As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Come join me for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in Beverly Hills at 2:00 PM on Monday, June 11, 2012. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee and snacks will be made available, but no food.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $199.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at an exclusive Beverly Hills club the details of which will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/category/luncheons/ and click on ?Beverly Hills.? Or simply click on the button below:

All eyes will be focused on Federal Reserve Chairman, Ben Bernanke, on Thursday looking for any hints that further quantitative easing is on the way. Don?t get your hopes up. I don?t expect the esteemed former Princeton professor to conveniently tip his hand. At the most he might make a reference to ?keeping all options open,? and that is it.

The Fed?s Beige Book was released today and doesn?t by any means justify bolder action. This is the report that Ben will have in hand when he treks up to Capitol Hill for his congressional testimony.

According to the report, the economy is expanding at a moderate pace. Manufacturing, loan demand, capital spending, consumer spending are all up modestly. New York rents are rising. Auto sales are strong. Construction is up in both the residential and commercial sectors. Price inflation and wage pressures remain modest. It is all consistent with the lukewarm, flaccid 2% GDP growth that I have been arguing for all year. There isn?t a QE3 anywhere in this.

You can therefore expect market to be disappointed once again. Whether the selloff resumes mid-way through Ben?s statement, when it is over, or sometime next week, is anyone?s guess. Keep in mind that everyone and his brother is looking to sell this rally. So you will need the fastest mouse finger in the West to unload at the top. It is wiser still to start scaling in at this level here, with the S&P 500 at 1,318.

If Europe can just shut up for a few more days and quit acting like a chicken with its head cut off, then we might make it up to the 1,336 high that we saw last week. That would be an opportunity to double up your short and sell out of the money calls. If the Greek election on June 20 goes the right way, then we could make it all the way up to 1,350. That would be a textbook retracement of half of the move down that started on April 2. However, I doubt we?ll make it that high.

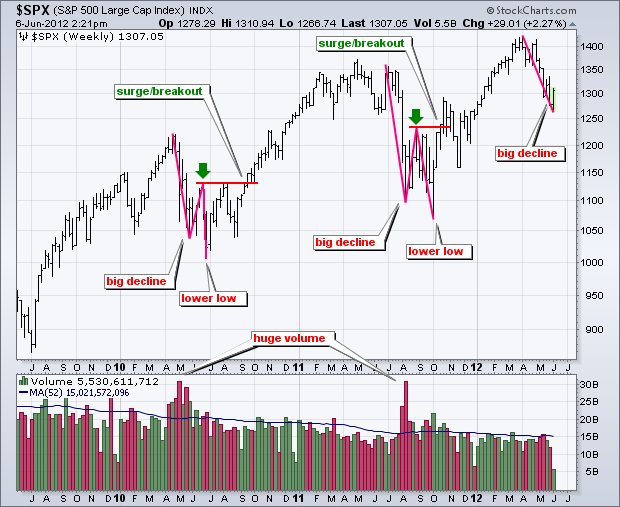

Take a look at the chart below and you?ll see that in recent years corrections have been a two-legged affair. First you see a dramatic selloff, then a dead cat bounce worth 50% of the move down, then a new marginal low. This logic also points to a final bottom at 1,250 or 1,200.

I am able to add shorts here because I covered the ones I had within one point of the 1,268 bottom on Monday. This enabled me to clock a three day, 45% gain in my short position on the S&P 500 (SPY). It gives me the dry powder I need to reload up here. That is provided I have the fastest mouse finger in the West, which my close friends assure me I do.

Global Trading Dispatch, my highly innovative and successful trade mentoring program, earned a net return for readers of 40.17% in 2011, putting it among the top hedge fund managers. The average annualized return since inception is 26%. The service includes my Trade Alert Service, daily newsletter, real time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Fastest in the West?

I heard a fascinating story from my friends at the US Treasury the other day. Even though unemployment is high, personal tax refunds were plummeting and tax revenues were soaring. What was even more puzzling was that the states with the worst unemployment rates, like California, Nevada, and Florida were seeing the heftiest increases. Weren?t elevated jobless rates supposed to generate less taxable income, not more?

The intrepid sleuths on Pennsylvania Avenue put some financial detectives on the case to solve the mystery. It turns out that with home ownership rates falling, real estate prices doing a swan dive, and interest rates at 200 year lows, taxpayers are losing their largest deductions, causing the tax bills to rocket. During the 2011 tax year deductions fell by some 20%, an enormous move given that there were no serious tax reforms enacted.

It turns out that this has been going on for some years, thanks to the unremitting bull market in bonds. According to IRS data, the home mortgage deduction, which can be worth up to $26,000 per household, fell by 14% from 2007 to 2009. The total number of returns claiming this deduction dropped by 5 million during these years.

Preliminary data show that this write off dropped by another 7.2% in 2010 alone. The windfall could bring in as much as $26 billion in additional federal revenues in 2012. It not just a payday for Washington. The 42 states with income taxes are seeing similar revenue rises, with California by far the biggest beneficiary, where the number of filers claiming a home mortgage deduction declined by 9% in 2011.

What?s more, the gravy train for government green eye shades could speed up from here. If the Federal Reserve modifies and extends its ?twist? policy of monetary easing through the purchase of mortgage securities, interest rates could crater as much as 25% from here. Tax bills would soar accordingly. Budget constrained governments across the country couldn?t be happier.

The home mortgage deduction has been a sacred cow of American politics since it was first initiated in 1913. Whoever though it would self-destruct?

Yes, That is Definitely a Smaller Deduction

?China has more dry gunpowder than just about anyone in the world. But it now looks like the soft landing is turning into a hard landing,? said John Brynjolfson, managing director of hedge fund Armored Wolf.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

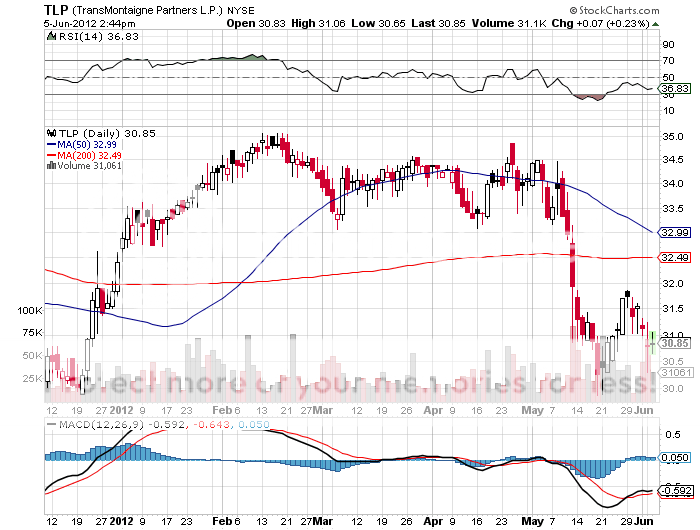

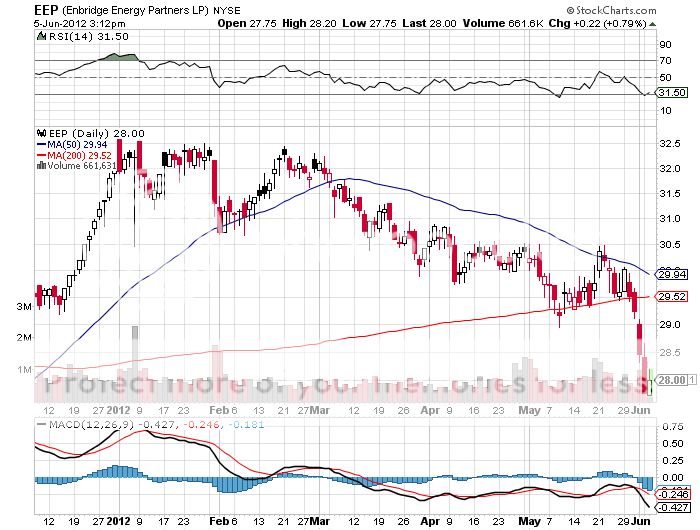

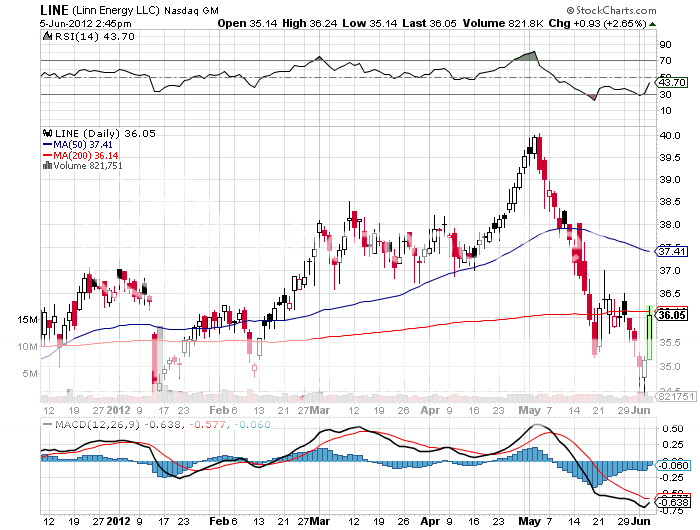

The dramatic collapse in the price of oil is creating a rare opportunity to get into some of the highest yielding paper in the financial markets, master limited partnerships (MLP)?s. These are LP?s that are publicly traded on a securities exchanges. These unique and versatile instruments combine the tax benefits of a limited partnership with the liquidity of publicly traded securities.

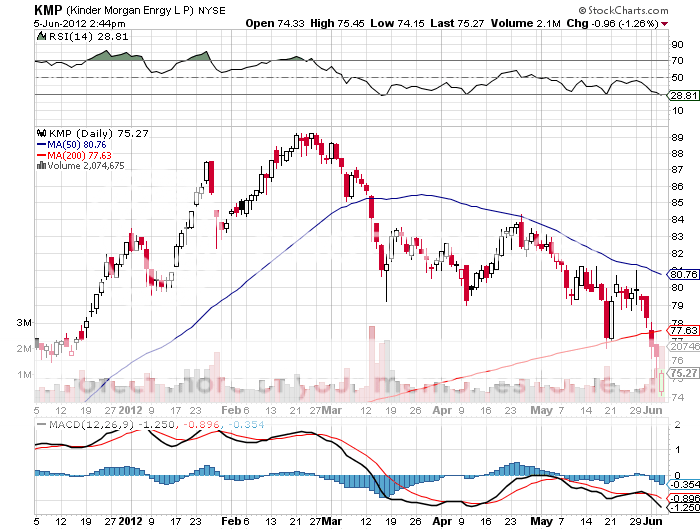

Enbridge Energy Partners (EEP) is run by some of my former colleagues at Morgan Stanley and offers a 7.5% yield. Kinder Morgan Energy (KMP) posts a healthy 5% yield, while Trans Mountain (TLP) ups the ante with an 8% return. Linn Energy goes all the way up to an eye popping 8.5% yield.

Why the enticing cash flow? The problem is that these partnerships suffer from their guilt by association with Texas Tea, which has plummeted by nearly 30% since March 1. Although they have no direct exposure to the price of oil, investors tend to incorrectly classify them as energy stocks and dump them whenever oil falls. The great thing about these high yields is that you get paid to wait until crude makes a comeback, which it always does. Not a bad game to play in a zero return world.

To qualify for MLP status, a partnership must generate at least 90 percent of its income from what the Internal Revenue Service deems "qualifying" sources. For many MLPs, these include all manner of activities related to the production, processing or transportation of oil, natural gas and coal. Energy MLPs are defined as owning energy infrastructure in the U.S., including pipelines, natural gas, gasoline, oil, storage, terminals, and processing plants. These are all special tax subsidies put into place when oil companies suffered from extremely low oil prices. Once on the books, they lived on forever.

In practice, MLPs pay their investors through quarterly distributions. Typically, the higher the quarterly distributions paid to LP unit holders, the higher the management fee paid to the general partner. The idea is that the GP has an incentive to try to boost distributions through pursuing income-accretive acquisitions and organic growth projects.

Because MLPs are partnerships, they avoid the corporate income tax, on both a state and federal basis. Instead of getting a form 1099-DIV and the end of the year, you receive a form K-1, which your accountant should know how to handle. Additionally, the limited partner (investor) may also record a pro-rated share of the MLP's depreciation on his or her own tax forms to reduce liability. This is the primary benefit of MLPs and gives MLPs relatively cheap funding costs.

The tax implications of MLPs for individual investors are complex. The distributions are taxed at the marginal rate of the partner, unlike dividends from qualified stock corporations. On the other hand, there is no advantage to claiming the pro-rated share of the MLP's depreciation (see above) when held in a tax deferred account, like a IRA or 401k. To encourage tax-deferred investors, many MLP?s set up corporation holding companies of LP claims which can issue common equity.

Since 2003, MLPs as an asset class have grown astronomically, from $30 billion to $250 billion , and have also been the best performing asset class in the world over the last 10, 5, and 3 year periods. The recent discovery of new, massive gas and oil fields in the US and the rapid expansion of shale fracking should auger well for the rising popularity of this instrument.

Nope, Don?t See Any Yield Yet

?Here come the helicopters once again,? said Austan Goolsbee, former chairman of the council of economic advisors.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.