While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

August 2, 2013

Fiat Lux

Featured Trade:

(AUGUST 9 ZERMATT, SWITZERLAND STRATEGY SEMINAR),

(THE WORLD?S LARGEST SOLAR PLANT),

(DINNER WITH JOSEPH STIGLITZ)

Come join me for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Friday, August 9, 2012. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired, but happy.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $189, down from last year, thanks to the dramatic and welcome, as well as predicted depreciation of the Swiss franc against the US dollar.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Unfortunately, I know Blythe, California too well. This natural blast furnace is in a God forsaken corner of the state where I hunted jackrabbits as a kid, the Indians survived on Gila monsters for protein, and it regularly reaches 130 degrees in the shade.

It is also where Peter Fonda and Dennis Hopper crossed the ?bridge of no return? over the Colorado River in the cult flick Easy Rider. Blythe has unsurprisingly become ground zero for the global thermal solar movement, which I have been chronicling with great interest in these pages (see ?The Solar Boom in California?).

The entire industry has just taken a quantum leap forward with the approval of a massive 2.8 megawatt plant to be built by Solar Trust of America, a joint venture between two European companies. The Solar Trust project qualified for $900 million in cash grants and additional loan guarantees from the Department of Energy.

The facility will deploy arrayed mirrors over 7,025 acres, or 11 square miles, aimed at a conventional steam turbine. This will generate enough electricity for 2 million homes, about 15% of the total in California. With the Tres Amigas facility in New Mexico coming online soon, this raises the possibility of the Golden State selling excess green, carbon free power to the rest of the rest of the west.

Sorry guys, no equity play here. The new plant will be built and operated by privately held European companies that have been flocking to the US with their advanced technology to cash in on our generous subsidies. But it does make other publicly listed smart grid, transmission, and storage plays out there more interesting. It is all part of a huge, new alternative energy industry that is growing far faster than most investors realize.

Who Knew This Place Would Be Worth Something Someday?

Who Knew This Place Would Be Worth Something Someday?

The great thing about interviewing Joseph Stiglitz over dinner is that you don?t have to ask any questions. You just turn him on and he spits out one zinger after another. And he does this in a kibitzing, wizened, grandfatherly manner like one would expect from a character that just walked off the set of Fiddler on the Roof.

The unfortunate thing is that you also don?t get to eat. The Columbia University professor and former World Bank Chief Economist animatedly talked the entire time, and I was too busy feverishly taking notes to ingest a single crouton.

Stiglitz argued that for 30 years after the end of the Great Depression there was no financial crisis because a newly empowered SEC was on the beat, and everything worked. A deregulation trend that started under Reagan began stripping away those protections, with the eventual disastrous repeal of Glass-Steagle in 1999. The philosophical justification adopted by many economists, including Fed chairman Alan Greenspan, was that unfettered markets always lead to efficient outcomes.

This belief was based on simplistic models assuming that markets were always perfect, always open, and that everyone had perfect information. Stiglitz?s own work on ?information asymmetry,? which earned him a Nobel Prize in economics in 2001, pulled the rug out from under this theory, because it showed that one party to a transaction always has more information than the other, often the seller.

The banks used this window to introduce super leveraged derivatives that had never been regulated, studied, or even understood. They then clawed open accounting loopholes that were so imaginative that not only were shareholders and regulators deceived about how much risk was involved, senior management was clueless as well. Instead of managing risk, they created risk.

A 2006 GDP that was 80% derived from real estate transactions and a savings rate that fell to zero meant that a severe crash was a sure thing. President Bush?s response was to unleash an extreme form of ?trickledown economics,? with the banks given $700 billion with no conditions attached. Intended to recapitalize the banks so they could resume lending to the mainstream economy, much of the money ended up being paid out in bonuses and dividends. Of the $180 billion used to rescue AIG, $13 billion went to Goldman Sachs, and much of the rest went to German and French banks. No wonder Main Street feels cheated.

The financial system is now more distorted than ever, with major institutions wards of the state, and smaller banks that actually lend to consumers and small businesses going under in record numbers, because the playing field is so uneven. There are too many structural conflicts of interest. The ?once in a 100 year tsunami? argument is merely a justification for changing nothing. No financial system has ever wasted assets on this scale, and the end result will be a national debt many trillions of dollars larger.

The 2009 $787 billion stimulus package was too small, and should have been at least $1.2 trillion, but there was no way Obama was going to get more out of this congress. The 40% of the stimulus that was tax cuts will get saved and create no immediate beneficial effects on the economy. More money should have gone to the states, which unable to deficit spend, are now a huge drag on the economy. But even this meager package was able to prevent the unemployment rate from rising from 10% to 12%, as it was set to do. The inadequacy of the first package means a second is almost a certainty. Any major spending cuts will produce ?Hoover? outcomes.

Well, I don?t get to chat at length with a Nobel Prize winner every day, so I thought I?d give you the full blast, even though I had to leave a lot out.

Global Market Comments

August 1, 2013

Fiat Lux

Featured Trade:

(AN EVENING WITH THE CHINESE INTELLIGENCE SERVICE),

(FXI), (CYB), (CHL), (BIDU), (PBR),

(WMT), (MSFT), (ORCL), (HPQ), (GOOG)

iShares China Large-Cap (FXI)

WisdomTree Chinese Yuan (CYB)

China Mobile Limited (CHL)

Baidu, Inc. (BIDU)

Petr (PBR)

Wal-Mart Stores Inc. (WMT)

Microsoft Corporation (MSFT)

Oracle Corporation (ORCL)

Hewlett-Packard Company (HPQ)

Google Inc. (GOOG)

I normally avoid the diplomatic circuit, as the few non-committal comments and soggy appetizers I get aren?t worth the investment of time. But I jumped at the chance to celebrate the 62nd anniversary of the founding of the People?s Republic of China with San Francisco consul general Gao Zhansheng.

Happy Birthday China!

Happy Birthday China!

When I casually mention that I survived the Cultural Revolution and interviewed major political figures like Premier Deng Xiaoping, who launched the Middle Kingdom into the modern era, and his predecessor, Zhou Enlai, modern day Chinese are enthralled. It?s like going to a Fourth of July party and letting drop that I palled around with Thomas Jefferson and Benjamin Franklin.

Five minutes into the great hall, and I ran into my old friend Wen. She started out her career with the Chinese Intelligence Service, and had made the jump to the Foreign Ministry, as all their best people did. Wen was passing through town with a visiting trade mission.

When I was touring China in the seventies as the guest of the Bank of China, Wen was assigned as my guide and translator, and we kept in touch over the years. I was assigned a bodyguard who doubled as the driver of a tank like Russian sedan, a Volga. The Cultural Revolution was on, and while the major cities were safe, we ran the risk of running into a renegade band of xenophobic Red Guards, with potentially fatal consequences.

I asked Wen when China was going to float the Yuan? She explained that this is something China knew it had to do, but it wasn?t going to be rushed into by some opportunistic foreign politicians. If it moves too soon, millions will lose jobs, creating political instability, something the central government wants to avoid at all costs. Many of the large-scale employers were only marginally profitable, and a hike in the renminbi of only a few percent would force them out of business. I pointed out that that was exactly what was happening in the US.

Worth More Than Meets the Eye

Worth More Than Meets the Eye

I warned that if the Middle Kingdom waited too long, Washington would force them into an appreciation through punitive import duties and anti-dumping actions, as we did with Japan 40 years ago. It was Nixon?s surprise ban on textile imports in 1971 that finally persuaded Japan to float the yen, then at ?360. If that didn?t convince the Chinese, then imported inflation would. The longer China delays, the bigger the pop when their currency is finally set free.

Wen then went on the offensive, claiming that Chinese workers were being exploited by American companies keeping wages low. The product that China made for $1, and sold to the US for $2, was then sold by Wal-Mart (WMT) for $20 to the end American consumer, which kept all the profits. She pointed out that the Walton family had a combined net worth of $100 billion, more than the total worth of the lower 40% of the US population. This could never happen in China. I told her that by selling the product at $20, Wal-Mart wiped out another US company that used to make that product domestically and sold it for $40, throwing those people out of work.

Modern Times in China

Modern Times in China

I then asked Wen what were her country?s plans for its massive foreign exchange reserves, now at $3.7 trillion? She agreed that this was a problem because the reserves were pouring in so fast, at an embarrassingly high rate of $10 billion a month, and that it was the most rapid accumulation of wealth in history.

While it had more than enough Treasury bonds, any attempt to sell might cause their value to collapse and freeze relations with the US. I suggested China should start hedging its gigantic holdings without selling them, or some managers would be facing a firing squad in the future.

China has therefore begun directing new reserve inflows into other instruments, like gold, Japanese government bonds, and ultra-high yield PIIGS bonds in Europe.

China tried to recycle its surpluses by buying foreign companies that produce the natural resources it desperately needs. But takeover attempts were fought tooth and nail as a foreign invasion, or on national security grounds, such as the attempt to buy California?s Unocal in 2005 and Australia?s Oz Minerals in 2010. It was now using a strategy of buying low profile minority stakes in foreign resource companies. China took a big stake in the Petrobras (PBR) secondary equity offering.

Check Out This tasty Little Morsel

Check Out This tasty Little Morsel

I asked her about the real estate bubble in China that was causing so many foreign investors to lose sleep. She said it was true that sales were slow at some luxury buildings in Beijing and Shanghai, but the great majority of developments were aimed at working people, and were filling up as soon as they came on the market. The 40% down payment demanded by the People?s Bank of China headed off the rampant speculation that brought the American financial system down. Buyers of second homes were required to pay entirely in cash.

Rooms with Views

Rooms with Views

Wen then complained about the aggressive military stance the US was taking towards China, ringing it in with the Seventh Fleet. Holding a knife so close to the country?s foreign supply line jugular vein made them nervous. China was basically indefensible. All it would take was the sinking of a few grain ships, causing insurance rates to rocket, and 100 million would starve within a year. President Bush was rattling his saber as soon as he moved into office, until 9/11 diverted his attention to Afghanistan and Iraq.

Wen told me there is a school of thought in Beijing that as the country?s economic power grows- it is passed Japan to become second in GDP last year? that the US will increasingly perceive it as a military threat. This would lead America to mete out the same hostile treatment to China as it did Russia during the cold war.

Walking Softly, But Carrying a Big Stick

Walking Softly, But Carrying a Big Stick

I assured her that the Seventh Fleet was there to watch and listen, but to do nothing. It was really in position to provide a security blanket for allies, like Japan and South Korea, but nothing more. China wasn?t engaging in the belligerent behavior that Russia was at the height of the cold war, like blockading Berlin, basing missiles in Cuba, stationing fast attack nuclear submarines off our coasts, and invading Afghanistan.

I argued that if China truly has no expansionary intentions, the more we know about you, the better. It is always prudent for a potential adversary to conclude you are not a threat, and that no action is needed. The more you help the US do that, the better. China is decades behind the US in military technology, and you really have nothing we want. Little more than 200 nuclear weapons without an ICMB or submarine delivery systems were hardly viewed as a major threat.

Wen seemed perturbed that I was aware of her country?s nuclear stockpiles, and asked how I knew this. I said that former CIA director Leon Panetta told me (click here for ?Lunch With the CIA?). She said ?Oh.? I asked what was that test downing of a satellite in space about, anyway? She didn?t answer.

In any case, with our military fully committed fighting two wars in the Middle East, we lacked the resources for an Asian offensive if we were so inclined, even against a piddling, mismanaged, rogue state like North Korea. But looking at the world for the next 30 years, who is the Pentagon going to model and war game against, but China, with its 2.5 million-man army?

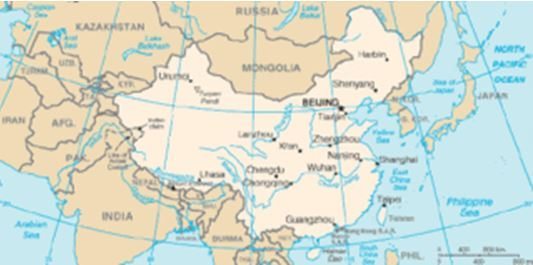

Wen countered that the People?s Liberation Army was purely a defensive force. With a 12,000-mile land border, an 11,000-mile coastline, and dubious neighbors like Russia, Iran, and India, they have no other choice. Its ability to project force over great distances, as the US can, is virtually nonexistent. Its 1979 invasion of Vietnam was about reclaiming ten miles of lost territory. China got involved in Korea only after general Douglas MacArthur threatened to rain atomic bombs on the mainland, losing 2 million men, including Chairman Mao?s son. China could have done a lot more in the Vietnam War, but didn?t, limiting its participation to a supply, logistical, and advisory role.

That?s a Lot of Border to Defend

That?s a Lot of Border to Defend

I then warned that if you really are worried about the Pentagon, you should stop hacking into our computers. She replied that the US started this by emptying out Chinese mainframes many times a decade ago, and they were only responding in kind. I said yes, but that China was targeting private companies, like Google (GOOG), Hewlett Packard (HPQ), and Oracle (ORCL) that without military grade software, were unable to defend themselves. The Chinese agencies involved then used the data to their own commercial advantage.

What Did You Say the Password Was Again?

What Did You Say the Password Was Again?

By the time Wen married, China had already adopted its one child policy. As much as she wanted more children, she understood the government?s need to adopt such a drastic policy. Without it, the population today would be 1.6 billion, not 1.2 billion, and all of the money that went into buying capital goods would have been spent on food imports instead. The country would have stagnated at its 1980 per capita income of $100/year. There would have been no Chinese economic miracle. She was very proud of her one son, who was a software engineer at Microsoft (MSFT) in Beijing.

Her husband, a mid level official at the Ministry of Commerce, fared less well, dying of lung cancer at a relatively early age. The US and Europe had exported their worst polluting industries to China to take advantage of lax environmental controls, turning the air in Beijing into a choking haze. Sometimes her son would come home from school coughing and wheezing so badly that he couldn?t play outside. The two packs of cigarettes a day her husband smoked didn?t help either.

Imported From the USA

Imported From the USA

I asked if she recalled our first trip together and a dark cloud came over her face. We were touring a section of Fuzhou when three policemen marched up. They started shouting at Wen that we were in a restricted section of the city where foreigners were not allowed. They started mercilessly beating her with clubs.

I was about to intercede when my late wife, Kyoko, let go with a blood curdling tirade in Japanese that froze them in their tracks. I saw from the fear in their faces that she had ignited their wartime fear of Japanese authority and the dreaded Kempeitai, or secret police, and they beat a hasty retreat. To this day, I?m not exactly sure what Kyoko said. We took Wen back to our hotel room and bandaged her up, putting ice on the giant goose egg on her head. When I left, I gave her my paperback copy of HG Well?s A Short History of the World, which she treasured, as the book was then banned in China.

Wen mentioned that she was approaching the mandatory retirement age of 60, and soon would be leaving the Foreign Service. I suggested she move to San Francisco, which offered a thriving Chinese community and home prices that had recently dropped by half. She laughed. No matter how much prices had fallen, she could never afford anything here on a Chinese civil servant?s salary.

Wen told me that China was grateful for the billions of dollars that foreigners had poured into her country as a result of my writings. I replied that I was simply trying to show my readers where to make some money, nothing more. It was the pure opportunistic self-interest that she might expect from any capitalist.

One of my recommendations, for Chinese search engine Baidu (BIDU), was up more than tenfold in less than two years, (click here for the article). Did she happen to know about any more future Baidus? Wen said that she wasn?t that close to the stock market, but that she would get back to me.

I asked Wen if she still had the book I gave her nearly four decades ago. She said it had become a treasured family heirloom, and was being passed down through the generations. As she smiled, I notice the faint scar on her eyebrow from that unpleasantness so long ago.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.