Featured Trades: (CORN), (WHEAT), (SOYBEANS)

Teucrium Commodity Trust Corn ETF

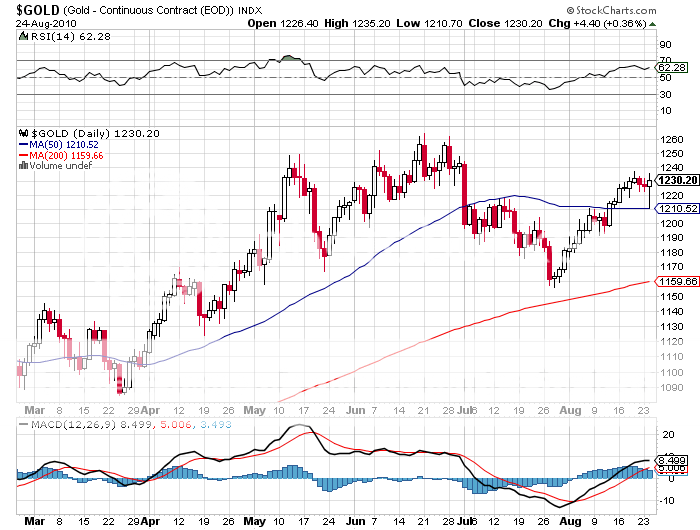

2) Time to Add some Corn to Your Diet.? I have been waiting for a substantial dip in the grains to add to a position in corn, and it is clear from the chart below that we are just not getting it. While the US crop seems to be in good condition, with 70% rated 'good/excellent', the global picture continues to move from bad to worse.

In just a few days, torrential rains wiped out Pakistan's entire crop for the year, which historically has been a regional net supplier, and they have destroyed much of the storage as well. Russia and the Ukraine have completely withdrawn from the export market, husbanding what meager harvests they can now expect to feed their own people, forcing several international suppliers to declare a? force majeur on their contracts. It's looking like Canada can expect an early winter, as frosts have already appeared in some of the northernmost fields. Cold, dry weather is also forcing major supplier, Argentina, to pare back forecasts.

I caught a double in wheat a few months ago (click here for 'Going Back into the Ags') during its parabolic move from $4/bushel to $8 and quickly cashed out at the top (click here for 'My Best Trade of the Year'). It is still rich at $6.75. Corn has been a laggard, up only 25% from its May low, and clearly looks like it has broken out to the upside. It also offers individuals a new, easily tradable, liquid ETF (CORN).

Mother Nature is not the only factor boosting grain prices. There is a ton of cash sitting on the sidelines because so many investors are afraid of an Autumn stock market crash, and are loathe to buy the top of the greatest bond bubble in history. Given the strong fundamentals (click here for 'The Bull Market in Food is Only Just Starting' ) and the historically low prices, the grains look pretty good right now on a risk/reward basis in the global scheme of things.

And if the trade doesn't work out, you can always take delivery and eat your long. It's great for the digestion. Believe me, I know!