I am a numbers guy. Show me the data and I?ll draw my own conclusions, ignoring conflicted brokerage research, the paid talking heads on TV, and all the politically motivated garbage pumped out by industry sponsored fake research institutes. I am also a glass half full kind of guy, willing to make a positive interpretation when all else is equal. After all, over the very long term, everything goes up in value.

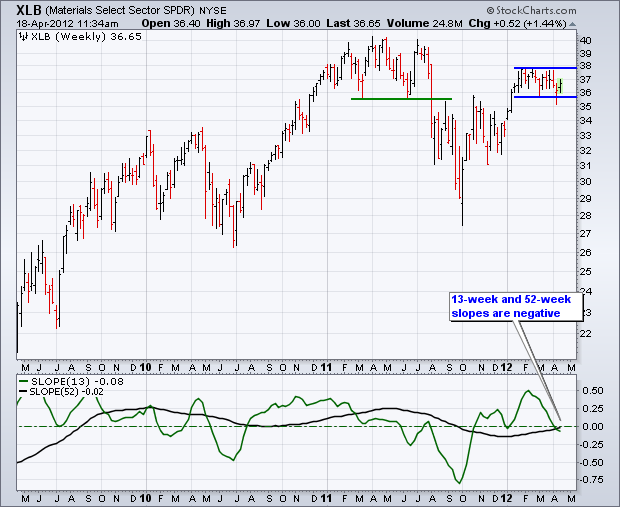

Having said all of that, I have to tell you that the economic data flow has recently been rolling over like the Bismarck. In January and February it was uniformly positive. In March, it turned decidedly mixed. Since the beginning of April they have turned overwhelmingly negative. This is what tops in both the economy and the stock market are made of.

I normally don?t bother you with such details, as most readers prefer me to distill my comments down to ?BUY? or ?SELL?. But the deterioration has been so dramatic in recent weeks that I thought you should see what I am looking at. Let me give you this week?s sampling:

April 19? March existing homes sales -2.6%

April 19? Philly Fed down from 12.5 in March to 8.5 in April

April 19? Leading economic indicators down from +0.7% in February to +0.3% in March.

April 19? Weekly jobless claims down 2,000, but held most of last week?s 13,000????? .?????????????? spike upward

April 17? New permits for Single Family homes -3.5% in March

April 17? Housing starts down from 2.8% in February to -5.3% in March

April 16? February business inventories +0.6% because people aren?t buying stuff.

April 16? Empire state down from 22 in March to 6.6 in April

April 16? March Consumer Price Index 0.3%, but most of the increase was for?????? gasoline.

Any one of these data points is relatively unimportant. When they are all moving in the same direction, that is important. And this has been going on for more than a month now. When preparing my last two biweekly strategy webinars I had difficulty finding any positive data points to report. The only plus figure that I have seen recently was the International Monetary Fund?s upgrade of its outlook for the global economy for 2012 from 3.3% to 3.5% which no one pays attention to anyway.

There is a big problem for the stock bulls in all of this. We have a stock market that is priced for perfection, having taken earnings multiples up from 11 to 14 in six months. As a result, we now have a market that is priced for 4% GDP growth in a 2% GDP economy. But guess what? The 2% GDP is coming through. Instead of perfection we are getting mediocrity. Look out below.

I am not a permabear, but I know plenty of people who are. Maybe it is time for me to start paying them more attention, reading their research, answering their e-mails.

Maybe I Should Start Returning His Calls