While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

November 15, 2013

Fiat Lux

Featured Trade:

(WATCHING THE CASH ROLL IN),

(SPY), (IWM), (FXE), (XLI), (C), (FXA), (AAPL),

(HOPPING ON THE AUSSIE),

(FXA), (EWA), (FCX),

(LUNCH WITH ROBERT REICH)

SPDR S&P 500 (SPY)

iShares Russell 2000 (IWM)

CurrencyShares Euro Trust (FXE)

Industrial Select Sector SPDR (XLI)

Citigroup, Inc. (C)

CurrencyShares Australian Dollar Trust (FXA)

Apple Inc. (AAPL)

iShares MSCI Australia (EWA)

Freeport-McMoRan Copper & Gold Inc. (FCX)

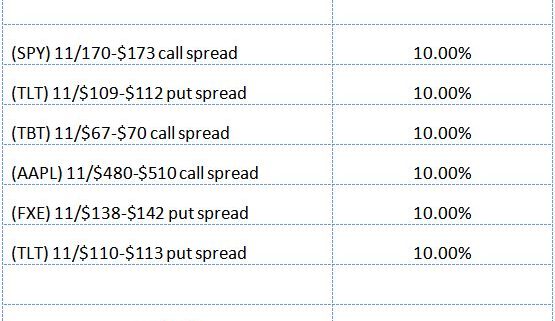

Today, many followers of the Mad Hedge Fund Trader?s Trade Alert service have up to eight November option spreads expiring at their maximum potential profit.

My strategy of taking advantage of the short November expiration calendar and betting that the markets stay in narrow ranges turned out to be wildly successful. At this stage I am batting eight for eight. If these all work, then I will have issued 15 consecutive profitable Trade Alerts since October, something most hedge fund managers would die for at this time of the year.

I have already taken profits on five of my November positions, but judging from the email traffic, many of you are hanging on to the bitter end and have asked me how to handle these.

It?s really easy. You don?t have to do anything. Nada, Squat.

Trading in the underlying ceases today, Friday, November 15 at 4:00 PM EST. The contracts legally expire on Saturday night, November 16. The cash profit is then credited to your account on Monday, November 18, the margin freed up, and the position disappears into thin air.

Only the (SPY) November 2013 $180-$183 bear put spread is giving us a run for our money. As I write this, the (SPY) is trading at$179.27, and we are a mere 73 cents in the money on the $180 puts that we are short.

If the (SPY) closes on Friday over $180, then you will be short 100 shares for every contract of the November $180 puts that you are short. Your long position in the November, $183 puts expired on Friday, so you will be naked short. This is not a position you want to have.

It is always best to cover this at the opening on Monday morning to limit your losses and keep your risk from running away. You may also not have sufficient margin to run a naked short, so If you don?t liquidate, your broker will, probably at a worse price.

Don?t try to trade a leveraged short (SPY) position in a bull market. It?s probably beyond your pay grade, and I doubt you?ll sleep at night.

I?m betting that the (SPY) will close on Friday below $180, so I am hanging on to my position. With only one single day to expiration, it is a coin toss what will happen. But with the markets this sluggish, if I am wrong, it will only be by pennies. Quite honestly, being up 56% on the year I don?t mind taking a gamble here.

I know all of this sounds very complicated to the beginners among you. Don?t worry, this all becomes second nature after you?ve done the first few thousand of these.

If you have any doubts, call your broker and they will tell you what to do, especially the part about you needing to do a thousand more trades.? Here, an ounce of prevention is worth a pound of cure. Then it?s on to the next trade.

In the meantime, take your winnings and plan your winter Caribbean holiday with your significant other. Or plan a ski vacation at Incline Village in Nevada. They?ve already had two nice dumps of snow. If you do, drop me a line and I?ll take you out for coffee at Starbucks.

Well done, traders!

Well Done Traders!

Well Done Traders!

We have a fantastic double bottom developing here on the charts for the Australian dollar (FXA). I think that RISK ON will be the order of the day for the next six months, and the currency of the Land Down Under should prosper mightily.

This is a play on the modest recovery of the Chinese economy continuing, as Australia is far and away their largest supplier to them of bulk commodities. It is also a bet that the global synchronized recovery remains on track in 2014, as I expect.

You can see from the chart below that the Australian stock market (EWA) is also reaching this conclusion, putting in a similar short term bottom to the (FXA). For a third assenting vote, look at the chart of copper producer Freeport McMoRan (FCX).

We did well with our last long play in the Aussie. Since then, we have seen a 4.5% pullback, almost exactly a 50% retracement of the entire move since August, from $88.5 to $97.5. This was prompted by more negative comments from the governor of the Reserve Bank of Australia, who is making every effort to talk his currency down and strengthen his own economy.

These (FXA) options are fairly illiquid, and trade at double the normal spread found in the foreign exchange options market, so execution here is crucial. Put in a strict limit order for the spread that works for you. If you don?t get done, just walk away and wait fore the next Trade Alert, of which there will be many.

The Aussie Has Been Hopping

The Aussie Has Been Hopping

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.