I?ll never forgot when my friend, Don Kagin, one of the world?s top dealers in rare coins, walked into the gym one day and announced that he made $1 million that morning.? I inquired ?How is that, pray tell??

He told me that he was an investor and technical consultant to a venture hoping to discover the long lost USS Central America, which sunk in a storm off the Atlantic Coast in 1857, heavily laden with gold from the California mines (click here for the full story at http://www.shipofgoldinfo.com/ ). He just received an excited call that the wreck had been found in deep water off the US east coast.

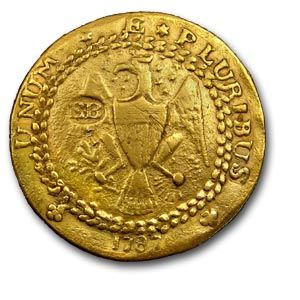

I learned the other day that Don had scored another bonanza in the rare coins business. He had sold his 1787 Brasher Doubloon for $7.4 million. The price was slightly short of the $7.6 million that a 1933 American $20 gold eagle sold for in 2002.

The Brasher $15 doubloon has long been considered the rarest coin in the United States. Ephraim Brasher, a New York City neighbor of George Washington, was hired to mint the first dollar denominated coins issued by the new republic.

Treasury secretary Alexander Hamilton was so impressed with his work that he appointed Brasher as the official American assayer. The coin is now so famous that it is featured in a Raymond Chandler novel where the tough private detective, Phillip Marlowe, attempts to recover the stolen coin. The book was made into a 1947 movie, ?The Brasher Doubloon,? starring George Montgomery.

This is not the first time that Don has had a profitable experience with this numismatic treasure. He originally bought it in 1989 for under $1 million, and has made several round trips since then. The real mystery is who bought it last? Don wouldn?t say, only hinting that it was a big New York hedge fund manager who adores the barbarous relic. He hopes the coin will eventually be placed in a public museum. Who says the rich aren?t getting richer?