?Economics is extremely useful as a form of employment for economists?, said noted Harvard economics professor, John Kenneth Galbraith.

Hello John. I`d like to subscribe to your Macro Millionaire program. I`m sure glad I found you as your suggestions have been gloriously FANTASTIC! Short the long bond-WOW.

Appreciatively,

John

Memphis, Tennessee

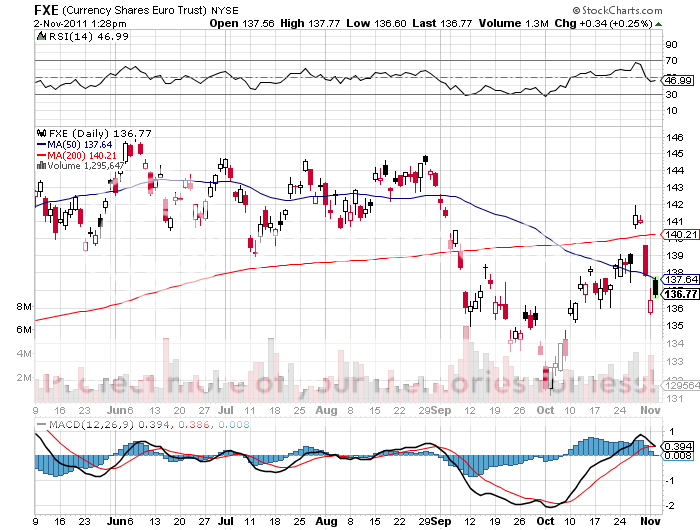

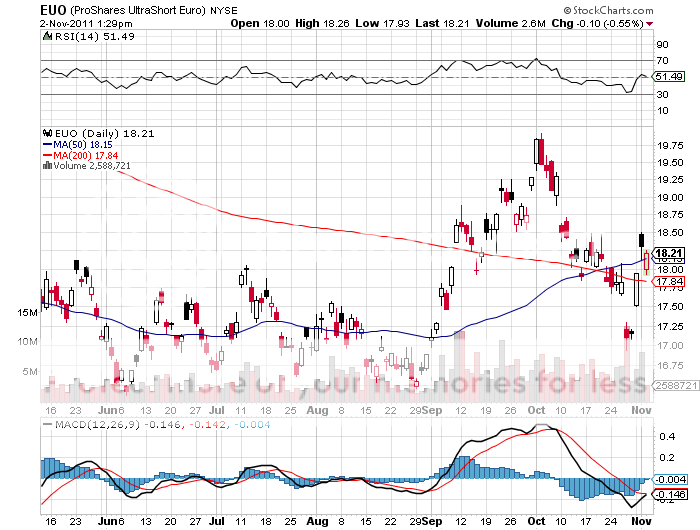

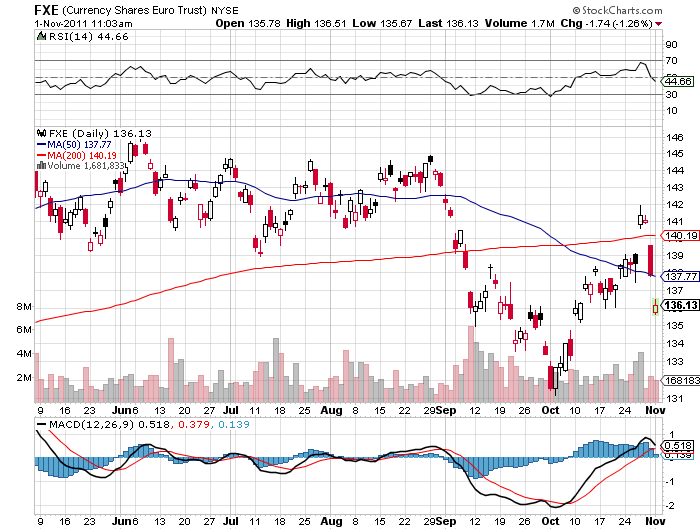

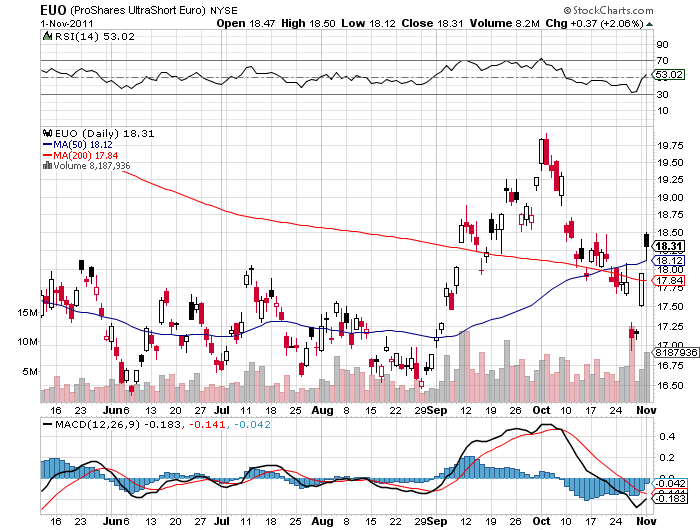

I am taking my profit in the Euro (FXE) December $140 puts this morning, nailing the high of the day at $5.70, and clocking a stunning three day profit of 107%. This adds 5.63% to the year-to-date return for Macro Millionaire, taking us up to 46%. Non option players who bought the short Euro ETF (EUO) made 9.5%.

My net profit on the trade was $2.95. For the model $100,000 portfolio this works out to $5,310 ($2.95 X 100 X 18). And we made this return while keeping 76% of our money in cash, out of harm?s way.

This was a perfect trade in so many ways:

*For a start, I got a great entry point on top of a 10 cent rally in the Euro.

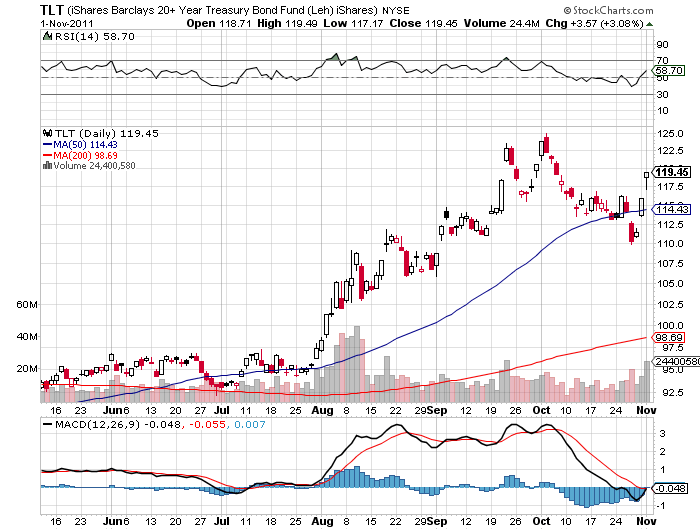

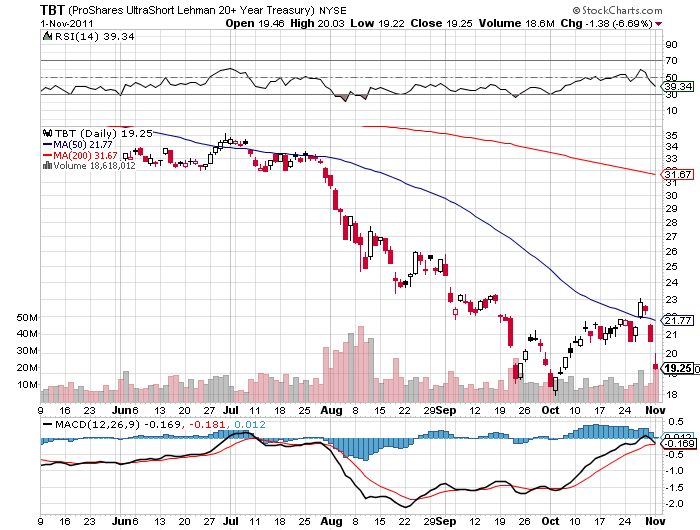

*The position was a great indirect ?RISK OFF? hedge for my sole remaining ?RISK ON? position in the (TBT). For every $1 I lost in the (TBT) since the Thursday high at $23.00, I made $2 on the Euro short.

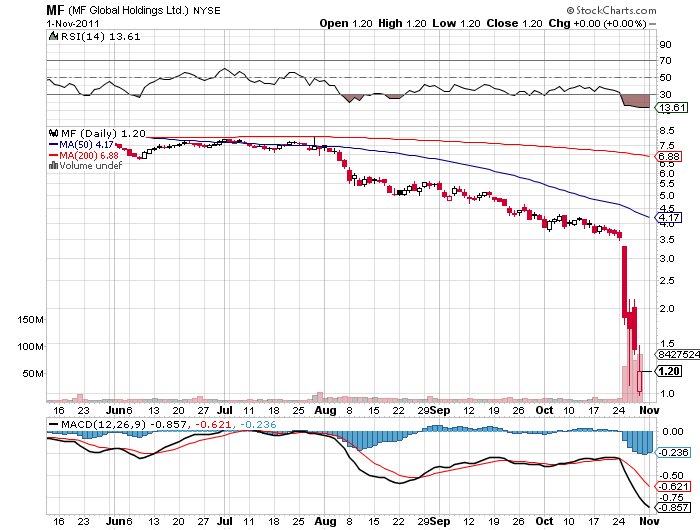

*We got an assist in the bankruptcy of MF Global, which resulted in the liquidation of their entire $6.5 billion portfolio of Euro bonds, which put additional pressure on the European currency.

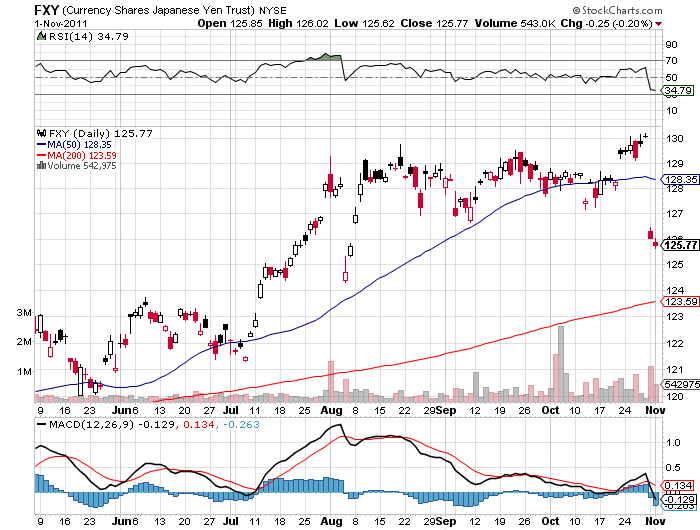

*We got a second assist from my friends at the Bank of Japan, who rushed to deflate the yen with a massive $130 billion round of intervention.

*I resisted the temptation to take a quickie 30% profit yesterday, believing that the trading community was caught badly off balance in their positioning, and that there was enough juice to take the Euro to my secondary target of $1.36.

*My friends at the People?s Bank of China told me they would take my advice and take down a big slug of any bond issue resulting from the European sovereign debt resolution. However, they said they would also take my advice and hedge out their Euro risk, making the trade currency neutral.

*I initially put on the trade expecting European Central Bank President, Mario Draghi, to cut interest rates tomorrow. With the Euro at $1.3630, I now don?t care if Mario has pasta al dente for lunch, a canole for desert, and sings O Solo Mio tomorrow. I can take my money and run at let the rest of the market run the overnight event risk. If Mario then fails to act tomorrow, I will simply resell the Euro higher up.

*We caught one of the sharpest moves in the history of the foreign exchange markets, some 5 cents in the Euro, in three trading days. You shouldn?t need to be told twice to cash in.

*No one ever got fired for taking a three day profit of 107%. Possession of the cash is 9/10ths of the law.

I know that some of you made more money on this trade than I did, because the $140 puts traded all the way down to $2.47 after the initial opening alert. No whining about not being able to get in this time. As they say down under ?Good on You!?

If you missed this trade for whatever reason, don?t chase it here. Another opportunity will come along. There are plenty of fish in the sea.

Yesterday, I wrote about the Nevadan wrinkle in the housing crisis where distressed homeowners are letting their horses go wild to make their mortgage payment. Now neighboring California is facing a Chihuahua glut, where evicted homeowners are handing over their pets to animal shelters. The diminutive Mexican canine enjoyed a boom in popularity in recent years, thanks to movies like Beverly Hills Chihuahua and Legally Blonde.? Celebrities, like Paris Hilton, have also helped promote the breed, flaunting one in front of the paparazzi. Animal shelters in the Land of Fruits and Nuts have been so overwhelmed they have had to ship the ultra-cute, but utterly useless animals to pounds as far away as Toronto. Will the unintended consequences of Greenspan?s low interest policy never end? Give the poor Chihuahua?s a break!

Thanks to the thousands of new subscribers that have poured into this service in recent months, I have been able to complete a major upgrade of my website at www.madhedgefundtrader.com . Now that the daily traffic is reaching astronomical proportions, it is time to join the big league of online financial services with an industrial strength website.

The new site offers vastly improved layout, design, and functionality. And according to my Dallas based designer, it is just plain purttier. Among the enhanced services are:

*There will be two levels of password access for paid subscribers.

*Current paid subscribers will have real time access to the online version of the entire newsletter for the first time. They will still be emailed the full daily letter to their personal addresses.

*Paid subscribers will also get access to a confidential page offering private news alerts.

*Subscriptions to my market beating Trade Alert Service will be available for the first time for $1,997 a year.

*The entire archives of Hedge Fund Radio are available for download.

*A new ?Luncheons? section offers tickets for sale with auto confirms.

*The subscription and renewal process has been fully automated.

*The public will still have free access to the less market sensitive research pieces.

My apologies to regular viewers, who have been faced with a website that has been going up and down like a yoyo during the past week. Paid subscribers should be receiving the new passwords by email in coming days.

I have put together this website with spit and bailing wire over the past four years, at it at long last time to bring in professional help. This involves migrating a dozen non-compatible databases to the new site, which I can tell you is a headache and a half. Thank you for your support and I hope you like the new site.

Your Loyal Servant,

John Thomas.

?Now, you are starting to see people front run hedge fund books. People are front running John Paulson?s book. Everybody can see this. People are starting to line up the ducks and ask which hedge funds are going to have redemptions. Which position should I get in front of? Gold is a big problem in that environment. Guess what? The biggest position in the hedge fund community is in gold,? said a leading hedge fund manager.

Diary Entry for Monday, October 31, 2011

Dear Diary,

4:30 PM Sunday- Looks like my Monday is going to start early this week. The head of the foreign exchange desk at one of Japan?s largest banks called and told me that the Bank of Japan was hitting all bids for the yen in any size at the Monday morning opening in Tokyo, heralding the beginning of a major intervention effort. I turn on my screens. The yen gaps down from ?75.30 to ?77.50 on the first trade. Looks like tomorrow is going to be a ?RISK OFF? day. Treasuries nosedive in the overnight market.

6:30 PM Sunday-Take kids to see the animated blockbuster, Puss & Boots, with voiceovers by Antonio Banderas, Penelope Cruz, and Selma Hayek. Notice how the kid movies are better than the adult movies these days. There are ample double entendres to keep the grownups entertained.

9:00 PM-Call from a friend at the People?s Bank of China in Beijing. He wants to know if they have missed the top of the Treasury bond market, and if they should start unloading their $1 trillion worth of holdings. I said don?t worry. While I expect the year ?RISK ON? trade to take the ten year yield up to 2.60% by year end, they will nosedive to 1%, and possibly go under Japanese ten year yields, if a recession hits next year. Plus, you will get a double kicker with a strong dollar. But please don?t try and sell ahead of a three day weekend, like you did last time. And thanks for the Peking Duck dinner in Shenzhen last week.

9:30 PM- Hit the sack and try and catch some shut eye before the next call.

2:00 AM-One of my former staff members at Morgan Stanley calls me from a Private Bank in Geneva to tell me that outgoing European Central Bank President, Jean Claude Trichet, said that he is not responsible for maintaining financial stability. What a moron! The Euro nosedives, break support at $1.40, and is already threatening $1.39. Sweet. My big Euro short against the dollar is looking good. I?m going to catch a hickey from my (TBT) position, but my profits from my short Euros should more than cover it.

3:00 AM- Call from one of the top New York trading houses. There are rumors that MF Global, once the world?s largest futures broker, will file for a Chapter 11 bankruptcy as soon as the court opens in 30 minutes. The firm?s risk managers are going apoplectic. Dow futures are down 200. The ?RISK OFF? day just got a turbocharger. I stagger back to bed and try to catch another hour of sleep.

5:00 AM-Woken up by an earthquake that sounds like a truck just hit the house. I turn on the TV and learn that I am directly above the epicenter. It?s the third one since Wednesday.

6:00 AM-My website administrator calls me in a panic. The store is down. A hacker attack prompted PayPal to suspend my account. Since I am one of their largest customers, I call my account rep and get it reopened.

6:30 AM- It?s official. MF files for Chapter 11. Sad to see them go. The Dow opens down 125. I have had a small account there for 20 years which I will have to close. I don?t bother calling because I know they will be flooded with inquiries by panicky customers. I?ll just wait for the check to come in the mail.

6:45 AM-I get flooded with 30 emails from Macro Millionaires asking if they should take the overnight 40% profit on their Euro short. I ignore them. Don?t bother me with the small change.

7:00 AM- Another call from my website administrator. The website is down. The Euro crash has brought a traffic spike that is causing the servers to melt. I am burning up the Internet.

7:30 AM- Conference call with support team. We agree to build in new infrastructure to accommodate a tenfold increase in new business. Couldn?t I be wrong just once to the growth down to a more manageable level? Pass.

8:00 AM- I get a call from a leading hedge fund in London?s Mayfair district. Europe is closing. Should we run the Euro short overnight? You betcha!

9:00 AM-Call from a large family office in Chicago. Should we use today?s strength in gold to lay out more hedges against core longs? Absolutely. Grab the brass ring. The barbaric relic is going to $1,500 before the fat lady sings, and will go lower if the recession next year is bad.

10:00 AM-Better get to work on today?s letter. I?m already behind the eight ball. I?ve gotta lead with the Macro Millionaire performance, which just hit a new high of 46%.

12:00-Break for lunch. Isn?t it great the way enchiladas always taste better after they have been reheated for a third day?

1:00-PM- Market close on their lows. Looks like another day of ?RISK OFF? for Tuesday.

1:15 PM-My friend, JR, a senior exec at an oil major, calls from Houston. What the hell was going on with the price of oil? Three weeks ago, it was at $75, then he blinked, and it was $95. I told him that the oil companies lost control of the price of Texas tea last year and the high frequency traders were now in the saddle. Better get used to the new frontier. It would help if he started following my trade alerts for crude. He said thanks, and next time I was in town he would buy me a 24 ounce chicken fried steak at Billy Bob?s that spilled over both sides of the plate. I can?t wait.

2:00 PM-Still haven?t started on the letter yet. I have been answering 200 email requests for information about Macro Millionaire. This always happens whenever I have a hot trade on. The watchers want to become players.

2:30 PM- I unplug the phones and close the curtains to do a one our live show on the recent market volatility for as a guest on a local radio station.

4:45 PM- Well, I got the letter done, but I?m too late. The web editor has gone trick or treating in Manhattan. This year, she is a vampire.

4:30 PM-The traffic stats for the site have gone down. I called the webmaster, but she has gone trick or treating too, in Dallas, dressed as a giant Taco.

5:00 PM-Ooops. Forgot to take the trash out.? My garbage man must wonder what goes on here. Every week, I recycle a giant bin of newspapers, magazines, and assorted broker research, but only throw out a tiny bag of actual trash. Am I green, or what?

6:30 PM-Time for trick or treat duty with a princess and the lion from The Wizard of Oz. Last year, I went as a hedge fund manager, but that went over like a lead balloon. So this year, I am a cowboy. I have these cool Justin cowboy boots which I bought in Fort Worth, Texas during my wildcatting days, but I can?t believe how much they have shrunk. I don my Stetson and I am out the door.

Those of us who live in the mountains in California pour out to the flat lands to trick or treat, looking for well-lit streets with lots of cul de sacs. As a result, these neighborhoods get flooded with thousands of kids. Up to 25 zombies, ninjas, mutant ninja turtles, skeletons, witches, Spidermen, and Buzz Lightyears mob the front doors, hands out for candy. Get a bunch of small kids together and they turn feral.

Some homeowners really get into it and build haunted houses. One house had this cool ?56 Chevy crashed into a tree with dead bodies hanging out the windows. I can?t believe how many adults dress up for this. The mom wearing the naughty school girl outfit was most appreciated.

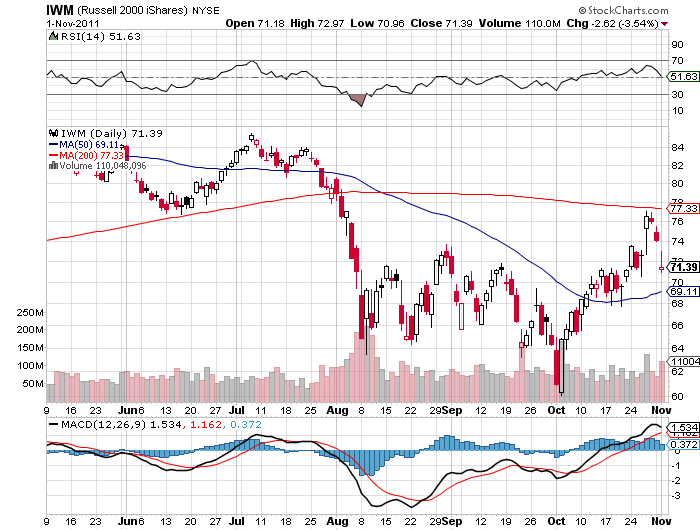

9:00 PM - Back to my screens. The Euro has broken $1.39. Looking good. Down 3 cents on the day. Why didn?t I short the Russell 2000 (IWM) again? Was I asleep, distracted, or just not paying attention? Can?t catch them all.

10:00 PM-Time to call it a night and break out a bottle of Duckhorn merlot. How many wine clubs do I belong to now? 12? As of now I am committed to buy more wine this year than I can possibly drink or give away.

12:00 AM- Time to do some early Christmas shopping. Bonham?s in London is holding their fine jewelry auction today, and lot no. 62 is a 5 carat diamond solitaire that is a real beut.

12:10 AM-Damn! Outbid by the Chinese again, who are running up the price of luxury goods absolutely everywhere to insane levels. Time to get some sleep. Maybe next time.

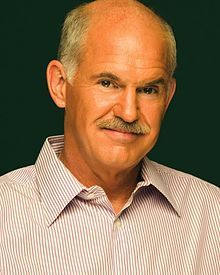

3:00 AM-An old friend at the Bank of England calls me. Greek Prime Minister, George Papandreou, says he will hold a referendum of the bailout package. What a cretin! The Euro goes into free fall. The Dow futures are down 200, gold is off $75, and Treasuries have vaporized. Better get some sleep. It looks like tomorrow is going to be a busy day. Does anybody want my job?

Note to Greece: Please Quit Waking Me Up in the Middle of the Night!

Update and explanation regarding the 11/1/2011 trade alert... Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

?It is not my job to guarantee financial stability,? said outgoing European Central Bank President, Jean Claude Trichet.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.