While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

February 21, 2014

Fiat Lux

Featured Trade:

(AMERICA?S NATIVE INDIAN ECONOMY),

(THE TAX RATE FALLACY)

When I was remodeling my 160-year-old London house, the chimney was in desperate need of attention. After the bricklayer crawled up the fireplace, he found a yellowed and somewhat singed envelope addressed to Santa Claus.

Thinking it was placed there by my kids, he handed it over to me. In it was a letter dated Christmas, 1910 asking for a Red Indian suit.

Europeans have long had a fascination with our Native Americans. So in preparation for my upcoming European strategy luncheon tour I thought I would get myself up to date about out earliest North American residents.

Business is booming on Indian reservations these days, or it isn?t, depending on where they live. Of the country?s 565 reservations, some 239 have moved into the casino business and the cash flow has followed.

In 2010, Indian gaming reaped some $26.7 billion in revenues, or some $9,275 per indigenous native. That is a stunning 44% of America?s total casino revenues.

Some, like the Pequot tribe?s massive Foxwood operation just two hours from New York City, now the world?s largest casino, once had money raining down upon it. But the casino grew so large that it entirely occupied the diminutive Connecticut reservation allocated to it by an obscure 17th century treaty.

During the salad days, the profits were so enormous that an annual $250,000 stipend was paid to each officially registered tribal member. A poker boom helped. No surprise that the tribe grew from 167 to 665 members during the last 30 years. Today, the operation is burdened with $2.5 billion in debt, thanks to some bad investments and an ill-timed expansion.

Casinos in more rural locations in the far west, distant from population centers, have fared less well. Those that contracted out for professional management from Las Vegas and Atlantic City firms, like Harrah?s, MGM, and Caesars, earn a modest living.

But the reservations attempting local management on their own fall victim to inefficiencies, incompetence, corruption, over hiring of locals, and outright theft. Believe it or not, it is possible to lose money in the casino business, and some have had to shut down.

Overbuilding is another problem. In Northern New Mexico you can find several casinos within five miles of each other competing for the same customer. Most of their clients (real losers) are in fact local tribal members, the same individuals these houses are intended to help.

The 326 tribes that avoided the casino industry do so at the cost of a big hit to their standard of living. That explains why Native American median household income reaches only $35,062, compared to $50,046 for the US as a whole. Many, like the numerous Hopi, shun it because of their religion.

Without gambling there are few economic opportunities on the reservations. The parched conditions of the west limit farming. Unemployment runs as high as 80% on some reservations, such as the White Mountain Apaches.

As a result, a high proportion of the country?s 2.9 million Native Americans are wards of the federal government, living on food stamps and other government handouts.

That?s not how it was supposed to be. The first modern reservation was set up for the Navajo tribe in 1851 at a baking hellhole on the Pecos River, with the intention of enforcing a primitive form of apartheid to insure their survival. Today, they are the most populous tribe, with 160,000, owning the largest reservation, at 24,000 square miles, mostly in Arizona.

Those who signed treaties early survived, which gave them status as an independent nation but ceded all matters regarding defense to the federal government. In fact the Iroquois, Sioux, and the Chippewa separately declared war on Germany during WWII. Some even issue their own passports. Those that didn?t had to settle for much smaller reservations, or got wiped out.

In 1975, congress passed the Indian Self-Determination Act, which devolved power from the government to the tribes. Florida?s Seminole tribe won the right to open a casino in court in 1981, which was confirmed by the Supreme Court in 1987. After that, it was off to the races, with Indian bingo parlors sprouting across the country.

During the 19th century Indian wars when hundreds of thousands died, the practice was to attack a wagon train, kill all the men, marry the women, and adopt the children. As a result, I am descended from three different tribes, the Delaware, Sioux, and the Cherokee, as are about a quarter of native Californians my age. So I tried to cash in on government largess by applying for tribal scholarships to go to college.

It was to no avail. Only those who can trace their lineage to a 1941 Bureau of Indian Affairs census and are one eighth Native American can qualify. When whites married Indians 150 years ago, the common practice was to baptize them and give western names, obliterating their true heritage.

They were also pretty casual with marriage records in the Wild West. But we still have many of the wedding photos and know who they are.

I never did find out if that little boy got his Red Indian suit for Christmas, but I hope he did.

So, Should I Double Down?

So, Should I Double Down?

When anyone starts lecturing you that the US has the highest tax rate in the industrialized world, just turn around, walk away, and pretend you never heard of them. This person is either ignorant about this country's taxation system, or is deliberately trying to deceive you.

According to a report released by the Internal Revenue Service, America's tax collection agency, the top 400 individual tax returns filed in 2009 reported an average gross income of $358 million each. The average amount of tax paid by these individuals came to under 17%, less than half the maximum Federal rate of 39%, which kicks in on annual income over $372,950 (click here for the 2012 tax tables).

This explains why Warren Buffet pays a much lower tax rate than his secretary. It really is true that in America, only the poor people pay taxes.

Look at any international comparison of taxes to GDP, and one can always find the United States at the bottom of the table. A Low American tax is one of the main reasons why I moved my company here from England 20 years ago.

Take a look at the Fortune 500, where one third of the largest companies pay no tax at all, and many that dominate the top of the list, like the oil majors and technology companies, pay only token amounts. However, if any politician wants to pander to voters during election time on a tax-cutting platform he will only bluster on about ?high tax rates?, not actual taxes paid.

What the US has that other countries lack is the 77,000 pages of the Internal Revenue Code. It is a 100 year accumulation of deductions, accelerated depreciation rates, tax credits, and other tax breaks that are the end product of intensive lobbying efforts and bribes by special interest groups, corporations, unions, and even religious groups.

If you do have a big tax bill, you need to hire a new accountant.

Take a look at the oil industry again. The oil depletion allowance permits drillers to deduct a substantial portion of the cost of a new well in the first year (click here for its fascinating history). When I first got into the oil and gas business 15 years ago, after reading the relevant sections of the tax code, I couldn't understand why everyone wasn't drilling for Texas tea.

The total value of this one tax break to the industry is estimated at $55 billion a year. This explains why we have had three presidents from Texas in the last 50 years. Some of this money ends up in campaign donations.

I have a very simple solution to the country's budget deficit problem. Hit the reset button. Eliminate the Internal Revenue Code. Just set it on fire or send it to the recycling bin. Keep the existing progressive, hockey stick tax rates on income, but eliminate all deductions.

And I mean everything; deductions for dependents, home mortgage interest, medical expenses, the works. The oil depletion allowance other corporate loopholes are worth at least $150 billion a year in lost federal revenues. There are no sacred cows.

My revised Form 1040 would be much like the original 1913 return, a postcard that would have only five lines on it:

Name

Social Security number

Income

Tax Rate

Tax Due

The budget deficit would disappear overnight. Government spending would shrink dramatically, because you could ditch most of the 100,000 who work for the IRS. Some 1.3 million auditors, CPA's, tax attorneys, and bookkeepers would have to hit the road in search of new work too.

The amount of money that is wasted on tax collection in this country is truly staggering. This is not some pie in the sky concept. This is how taxation already works in most countries, and they seem to get along just fine.

In fact, the whole scheme might even pay for itself.

I Don't See Any Jobs For Former IRS Agents, Do You?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

February 20, 2014

Fiat Lux

Featured Trade:

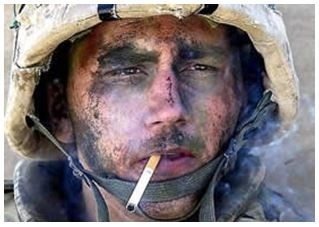

(NOTICE TO MILITARY SUBSCRIBERS),

(CHINA?S COMING DEMOGRAPHIC NIGHTMARE),

(TRIBUTE TO A GIANT OF JOURNALISM, ROY ESSOYAN)

To the dozens of subscribers in Iraq, Afghanistan, and the surrounding ships at sea, thank you for your service!

I think it is very wise to use your free time to read my letter and learn about financial markets in preparation for an entry into the financial services when you cash out. Nobody is going to call you a baby killer and shun you, as they did when I returned from Southeast Asia four decades ago. In fact, many firms on Wall Street give veterans applications first priority, because they know they can get millions of dollars worth of training and discipline for free.

I have but one request. No more subscriptions with .mil addresses, please. The Defense Department, the CIA, the NSA, Homeland Security, and the FBI do not look kindly on newsletters entering the military network, even the investment kind. If you think civilian spam filters are tough, watch out for the military kind! And no, I promise that there are no secret messages embedded with the stock tips. ?BUY? really does mean ?BUY.?

If I did not know the higher ups at these agencies, as well as the Joints Chiefs of Staff, I might be bouncing off the walls in a cell at Guantanamo by now. It also helps that many of the mid level officers at these organizations have made a fortune with their meager government retirement funds following my advice. All I can say is that if the Baghdad Stock Exchange ever become liquid, I?m going to own it.

Where would you guess the greatest concentration of readers The Diary of a Mad Hedge Fund Trader is found? New York? Nope. London? Wrong. Chicago? Not even close. Try a ten mile radius centered on Langley, Virginia, by a large margin. The funny thing is, half of the subscribing names coming in are Russian. I haven?t quite figured that one out yet.

So keep up the good work, and fight the good fight. But please, only subscribe to my letter with personal Gmail or hotmail addresses. That way my life can become a lot more boring. Oh, and by the way, Langley, you?re behind on you bill. Please pay up, pronto, and I don?t want to hear whining about any damn budget cuts!

Semper Fidelis!

I Want My Mad Hedge Fund Trader!

I Want My Mad Hedge Fund Trader!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.