While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

September 18, 2013

Fiat Lux

Featured Trade:

(THE ULTRA BULL ARGUMENT FOR GOLD),

(GLD), (GDX), (ABX), (SLV),

(AN EVENING WITH BILL GATES, SR.)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

Barrick Gold Corporation (ABX)

iShares Silver Trust (SLV)

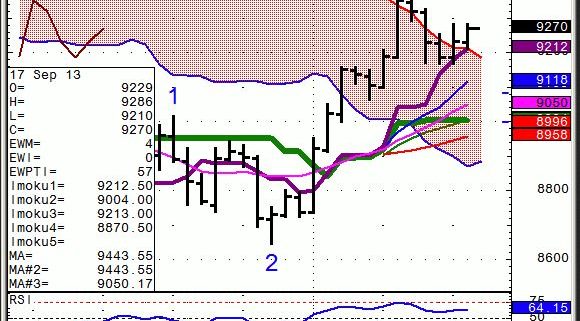

We sit here in the calm before the storm awaiting the Federal Reserve?s decision to taper a little, a lot, or not at all. Every asset class on the planet is in a holding pattern until then. So I?ll take this opportunity to review the current state of play in gold (GLD).

Since it peaked in the summer of 2011, the barbarous relic has been beaten like the proverbial red headed stepchild, dragging silver (SLV) down with it. It now appears to be facing a perfect storm.

If the Fed doesn?t taper today, it will shortly. That will bring us rising interest rates, raising the opportunist cost of own non-interest bearing assets for the first time in six years. Gold is at the top of that list.

Gold has traditionally been sought after as an inflation hedge. But with jobs growth weak, wages stagnant, and much work still being outsourced abroad, rapid price increases are nowhere on the horizon. Unless, of course, you drive a gas-guzzler, which I don?t.

The biggest buyers of gold in the world, the Indians, have seen their purchasing power drop by half, thanks to the collapse of the rupee against the US dollar. The government there is now threatening to increase taxes once again in order to staunch precious capital outflows. That?s why Indian gold imports fell by a stunning 95% last month to a mere 2 ? metric tones.

You can also blame the China slowdown for declining interest in the yellow metal, which is now in its fourth year of falling economic growth. Chart gold against the Shanghai index, and the similarity is striking.

The brief bid gold caught this summer over war fears in Syria was worth an impressive $250 rise. But the diplomats then got involved and hostilities were taken off the table, or at least delayed. That caused gold to roll over like the Bismarck.

Can?t the metal catch a break?

With conditions this grim, you?d think the price of gold was going to zero. It?s not. While now one was looking, the average price of gold production has soared from $5 in 1920 to $1,300 today. Over the last 100 years, the price of producing gold has risen four times faster than the underlying metal. It?s almost as if the gold mining industry is the only one in the world which sees real inflation, which has seen costs soar at a 15% annual rate for the past five years.

This is a function of what I call ?peak gold.? They?re not making it anymore. Miners are increasingly being driven to higher risk, more expensive parts of the world to find the stuff. You know those tires on heavy dump trucks? They now cost $200,000 and buyers face a three-year waiting list to buy one. Barrick Gold (ABX) isn?t mining at 15,000 feet in the Andes, where freezing water is a major problem, because they like the fresh air.

What this means is that when the spot price of gold falls below the cost of production, miners will simply shout down their most marginal facilities, drying up supply. They can still operate, and older mines carry costs that go all the way down to $600. No one is going to want to supply the sparkly stuff at a loss. That should prevent gold from falling dramatically from here.

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value, and that the barbaric relic is really worth $5,000, $10,000, or even $50,000 an ounce (GLD). They claim the move in the yellow metal we are seeing is only the beginning of a 30 fold rise in prices similar to what we saw from 1972 to 1979, when it leapt from $32 to $950.

So when the chart below popped up in my in-box showing the gold backing of the US monetary base, I felt obligated to pass it on to you to illustrate one of the intellectual arguments these people are using. To match the 1936 monetary value peak, when the monetary base was collapsing, and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by eight times, or to $9,600 an ounce.

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter. But I am not that bullish. It makes my own $2,300 prediction positively wimp-like by comparison. The seven year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg, South Africa to unload my own krugerrands in 1979, was triggered by a number of one off events that will never be repeated.

Some 40 years of demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold. South Africa, the world?s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence my more subdued forecast. But then again, I could be wrong.

In the end, gold may have to wait for a return of inflation to resume its push to new highs. The last bear market in gold lasted 18 years, from 1980 to 1998, so don?t hold your breath.

What should we look for? When your friends start getting surprise, out of the blue pay increases, the largest component of the inflation calculation. That is happening now in the technology and the new US oil fields, but nowhere else. It could be a long wait, possibly into the 2020?s, until the wage hikes spread elsewhere.

You may have noticed that I have not been doing much trading in gold or the other precious metals lately, except from the short side. That is because they are still working off a multiyear overbought condition. Given some time, and a solid floor under prices, and I?ll be back there in a heartbeat.

You?ll be the first to know when that happens.

I had a chat with Bill Gates, Sr. recently, co-chairman of the Bill and Melinda Gates Foundation, the world?s largest private philanthropic organization. There, a staff of 800 helps him manage $30 billion.

The foundation will give away $3.1 billion this year, a 10% increase over last year. Some $1.5 billion will go to emerging nation health care, and another $750 million to enhance American education.

The foundation?s spending in Africa has been so massive, that it is starting to have a major impact on conditions, and is part of the bull case for investing.

The fund happens to be one of the best managed institutions out there, having sold the bulk of its Microsoft (MSFT) stock just before the dotcom bust and moving the money into Treasury bonds.

Mr. Gates? pet peeve is the precarious state of the US K-12 public education system, where teaching is not as good as it could be, expectations are low, and financial incentives and national standards are needed.

When asked about retirement, he says ?having a son with a billion dollars puts a whole new spin on things.?? Now razor sharp at 87, his favorite treat is the free NetJet miles he gets from his son Bill every year. In his memoir Showing up for Life, he says a major influence on his life was his Scoutmaster 70 years ago.

Being an Eagle Scout myself, I quickly drilled him on some complex knots, and he whipped right through all of them.

The world needs more Bill Gates Srs.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.