As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

April 30, 2013

Fiat Lux

Featured Trade:

(TRADE ALERT SERVICE POSTS TWO YEAR 90% PROFIT),

(MAY 8 LAS VEGAS STRATEGY LUNCHEON),

(IT?S OFFICIAL: THERE?S NOTHING TO DO),

?(SPY), (TLT), (JNK),

(DINNER WITH ELIOT SPITZER)

SPDR S&P 500 (SPY)

iShares Barclays 20+ Year Treas Bond (TLT)

SPDR Barclays High Yield Bond (JNK)

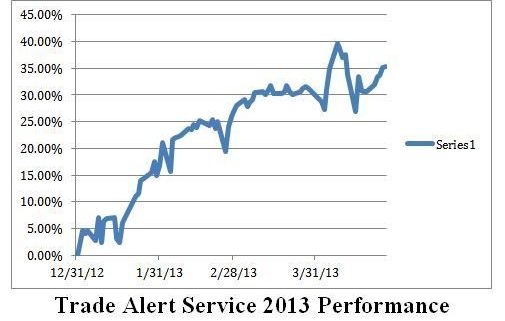

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 90.6% profit since the inception of the service 30 months ago. That compares to a modest 21% return for the Dow average during the same period. This raises the average annualized return for the service to 36.2%, elevating it to the absolute apex of hedge fund ranks.

My bet that the stock markets would continue to grind up to new all time highs in the face of complete disbelief and multiple international shocks paid off big time, as I continued to initiate new long positions in the S&P. After steering readers away from gold (GLD) all year, I then caught the bottom and rode a $74 rally on the way back up. Every short position in the yen has been a money maker. I even managed to cover a brief short in the Treasury bond market for a small profit.

Trade Alerts that I wrote up, but never sent, worked. That?s because I have been 100% invested for the entire year in long stock/short positions. However, followers of my biweekly strategy webinars caught my drift and benefited from the thinking, and many did these trades on their own. These included shorts in the Treasury bond market, (TLT), the Euro (FXE), (EUO), and the British pound (FXB).

Sometimes the best trades are the ones you don?t do. I have been able to dodge the bullets that have been killing off other hedge funds, including those in (USO) and commodities (CORN), (CU). The average hedge fund is up only 4% in 2013, as their short positions in the lowest quality companies have easily outpaced their longs on the upside.

All told, the last 35 of the 42 trade alerts issued by the Trade Alert Service in 2013 were profitable, a success rate of 83%. The year-to-date profit stands at a stunning 35.5%.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

You may have noticed that I am a man who is never short of words. I also rarely am for wont of things to do.

This is one of those times.

Every morning, I drag myself out of bed early, throw cold water on my face, and drag my sorry ass to my computers, where I compile lists of the positives and negatives facing the markets. Here is this morning?s list:

Negatives

*Almost all macro data has turned negative

*Economic growth is weak at 2.5%

*Q2 growth is decelerating

*Corporate earnings growth is weak

*Bonds are going up with stocks

Volume spikes on down days

Buying focused on defensives

Buying in a narrowing number of names

Top of 13 year channel

Commodities are crashing everywhere

Eve of seasonal weakness for 6 months

The sequester is slowly eating into our economy

The bottom line here is that even a first year intern would be out of his mind to buy stocks now.

Positives

The net net here is that you would be crazy not to pour every penny you had into stocks now. And therein lies the problem.

It would be easy to say that the two lists balance each other out. The reality is that the edge is in favor of the positives, and that the outlook for risk assets is still a friendly one, just. Some $170 billion a month is a lot of money, and buys truckloads of paper, like stocks and bonds. That means stock prices will probably go up before they go down.

This is the dilemma. Just as the markets was becoming exhausted of Ben Bernanke?s QE3, now eight months old, and stocks are hitting the top of a 13 year channel in the (SPY), we got an entire new round of quantitative easing from Japan. That was the outcome of ?Abenomics,? the last ditch, throw in the kitchen sink effort by the Japanese government to pull the country?s economy out of a death spiral.

The real shocker here is how much of the Japanese QE is diverting into foreign markets. Japanese institutions have been using the government buying to unload their domestic positions and buy the American equivalents. Japanese bond funds have begun soaking up US debt instruments (TLT), (JNK) on a large scale, and equity players have been piling into US high dividend stocks. They have also been flooding into high yielding instruments of any other description, including European sovereign debt, creating the mother of all rallies there.

So the choice here is very simple. Buy at the top of the biggest stock market rally in history, or do nothing at all. Sitting on top of a humongous 35.6% gain this year, and 46% off of the November bottom, I am inclined to do the latter.

I kind of like being up 35.6% on the year. I like posting a 26.6% gain less. I positively dislike being up only 16.6%, and I despise a mere 6.6% return, where most hedge funds now live. I think I?ll vote for sitting on my hands.

It is not like I?m really going to do nothing. But my standards for opening a new trade just got a lot tougher. I am going to wait for more extreme moves up before going short, bigger selloffs ahead of buying, and doing so with smaller sized positions when I do. I?ll be quicker on the draw when it comes to taking profits or stopping out. Better to wait for the market to come to me, than try and jump on a moving train.

To paraphrase an old expression from Navy flight school, it is better to be flat, wishing you had a position, than having a position and wishing you were flat.

![Plane-Crashed]() Maybe It?s Better to Be Flat

Maybe It?s Better to Be Flat

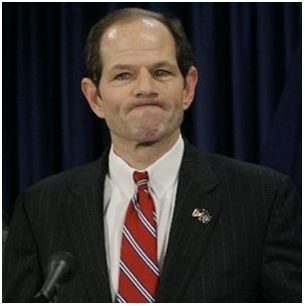

I couldn?t for the life of me figure out why New York?s former governor and federal prosecutor, Eliot Spitzer, wanted to invite me to dinner. He wasn?t flogging a book or promoting a movie, and he certainly wasn?t running for office again. But I went anyway, thinking perhaps the notorious ?Client No. 9? might let me peek at his famous black book.

Eliot, who showed up wearing a classic New York blue pin striped suit that seems oddly out of place in San Francisco, is currently running his family?s commercial real estate business.

He told me the advantages that the US enjoyed over the rest of the world in 1945, such as a monopoly in skilled labor, are now long gone. The driver of the world economy has switched from America to Asia in the nineties.

As a result, income distribution here has morphed from a bell shaped curve to a barbell, with both the wealthy and the poor increasing in numbers, squeezing the middle class. The financial crisis compressed 30 years of change into two, taking us from libertarian Ayn Rand to pay czar Ken Feinberg in one giant leap.

Having cut his teeth prosecuting the Gambino crime family in the eighties, Eliot had some views on the need for more regulation. We only need to enforce the laws on the books, not pass new ones. The ?white collarization? of organized crime has been a secular trend since the sixties. He said the ethical lapses in the run up to the crash were best characterized by a quote from Merrill Lynch?s Jack Robins; ?What used to be a conflict of interest is now a synergy.?

AIG getting 100 cents on the dollar from the federal government was the greatest scam in history. The US did not extract a high enough price from top paid executives and shareholders of financial institutions for failure, and should have let more firms go under. As for his own scandal in 2008, Eliot admitted that he failed, that his flaws were made publicly apparent, and that other politicians should be smarter than he was.

Although Eliot had some good ideas, I was still puzzled over what this was all about as I ploughed through my cr?me brulee. Perhaps the governor has a pathological need to be in front of the spotlight, even at the risk of flaming out. And no luck with the black book.

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

If I had a nickel for every time that I heard the term ?Sell in May and go away? this year, I could retire. Oops, I already am retired! In any case, I thought that I would dig out the hard numbers and see how true this old trading adage is.

It turns out that it is far more powerful than I imagined. According to the data in the Stock Trader?s Almanac, $10,000 invested at the beginning of May and sold at the end of October every year since 1950 would be showing a loss today. Amazingly, $10,000 invested on every November 1 and sold at the end of April would today be worth $702,000, giving you a compound annual return of 7.10%.

My friends at the research house, Dorsey, Wright & Associates, (click here for their site at http://www.dorseywright.com/) have parsed the data even further. Since 2000, the Dow has managed a feeble return of only 4%, while the long winter/short summer strategy generated a stunning 64%.

Of the 62 years under study, the market was down in 25 May-October periods, but negative in only 13 of the November-April periods, and down only three times in the last 20 years! There have been just three times when the "good 6 months" have lost more than 10% (1969, 1973 and 2008), but with the "bad six month" time period there have been 11 losing efforts of 10% or more.

Being a long time student of the American, and indeed, the global economy, I have long had a theory behind the regularity of this cycle. It?s enough to base a pagan religion around, like the once practicing Druids at Stonehenge.

Up until the 1920?s, we had an overwhelmingly agricultural economy. Farmers were always at maximum financial distress in the fall, when their outlays for seed, fertilizer, and labor were the greatest, but they had yet to earn any income from the sale of their crops. So they had to borrow all at once, placing a large cash call on the financial system as a whole. This is why we have seen so many stock market crashes in October. Once the system swallows this lump, it?s nothing but green lights for six months.

After the cycle was set and easily identifiable by low-end computer algorithms, the trend became a self-fulfilling prophecy. Yes, it may be disturbing to learn that we ardent stock market practitioners might in fact be the high priests of a strange set of beliefs. But hey, some people will do anything to outperform the market.

It is important to remember that this cyclicality is not 100%, and you know the one time you bet the ranch, it won?t work. But you really have to wonder what investors are expecting when they buy stocks at these elevated levels, over $159 in the S&P 500.

Will company earnings multiples further expand from 15.5 to 17 or 18? Will the GDP suddenly reaccelerate from a 2% rate to the 4% expected by share prices when the daily data flow is pointing the opposite direction?

I can?t wait to see how this one plays out.

![Beach Sun Bathers]() Thank Goodness I Sold in May

Thank Goodness I Sold in May

Dilbert cartoonist Scott Adams argues that you should invest in companies you hate, because only the most unprincipled and rapacious firms make the greatest profits.

Moral bankruptcy is a great leading indicator of success, and the best ones can get you to balance your wallet on the end of your nose and bark like a seal, as you buy products that you utterly despise. Companies with the work ethic of a serial killer, like British Petroleum (BP) come to mind, but you can also add other firms to the list, like Goldman Sachs (GS), Citicorp (C), Pfizer (PFE), and Altria (MO).

Adams initially started investing in companies he loved, like Enron, WorldCom, and Webvan, and absolutely lost his shirt. His advice to (BP) is not to waste money on artificial, sincere, maudlin ad campaigns apologizing, but get us to hate them more. Bring on more dead bird pictures!

![Anger-Computer]() Hand Me a &*%@* Buy Ticket!

Hand Me a &*%@* Buy Ticket!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.