As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

I just contracted to buy all the gasoline I want at 14 cents a gallon. No, I have not struck oil in my backyard, or come into an inheritance from a long lost Kuwaiti relative. That is the de facto price that PG&E is billing me for a full charge on my all-electric Nissan Leaf.

That works out to $1.20 to recharge a vehicle that will transport me 80 miles, at the price of five cents a kilowatt hour. This is a tiny fraction of? the 40 cents/hour I pay to run the rest of my appliances, and a pittance compared to the 50 cent/hour peak rate I pay to run the air conditioner in the summer.

PG&E has exactly one engineer to talk to its 10 million customers about this ground breaking new technology, and after much effort, I managed to get him on the phone. I asked who was paying the subsidy? Were those profligate spendthrifts in Washington involved? He answered that there was no subsidy, that power sold at night was cheap because there was no other market.

So I inquired as to who was paying for all of the equipment upgrades, like the new transformers and power lines that were needed? Do I sense the heavy hand of Sacramento? He replied that there was no capital cost because the same infrastructure that delivered power to me during the day would be used to power my car at night. Only a couple of bucks would be spent on the installation of a new 'time of use smart meter'.

The car cars with a $7,500 clean energy tax credit. I know we're supposed to be cutting the deficit by eliminating handouts like this. But you'll only take my subsidies away by prying my cold dead hands away off of them. Take someone else's subsidies, not mine! It is the American thing to do these days.

He did mention that one unanticipated problem had arisen. My ears perked up. Many wealthy Tesla Roadster owners in Los Altos Hills were impressing so many girlfriends with rides that they were requiring multiple daytime recharges, even though they promised to recharge only at night. Not only did this send their electricity bills through the roof, it was causing problems with the grid as well. I guess it?s all part of the teething process, a cost of making the great leap forward to the next generation. Who knew that Match.com would be involved?

I never thought I'd get something for nothing, but it looks like this time I will. That is, as long as the car works, and my kids don't run the battery down playing rap music all night.

I am in Orlando, Florida today to appear as the Keynote speaker at the 2012 Money Show. A search for a nearby bank took me to the surreal suburb of Celebration, a city developed by the Disney people during the mid-1990's. Created to evoke small town USA circa 1940, the berg tastefully replicates an America from the bucolic past, with wide parks, period street lights, white picket fences, fluttering American flags, and some of the strictest design review and zoning restrictions in the country.

Today, Celebration suffers from a foreclosure rate that is double that found in the rest of Florida. Disney was able to realize fantasy prices for its pixie dust sprinkled homes, about 30% more than equivalent property in the surrounding area. It wisely unloaded its ownership of the downtown commercial property to a California based investor group, which is no doubt regretting its move. The downward spiral began shortly after that. Prices are now thought to be 60% off their 2006 peak.

When the sheriff went to evict one unfortunate homeowner, they were held off at gunpoint for 14 hours before he took his own life. Another unfortunate resident was recently found bludgeoned to death. There is a sad irony that investors who drank the most Kool-Aid during the real estate bubble chose to live along the Southern edge of Disney World. Today, Mickey Mouse seems to be saying 'Rent, don't Buy.'

But That's Not What the Broker Told Me

'Total credit market debt in the world has gone from $80 trillion to $200 trillion in the last ten years, an 11% annual rate, while GDP has grown by 4%. This can't continue. It's a simple matter of arithmetic,' said Kyle Bass, of hedge fund Hayman Partners.

The great thing about interviewing Joseph Stiglitz over dinner is that you don't have to ask any questions. You just turn him on and he spits out one zinger after another. And he does this in a kibitzing, wizened, grandfatherly manner like one would expect from a character that just walked off the set of Fiddler on the Roof.

The unfortunate thing is that you also don't get to eat. The Columbia University professor and former World Bank Chief Economist animatedly talked the entire time, and I was too busy feverishly taking notes to ingest a single crouton.

Stiglitz argued that for 30 years after the end of the Great Depression there was no financial crisis because a newly empowered SEC was on the beat, and everything worked. A deregulation trend that started under Reagan began stripping away those protections, with the eventual disastrous repeal of Glass-Steagle in 1999. The philosophical justification adopted by many economists, including Fed chairman Alan Greenspan, was that unfettered markets always lead to efficient outcomes.

This belief was based on simplistic models assuming that markets were always perfect, always open, and that everyone had perfect information. Stiglitz's own work on 'information asymmetry,' which earned him a Nobel Prize in economics in 2001, pulled the rug out from under this theory, because it showed that one party to a transaction always has more information than the other, often the seller.

The banks used this window to introduce super leveraged derivatives that had never been regulated, studied, or even understood. They then clawed open accounting loopholes that were so imaginative that not only were shareholders and regulators deceived about how much risk was involved, senior management was clueless as well. Instead of managing risk, they created risk.

A 2006 GDP that was 80% derived from real estate transactions and a savings rate that fell to zero meant that a severe crash was a sure thing. President Bush's response was to unleash an extreme form of 'trickledown economics,' with the banks given $700 billion with no conditions attached. Intended to recapitalize the banks so they could resume lending to the mainstream economy, much of the money ended up being paid out in bonuses and dividends. Of the $180 billion used to rescue AIG, $13 billion went to Goldman Sachs, and much of the rest went to German and French banks. No wonder Main Street feels cheated.

The financial system is now more distorted than ever, with major institutions wards of the state, and smaller banks that actually lend to consumers and small businesses going under in record numbers, because the playing field is so uneven. There are too many structural conflicts of interest. The 'once in a 100 year tsunami' argument is merely a justification for changing nothing. Banks would rather maintain the fiction that the loans on their books are good, than make adjustments, meaning there will be more foreclosures in 2012 than in 2011 or 2010. No financial system has ever wasted assets on this scale, and the end result will be a national debt many trillions of dollars larger.

The $787 billion stimulus package was too small, and should have been at least $1.2 trillion, but there was no way Obama was going to get more out of this Senate. The 40% of the stimulus that was tax cuts was saved or put into Treasury bonds and created no immediate beneficial effects on the economy. More money should have gone to the states, which unable to deficit spend, are now a huge drag on the economy. But even this meager package was able to prevent the unemployment rate from rising from 10% to 12%, as it was set to do. Any major spending cuts will produce 'Hoover' outcomes.

The outlook for the economy is bleak, at best.

Well, I don't get to chat at length with a Nobel Prize winner every day, so I thought I'd give you the full blast, even though I had to leave a lot out. For a dinner that I could actually eat, I walked next door for a Big Mac meal and supersized the fries.

?We?ll still operating off of Jackson Hole, 2011 when Ben Bernanke delivered his famous speech preceding quantitative easing,? said foreign exchange trader, Ira Harris.

After my weekly dump on residential real estate, I feel obliged to reveal one corner of this beleaguered market that might actually make sense.

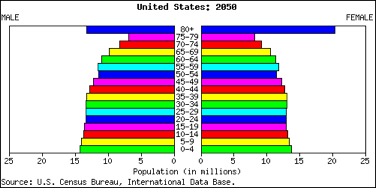

By 2050 the population of California will soar from 37 million to 50 million, and that of the US from 300 million to 400 million, according to data released by the US Census Bureau and the CIA fact Book (check out the population pyramid below).

That means enormous demand for the low end of the housing market, apartments in multi-family dwellings. Many of our new citizens will be cash short immigrants. They will be joined by generational demand for limited rental housing by 65 million Gen Xer's and 85 million Millennials enduring a lower standard of living than their parents and grandparents. These people aren't going to be living in cardboard boxes under freeway overpasses.

The trend towards apartments also fits neatly with the downsizing needs of 80 million retiring Baby Boomers. As they age, boomers are moving from an average home size of 2,500 sq. ft. down to 1,000 sq ft condos and eventually 100 sq. ft. rooms in assisted living facilities. The cumulative shrinkage in demand for housing amounts to about 4 billion sq. ft. a year, the equivalent of a city the size of San Francisco.

In the aftermath of the economic collapse, rents are now rising and vacancies rates are shrinking. Fannie Mae and Freddie Mac financing is still abundantly available at the lowest interest rates on record. Institutions combing the landscape for low volatility cash flows and limited risk are starting to pour money in.

Legendary Fortune Magazine editor, Winslow Jones, created the first hedge fund out of a shabby office on Broadway Avenue in New York City in 1948, and generated monster returns over the next 20 years. He got the idea of a 20% performance bonus, now an industry standard, from ancient Phoenician sea captains who kept a fifth of the profits from successful voyages. Jones must have had an historical bent.

Then came the second generation titans, George Soros, Julian Robertson, and Michael Steinhardt, who made their debut in the sixties. I count myself among the third generation along with Paul Tudor Jones and Louis Bacon, who launched funds in the late eighties, when there were still fewer than 200 funds and $25 million was still considered a lot of money. The really big money showed up in the nineties when the pension funds found them.

After that, we suffered through the many ordeals that followed, including the collapse of Long Term Capital in 1995, the Amaranth blow up in natural gas in 2006, the Lehman Brothers bankruptcy in 2008, and John Paulson?s 50% draw down in 2011. Today there are over 7,000 hedge funds, thought to manage some $2.2 trillion which dominate all financial markets.

Hedge Funds Do Have Their Advantages

?You can reduce discretionary spending down to zero and it won?t have much impact on our fiscal problems because it?s such a small proportion of the total,? said Ben Bernanke, chairman of the Federal Reserve.

Due to the overwhelming surge in new subscriptions last night, my website crashed, preventing many subscribers from renewing at the old $1,997 annual rate BEFORE THE February 7 deadline. I am therefore extending my special offer for just 24 more hours. After that, at midnight EST, Wednesday February 8, prices for both of my products are rising by 50%.

It is an old adage in the investment business that you get what you pay for. Followers of my Macro Millionaire?? trade mentoring got quite a lot last year, with my 56 recommendations bringing in a return of 40.17%.

Since this is the land of the free, the home of the brave, and the last bastion of capitalism, I am going to use this strength to raise prices for the first time in 18 months. The return of inflation starts here.? I am also going to plow my profits into substantially upgrading my products.

My Trade Alert Service will change names to the Global Trade Dispatch. The new services will include a beefed up research team covering a broader array of asset classes, more strategy lunches and seminars around the world, instantaneous distribution of trade alerts through text messaging, and a relaunch of Hedge Fund Radio. It will also include an enhanced live customer support. The new prices are:

$3,000?- One year subscription to Global Trade Dispatch, including the daily newsletter, trade alerts, and webinars

$500?-?Three month subscription to the daily newsletter only

Since I value loyalty, I am honoring the old price of $1,997 until February 8 only. So if your subscription is about to run out, or if you have been sitting on the fence with a view to subscribing, now is the time to act.

[box type="note" icon="none" border="full"]

Subscribe to Global Trading Dispatch - (12-Months)

New Subscribers - Sign-Up Now for $1,997

Current Subscribers - Login and Renew Your Subscription

[/box]

[box type="note" icon="none" border="full"]

Subscribe to Newsletter - (3-Months)

New Subscribers - Sign-Up Now for $399

Current Subscribers - Login and Renew Your Subscription

[/box]

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.