As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

After my weekly dump on residential real estate, I feel obliged to reveal one corner of this beleaguered market that might actually make sense.

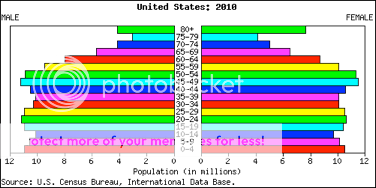

By 2050 the population of California will soar from 37 million to 50 million, and that of the US from 300 million to 400 million, according to data released by the US Census Bureau and the CIA fact Book (check out the population pyramid below).

That means enormous demand for the low end of the housing market?apartments in multi-family dwellings. Many of our new citizens will be cash short immigrants. They will be joined by generational demand for limited rental housing by 65 million Gen Xer?s and 85 million Millennials enduring a lower standard of living than their parents and grandparents. These people aren?t going to be living in cardboard boxes under freeway overpasses.

The trend towards apartments also fits neatly with the downsizing needs of 80 million retiring Baby Boomers. As they age, boomers are moving from an average home size of 2,500 sq. ft. down to 1,000 sq ft condos and eventually 100 sq. ft. rooms in assisted living facilities. The cumulative shrinkage in demand for housing amounts to about 4 billion sq. ft. a year, the equivalent of a city the size of San Francisco.

Four years after our economic collapse, rents are one of the few areas in real estate that have been consistently rising in price. Fannie and Freddie financing is still abundantly available at the lowest interest rates on record. Institutions combing the landscape for low volatility cash flows and limited risk are starting to pour money in.

In Your Future?

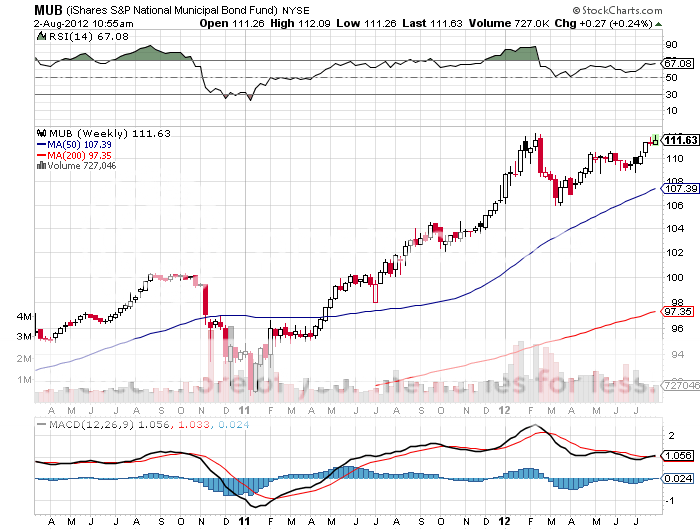

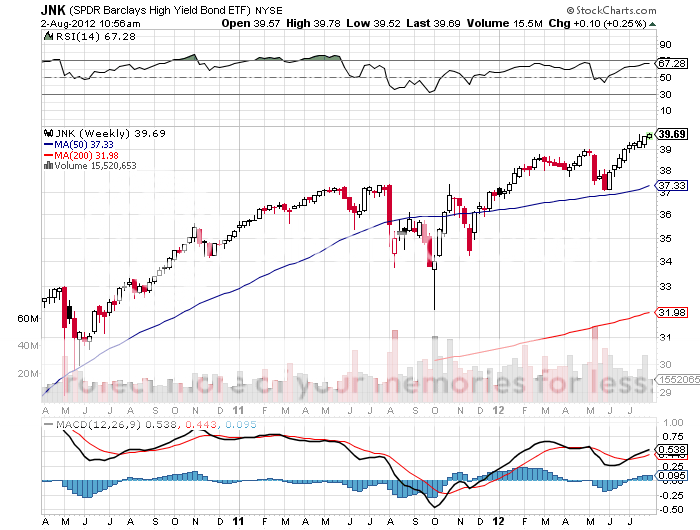

Some 18 months ago, bank research analyst Meredith Whitney is predicted that the dire straits of state and local finances would trigger a collapse of the municipal bond market that would resemble the Sack of Rome. She believed that total defaults could hit 2,000 issues and reach $100 billion in value. Those sharp edged comments caused the main muni bond ETF (MUB) to plunge from $106 to $97.

So how did that forecast do? Since then, muni bonds have been one of the top performing asset classes in the financial market. (MUB) has soared from 92 to 113, a gain of 23%. As for the number of defaults? The amounted to a handful worth only a few million dollars. Try again Meredith!

I didn?t buy it for a second. States are looking at debt to GDP ratios of 4% compared to nearly 100% for the federal government, which still maintains its triple ?A? rating. They are miles away from the 130% of GDP that triggered defaults and emerging refinancing?s by Greece, Portugal, and Ireland.

The default risk of muni paper is vastly exaggerated. I have read the prospectii of several California issues and found them at the absolute top of the seniority scale in the state?s obligations. Teachers will starve, police and firemen will go on strike, and there will be rioting in the streets before a single interest payment is missed to bond holders.

How many municipal defaults have we actually seen in the last 20 years? The nearby City of Vallejo, where policemen earn $140,000 a year, is one of the worst run organizations on the planet. And Orange County got its knickers in a twist betting their entire treasury on a complex derivatives strategy that they clearly didn?t understand sold by, guess who, Goldman Sachs. They were recently joined by the city of Stockton, California. To find municipal defaults in any real numbers you have to go back 80 years to the Great Depression.

My guess is that we will see a rise in muni bond defaults. But it will be from two to only 20, not the hundreds that Whitney is forecasting. Let me preface my call here that I don?t know anything about the muni bond market. It has long been a boring, quiet backwater of the debt markets. At Morgan Stanley, this is where you sent the new recruit with the ?C? average from a second tier school who you had to hire because his dad was a major client. I have spent most of my life working with hedge funds, major offshore institutions, and foreign governments for whom the tax advantages of owning munis have no value.

However, I do know how to use a calculator. Top quality ?AAA? muni bonds now carry 3% yields. If you buy bonds from you local issuer, you can duck the city, state, and federal tax due on equivalent grade corporate paper. That gives you a pre tax yield as high as 6%, depending on where you live. While the market has gotten a little thin, prices from here are going to get huge support from these coupons.

Since the tax advantages of these arcane instruments are highly local, sometimes depending on what neighborhood you live in, I suggest talking to a financial adviser to obtain some tailor made recommendations. There is no trade for me here. I just get irritated when conflicted analysts give bad advice to my readers and laugh all the way to the bank. Thought you should know.

There is another factor that will support this market. When taxes go up, and they almost certainly will no matter who wins the presidential election, the tax free aspect of muni bonds also increases. That makes them a ?buy? in my book. But only a buy and hold. They way to play it safe here is to only invest in maturities that match your cash flow needs. They way you can ignore the market gyrations and hold everything to maturity. For most investors, that means limited maturities to 10 years or less.

This is Not the Muni Bond Market

Milan, Italy appears to be a city entirely populated by fashion models riding bicycles on the city?s frenetic streets. That is one?s first impression coming out of the monolithic Milano Centrale train station, built by Mussolini to reaffirm faith in his state. Despite years of allied bombing during WWII, the building is as imposing as the day it was built.

You Think It?s Easy Fitting into a Size 0?

I came to this medieval city to speak at another strategy luncheon, which was attended by readers from throughout Europe, from the surgeon hailing from Trondheim, Norway, to the Hungarian hedge fund manager. The Westin Hotel provided a spectacular lunch, as only the Italians can.

We discussed various breakup scenarios for the EC which come into vogue every time Greek debt gets downgraded, which is often. This is unlikely, given the modern European?s dislike for open conflict. Bring nationalism into the equation, and things could deteriorate quickly. Germany could bail, unwilling to refinance the debt of lazy, tax avoiding, garlic eaters. Southern Europe could do a disappearing act, unwilling to pay their debts to the sauerkraut eaters up North.

Yes, I Can Be Bribed

In either case, the European currency bloc shrinks, or disappears completely. It is just a matter of time before an opportunistic political party rides this fast track into power. The Germans will tell you from hard earned experience that this always ends badly.

I had exactly one free afternoon to spend in this amazing city. I visited Da Vinci's The Last Supper at Santa Maria della Grazie monastery, looking for evidence of the conspiracy theories long ascribed to this masterpiece. I did a quick run through the Galleria and stepped on the bull?s balls, conducting three clockwise rotations to bring good luck. Looking at my performance since then, it obviously worked. The impact of the fashion industry on Milan is enormous, with every conceivable brand imaginable on show.

I managed to duck into the main Brioni store just before closing. There, I watched two Russian Mafia types in their thirties buy a half dozen exquisitely tailored, 200 thread count suits each for $6,000 apiece. That?s $72,000 worth of clothes?. for guys!

Alas, they don?t carry an American size 48 long in stock, it would have to be a custom order, so I left with only a couple of Leonardo ties in hand. It turns out that Brioni doesn?t manufacture suits for big guys anymore. The company has downsized production to fit Chinese and Russian customers off the rack, where the big money is these days. In any case, I happen to know that I can get the identical suit at the Brioni shop Caesar?s Palace in Las Vegas for a third less, plus they likely have my size. And I will be there in two months for a strategy luncheon.

The next morning found me in a mad dash back to the train station, my taxi driver artfully weaving in and out of traffic, where I boarded a first class Eurostar train. The engine powered North towards the Italian Alps, passing through the Milan slums. Retracing the route seen in the classic Frank Sinatra war flick, Von Ryan?s Express.

?It?s ironic that just as we break out of a three year trading range, the market is about to be hit by a sledge hammer,? said Dave Rovelli at Canaccord Genuity.

After my entertaining repast with the head of our nation?s intelligence service, I had to ask myself this question.

During the sixties, new dwarf varieties, irrigation, fertilizer, and heavy duty pesticides tripled crop yields, unleashing a green revolution. But guess what? The world population has doubled from 3.5 to 7 billion since then, eating up surpluses, and is expected to rise to 9 billion by 2050.

Now we are running out of water in key areas like the American West and Northern India, droughts are hitting Australia, Africa, and China, soil is exhausted, and global warming is shriveling yields. Water supplies are so polluted with toxic pesticide residues that rural cancer rates are soaring.

Food reserves are now at 20 year lows. Rising emerging market standards of living are consuming more and better food, with Chinese pork demand rising 45% from 1993 to 2005. The problem is that meat is an incredibly inefficient calorie transmission mechanism, creating demand for five times more grain than just eating the grain alone.

To produce one pound of beef, you need 16 pounds of grain and over 2,000 gallons of water! I won?t even mention the strain the politically inspired ethanol and biofuel programs have placed on the food supply. Burning food so you can drive your GM Suburban to Wal-Mart on the weekends while millions are starving never made much sense to me.

It is possible that genetic engineering, sustainable farming, and smart irrigation could lead to a second green revolution, but the burden is on scientists to deliver.

The amount of arable land per person has fallen precipitously since 1960, from 1.1 acres to 0.6 acres, and that could halve again by 2050. Water is about to become even more scarce than land. Productivity gains from new seed types are hitting a wall.

China, especially, is in a pickle because it has 20% of the world?s population, but only 7% of the arable land. It has committed $5 billion to develop agricultural land in Africa. There are now thought to be over one million Chinese agricultural workers on the Dark Continent. Similarly, South Korea has leased half the arable land in Madagascar to insure their own food supplies.

An impending global famine has not escaped the notice of major hedge funds. George Soros has snatched up 650,000 acres of land in Argentina and Brazil on the cheap, an area half the size of Rhode Island, Others are getting into the game, quietly building portfolios of farms in the Midwest and the South.

This year promises to deliver one of the greatest US crop yields in history, brought on by the warmest winter in 100 years. The US Dept. of Agricultural January crop report then predicted huge surpluses, slamming prices once again, and delivering limit down moves in the futures markets. But the weather may not cooperate, as it did last year.

The net net of all of this is that food prices are going up, a lot. Use this year?s expected weakness in prices to build core long positions in corn, wheat, and soybeans, as well as in the second derivative plays like Potash (POT), Agrium (AGU) and Monsanto (MON). You might also look at the PowerShares Multi Sector Agricultural ETF (DBA) and the Market Vectors Agribusiness ETF (MOO).

A ?BUY? SIGNAL?

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund. When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops up. With a link chain to older stories.

You can do the same. Just type anything into the search box with the little magnifying glass in the upper right hand corner of my homepage and a cornucopia of data, charts, and opinion will appear. Even the price of camels in India (to find out why they?re going up, click here). As of today, the database goes back to February 2008, and comprises some 2 million words, or triple the length of Tolstoy?s epic novel, War and Peace.

Watching the traffic over time, I can tell you how the database is being used, and the implications are fascinating:

1) Small hedge funds want to see what the large hedge funds are doing.

2) Large hedge funds look to see what they have missed, which is usually nothing.

3) Midwestern advisors to find out what is happening in New York and Chicago.

4) American investors to find out if there are any opportunities overseas (there are lots).

5) Foreign investors wish to find out what the hell is happening in the US (about 1,000 inquiries a day come in through Google?s translation software in a multitude of languages).

6) Specialist traders in stocks, bonds, currencies, commodities, and precious metals are looking for cross market insights which will give them a trading advantage with their own book.

7) High net worth individuals managing their own portfolios so they don?t get screwed on management fees.

8) Low net worth individuals, students, and the military looking to expand their knowledge of financial markets (lots of free online time in the Navy).

9) People at the Treasury and the Fed trying to find out what the private sector is doing.

10) Staff at the SEC and the CFTC to see if there is anything new they should be regulating.

11) More staff at the Congress and the Senate looking for new hot button issue to distort and obfuscate.

12) Yet, even more staff in Obama?s office gauging his popularity and the reception of his policies.

13) As far as I know, no justices at the Supreme Court read my letter. They?re all closet indexers.

14) Potential investors/subscribers attempting to ascertain if I have the slightest idea of what I am talking about.

15) Me trying to remember trades which I recommended, but have forgotten.

16) Me looking for trades that worked so I can say ?I told you so.?

It?s there, it?s free, so please use it.

There is no end to which I am willing to go to understand the future direction of the world economy. So when I learned that the price of Brazilian bikini waxes was going through the roof, I had to sit up and take note. Last month, the price of the popular beauty treatment soared by 16.6% to 35 Reals, about $22.

This is no joke. The Brazilian government includes the removal of body hair in the most strategic of places in a basket of consumer services that it uses in calculating the country?s inflation rate, now estimated at 6.5%. An economist in Rio de Janeiro assured me that this has nothing to do with the opposite sex. It is one of the few measures they track which can?t be clouded through the surreptitious altering of its quantity or quality. You either get it, or you don?t.

The big picture here is that inflation is worsening, not only in Brazil, but other emerging markets, like China, India, and Vietnam. This is why the yields on one year Brazilian debt are at sky high double digits, a hedge fund favorite. It is also why the People?s Bank of China?s efforts to stanch inflation through higher interest rates and tightened bank reserve requirements are likely to get worse before are gets better.

What can I say? An economic indicator in the hand is worth two in the bush? And I won?t even get into the implications of ?Stealth? inflation.

?There seems to be an impression that we can solve our problems without pain. There is no conceivable way that can happen,? said former Federal Reserve chairman, Alan Greenspan.

Long time readers of this letter know that demographic issues will be one of the most important drivers of all asset prices for the rest of our lives (click here). Researchers expect that the global population will reach 9 billion by 2045, the earliest date that I have seen so far. Can the planet take the strain? Early religious leaders often cast Armageddon and Revelations in terms of an exploding population exhausting all resources, leaving the living to envy the dead. They may not be far wrong.

A number of developments have postponed the final day of reckoning, including the development of antibiotics, the green revolution, DDT, and birth control pills. Since 1952, life expectancy in India has expanded from 38 years to 64. In China, it has ratcheted up from 41 years to 73. These miracles of modern science explain how our population has soared from 3 billion in a mere 40 years.

The education of the masses may be our only salvation. Leave a married woman at home, and she has eight kids, as our great grandparents did, half of which lived. Educate her, and she goes out and gets a job to raise her family?s standard of living, limiting her child bearing to one or two. This is known as the ?demographic transition.? While it occurred over four generations in the developed world, it is happening today in a single generation in much of Asia and Latin America. As a result, fertility around the world is crashing. The US is hovering at just below the replacement rate of 2.1 children per family, thanks to immigration. But China has plummeted to 1.5, Europe is at 1.4, and South Korea has plunged as low as 1.15.

Population pressures are expected to lead to increasing civil strife and resource wars, according to my friends at the CIS. Some attribute the genocide in Rwanda in 1999, which killed 800,000, as the bloody result of overpopulation. If you want to get a first class foundation in the demographic issue along with a lot of cool graphics and charts, read the story in full by clicking here. I?ll be the one to tell you which stocks to buy to capitalize on these trends.

Will There be Room For Us All?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.