?I suspect the analysts who follow Apple are great people and are nice to their mothers. But as a group those people missed the last quarter by 40%, so I?m not listening to them. The stock is a trading sardine for a while. It?s a high beta stock which is leveraged to the market which is over extended. So I don?t see a hell of a lot of alpha until we get the next significant data point, which might be squishy,? said Dug Kass of hedge fund Seabreeze Partners.

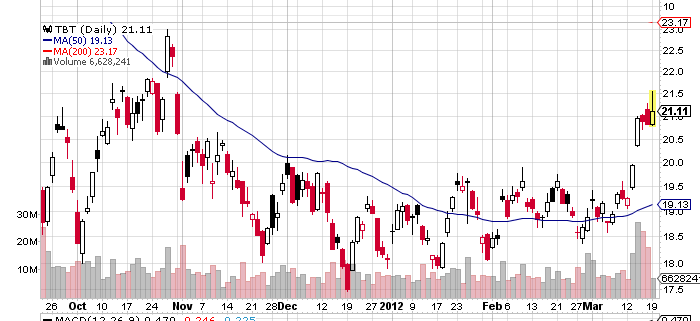

This is the year of the one way move. That has been the harsh lesson of the marketplace since trading commenced at the New Year. We have seen this in Apple, the S&P 500, the Japanese yen, bank shares, natural gas, the volatility index, and now it looks like the Treasury bond market.

Once a move starts, it continues in a straight line. There are no pull backs, corrections, or chances for newcomers to join the party. It is all momentum, or ?momo? as the pit traders refer to it. You either have to close your eyes and buy, or read about it in the newspapers while you are fielding calls from clients complaining about underperformance.

While I am reluctant to buy highs in other asset classes, not so with short Treasury bond plays like the (TBT). The long term case is against Treasury bonds, which have been paying negative real interest rates for years now, is overwhelming. If the (TBT) pulls back 10% from here, I will happily double up.

If you want to read about Treasury bonds, warts and all, please refer to last week?s piece, ?The Structural Bear Case for Treasury Bonds? by clicking here.

There are many reasons why the markets are behaving like this. Volumes are low. Conviction is low. The big volume generators, like the high frequency traders, have departed for friendlier climes, like the foreign exchange and oil markets. Hedge fund traders are out until their models start working again. Individual investors are still back at the station waiting for the next train, having spent the last decade unloading stocks.

The markets aren?t rising because of a new surge of cash coming into the market. Rather, a lack of sellers is the cause, as almost everyone is underweight equities. It only takes a small amount of money coming in from performance chasers to cause the indexes to rise.

It is impossible to say how long the markets will last like this. They will continue until they don?t. There is no quantifying human emotion. Until then, I will keep my book relatively small. I can tell you that when the geniuses look like idiots and the idiots look like geniuses, markets can be very dangerous.

I received an email from the MF Global bankruptcy trustee this morning indicating that they would be returning another $685 million to customers. Of this amount, $600 million will go to customers who traded on US exchanges, $50 million to those who traded on foreign exchanges, and $35 million who were holders of physical metals. That would enable them to increase their payout on cash funds owned by the former US customers of MF Global to 80%.

I was suspecting that something like this would come along soon, as I recently was solicited by a couple of East coast hedge funds offering to buy out my existing claim at a discount. Now I hear that a private exchange it setting up in Connecticut which will buy and sell such claims, of which there are thought to be more than 10,000.

When MF Global filed for bankruptcy last year, it was the eighth largest in US history with debts of $40 billion. It is believed that the company lost $6.3 billion on ill-timed long positions in European sovereign debt. As is so often the case in these situations, it was the distressed liquidation of the MF portfolio that made the final bottom in that market. If MF had only been able to hold on a few more weeks, they would have made a fortune. For example, Italian ten year bond yields have fallen from over 8% to under 5% since then, creating massive capital gains.

The bankruptcy triggered a mini financial crisis just in the midst of a global selloff. It cast a pall over the agricultural markets from which they have yet to recover as thousands of farmers saw capital tied up. That left them unable to come out of existing hedges or roll into new ones. Even those who stored physical metals with MF, like gold and silver, were only given partial payouts.

Initially, the finger pointed at CEO John Corzine, once a Goldman Sachs co-chairman, US senator, and governor of New Jersey. I never believed it for a second. It now looks like a mid-level manager accidently sent $150 million to JP Morgan, which refused to return the funds before the bankruptcy was filed. A further complication is the conflict between US and UK bankruptcy law which assign different rights to creditors. The matter will no doubt be tied up in the courts for years.

I believe that that beleaguered MF customers will eventually get 100% of their funds returned. There are still substantial assets to be liquidated at far better prices than prevailed in the fall and paid out to customers. This was not a negative net worth bankruptcy, and customers are at the very top of seniority of claims. But it could be a long wait. However, their confidence on the US financial system is almost certainly gone for good.

After a 15 year hiatus, Apple (AAPL) has restored its dividend, announcing a 2% annual yield that exactly matches the average for the rest of the S&P 500. It also announced a $10 billion share buyback. The only thing missing that the cheerleaders were hoping for was a 10:1 share split.

The move now makes Apple eligible to buy for the 40% of US institutions that don?t own it yet, such as dividend funds and pension funds. Hedge funds currently only account for 4% of the Apple ownership.

Apple holds two thirds of its cash overseas in foreign holding companies to keep profits out of reach by the IRS. But it says that it will be able to fund these new commitments purely from US cash flow alone.

The tab for the new policy will only put a small dent in the company?s gargantuan cash flow. Cash on the balance sheet will soon reach $100 billion. The dividend and buy back will total $45 billion over the three years. But the cash mountain will still grow to over $200 billion by then, even after these new expenses are paid out.

Many hedge fund traders are unhappy about the current near monopoly enjoyed by the top three ETF issuers, Black Rock, State Street, and Vanguard, which control 83% of the market. At last count more than 1,100 ETF's were capitalized at more than $1 trillion. The result has been grasping management fees, exorbitant expense ratios, and poor structural designs which create massive tracking error.

The good news is that new entrants are flooding into the ETF space, and the heightened competition they are bringing will help curtail the worst of these abuses. This development will accelerate the demise of the bloated and arthritic mutual fund industry, whose end has been a long time in coming. Not only will management fees and expense ratios plunge, there will be a far broader range of offerings, as new funds are launched from a diverse range of institutions coming from differing areas of expertise. Failure to enter the newly lucrative ETF market by the remaining giants sitting on the sidelines means that their existing mutual fund businesses will be cannibalized.

Look no further than bond giant PIMCO, which is coming out with a plethora of fixed income related funds, Van Eck's expanding list of ETF's for commodities, and the even growing list of inverse and leveraged inverse ETF's presented by ProShares. The bottom line will be that lower costs and tighter spreads will leave more profits on the table for the rest of us.

The Mutual Fund Industry is Getting Cannibalized

?I think we?re headed towards VAT taxes. It?s only a question of how long it takes for them to wake up and figure it out. You can?t tax the wealthy enough to close the budget deficit we have,? said Leon Cooperman of hedge fund Omega Advisors.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

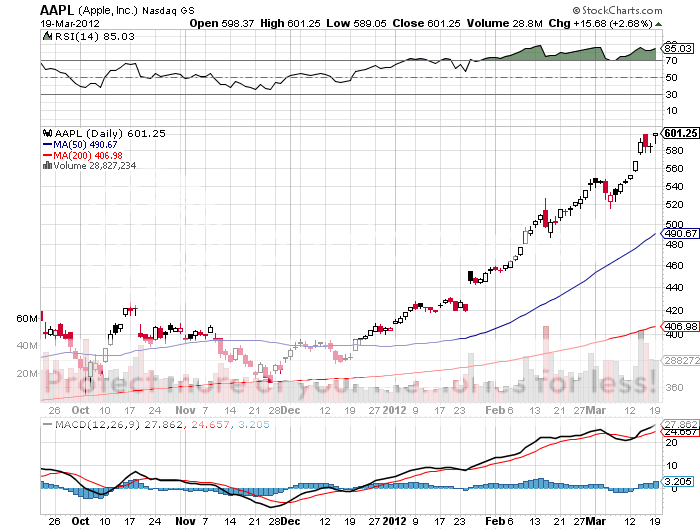

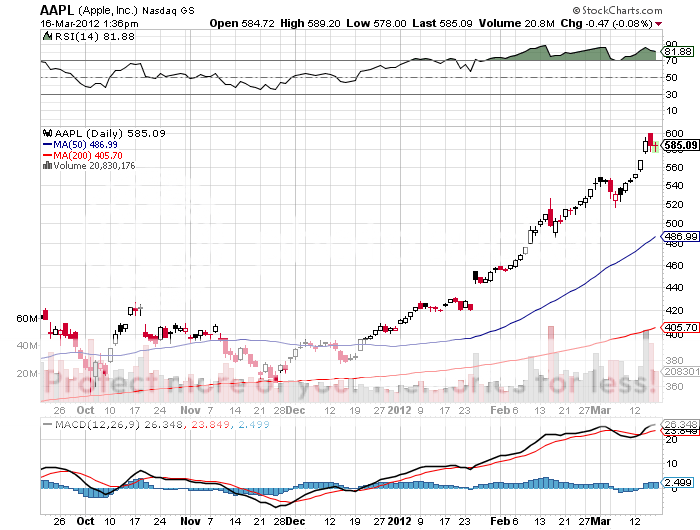

When Apple (AAPL) made its three day, $50 move up last week, it created $55 billion in new market capitalization. That 72 hour addition alone would rank it as the 100th largest company in the world besides Boeing (BA), Union Pacific Railroad (UNP), and Nike (NKE). Trading volume in Apple calls is has smashed all records. The action has been more frenzied than seen in any single name since the height of the dotcom bubble 12 years ago.

I tried to take a bite out of Apple, selling 20% deep out of the money, front month calls. It looked clever for exactly two weeks. Instead, Apple took a bite out of me. When the appreciation suddenly accelerated on no news specific to Apple, implied volatility for the options popped from 30% to 40% in an hour, and I got stopped out.

Moves like this are unprecedented in the history of the options market. I know people who are doubling their money every week, buying out of the money Apple weekly calls, and rolling their way all the way up, knowing full well that their last trade will result in a total loss.

So that got me to thinking. Is the greatest shorting opportunity of the year setting up here? I started playing around with some numbers when Steve Jobs? creation hit $600 a share yesterday. I looked at the April, 2012 put series, which expire in 25 trading days, on April 20. Then, the $500 puts were trading at $2.00. What would happen if the stock fell? I did some back of the envelop calculations and came up with the following:

Apple Option

Fall??? Price?????? % Gain

$10??? $2.50???????? 25%

$20??? $3.25???????? 62%

$30??? $4.50???????? 125%

$40??? $6.00???????? 300%

$50??? $8.00???????? 400%

$60??? $10.50?????? 425%

$70??? $13.75?????? 587%

$80??? $17.75?????? 787%

$90??? $22.25?????? 1012%

$100? $27.50?????? 1275%

I thought ?well, that?s pretty interesting?, and set to write up a Trade Alert to buy the $500 puts. But by the time I finished writing it, Apple fell $25 and the puts doubled. I missed the entry point so I decided to wait.

I love Apple stock, and it now looks like it will hit my long term $1,000 target sooner than later. I have been filling up my house with Apple gadgets as fast as I can, like everyone else, picking up an iPhone, a MacBook Pro, and a MacBook Air. The ecstatic people on TV this morning piling into Apple stores at the crack of dawn to buy the new iPad behave like they?re just won the lottery.

But I also know what a parabolic stock move looks like on the charts, and I have never seen them end in anything but tears. At some point they end, falling back down to a trend line, even if that trend remains up. The volume on the downside is even greater than on the upside. I image that quite a lot of the recent buying has been on margin or with huge leverage. Apple stock is cruising for a bruising, and no one would be surprised to see a sudden $100 sell off.

I?ll tell you when to put on this trade. Wait for the next three day, $50 spike, and then commit 1% or 2% of your capital, no more. You are looking to risk 1% to make 10%, not 100% to make 1,000%. I frequently get resumes from those who tried the later and are now unemployed, and believe me, you don?t want to try this.

Of course, it is possible that the final $50 spike is behind us, in which case this entire discussion has been academic. But it is still a good exercise to carry out to learn what is possible. And since St. Patrick?s Day is upon us, you might want to down a quick shot of Irish whiskey first, neat, if you end up doing the trade.

Sign of a Top?

I have been banging the table for years now about the importance of demographic trends for the economy, the financial markets, and the housing market. Well, politics is no different.

According to recent surveys, Millennials, who are now aged 19-30 (I have three of them) are suspicious of government, have a strong anti-business bias, are opposed to new regulation, are highly conscious of environmental issues, and give the president his highest marks. They also happen to care the least about health care, and put a high value on ethics. We also have learned that they don't bother to vote in midterm elections. This is important because the Millennium Generation surpassed in size 80 million strong baby boomer generation last year.

No wonder the last election focused so much energy on online campaigning and social media. Is the outcome of future elections to be determined by clicks and bandwidth? The data effectively means that the population of liberals is growing, while that for conservatives is shrinking. Politician planners and makers of campaign tchotchke take note.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.