As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

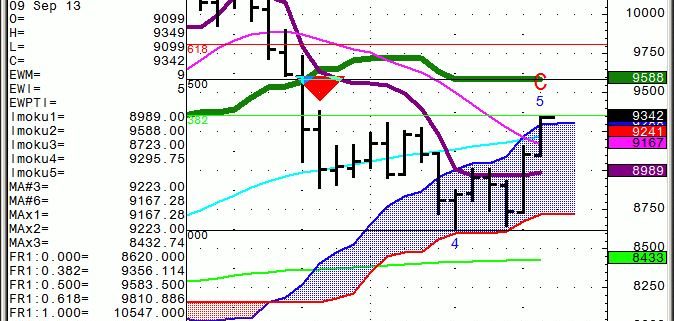

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

September 10, 2013

Fiat Lux

Featured Trade:

(NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON),

(BAILING ON MY OIL SHORT), (USO),

(QUANTITATIVE EASING EXPLAINED TO A 12 YEAR OLD),

(TESTIMONIAL)

United States Oil (USO)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $191.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

We got the dollar drop over the weekend that I was expecting. There was no way that the war was going to start before Obama gave his speech on Tuesday and congress votes yea or nay later on.

So when the missiles failed to show by the Monday morning opening, they took Texas tea down a full buck. The Charlie Rose interview with Bashar al-Assad, where he blamed it all on the rebels, also cast more doubt on the prospect of immediate hostilities.

Don?t kid yourself. There is going to be a war. Over the weekend, I did manage to get a peek at the classified proof of the sarin gas attack, thanks to some senior military sources at the Pentagon.

It includes recordings of radio transmissions from Syrian generals ordering the use of poison gas to teach a lesson, and other recordings of radar tracks showing the missiles flying from a Syrian army base to a Damascus neighborhood. You are not going to get a better smoking gun than that.

The Russians were not given access to this data to keep sources, methods, and the advanced state of our monitoring technology, secret. Besides, relations with the Ruskies have been pretty rocky lately. This is why President Obama said at the St. Petersburg press conference that he was elected to end wars, not start new ones, based on false information, a jab at the originators of the 2002 second Gulf War.

However, it?s time to use this window to cut our losses on our United States Oil Fund September, 2013 $39-$42 in-the-money bear put spread, which is now out-of-the-money, if just a touch. Think of it has folding your hand and losing your ante when the dealer has an ace showing in Texas hold?em.

Everything that can go wrong with a trade happened with this one. My initial assumption that Egypt would go to sleep in the wake of the army massacre of 1,000 protesters proved correct. At first, my oil short made money, as oil fell from $108 a barrel to $105, taking the (USO) down with it.

Then Secretary of State John Kerry made his blockbuster, saber rattling speech, ramping up speculation about a new war in Syria by a quantum leap. Oil soared to $112.50. Since then, it has been all back and fill, based on the totally unpredictable headline?du jour, with most of the movement occurring in an untradeable daily gap opening.

There are only nine trading days left to expiration on this position. We would make money with an expiration at this level with the (USO) a mere 25 cents in-the-money.

But the risk/reward of continuing has gone asymmetric against us, meaning that we are risking a lot of money here to make just a little bit. It is not worth it. If things suddenly go against us, like missiles actually flying, a 1.18% loss could turn into a sickening 10% one very quickly. And with nine days to expiration, there is not enough time for conditions to turn right for us once again.

It easier to take a loss when your overall profit reaches another all time high. As of now, the?Trade Alert?service of the?Mad Hedge Fund Trader?is up a hefty 41.48%, thanks to my major short in the Japanese yen. I would hate to lose a quarter of this on a single rogue trade, thanks to some Middle Eastern warlord.

I already have plans on how to spend this money, like buying a second Tesla, the four wheel drive SUV model X, which will probably set me back another $100,000. I am not going to let oil pee on my parade.

When war does break out, and then escalates, and we get the spike up to $118 that many are predicting, then you?ll see me re emerge as a seller once again. If anything, the underlying supply/demand dynamics are getting worse, with the precipitous size of the Wall Street long position in oil rising, while underlying demand is melting away like an ice cube in the desert. For explanations of the fundamentals here in eloquent and florid detail, please read ?Why I Sold Oil? by?clicking here?and ?Why I?m Keeping My Oil Short? by?clicking here?at.

On to the next trade.

A Tesla Model ?X?

A Tesla Model ?X?

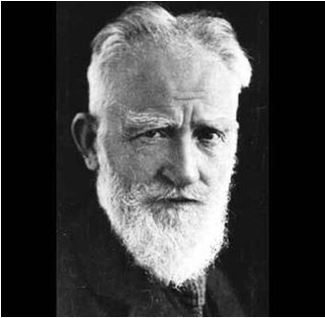

Great to have you back in the States putting out trade alerts, John. Looking forward to your story about climbing the Matterhorn. I have two questions: What made the difference in getting to the top this year? Was it the preparation or just the determination to do it before you got any older? Second question is do you still have your beard? I thought it looked cool.

My gains with your trading service are not as good as yours, but I'm learning. I find that if I do exactly as you say I make money. When I try something on my own I usually lose money. I've never been very good at doing what I was told, but I think I'll stick to just following your trades.

Susanna

On the Road

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.