As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Global Market Comments

January 3, 2013

SPECIAL FOREIGN CURRENCY ISSUE

Featured Trades:

(LONG TERM DOLLAR TREND),

(FXA), (FXC), (BNZ), (CYB), (FXE)

(THE COMING COLLAPSE OF THE YEN),

(THE BIG MAC INDEX), (MCD

CurrencyShares Australian Dollar Trust

CurrencyShares Canadian Dollar Trust

WisdomTree Dreyfus New Zealand Dollar

WisdomTree Dreyfus Chinese Yuan

CurrencyShares Euro Trust

Any trader will tell you the trend is your friend and the overwhelming direction for the US dollar for the last 220 years has been down.

Our first Treasury Secretary, Alexander Hamilton, found himself constantly embroiled in sex scandals. Take a ten-dollar bill out of your wallet and you?re looking at a world class horndog, a swordsman of the first order. When he wasn?t fighting scandalous accusations in the press and the courts, he spent much of his six years in office orchestrating a rescue of our new currency, the US dollar.

Winning the Revolutionary War bankrupted the young United States, draining it of resources and leaving it with huge debts. Hamilton settled many of these by giving creditors notes exchangeable for then worthless Indian land west of the Appalachians. As soon as the ink was dry on these promissory notes, they traded in the secondary market for as low as 25% of face value, beginning a centuries long government tradition of stiffing its lenders, a practice that continues to this day. My unfortunate ancestors took him up on his offer, the end result being that I am now writing this letter to you from California?and am part Indian.

It all ended in tears for Hamilton, who, misjudging former Vice President Aaron Burr?s intentions in a New Jersey duel, ended up with a bullet in his back that severed his spinal cord. Cheney, eat your heart out.

Since Bloomberg machines weren?t around in 1790, we have to rely on alternative valuation measures for the dollar then, like purchasing power parity, and the value of goods priced in gold. A chart of this data shows an undeniable permanent downtrend, which greatly accelerates after 1933 when FDR banned private ownership of gold and devalued the dollar.

Today, going short the currency of the world?s largest borrower, running the greatest trade and current account deficits in history, with a diminishing long term growth rate is a no brainer. But once it became every hedge fund trader?s free lunch and positions became so lopsided against the buck, a reversal was inevitable. We seem to be solidly in one of those periodic corrections, which began six month ago, and could continue for months or years.

The euro has its own particular problems, with the cost of a generous social safety net sending EC budget deficits careening. Use this strength in the greenback to scale into core long positions in the currencies of countries that are major commodity exporters, boast rising trade and current account surpluses, and possess small consuming populations. I?m talking about the Canadian dollar (FXC), the Australian dollar (FXA), and the New Zealand dollar (BNZ), all of which will eventually hit parity with the greenback. Think of these as emerging markets where they speak English, best played through the local currencies.

For a sleeper, buy the Chinese Yuan ETF (CYB) for your back book. A major revaluation by the Middle Kingdom is just a matter of time.

I?m sure that if Alexander Hamilton were alive today, he would counsel our modern Treasury Secretary, Tim Geithner, to talk the dollar up, but to do everything he could to undermine the buck behind the scenes, thus over time depreciating our national debt down to nothing through a stealth devaluation. Given Geithner?s performance so far, I?d say he studied his history well. Hamilton must be smiling from the grave.

?Oh, how I despise the yen, let me count the ways.? I?m sure Shakespeare would have come up with a line of iambic pentameter similar to this if he were a foreign exchange trader. I firmly believe that a short position in the yen should be at the core of any hedged portfolio for the next decade. To remind you why you hate the Japanese currency, I?ll refresh your memory with this short list:

* With the world?s weakest major economy, Japan is certain to be the last country to raise interest rates.

* This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets.

* Japan has the world?s worst demographic outlook that assures its problems will only get worse. They?re not making Japanese any more.

* The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt approaching 200% of GDP, or 100% when you net out inter agency crossholdings, Japan is at the top of the list.

* The Japanese long bond market, with a yield of 0.1.2%, is a disaster waiting to happen.

* You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji if they must to get the yen down and bail out the country?s beleaguered exporters.

When the big turn inevitably comes, we?re going to ?100, then ?120, then ?150. That works out to a price of $40 for the (YCS), which last traded at $16.35. But it might take a few years to get there. The Japanese government has some on my side with this trade, not that this is any great comfort. Four intervention attempts have so been able to weaken the Japanese currency only for a few nanoseconds.

If you think this is extreme, let me remind you that when I first went to Japan in the early seventies, the yen was trading at ?305, and had just been revalued from the Peace Treaty Dodge line rate of ?360. To me the ?84 I see on my screen today is unbelievable. That would then give you a neat 15-year double top.

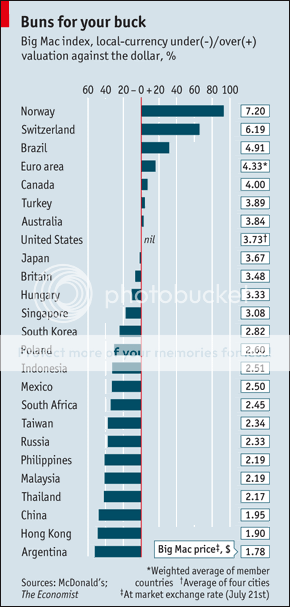

My former employer, The Economist, once the ever tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its ?Big Mac? index of international currency valuations (click here for the link).

Although initially launched as a joke three decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic success. The index counts the cost of McDonald?s (MCD) fat and sodium packed premium sandwich around the world, ranging from $7.20 in Norway to $1.78 in Argentina, and comes up with a measure of currency under and over valuation.

What are its conclusions today? The Swiss Franc, the Brazilian Real and the Euro are overvalued, while the Hong Kong Dollar, the Chinese Yuan and the Thai Baht are cheap. I couldn?t agree more with many of these conclusions. It?s as if the august weekly publication was tapping The Diary of the Mad Hedge Fund Trader for ideas. I am no longer the frequent consumer of Big Macs that I once was, as my metabolism has slowed to such an extent that in eating one, you might as well tape it to my ass. Better to use it as an economic forecasting tool, than a speedy lunch.

The Big Mac in Yen is Definitely Not a Buy

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Global Markets Comments

January 2, 2013

SPECIAL ENERGY ISSUE

Featured Trades: (OXY), (BP), (OIL),

(NATURAL GAS), (UNG),

(NSANY), (BP), (XOM), (PGE)

Occidental Petroleum Corporation

BP PLC

iPath S&P GSCI Crude Oil Total Return Index ETN

United States Natural Gas Fund, LP

Nissan Motor Co. Ltd.

Exxon Mobil Corp.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.