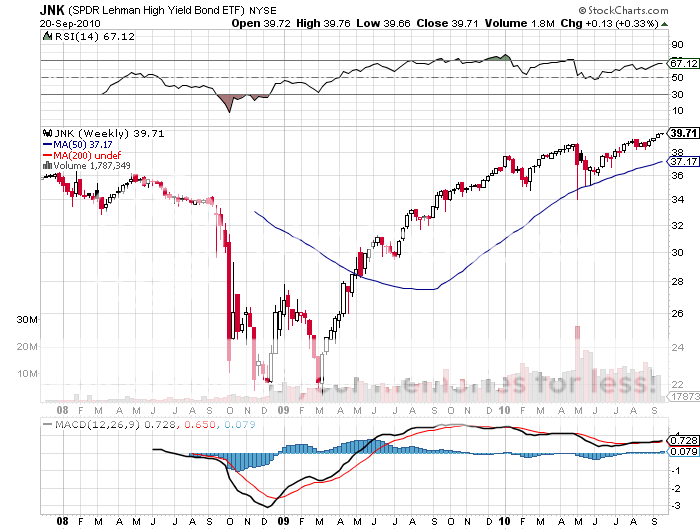

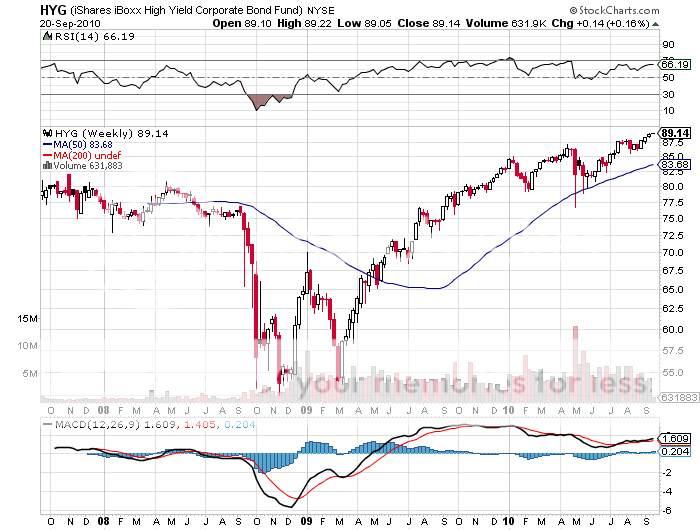

Featured Trades: (JUNK BONDS), (JNK), (HYG), (PHB)

SPDR Lehman High Yield Bond Fund ETF

iShares iBoxx High Yield Corporate Bond Fund ETF

PowerShares High Yield Bond Fund Portfolio ETF

2) Are Junk Bond Investors Paying Rolls Royce Prices for Jalopy Securities? One of my more prescient calls of the past two years has been to move readers into the junk bond arena (click here for my '2009 Annual Asset Class Review'). My argument then was that the market was discounting a default rate of 14%, but that the realized default rate would be a tiny fraction of that.

This turned out to be true, prompting the (JNK) ETF to deliver a parabolic 80% return, not bad for a bond fund. Similar gains were seen in the other junk ETF's, like (HYG), and (PHB). However, it looks like this market is returning to the bad old days that we saw at the last top of this market in 2007. Inferior credits are now flooding the market with dubious conditions, lax covenants, but premium terms, taking new issuance up to an unbelievable $172 billion during the first nine months of 2010. Banks may not be willing to lend, but investors of every stripe are more than happy to. Investors are once again paying Rolls Royce terms for jalopy credits. Apparently the reach for yield knows no bounds.

If you haven't started to sell off your position in this area, I would begin to do so. What seemed like a riskless yield with (JNK) at 18% last year doesn't seem like such a bargain now at 10.8%. Use the current strength in the equity market to take profits at these very rich prices. When credit quality once again becomes an issue, these will be the first securities to drive into the ditch.

Rolls Royce Prices for Jalopy Securities