?Oh wow, Oh wow, Oh wow!? Were the last words of Apple founder, Steve Jobs.

It is already January 24, and the S&P 500 has seen a grand total of two down days so far in 2012. Are we on the eve of one of the great bull markets of all time? Is it off to the races once again?

I follow dozens of fundamental and trading research services and the number that are flashing warning lights right now is close to an all-time high. For example, the AAII sentiment survey now shows that 46% of investors believe that the stock market will be high in six months, well above the 39% historic average. It has only been higher than this 11% of the time since 1990. The put/call ratio has collapsed, indicating that traders no longer see the need for expensive downside protection. It has not been this low since 1998.

A number of surprises have conspired to create this warm and fuzzy feeling. The ECB has engineered a stealth quantitative easing that is helping support asset prices worldwide, as the Federal Reserve did a year ago. The recent spate of European bond auctions has gone well. China surprised many (but not me) with a Q4 GDP of 8.9%.

It is not unusual to see a strong January, which is the most bullish month of the year by a large margin. Since 1928, the average January gain has been 1.69%, compared to 0.51% for all other months. As of this writing, we are up 4.8% month to date and it is definitely appearing overcooked. With the (SPX) up 22.8% in less than four months, it is normal to see data as sizzling as these. The last time traders were this positive was back in April, just ahead of a 25% swoon.

I think we are seeing the same ?benefit of the doubt? market that we saw 12 months ago. Many of the most conservatively run institutions, like pension funds, only change asset allocations once a year, usually in January. With the ten year Treasury bond yielding a pitiful 1.80% at the end of 2011, it forced a natural one time only reweighting out of bonds and into stocks. Much of that new money for stocks gets spent in January.

In additional, with S&P multiples at 12.3, close to a historic lows, many institutions are willing to raise market weightings from underweight to neutral. If the economy improves they will add to positions. If it doesn?t, they will dump what they just bought. I am betting on the latter.

I am looking to see how I could be wrong in this assertion and I am hard pressed to find out how. This morning, the International Monetary Fund predicted that a Europe falling into recession could chop as much as 2% off of world economic growth this year. Is there any way they can avoid a recession? Not with long term interest rates at 6%-14%, the ECB engineering a slow motion decline in short term rates, and the interbank lending rates in a catatonic state. And that is ignoring Greek bond rates at 35%.

Will China?s economy suddenly rebound to double digit growth rates once again? Not if Beijing has anything to say about it, which has been pouring cold water on the economy to extinguish the inflationary fires.

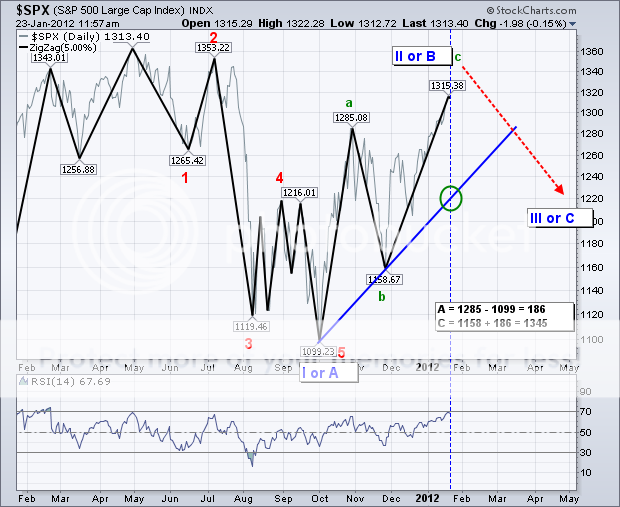

Calling the top in these speculative mini bubbles is always an impossible exercise. But it is safe to say that we are far closer to the top of this move than the bottom, and the next trade alert is far more likely to be a sell than a buy. If you don?t believe me, then take a look at the Elliot wave analysis by my friends at stockcharts.com. It predicts an (SPX) top on this move of 1345 to be followed by a sell off to the trendline at 1,280 at the least, to a complete breakdown of the move at the worst.

The Alarm Bells Are Ringing

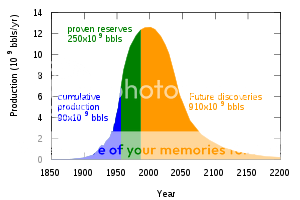

It has been a long wait for 'peak oilers,' whose passionate belief is that the world will run out of oil in coming years, sending prices through the roof.

This splinter religion came into being in 1956 when M. King Hubbert produced some simple supply/demand charts showing that US reserves of Texas tea would dry up by 1965-70, forcing a heavy reliance on imports with which we have become all too familiar. This was later expanded globally, implying that Western civilization would come to a grinding halt.

It all seemed very prescient, when in 1973 OPEC raised prices from $3/barrel to $12 in the wake of the Yom Kippur war, and the resulting boycott caused enormous lines at American gas stations. It happened again in 1979 with the fall of the Shah of Iran, taking crude from $12 to $40. Then Saudi overproduction kicked in big time, bring 20 years of falling prices, all the way down to $8. At the 1998 low, oil was selling for less than the barrel that contained it.

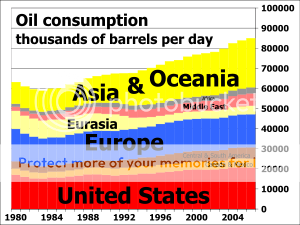

Then came China and the commodities boom, which suddenly sent the value of all things 'hard' skyward. Virtually overnight, the Middle Kingdom became the world's largest marginal consumer of not only oil, but all energy sources. By 2008, peak oilers had the second coming in sight, with prices soaring to $150/barrel.

Enter the Great Recession. The real damage this caused was not the temporary collapse of prices down to $28/barrel and the wiping out of many industry participants. It was the two year freeze on the financing of new exploration and development, a byproduct of the Wall Street crash. BP's Gulf oil spill didn't help matters either. These events have combined to create a bubble in the energy pipeline, the implications of which we may only just now be seeing.

Now the Middle East is blowing up. With populations exploding, per capita incomes plunging, and a religion that mires them in the 14th century, this sort of viral, grass roots revolution could have, and should have happened any time over the last 40 years. It took cell phones, social media, and the Internet to provide the spark. At first, the world didn't care, as Egypt and Tunisia produce little oil, and are non-factors in the global economy.

Then came Libya, an entirely different kettle of fish. Having dealt with the Libyan government myself since 1968 when Muammar Khadafi overthrew the government and kicked me out of the country, I can only say this couldn't happen to a nicer guy. I missed the Pan Am flight he blew up over Lockerbie, Scotland by a week and lost a few friends. Justice finally came when he was dragged out of a storm drain and shot at close range.

The revolution there raised broader, far more concerning questions. If it can happen in Libya, why not in Saudi Arabia, where the government is still essentially tribal in nature and will not be winning any prizes for their human rights record anytime soon. Women are still not allowed to drive. Take their 12 million barrels/day off the market, even for a few days, and the geopolitical implications are large.

Which brings me back to peak oil. After a quiet, long term downsizing, the US now only imports 2 million barrels a day from the Middle East. Canada is now our largest foreign supplier, followed by Mexico and Venezuela. But oil is a globally traded commodity, and if you prick the supply line in one place we all have to pay. Remove Saudi Arabia from the picture, and the results could be catastrophic, for China first, but for ourselves as well.

Even without these Armageddon scenarios, we are still facing a huge

problem. World oil production today is 83-84 million barrels/day. There is probably another 5 million barrels/day in reserve. By 2015, an additional 3 million barrels/ day in will come on stream that was financed prior to the Wall Street melt down. After that, new supplies become very problematic.

Even if the US can keep its own demand relatively flat through modest economic growth, conservation, new efficiencies, alternatives, and switching to natural gas, China promises to eat up all of this increase. That's when the sushi hits the fan. I think oil could hit $300/barrel by 2020, or $225 in today's prices. If you are wondering why I have become so cautious about investing lately, this is a major reason why.

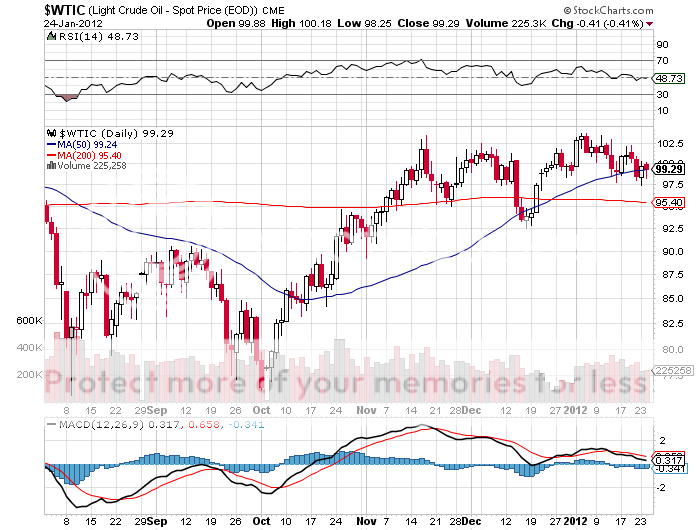

Which leads us all to the bigger question of how do we make a buck out of all of this? Brent crude, which trades in Europe, is already at $110/barrel, an $11/barrel premium to our own West Texas intermediate. Prices here have stayed low because of a shortage of storage facilities. My buddies in the field also tell me there is some elaborate conspiracy to keep West Texas artificially low, because the prices for Middle Eastern imports are priced off of that highly manipulated benchmark. It is far more likely that West Texas trades up to Brent than the other way around.

I missed the window to get in last week at $85/barrel. But if you believe it's going substantially higher, it is not too late to get involved with long term portfolios. For a start, do not buy the oil ETF (USO). The tracking error caused by the contango will kill you, assuring that you will take all of the risk but get few of the benefits.

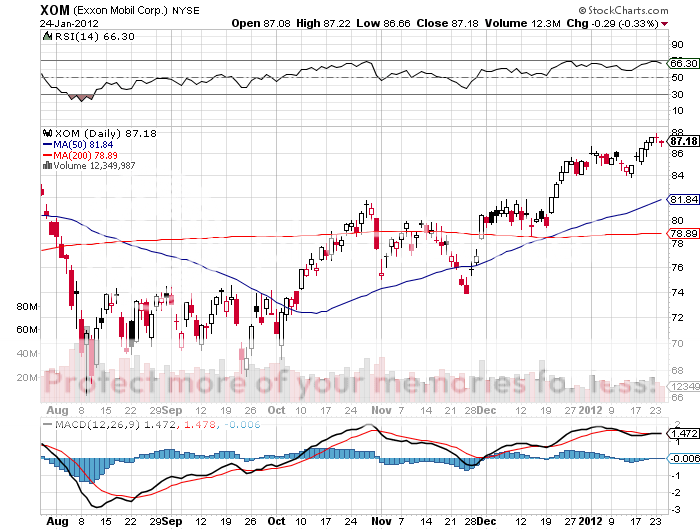

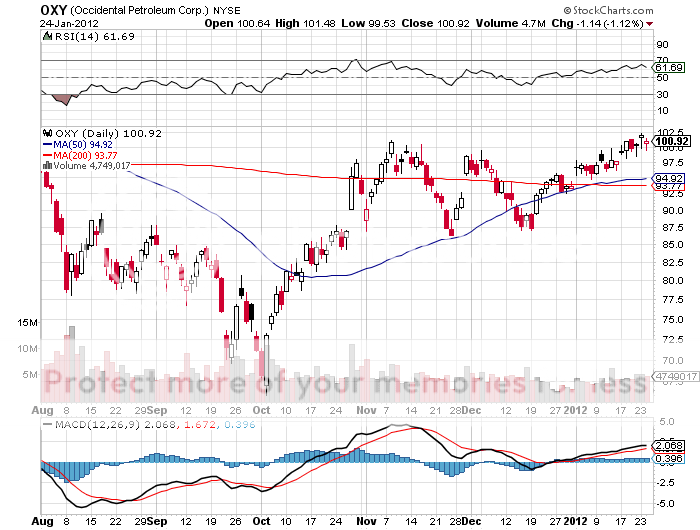

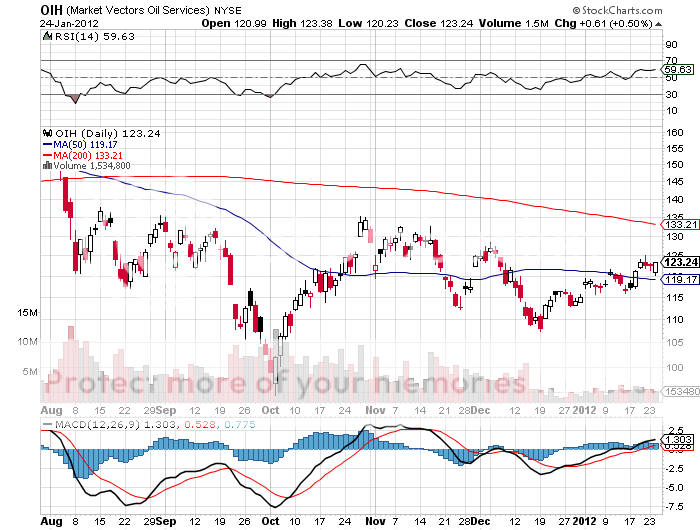

Individual oil major stocks that I have been recommending, like ExxonMobil (XOM), BP (BP), and ConocoPhillips (COP) are great vehicles. A simple alternative is to pick up the double long oil majors ETF (DIG). These guys have massive supplies in the pipeline that are about to be revalued by higher prices. So are independents like Occidental Petroleum (OXY). You can throw oil service companies into the mix as well through the ETF (OIH).

As (OXY) founder, Dr. Armand Hammer, told me when I was a kid, 'Keep your eye on oil, because everything stems from that.' Some 40 years later, and I think the old man is still right.

'He who lives upon hope will die fasting,' said Benjamin Franklin.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas at 12:00 noon on Friday, January 27, 2012. A three course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be tossed at you to keep your ears ringing for a week. Tickets are available for $243.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The event will be held at a major hotel on the Las Vegas strip. Details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please click on ?Luncheons? along the top banner.

[button size="large" color="red"]Sold Out[/button]

Often while searching for a piece of data through Google, I stumble across something else which is far more interesting. That is how I found the table below of international savings rates.

Why should you care? Because countries with high savings rates tend to have strong economies and great stock markets, since there is plenty of excess cash available to pour into investments. Those with low savings rates suffer from weak economies and poor stock markets, because of a shortage of available capital. When the American savings rate dropped below zero in the latter part of the last decade, it set off emergency alarms for me that a collapse of the financial markets was on the horizon.

During the last four decades, I have watched Japan's savings rates plunge from 16% to 2.8%, and you know the result for markets there. When it approaches zero, that will be the time to short the JGB's, the yen, and the Nikkei stock index. The only country that doesn't fit this analysis is Australia, with a mere 2.5% savings rate, but boasts a positively virile stock market and currency. The resource boom there is skewing things towards under saving and over consumption.

By the way, the outlook for the US, with its still miserable 3.9% savings rate, does not look great when considering this benchmark. Don't expect a runaway bull market anywhere savings rates are low and falling. What are savings rates telling us are the best countries in which to invest? China, 38%, India, 34.7%, and Turkey, 19.5%.

Australia? 2.5%

Japan? 2.8%

USA? 3.9%

Brazil? 6.8%

Britain? 7.0%

Germany? 11.7%

Ireland? 12.3%

Switzerland? 14.3%

Turkey? 19.5%

India? 34.7%

China? 38%

In their century long coverage of exotic places, cultures, and practices, National Geographic Magazine inadvertently sheds light on broad global trends that deeply affect the rest of us. Plus, the pictures are great. A recent issue celebrated the approach of the world's population to 7 billion, and the implications therein.

Long time readers of this letter know that demographic issues will be one of the most important drivers of all asset prices for the rest of our lives. The magazine expects that population will reach 9 billion by 2045, the earliest date that I have seen so far. Can the planet take the strain? Early religious leaders often cast Armageddon and Revelations in terms of an exploding population exhausting all resources, leaving the living to envy the dead. They may not be far wrong.

A number of developments have postponed the final day of reckoning, including the development of antibiotics, the green revolution, DDT, and birth control pills. Since 1952, life expectancy in India has expanded from 38 years to 64. In China, it has ratcheted up from 41 years to 73. These miracles of modern science explain how our population has soared from 3 billion in a mere 40 years.

The education of the masses may be our only salvation. Leave a married woman at home, and she has eight kids, as our great grandparents did, half of which died. Educate her, and she goes out and gets a job to raise her family's standard of living, limiting her child bearing to one or two. This is known as the ?demographic transition.?

While it occurred over four generations in the developed world, it is happening today in a single generation in much of Asia and Latin America. As a result, fertility around the world is crashing. The US is hovering at just below the replacement rate of 2.1 children per family, thanks to immigration. But China has plummeted to 1.5, Europe is at 1.4, and South Korea has plunged as low as 1.15.

Population pressures are expected to lead to increasing civil strife and resource wars. Some attribute the genocide in Rwanda in 1999, which killed 800,000, as the bloody result of overpopulation.

If you think that the upcoming energy shortage is going to be bad, it will pale in comparison to the next water crisis. So investment in fresh water infrastructure is going to be a great recurring long term investment theme. One theory about the endless wars in the Middle East since 1918 is that they have really been over water rights.

Although Earth is often referred to as the water planet, only 2.5% is fresh, and three quarters of that is locked up in ice at the North and South poles. In places like China, with a quarter of the world's population, up to 90% of the fresh water is already polluted, some irretrievably so. Some 18% of the world population lacks access to potable water, and demand is expected to rise by 40% in the next 20 years.

Aquifers in the US, which took nature millennia to create, are approaching exhaustion. While membrane osmosis technologies exist to convert seawater into fresh, they use ten times more energy than current treatment processes, a real problem if you don't have any, and will easily double the end cost of water to consumers. While it may take 16 pounds of grain to produce a pound of beef, it takes a staggering 2,416 gallons of water to do the same. Beef exports are really a way of shipping water abroad in concentrated form.

The UN says that $11 billion a year is needed for water infrastructure investment, and $15 billion of the 2008 US stimulus package was similarly spent. It says a lot that when I went to the University of California at Berkeley School of Engineering to research this piece, most of the experts in the field had already been retained by major hedge funds!

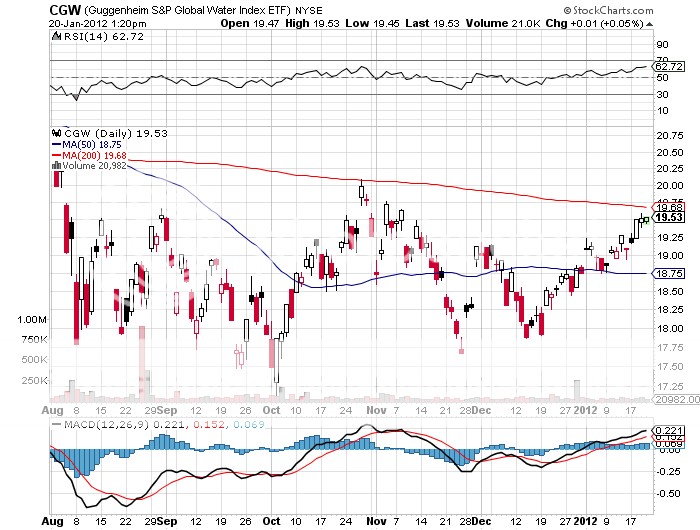

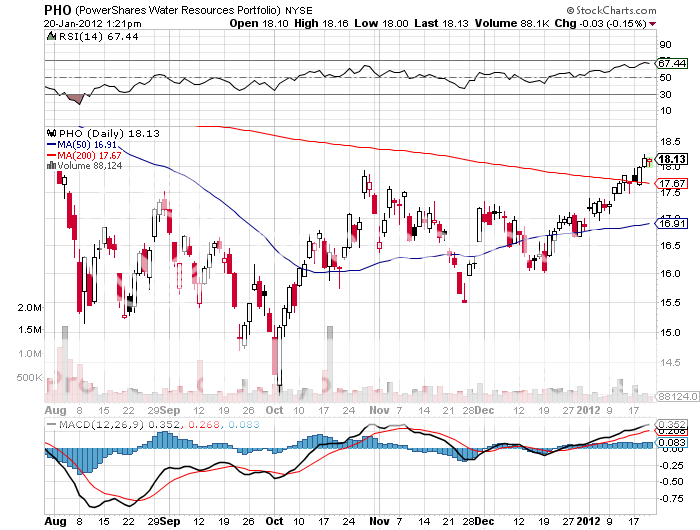

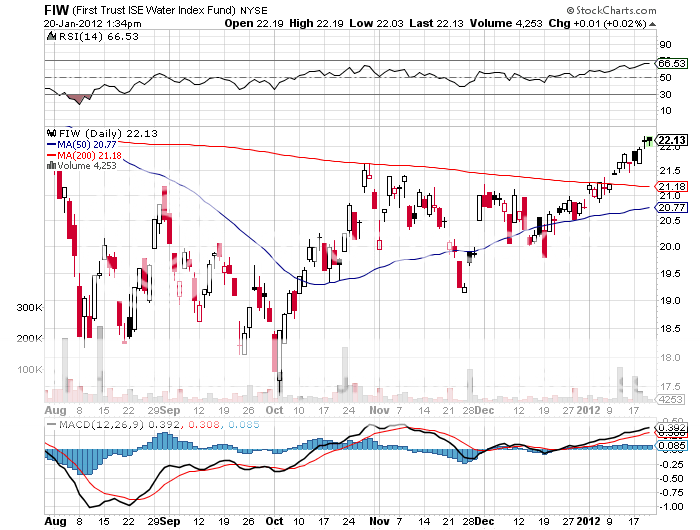

At the top of the shopping list to participate here should be the Claymore S&P Global Water Index ETF (CGW), which has appreciated by 14% since the October low. You can also visit the PowerShares Water Resource Portfolio (PHO), the First Trust ISE Water Index Fund (FIW), or the individual stocks Veolia Environment (VE), Tetra-Tech (TTEK), and Pentair (PNR). Who has the world's greatest per capita water resources? Siberia, which could become a major exporter of H2O to China in the decades to come.

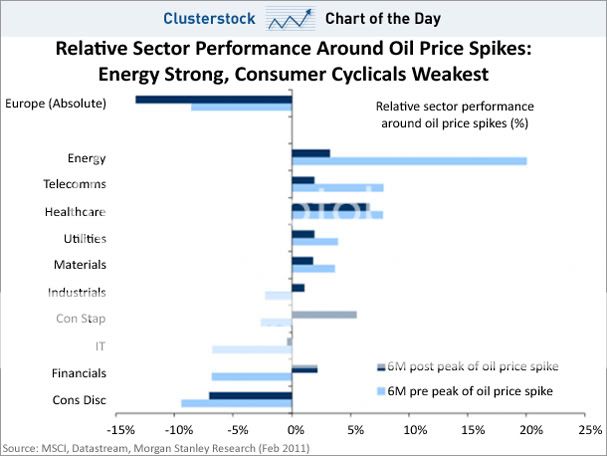

Every time the price of oil spikes, we learn vast amounts of information about the global reach of this indispensable commodity. It's like taking a non-core elective in geology at college. So I was fascinated when I found the chart of relative sector winners and losers below.

No surprise that energy does best from sky high crude prices. It is followed by telecommunications and health care. You would also expect consumer discretionary stocks to take it on the nose, as high energy prices almost always lead to a cyclical downturn in the economy. Who is the worst performer of all? Europe, which makes the recent weakness even more understandable.

Europe Will be the Biggest Loser from High Oil Prices

?Apple will never be a consumer products company,? said John Sculley, the Apple CEO who fired Steve Jobs in 1985. Today Apple is the world?s largest and most profitable consumer products company.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.