'How can you have confidence in any of these currencies? They are all a joke,' said legendary hedge fund manager Bill Fleckenstein on Hedge Fund Radio.

'How can you have confidence in any of these currencies? They are all a joke,' said legendary hedge fund manager Bill Fleckenstein on Hedge Fund Radio.

Featured Trades: (TREASURY BONDS), (TBT), (TMV)

ProShares Ultra Short Lehman 20+ Year Treasury ETF

Direxion Daily 30 Year Treasury Bear 3X Shares ETF

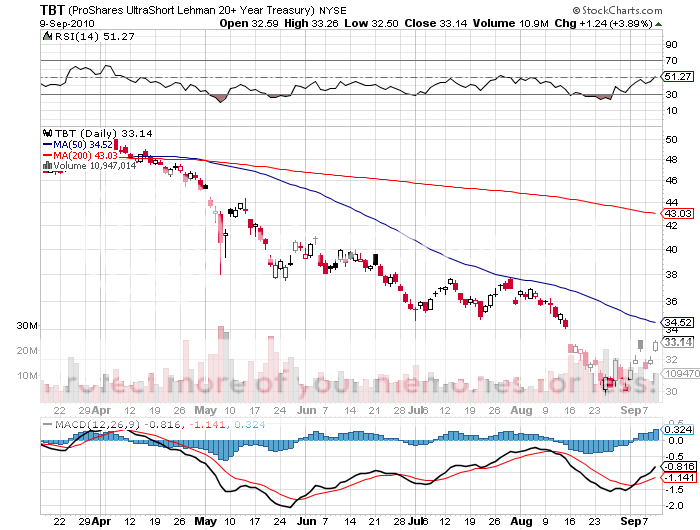

1) The Fat Lady Sings Another Bar. The Treasury bond market is certainly doing its best to roll over like the Bismark, the 30 year closing on the lows, 5 ? points off its highs two weeks ago, boosting the yield back up to 3.81% (click here for my last piece, 'Have Treasury Bonds Had It?').

Like a good Agatha Christie mystery, there are culprits hiding behind every set of drapes. Maybe it was the immense amount of debt the government brought to the market in the past two days as part of its regular refunding operations? Perhaps it was the surprise fall in initial jobless claims today from 477,000 to 451,000?

The smoking gun might even be found in Obama's hand with his $50 billion infrastructure spending project and proposed capital investment tax cuts. Sure, $50 billion amounts to little more than the change found under the sofa cushions in Washington these days. But it might just be the stick that finally broke the horribly burdened camel's back.

You knew the end was near with prime corporates, Like Hewlett Packard (HPQ), suddenly floating 100 year debt issues. The big call here is whether we have put in the definitive spike top in the Treasury market, or if we have established a new, higher trading range. A September sell off in equities, even a little one, would without a doubt make the case for the latter. It looks like someone just gave the short ETF (TBT) a shot of Viagra. Stay tuned for the next act.

The Treasury Market Takes a Hit

Featured Trades: (JGB), (YCS)

2) The Fat Lady is Also Singing in Japanese. A political slugfest in Japan could also be signaling the end of the great bull market in the JGB market, which I have been pissing on from the greatest possible height (click here for 'Why the JGB Market May be Ready to Collapse').

Political kingpin, Ichiro Ozawa, is challenging prime minister Naoko Kan a scant three months after he landed the top job with promises of increases stimulus spending to revive an economy that has been comatose for two decades. If Ozawa wins, he could push Japan's debt/GDP ratio above 200%, a level that would prompt the IMF to warn the country that it is over its debt limit. That in turn would lead to downgrades of Japanese paper by the ratings agencies.

You could easily see the entire house of cards falling apart after that. Since I posted my last piece on the topic, the yield on the ten year JGB has leapt from 0.89% to 1.19%, while 30 year paper has rocketed to 1.97%. I always thought that a selloff in the Japanese bond market would happen along with the collapse in the yen. But with the Japanese currency still flirting with 15 year highs at ??83.7, it looks like the country's bond vigilantes are unwilling to wait.

No, there is no readily available short JGB ETF which you can use to cash in on this move, as there is for the yen (YCS) but you can bet that one will magically appear when the trend gets going. There is a JGB contract listed on the CME, but the real volume and tight spreads are to be found in futures markets in Osaka and Singapore.

(SPECIAL ELECTION ISSUE)

Featured Trades: (CVX), (XOM), (COP), (BP), (RIG), (DO),

(BTU), (JOYG), (SHAW), (CCJ), (DVN), (CHK), (FSLR),

(NOC), (GD), (ZMH), (UNH), (HUM), (PFE), (DV), (STRA), (COCO),

(TBT), (TMV)

1) Here's the Winner of the November Election. What has been one of the best performing trades in the world since Obama took office in January, 2008? You could have bet that the Republicans would take control of the House of Representatives in the November, 2010 election, the probability of which has risen from 18% to 80%, a gain of 444%, and last traded at 70.7%.

Those are the odds offered at the online site, Intrade, (click here for their site), where you can bet on the likelihood of everything from the outcome of elections, to the chance of baseball great Roger Clemens pleading guilty to lying to Congress (80.8%), to the possibility that Israel will launch an air strike against Iran by the end of 2011 (24%).

Intrade determines these probabilities by matching real buyers and sellers who are seeking to take a flyer on the outcome of an event, or simply protect a portfolio from a sudden surprise. The site rates the chances of the Republicans taking more than 50 seats in November at only 47.5%, Senate majority leader Harry Reid defeating Tea Party activist Sharron Angle at 56.9%, and California's senator Barbara Boxer beating challenger Carly Fiorina at 59.9%.

After watching this site with some amusement for years, I should caution potential traders that these prices are subject to huge swings, are often wrong, and come with hefty dealing spreads. Expectation often meets a tragic end at the hands of reality. They can also be very contradictory. While predicting a Democratic slaughter in two months, they also anticipate that Obama has a 60.1% chance of winning the 2012 presidential election.

Still, with no other metric to rely on beyond the endless, and often paid for, blather offered by talk show hosts (Hi Larry!), it is the only game in town. Full disclosure: the Tea Party attempted to buy all the advertising at this site for the next six months and I turned them down. I gave the same answer to the California gay marriage people. I reserve the right to maintain my neutrality and discriminate against everyone.

Probability of the Republicans Taking the House in November, 2010

Republicans Taking more Than 50 Seats in the House in November, 2010

No Thanks. I Think I'll Pass

(SPECIAL ELECTION ISSUE)

Featured Trades: (CVX), (XOM), (COP), (BP), (RIG), (DO),

(BTU), (JOYG), (SHAW), (CCJ), (DVN), (CHK), (FSLR),

(NOC), (GD), (ZMH), (UNH), (HUM), (PFE), (DV), (STRA), (COCO),

(TBT), (TMV)

2) My Call on the Election. Like Sherlock Holmes, I like to consider every alternative, and eliminate the obvious. I think that if the Republicans take the House, it is unlikely that we will see any major legislation pass for the next two years. Gridlock will reign supreme.

While traditionally, Wall Street favors a new ice age in Washington,? I think things are different this time. The last time we had gridlock, Bill Clinton was president, the budget was near balance, unemployment was stable at 5.5% (click here for the raw St. Louis Fed data), and China was this far away place where you bought cheap suits and spicy food.

Gridlock today would mean that critical problems like high unemployment, failing wars, and soaring deficits would be ignored. Instead, a Republican majority in the House would bring control of every committee, which would launch into nonstop Congressional investigations of everything under the sun. At the top of the list: fraud and corruption in stimulus spending and the destructive aspects of Obama's health care plan. Think of it as the Lewinsky scandal times ten.

Warning: this will not inspire the confidence of equity investors. It also might cause holders of the dollar and Treasury bonds to reassess their positions. When did equities peak this year and start their six month slide? April 25, about the time the Republicans began claiming victory in the November elections. A second decade of zero equity returns, anyone?

What do I think is going to happen? I'll take the other side of the trade and bet that the Democrats suffer close to the average loss endured by every ruling party in the midterm elections for the past 50 years, which is 27 seats. Painful for the Dems to be sure, but below the 41 seats the right needs to achieve majority rule.

As for the Senate, the Republicans have no chance of winning whatsoever. In Nevada, Sharron Angel is trying to unseat the Senate majority leader with a plan to end social security in a state loaded with retirees. In California, where jobs is a huge issue with an unemployment rate of 12% and a broader jobless rate of 18%, Barbara Boxer is pointing out correctly that Carly Fiorina fired 30,000 workers, shipping most of the jobs overseas, then paid herself a $100 million bonus. This does not sell well in the populist Golden State. That's two key seats thrown away right there.

The Republicans could have won the Senate, but blew their opportunity in the spring when the Tea Party forced the selection of candidates from unelectable extremes. Want to review the 1964 civil rights act? No problem. How many immigrant voters have they picked up, two million of which have joined the voter registration polls since the last election and have an extremely high election day turn out? I would venture to say none. How many millennials in their early twenties, which are devoutly pro environment and anti war? That's another four million. Sure, a lot don't vote, but enough may to make a difference in swing states like Ohio and Florida.

I have been scanning the horizon looking for a policy on which the Republicans could ride to victory. So far, I have seen none. They have become a single issue party, that of tax cuts for those making over $250,000 who on average own $7 million in assets. They say they want to cut spending, but won't say where. Until other ideas are enunciated, voters will assume this is just going to be another Bush replay.

In an election where making jobs is the principle issue, the party has the worst job creation record since Herbert Hoover. According to the Bureau of Labor Statistics (click here for the link) during 1992-2000 Clinton created 23 million jobs, while Bush could only find 3 million from 2000-2008. Allowing for population growth, those missing 25 million jobs were created in China, stimulating their economy, not ours.

Even Obama's vitriolic opponents concede that the guy is a terrific campaigner. To win elections in November, you want your opponents to peak at the end of August. Remember the Republican fanfare after Sarah Palin's nomination in 2008 and the bleed that followed? We may be seeing a replay now. Look at Obama's move today, which puts the Republicans in the awkward position of having to oppose tax cuts for small businesses and the middle class, a brilliant political pre election move. A time honored way to win elections is to steal your opponent's issues, something Clinton was good at.

Having spent only a year in the White House Press Corp, after which I wanted to take the longest possible shower, I can't pretend to ever know the ways of Washington and elections. Thank goodness my career led me out of the dreaded Beltway and landed me in the deep canyons of Wall Street. I wouldn't write about politics at all if it didn't have such a big impact on your financial future. A fact-oriented person like myself is uncomfortable in the world of pure opinion, spin, and hyperbole. But it does, so I must. I just look at the data, reach the obvious conclusions, and call them as I see them.

Eliminate the Obvious, and Consider Every Alternative

Calling Them as I See Them

(SPECIAL ELECTION ISSUE)

Featured Trades: (CVX), (XOM), (COP), (BP), (RIG), (DO),

(BTU), (JOYG), (SHAW), (CCJ), (DVN), (CHK), (FSLR),

(NOC), (GD), (ZMH), (UNH), (HUM), (PFE), (DV), (STRA), (COCO),

(TBT), (TMV)

3) The Republican Portfolio. Let's say I'm all wrong, and the Republicans take everything in November, what will it mean for your portfolio?? This is an easy call to make. Expect a dramatic roll back of the leftward policies the country has adopted over the last two years, and a sudden revival of the industries that have suffered as a result. In fact, if you look at the charts below, many of the stocks I am suggesting have already started to discount a conservative win.

Big oil companies will be huge winners. American oil imports from the Middle East will accelerate, where the industry earns 80% of its profits. That will bring peak oil sooner, easily taking crude over $100/barrel quickly, and eventually to $150 or $200. Restrictions on both onshore and offshore drilling will get rolled back to their Bush era laissez faire levels, cutting costs and boosting profitability. You want to own Chevron (CVX), ExxonMobile (XOM), Conoco Phillips (COP), and of course, BP (BP). The drilling and service companies, like Transocean (RIG) and Diamond Offshore (DO), should do spectacularly well.

Coal will benefit immensely from relaxed environmental regulation, paving the way for more exports to China. You want to own Peabody Energy (BTU) and Joy Global (JOYG). Nuclear Energy is a big beneficiary here, which should drive you into Shaw Group (SHAW) and top uranium producer Cameco (CCJ). Forget about natural gas companies, like Chesapeake Energy (CHK) and Devon Energy (DVN). Relaxed environmental controls will stonewall restrictions on the new fracking technology that is unleashing huge supplies on the market, driving prices for CH4 to the basement.

You can count on subsidies for alternative energy to get axed as unaffordable luxuries, which have created 500,000 jobs in California alone in the past two years. After all, global warming is nothing more than a leftist hoax, right? The good news is that the higher oil prices Republican policies are guaranteed to bring means that green companies of every stripe will become profitable in their own right, making subsidies unnecessary. Remember, Bush policies took crude from $20/barrel to $150, topping up the Strategic Petroleum Reserve at the absolute top. Buy First Solar (FSLR) on the knee jerk sell off after the election.

The Republican portfolio should also have a heavy weighting in defense companies, as an expanded war against terrorism means we will be fighting more wars in more places for longer. Any shopping list should include Northrop Grumman (NOC) and General Dynamics (GD). Also prospering mightily will be the makers of prosthetic limbs for the military, like Zimmer Holdings (ZMH).

Health care is a natural. It is unlikely that we could see a complete abolition of Obama care until 2016 at the earliest. But a Republican win in the House would eliminate the possibility of any expansion of socialized medicine. Health care companies like United Health (UNH), Humana (HUM), and Pfizer (PFE) will do well.

The government's war on for profit education will grind to a complete halt (click here for my last piece). With a tidal wave of government subsidized loans to the industry assured, and hapless students stuck with the bill, companies like DeVry (DV), Strayer Education (STRA), and Corinthian Colleges (COCO) will rocket.

Major tax cuts for the top 2% of income earners costing $700 billion over ten years and more loopholes for corporations pared with increased defense spending promise to send deficits through the roof. That will last bring an end to the 30 year bull market in Treasury bonds, which are teetering as I write this. The double short Treasury ETF (TBT) and the triple short (TMV) will have to be a core holding in any long term portfolio.

As the two parties are diametrically and violently opposed to each other on virtually every issue, the impact of a regime change on the economy and the markets promises to be huge. I could write on this for days, so these are just the high points.

Meet the Republican Portfolio

1) Summer is Over. There is no better feeling than sitting by the campfire at night, listening to the coyotes howl, watching the stars twinkle, and feeding my broker research into the flames one page at a time. The research from Goldman Sachs (GS) seemed to burn especially well. Perhaps it is the esteemed firm's close association with Satan so alleged in Congress that makes its product particularly incendiary. The Merrill Lynch research? You might as well throw a bucket of water into the embers.

Alas, summer has come to a close. Driving back to San Francisco was the usual five hour nightmare on Labor Day. But this time I was joined by 50,000 refugees from Burning Man, toting home dusty bicycles and coming down from hopefully enjoyable acid trips, driving an assortment of vehicles modified to look like spaceships, warthogs, and gigantic fish. The Highway Patrol had a field day.

For me, it's back to worrying about the next move in interest rates in Australia instead of the bears raiding the ice chest, focusing on Saudi Arabia's crude output figures instead of whether the bacon is burning, and analyzing the thunderstorm that may hit the financial markets rather than the one that is just clearing the nearest High Sierra ridge. So it's time to clean up the Coleman stove, empty the sand out of the sleeping bags, and mend the holes in the tent before returning all to storage.

Featured Trades: (GOLD), (GLD), (SILVER), (SLV), (PPLT), (PALL), (TBT), (SPX), (CORN), (FXA)

SPDR Gold Trust Shares ETF

iShares Silver Trust ETF

ETFS Physical Palladaium Shares ETF

ETFS Physical Platimum Shares ETF

Currency Shares Australian Dollar Trust ETF

Teucrium Commodity Trust Corn ETF

2) Everything is Working. So far, the markets are welcoming me back from vacation with open arms. Gold, which I have been relentless flogging for the last 18 months (click here for the last piece), ground up to a new all time high of $1,260. Silver continues to outperform, threatening a multiyear high at $21 (click here for that piece). The industrial white metals, platinum (PPLT) and palladium (PALL), have been rallying hard. Treasury bonds have been selling off, taking the short play TBT up 10% from its low. And the ags have been positively on fire, with the corn ETF (CORN) adding 25% in little more than two months (click here for that call). Even the resource backed Australian dollar has been virile at 92 cents, a currency I have promoted so much that I am developing that seductive down under accent.

The metals and the ags have been soaring, partly because their long term fundamentals are so strong, and because those for paper stock and bond alternatives are so dreadful. The markets I have been avoiding, likes equities generally and the US specifically, are reassuringly going absolutely nowhere.

It appears that the market is catching up on its overdo homework, reading the research reports which I put out three months ago. Seeing investors coming around to my views is even more warming than my High Sierra campfire stoked with the most pitch bearing pine. I've had a great year so far, and it seems to be getting better by the day. Maybe I should go back on vacation.

Looking for More Australian Dollars

Featured Trades:?? (AUGUST NONFARM PAYROLL)

3) The Bad News In the August Non Farm Payroll. One of my favorite math professors always used to tell me that statistics were like bikini bathing suits. What they reveal is fascinating, but what they conceal is essential.

If there were ever a chart that showed how the pulse of the economy was flat lining, this is it. The scary thing is not the past, but the prologue. The expectations bar was so low, that anything short of Armageddon had to deliver a stock market rally, which is promptly gave back on Tuesday. Apparently, this is how long it takes for traders to figure out a loss of 54,000 jobs is actually a 'real' loss of 154,000 jobs when population growth is taken into consideration. And we know that these figures omit the millions subject to mandatory furloughs, pay, and benefit cuts. It is back to school season again, and for many municipalities that means it's time to fire more teachers, cops, and firemen.

The 200,000 monthly job gains normally seen at this stage of the economic cycle will not arrive for years, if ever. Over employment in these fields is still legion when compared to the corporate world. While the 67,000 new private sector jobs are laudable, it is not the sort of growth that bull markets are built upon. At this rate, it will take 120 years just to bring the unemployment rate down to 5%. No matter how much money the government throws at the economy, those 25 million mostly blue collar jobs that we shipped to China from 2000-2008 are never coming back. The only question is how many more jobs the Middle Kingdom relieves us of as they relentlessly work their way up the value chain.

The new management in America is all about staying thin and agile, and that involves only hiring a new worker at the point of a gun, lest one become saddled with all of the secondary costs and entitlements that entails. Expect more of the same in coming months, and if you have a job, keep it all costs.

What Statistics Conceal is Essential

4) Thanks for the Testimonials. My request for testimonials about the merits of The Diary of a Mad Hedge Fund Trader overwhelmed me with more than 100 responses. Flattering and humbling at the same time, it is a vindication of all the blood, sweat, and tears that I pour into this letter each day. I will be running some of the best at the bottom of the letter every few days. Thanks, all of you!

'I have been a retail stockbroker for 29 years and I spend a great amount of time reading and "net" surfing for info, ideas, and insights otherwise my clients will receive the same dull, uninspired, and mostly unprofitable opportunities that are primarily designed to generate fees for the large financial institutions that now own virtually everything, including the brokerage firm I worked at for 26 years.'

'I have been checking your site since about January. For several years, before 2008, I have been trying to inspire my clients to look outside the buy and hold stocks/mutual fund strategies of the prior 20 years and to look at other markets, geographically and in an asset class sense. Otherwise I am afraid that their investment returns for the next 10 years will be no better than the last 10 if not worse.'

'I believe I have done a decent job of protecting their assets, but as you know that ain't going to cut it going forward. At some point you need returns, and I truly believe we need a broader scope to achieve that, and that is where you come in.'

'You obviously have a broad view as well as depth, and are not content to write about "another list of high quality dividend paying stocks." Your circle of contacts in business and government, not to mention the industry, is quite impressive and obviously evolved over a number of years. Love your sense of humor.? My view is that only those who really understand their craft can see the humor and irony. And yes it is true that even one idea will more than pay for your subscription cost. '

Thanks again for your unique work.

AJ in Louisiana

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.