As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

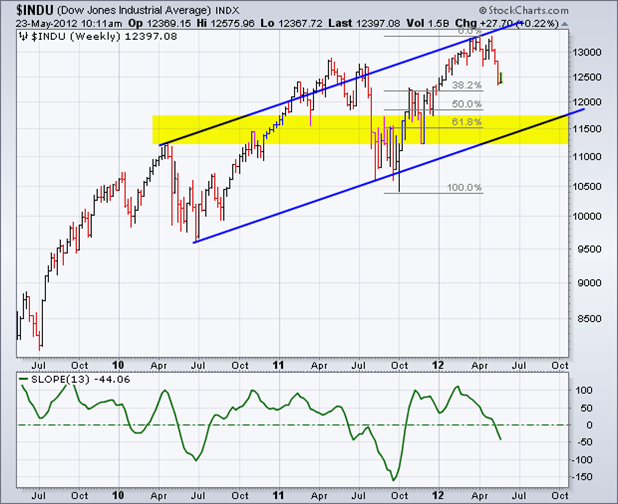

The easy money has been made on the short side this year for a whole range of asset classes. While we will probably see lower lows from here, the risk/reward ratio for taking short positions in (SPX), (IWM), (FXE), (FXY), (GLD), (SLV), (USO), and (CU) are less favorable than they were two months ago.

Of course, the ultimate arbiter will be the news play and the economic data releases. It they continue to worsen as they have done, you can expect a brief rally in the (SPX) up to the 1,340-1,360 range before the downtrend resumes. First, we will revisit the old low for the move at 1,290. Then 1,250 cries out for attention, which would leave us dead unchanged on the year. Lining up next in the sites is 1,200. But to get that low, probably by August, we would need to see something dramatic out of Europe, which we may well get. For the Russell 2000, look to sell it at the old support range of $78-80, which now becomes overhead resistance, to target $72 on the downside.

Don?t underestimate the devastating impact the Facebook (FB) debacle will have on the overall market. Retail investors lost $6 billion on the deal after institutional investors were given the heads up on the impending disaster and stayed away in droves. The media has plenty of blood on its hands on this one. The day before the pricing, one noted Cable TV network reported that the deal was oversubscribed in Asia by 30:1. Morgan Stanley reached for the extra dollars, increasing the size, and boosting the price by 15%. It all came to tears.

Expect investigations, subpoenas, congressional hearings, prosecutions, multi million out of court settlements, thousands of lawsuits, and many careers ended ?to spend more time with families.? Horrible thought of the day: Apply Apple?s (AAPL) 8X multiple, which is growing at 100% a year, to Facebook, which is not, and you get a (FB) share price of $5. None of this exactly inspires confidence in the stock market.

Notice that emerging markets have really been sucking hind teat this year, dragged down by falling commodity prices, a slowing China, and a general ?RISK OFF? mood. This is probably the first sector you want to go back in at the summer bottom to take advantages of their higher upside betas.

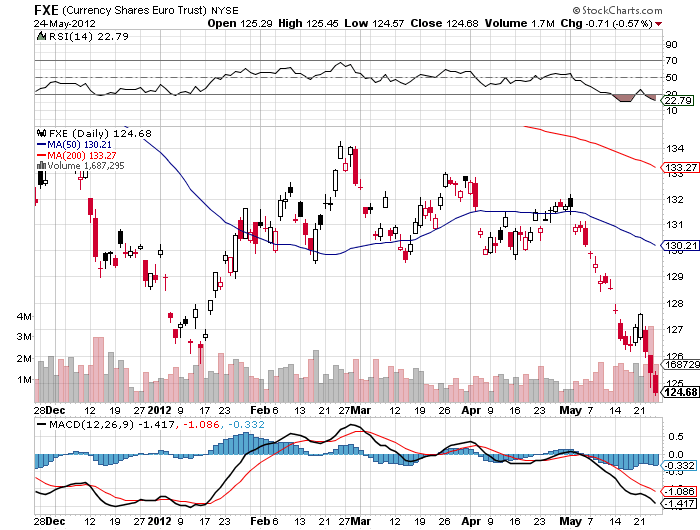

The Euro went through the old 2012 low at $1.260 like a hot knife through butter. On the breach, a lot of momentum programs automatically kicked in and doubled up their short positions. That is what has taken us all the way down to the high $124 handle in the cash. Let?s see how the market digests this breakdown. The commitment of traders report out on Friday should be exciting, as we already have all-time highs in short positions in the beleaguered European currency.

The problem is that any good news whispers or accidental tweets on the sovereign debt crisis could trigger ferocious short covering and gap openings which the continental traders will get a head start on. So again, this is not the low risk trade that it was months ago.

Still, the 2010 lows at $1.18 are now on the menu. I would sell all the ?good news? rallies from here two cents higher. Aggressive traders might consider selling penny rallies, like the one we got today. Notice that the Euro is rallying into the US close every day. This is caused by American traders covering shorts, not wishing to run them into any overnight surprises.

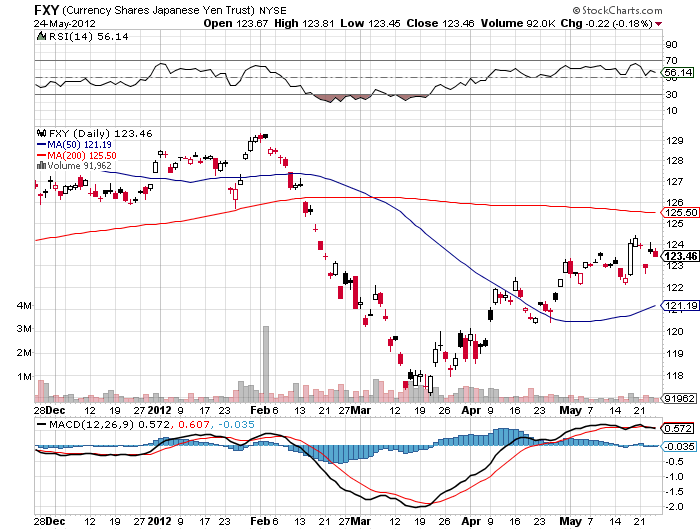

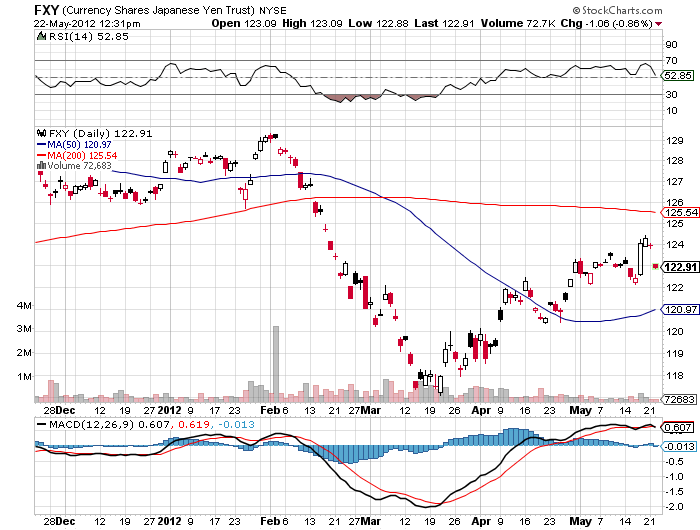

The Japanese yen seems to be stagnating here once again, now that the Bank of Japan has passed on another opportunity to exercise more much needed quantitative easing. Therefore, I will use the next dip to get out of my September put options at a small loss. There is a better use of capital and bigger fish to fry these days.

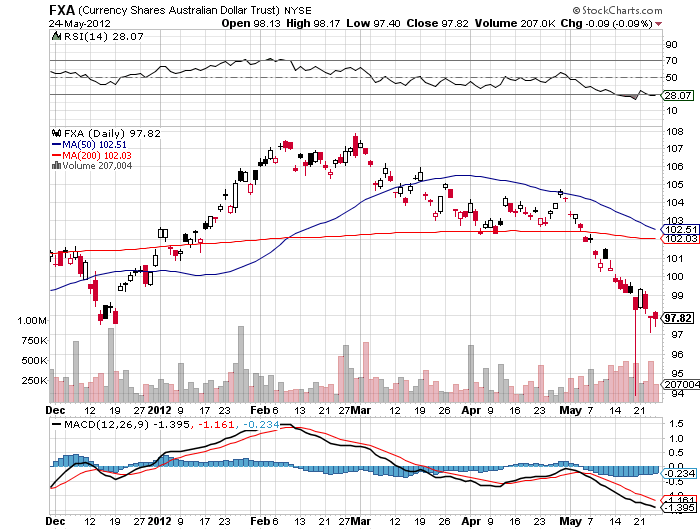

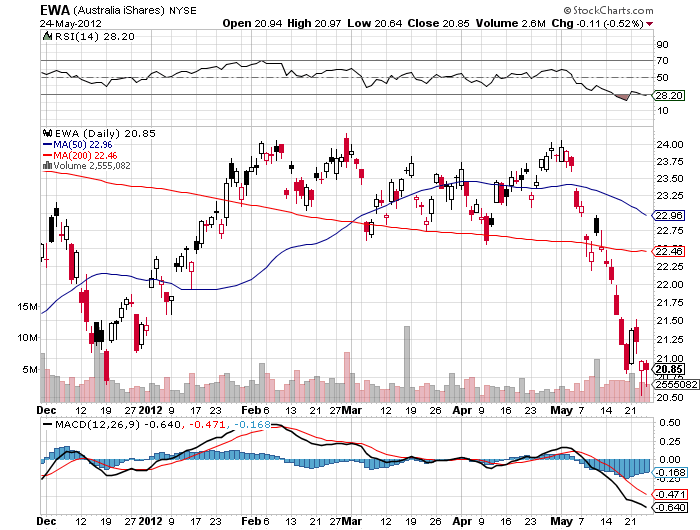

The Australian dollar has been far and away the world?s worst major currency this year, falling from $110 all the way down to $94 on a spike. It now languishes at $97. I long ago stopped singing ?Waltzing Matilda? in the shower. I hope all my Ausie friends took my advice at the beginning of the year and paid for their European and American vacations while their currency was still dear. We could see as low as $90 in the months to come.

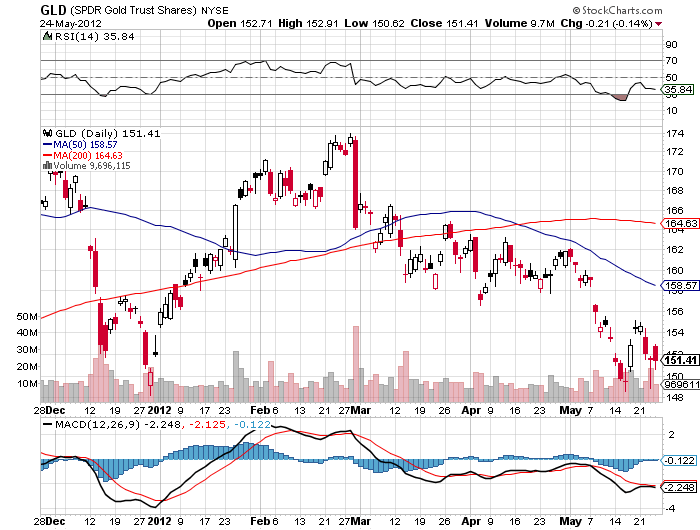

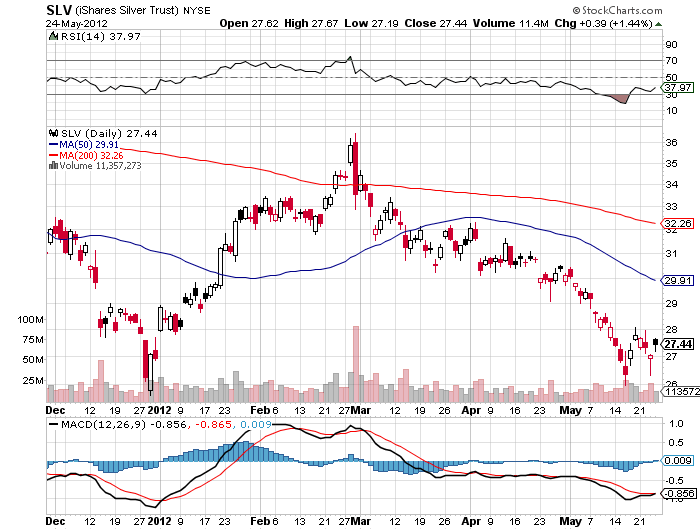

Gold (GLD) and silver (SLV) still look week, as this week?s failed rally attests. The strength of the Indian rupee still has the barbarous relic high priced for the world?s largest buyer, and this will continue to weigh on dollar based owners. But we are also reaching the tag ends of this move down from $1,922. Speculative short positions are at a multi-year low. It would take something pretty dramatic to get me to sell short gold again. For the time being, I am targeting gold at $1,500 on the downside, $1,450 in an extreme case, and $25 in silver.

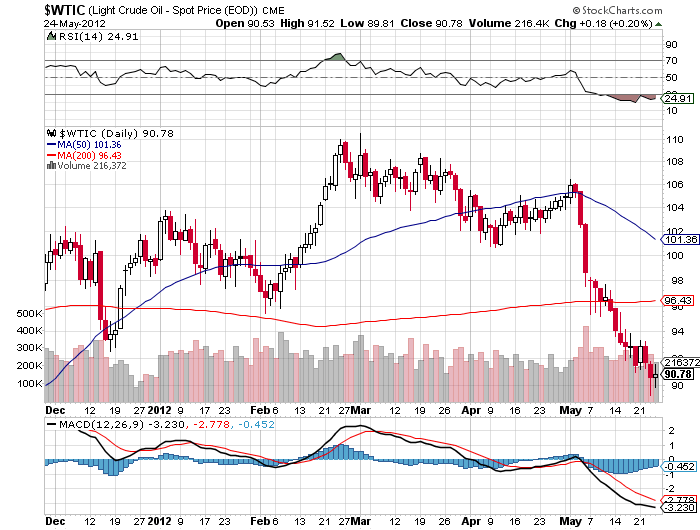

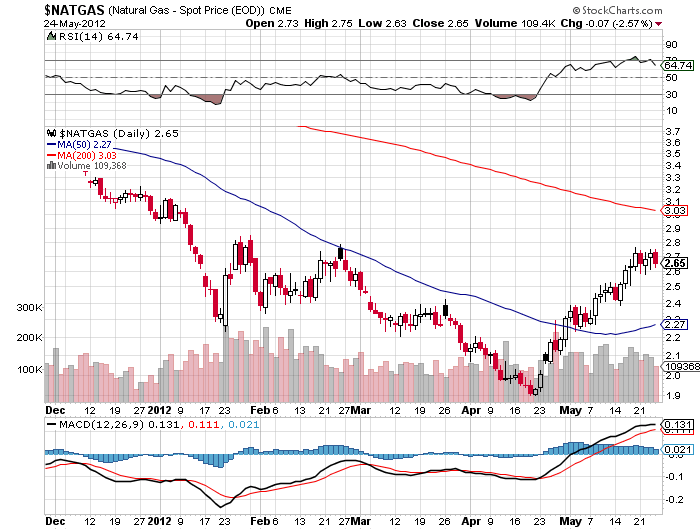

We are well into the move south for oil, which peaked just at the March 1 Iranian elections just short of $110/barrel. The market now seems to be targeting $87 for the short term. The global economic slowdown is the clear culprit here. But in the US, we are starting to see a clear drag on oil prices caused by the insanely low price of natural gas. You can see this clearly on the charts below where gas has been rising while Texas tea has been plunging. Utilities and industry are switching over to the cleaner burning ultra cheap fuel source as fast as they can. As a result, greenhouse gas emissions are falling faster in the US than any other developed country, according to the Paris based International Energy Agency. Sell any $4 rally in crude and keep a tight stop.

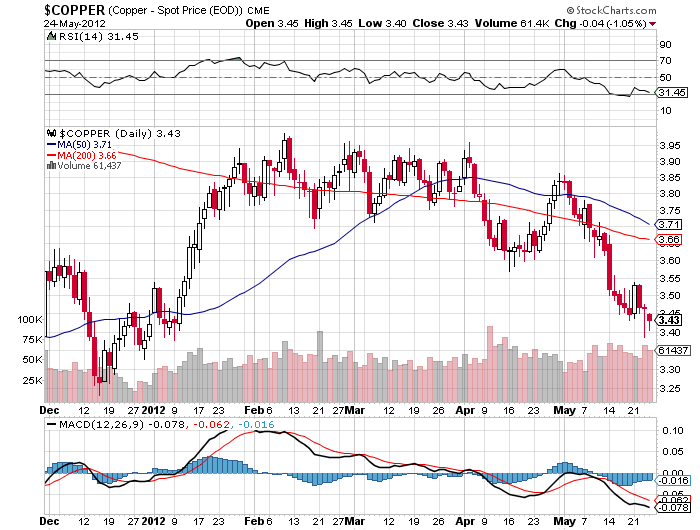

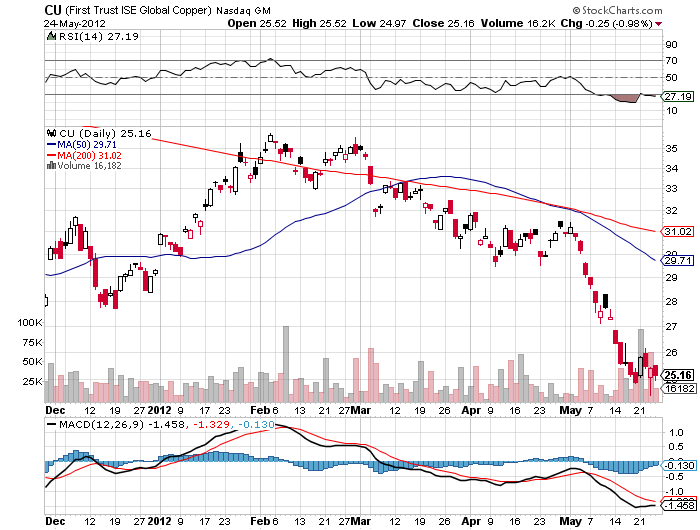

When China catches cold, copper gets pneumonia. So does Australia (FXA), (EWA), for that matter. The China slowdown will most likely continue on into the summer, knocking the wind out of the red metal. If copper manages to rally back up to $3.60, grab it with both hands and throw it out the window. Cover when you hear a loud splat. That works out to about $26.50 in the ETF (CU).

It all points to a highly choppy and volatile ?RISK ON? rally that could last a week or two. It will be a time when you wish you took your mother in law?s advice to get a real job by becoming a cardiologist or plastic surgeon. Do you want to know when I want to reestablish my shorts? If you get a modestly positive nonfarm payroll on at 8:30 am on Friday, June 1, that could deliver a nice two day rally that would be ideal to sell into.

Paid up subscribers to Global Trading Dispatch and the Diary of a Mad Hedge Fund Trader newsletter are entitled to a password that gives them access to my premium content. Without it you will be unable to access the best parts of the new website, including my daily real time trading portfolio, trade alert tutorial and user?s manual, my Review of 2011, 2012 Outlook, and live biweekly strategy webinars. If you still have not received your password, or have lost it, please email us at support@madhedgefundtrader.com . A new password will be issued promptly.

For those who are yet to have their investment returns enhanced beyond their wildest imagination by Global Trading Dispatch, please sign up for the newsletter only for $500 a quarter. If you like what you see, then you can upgrade later to the full service for $3,000 a year and we will give you a credit for what you already spent.

Global Trading Dispatch, my highly innovative and successful trade mentoring program, earned a net return for readers of 40.17% in 2011, and has an annualized 25% return since inception. The service includes my Trade Alert Service, daily newsletter, real time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. The goal is to level the playing field for you and Wall Street. To subscribe, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

?I would love it if they only allowed me and a whole bunch of psychotic drunks to trade in stocks. I would get very rich,? said Oracle of Omaha, Warren Buffett, about the European debt crisis.

The first thing I noticed when Paul walked in was the few extra pounds and silvery tinge to his hair he acquired since I saw him last. He?s clearly spending too much time behind a computer writing those acidic columns for the New York Times. We?re all short dated options in the end, I thought.

We met at my favorite San Francisco restaurant, Gary Danko?s (click here for their site at http://www.garydanko.com/), where one can get a once in a lifetime, bucket list type meal for about $300 for two, but only if you get the cheaper wine. Ideally located near Fisherman?s Wharf, they are one of only a tiny handful of Bay area restaurants to boast a coveted Michelin star. Good luck getting a reservation if you?re not having dinner with Bill Clinton.

Paul went for the lobster salad with hearts of palm and the soft shell crab with bacon. I settled for the Dungeness crab salad with quinoa and quail stuffed with foie gras. We washed it down with an excellent 2008 Duckhorn cabernet called ?The Discussion?. I kidded him about recent articles in the press that described him as the ?Mick Jagger of economics?.

These days, Paul is not about pulling any punches. He argued that the US is really in another Great Depression that started in 2007. Only narrow segments of the economy are doing well, like the fracking driven boom in the Dakotas, which has a population smaller than Brooklyn.

In terms of chronic unemployment, human suffering, and hopelessness, this Depression is every bit as soul crushing as the one the country experienced during the 1930?s. Long term unemployment over 4 million is unprecedented in the postwar period. The jobless rate of recent college grads is even worse.

The only thing preventing Depression era breadlines and soup kitchens is the Food Stamp program that is feeding 45 million people, including many active duty military. The original Great Depression lasted ten years and included two mini recoveries like the one we just saw. The current one will last just as long if we continue the current policies.

The great misconception is that these problems are long term and structural. Adopt the right policies, and the economy would rebound ?faster than you can possibly imagine?. Vicious austerity at the state and local level is the main culprit, squeezing the life out of the economy and cancelling out any stimulus efforts by the federal government.

Austerity is not the answer. It doesn?t work when everyone is trying to reduce their debt at the same time. One man?s debt is another?s income. It?s all about the teachers. The Great Recession has prompted the firing of 1.2 million and prevented the hiring of another 800,000. Hire 2 million teachers, and the unemployment rate drops from 8.1% to 6.5%, and the consumer spending and the multiplier effects they bring with them will return the economy from a 2% to a more normal and sustainable 3% growth rate.

The answer is to spend more money, and a lot of it. If you need proof before proceeding, look no further than the 1939-41 period. Then it was massive government spending in the buildup to WWII that caused the unemployment rate to plummet from 20% to near zero.

If Paul were king of the world, he would immediately allocate $300 billion to the states to rehire teachers, and maintain the infusion annually until we are out of the crisis. The one time only injection we saw in 2009 was inadequate. He would change FHA rules to allow underwater homeowners to refinance at current rock bottom interest rates. That will keep their homes off the market and allow some recovery there, one of the largest sectors of the economy. He would keep monetary policy easy. A modest level of subsidies for alternative energy so we can quit financing sellers of oil in the Middle East who are trying to kill us is also justified.

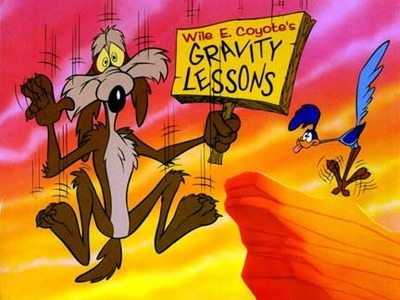

The origins of the current malaise aren?t hard to fathom and are an exact repetition of what occurred in the 1920?s. A long period of complacency led to a relaxed attitude towards debt and risk. The flames were fanned by deregulation. Gatekeepers of the public interest were lavishly paid to look the other way. Then the Wiley E. Coyote moment came when he only plummets after looking down, that particular physics unique to cartoon characters.

Today, the waters are being deliberately muddied by a dozen billionaires funding hundreds of PAC?s and countless bogus research institutes. Their sole interest is to minimize their own tax bills, at whatever cost.

Krugman spits out ideas with machine gun rapidity and is a gold mine of insightful economic data. Eye opening observations are regularly interlaced with biting humor. I?m sure that in a past life he was a standup comedian, or in vaudeville.

I only touched on Europe with him, as my own predictions there have already come true and have become my biggest earner this year. He said that the US and Europe are in a contest to see who has the worst managed economy, and that right now, Europe was winning. He observed that maintaining a single currency without a single government is untenable. It doesn?t help that in the German language the same word is used for debt and guilt. A work out will take years, if not decades.

Paul used to work for Fed Chairman Ben Bernanke as a Princeton economics professor before Ben was demoted to the job of saving the world. When he recently met him he handed him a well-known academic paper written in the 1990?s on the monetary policy mistakes that led to the post bubble collapse of the Japanese economy, and admonished him for repeating the mistakes. The author of the paper? Ben Bernanke.

Krugman argued that the tax system was long overdue for a major overhaul, which now has the lowest tax burden of any developed country in terms of GDP. He said the maximum rate should rise from the current 43%, including state and local taxes, to 70%, possibly for earners over $1 million.

That is still well below the 90% peak rates during the Roosevelt era. Money is concentrating at the top at an unprecedented rate and stagnating in the bond market instead of being invested to create jobs. As for health care, we may have to implement a European style VAT tax to pay for it, however regressive that may be.

I asked, with the national debt now over 100% of GDP, how much more could the US borrow without crashing the bond market, he answered ?a lot more.? Japan is able to borrow 240% of GDP at only 0.8% interest rates with far worse fundamentals than our own. There is a global savings glut and bond shortage, and investors are crying out for a safe haven.

Runaway government borrowing is a problem, but not now. Falling bridges and failing infrastructure are causing much more long term damage to the economy than additional debt. Kids today are infinitely more concerned about getting a job tomorrow than the amount of money the government will owe in 30 years.

Paul is a naturally shy fellow who avoids the limelight whenever possible. He once had a thin skin, but after the attacks from the right that erupted after he started writing for the New York Times, ?a rhinoceros has nothing on me?.

As divine as they are at Gary Danko?s, I skipped the desert, as I know I will be packing on the pounds during my upcoming cruise across the Atlantic on the Queen Mary 2. Paul went for the warm Louisiana butter cake with apples, huckleberry sauce and vanilla bean ice cream. Well, that explains the weight gain.

Before he left, Paul handed me an autographed copy of his latest book, End This Depression Now!, the second tome he penned since the 2008 crash (click here to buy the book at Amazon at a discount). There was one condition. I had to give him an autographed copy of my next book.

I pointed out that by grinding out 10,000 words a week with my blog, trade alerts, and webinars, I was effectively knocking out a new book every two months. That was no excuse he said, with the impatience of a university professor admonishing a grad student who was late with a dissertation. With that, he was out the door like a whirlwind.

I don?t get to meet with Nobel Prize winners very often, so I thought I would give you the full blast. Believe it or not, I left out some of his more incendiary opinions. After all, I have dined with only three in the past month. So take from it what you may.

?Green pictures of dead presidents suddenly have a lot of appeal,? said Art Cashin of UBS Securities.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

The next step has been taken in the coming Japan crisis. American ratings agency, Fitch, has downgraded Japanese government debt to A+, with a negative outlook. The move cut the knees out from under the country?s dubious currency, sending it down sharply.

Fitch expects the country?s debt to reach a nosebleeding 240% of GDP by year end, far and away the largest of any major country. That makes our own 100% debt to GDP look paltry by comparison. The Mandarins in Tokyo have been able to finance this enormous debt through a whole raft of financial regulations that limit local institutions to investing a large portion of their assets in Government bonds.

Regular readers of this letter are well aware that the asset base of these institutions is about to shrink dramatically due to the death through old age of the country?s primary savings generation. The problem is that there is not another generation of savers to follow them. An average growth rate of 1% for the last 22 years, and a ten year government bond yield that has hovered around 1% since 1995 mean that no one has accumulated new savings for a very long time. It is just a matter of time before the country runs out of money. In the meantime, government borrowing for perennial stimulus packages continues to skyrocket.

How long it will take this house of cards to collapse is anyone?s guess. My old friend, retired Japanese Vice Minister of Finance, Eisuke Sakakibara, otherwise known as ?Mr. Yen?, thinks that is still five years away. Hedge fund legend, Kyle Bass, says that it should have started in April. The timing of the onset of this looming financial crisis is now a subject of endless analysis by the hedge fund industry, and will be one of the big investment calls of the coming decade.

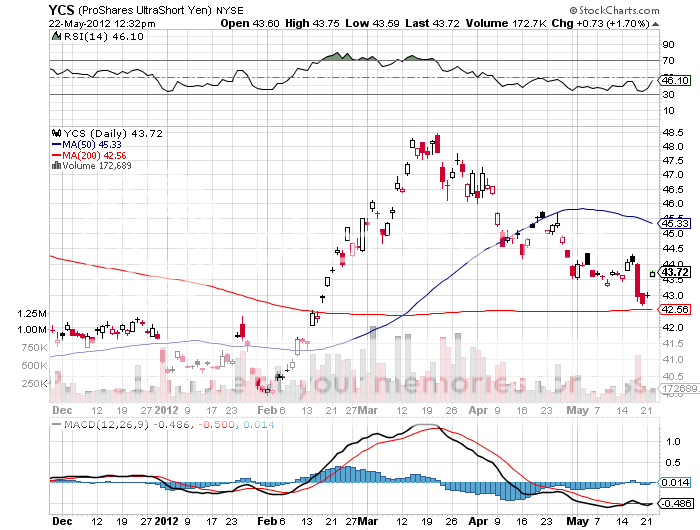

This is why I am running a major short position in the yen through the (FXY), and frequently am involved in the double short yen ETF (YCS). When the sushi hits the fan, you can count on this beleaguered currency to fall to ?90, then ?100, then ?120, and finally ?150. This gets you 200% potential gain on the (YCS). Us the recent ?RISK OFF? run to establish shorts in the yen at great prices.

Time to Sell the Yen?

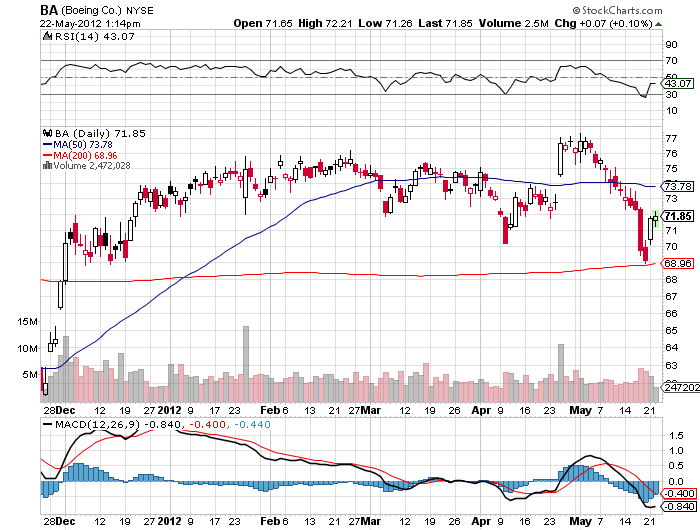

This trade was an unmitigated disaster, and hopefully it will be the worst of the year. I?m glad we had one of these because it provides a wonderful opportunity to illustrate everything that can go on with a trade. Every loss is a learning opportunity, and a loss not learned from is an opportunity wasted, and dooms one to repetition. Let me count the ways:

1) I was too aggressive on the strike. I should have matched my long August $70 strike with a short May $70 strike instead of reaching for the extra income by selling the $72.50?s. I got away with this on the (PHM) trade. Not so on (BA).

2) I shouldn?t have leveraged up with a 1:2 ratio. Those who did straight 1:1 spreads did much better and slept well at night. They saw only a slight opportunity cost as some losses were offset by profits in the August $70 puts as intended.

3) I was not aware that individual investors were so harshly treated by margin clerks. Hedge funds only get charged margin on the delta plus some small maintenance, which they then continuously rehedge. Most retail investors were prevented from doing this trade by broker policies banning naked put selling.

4) The Morgan Stanley guy who decided to price the Facebook (FB) issue on an options expiration day has to have a hole in his head. That only succeeded in increasing market volatility. I?m sure that when they made the call, they thought this would make (FB) go up faster. Instead, the reverse happened. On Friday, everyone?s portfolio effectively turned into a long Facebook position, tracking (FB) tick for tick. This did not end well.

5) This was a really unlucky trade. Although the global macro situation is pretty much unfolding as I expected, I didn?t think the rot would spread so fast once it set in. Even a one-day short covering rally on Friday would have turned this trade profitable. Thank Greece for that. Facebook too. It took one of the longest continuous market moves down, 12 out of 13 days, for this trade to lose money.

6) The only consolation is that those who had puts exercised against them and saw stock delivered into their accounts Monday morning at a cost of $72.50 were granted a huge short covering rally to sell into, with (BA) rising $2.85 back up to $72. This enabled shareholders to recover 85% of their losses on the position.

Taking in the entire May short option expiration play, and it is clear that this didn?t work. Add up all the P&L?s and this is what the damage came to:

(FXE) $127 puts? +$950

(FXE) $132 calls? +$950

(FXY) $121 puts? +$1,500

(PHM) $8 puts? +$980

(IWM) $77 Puts? -$5,544

(BA) $72.50 puts -$8,708

Total?? -$9,872, or ?9.87% for the notional $100,000 model portfolio.

Of course, this loss was more than offset by the enormous profits that we took in on our long put positions in the recent market meltdown. Since I initiated the short put strategy on May 3, the long put positions added a welcome 30% to the value of the portfolio.

We did get the protection against a sideways market that had been killing my performance in April. So it did perform its insurance function as intended. As I often remind readers, when you buy fire insurance, you don?t complain to the company when your house doesn?t burn down.

The way this strategy usually works is that you make money like clockwork all year, then one bad month wipes out two thirds of your total profits. That means repeating this play will probably work for the rest of 2012.

This also illustrates how the neophytes who attempt this strategy with tenfold leverage regularly get wiped out. What looks like easy money on the outside quickly becomes toxic waste on your position sheet. The rich uncle morphs into a serial killer overnight. When I look at those miracle 100% a year track record regularly touted on the Internet, this is usually what I find.

These calculations assume that you sold your (BA) at the close on Friday, which was a new low for the year. The net loss on the short (BA) May $72.50 puts comes to ($72.50 - $69.15 + $0.24 = $3.11). This subtracts (100 X 28 X -$3.11) = -$8,708, or -8.70% for the notional $100,000 model portfolio.

Oops

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.