.

Palladium, named after Pallas, the Greek goddess of wisdom, has been mined in South America for over 1,000 years, was discovered as an element in 1804, and saw jewelry use start in 1939. But in 1975 it really came into its own when a nascent environmental movement got legislation passed requiring catalytic converters on all new American cars.

Toyota's USA's president, Jim Lentz, believes that the US car market will recover from the present 12 million annual units to 15 million by 2015. You can forget the drug induced haze of 20 million annual units free money brought us, returning in our lifetime. Fewer than one million of these will be hybrids or electrics. That means industry demand for catalytic converters is ramping up by 3 million units a year.

Which catalyst will the auto makers choose? Palladium at $539 an ounce or platinum at $1,642 an ounce? Hmmmm, let me think. They do have new management now, so maybe they'll figure it out. Some 80% of the world's palladium production comes from Russia and South Africa, dubious sources on the best of days. That means that a long position in this white metal gives you a free call on political instability in these two less than perfectly run countries.

Also known as the 'poor man's platinum,' demand for palladium for jewelry in China has been soaring with the growth of the middle class. On top of this, you can add $387 million of new demand from the palladium ETF (PALL) launched in January, which will soak up a hefty 10% of the world's production.

Those set up to trade the futures can play the Decembers contract, where a margin of $3,713 gets you a 100 ounce exposure worth $53,900. If you are looking for something to stash in your gun safe, bury in the backyard, or give to the grandkids on their college graduation, get physical. You can buy 100 ounce bars at $50 over spot, or Royal Canadian Mint one ounce .9995% fine palladium Maple Leaf coins at $50 over spot. And yes, you can even buy them on Amazon by clicking here.