As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

May 3, 2013

Fiat Lux

Featured Trade:

(SO I LIED),

(TURKEY IS ON THE MENU), (TUR), (TKC)

(THE NEW CALIFORNIA GOLD RUSH), (GLD)

iShares MSCI Turkey Invest Mkt Index (TUR)

Turkcell Iletisim Hizmetleri AS (TKC)

SPDR Gold Shares (GLD)

I sit here with my fingertips battered, bruised, and bleeding. My lower back aches, and my shoulders are as tight as a drum. After promising to take it easy for a while because the risk/reward in the market so badly sucks, I knocked out six Trade Alerts in one day. That is on top of conducting a one-hour strategy webinar and writing a 1,600 word daily newsletter. So I lied.

So far in 2013, I have issued an exhausting 114 opening, closing, and updated Trade Alerts. That includes one amazing run of 19 consecutive profitable trades. You have to strike while the iron is hot, make hay while the sun shines, yada, yada, yada. Making money in the market this year has been a turkey shoot.

Since writing about my performance a few days ago, which now stands at an eye popping 35.88% for 2013 and 90.93% over the past 30 months, I have been deluged with inquiries about how I pulled off this trading miracle from the incredulous. Is he using insane amounts of leverage? Or is he just telling porky pies, a not unheard of practice in this sullied industry.

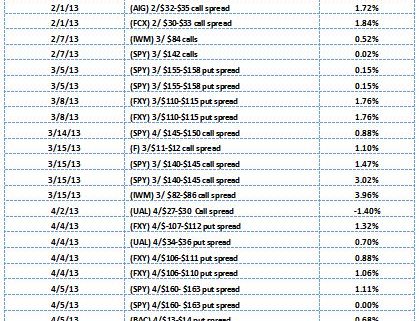

So in the interest of full disclosure, I am posting below every trade I have alerted readers to since January 1, along with the profit and loss. Of the 43 trades executed in 2013, 37 have been profitable, some quite impressively so. Each trade is shown in terms of its contribution to the portfolio?s total annual return. That is a success rate of 86%, which rightly earns me an honored place in the Hedge Fund Trader?s Hall of Fame.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Feast your eyes.

On my way back from Lake Tahoe last weekend I saw that every bend of the American river was dotted with hopeful miners, looking to make a windfall fortune. Weekend hobbyists were there panning away from the banks, while the hardcore pros stood in hip waders balancing portable pumps on truck inner tubes, pouring sand into sluice boxes. Welcome to the new California gold rush.

A sharp-eyed veteran can take in $2,000 worth of gold dust a day. The new 2013'ers were driven by a price of gold at $1,450 and the attendant headlines, but also by unemployment, and heavy rains that flushed new quantities of the yellow metal out of the Sierras. They were no doubt inspired by the chance discovery of an 8.7 ounce nugget in May near Bakersfield, worth an impressive $12,615.

Local folklore says that The Sierra's have given up only 20% of their gold, and the remaining 80% is still up there awaiting discovery. Out of work construction workers are taking their heavy equipment up to the mountains and using it to reopen mines that have been abandoned since the 19th century.

The US Bureau of Land Management says that mining permits in the Golden State this year have shot up from 15,606 to 23,974. Unfortunately, the big money here is being made by the sellers of supplies and services to the new miners, much as Levi Strauss and Wells Fargo did in the original 1849 gold rush.

I am building lists of emerging market ETF?s to snap up during any summer sell off, and Turkey popped up on the menu. The country is only one of two Islamic countries that I consider investment grade, (Indonesia is the other one). The 82 million people of Turkey rank 15th in the world population, and 16th with a GDP of $960 billion GDP. Some 25% of the population is under the age of 15, giving it one of the planet?s most attractive demographic profiles.

The real driver for Turkey is a rapidly rising middle class, generating consumer spending that is growing by leaps and bounds. Its low wage labor force is also a major exporter to the European Community next door.

I first trod the magnificent hand woven carpets of Istanbul?s Agia Sophia in the late 1960?s while on my way to visit the rubble of Troy and what remained of the trenches at Gallipoli, a bloody WWI battlefield. Remember the cult film, Midnight Express? If it weren?t for the nonstop traffic jam of vintage fifties Chevy?s on the one main road along the Bosporus, I might as well have stepped into the Arabian Nights. They were still using the sewer system built by the Romans.

Four decades later, and I find Turkey among a handful of emerging nations on the cusp of joining the economic big league. Exports are on a tear, and the cost of credit default swaps for its debt is plunging. Prime Minister Erdogan, whose AKP party took control in 2002, implemented a series of painful economic reform measures and banking controls, which have proven hugely successful.

Foreign multinationals like General Electric, Ford, and Vodafone, have poured into the country, attracted by low costs and a rapidly rising middle class. The Turkish Lira has long been a hedge fund favorite, attracted by high interest rates.

Still, Turkey is not without its problems. It does battle with Kurdish separatists in the east, and has suffered its share of horrific terrorist attacks. Inflation is a worry. The play here long has been to buy ahead of membership in the European Community, which it has been denied for four decades. Suddenly, that outsider status has morphed from a problem to an advantage.

The way to get involved here is with an ETF heavily weighted in banks and telecommunications companies, classic emerging market growth industries like (TUR). You also always want to own the local cell phone company in countries like this, which in Turkey is Turkcell (TKC). June elections could provide us with the trigger to move into this enchanting country. Turkey is not a riskless trade, but is well worth keeping on your radar.

I See A Trade Here

I See A Trade Here

Global Market Comments

May 2, 2013

Fiat Lux

Featured Trade:

(SELLING GOLD AGAIN), (GLD),

(IS USA, INC. A ?SELL?),

(COLUMBIA IS POPPING UP ON MY RADAR), (GXG), (EEM)

SPDR Gold Shares (GLD)

Global X FTSE Colombia 20 ETF (GXG)

iShares MSCI Emerging Markets Index (EEM)

The real shocker today in the Fed?s announcement is that it may increase monetary easing from here. As if we haven?t had enough already, with the US and Japan throwing in a combined $170 billion a month worth of monetary stimulus!

More easing means that the America?s central bank thinks the global economy is even weaker than you and I realize. Yikes! Man the lifeboats, pass out the parachutes, and tighten your seatbelts! This is bad for commodities and even worse for precious metals, especially gold.

The barbarous relic has managed an impressive $155 rally off its $1,325 bottom made two weeks ago. This is one of the sharpest and fastest moves up in the yellow metal in history. It has been largely achieved through massive buying of physical coins in India and the US, as well as short covering in the futures markets and the ETF (GLD). The disappearance of margin calls has also been a major help.

The heavy hand of the China slowdown is still with us. So I am more than happy to buy the SPDR Gold Trust Shares June, 2013 $150-$155 in-the-money bear put spread. The big attraction here is that I have a generous $97 safety cushion over the next six weeks before I lose money on this trade.

You can thank the sky high implied volatilities on the (GLD) puts for getting such a great deal on this spread. Just for the sake of comparison, the implied on the (GLD) $150 puts you just sold short is 18.2%, some 30% higher than the 14% front month implied on the Volatility Index on the S&P 500. If you don?t understand why this is important, please buy the book, Options for the Beginner and Beyond, at Amazon by clicking the title or the book cover below.

Time To Grab a Second Handful

Time To Grab a Second Handful

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.