While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 11, 2014

Fiat Lux

Featured Trade:

(IS THE TURNAROUND AT HAND, AND TEN STOCKS TO BUY AT THE BOTTOM?), (SPX), (TLT),

(UNLOADING MORE EUROS), (FXE), (EUO),

(I?M BACK FROM EUROPE!)

S&P 500 Index (SPX)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

War threatens in the Ukraine. Iraq is blowing up. Rebels are turning our own, highly advanced weapons against us. Israel invades Gaza. Ebola virus has hit the US. Oh, and two hurricanes are hitting Hawaii for the first time in 22 years.

Should I panic and sell everything I own? Is it time to stockpile canned food, water and ammo? Is the world about to end?

I think not.

In fact the opposite is coming true. The best entry point for risk assets in a year is setting up. If you missed 2014 so far, here is a chance to do it all over again.

It is an old trading nostrum that you should buy when there is blood in the streets. I had a friend who reliably bought every coup d? etat in Thailand during the seventies and eighties, and he made a fortune, retiring to one of the country?s idyllic islands off the coast of Phuket. In fact, I think he bought the whole island.

Now we have blood in multiple streets in multiple places, thankfully, this time, it is not ours.

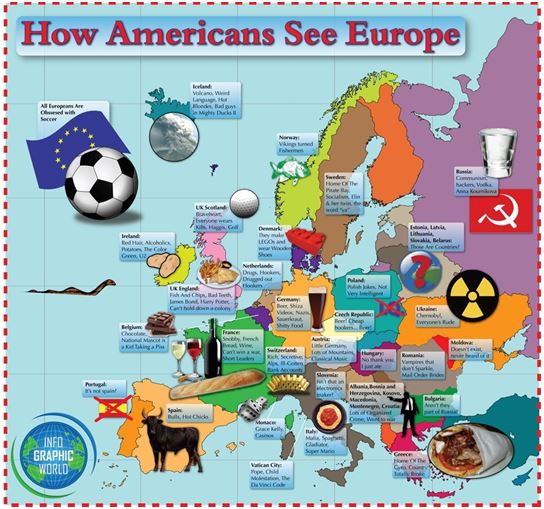

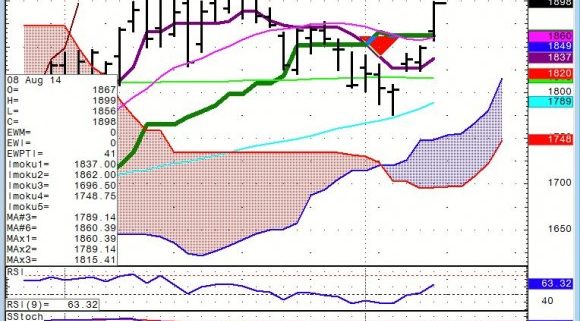

I had Mad Day Trader, Jim Parker, do some technical work for me. He tracked the S&P 500/30 year Treasury spread for the past 30 years and produced the charts below. This is an indicator of overboughtness of one market compared to another that reliably peaks every decade.

And guess what? It is peaking. This tells you that any mean reversion is about to unleash an onslaught of bond selling and stock buying.

There is a whole raft of other positive things going on. Several good stocks have double bottomed off of ?stupid cheap? levels, like IBM (IBM), Ebay (EBAY), General Motors (GM), Tupperware (TUP), and Yum Brands (YUM). Both the Russian ruble and stock market are bouncing hard today.

There is another fascinating thing happening in the oil markets. This is the first time in history where a new Middle Eastern war caused oil price to collapse instead of skyrocket. This is all a testament to the new American independence in energy.

Hint: this is great news for US stocks.

If you asked me a month ago what would be my dream scenario for the rest of the year, I would have said an 8% correction in August to load the boat for a big yearend rally. Heavens to Betsy and wholly moley, but that appears to be what we are getting.

It puts followers of my Trade Alert service in a particularly strong position. As of today, they are up 24% during 2014 in a market that is down -0.3%. Replay the year again, and that gets followers up 50% or more by the end of December.

Here is my own shopping list of what to buy when we hit the final bottom, which is probably only a few percent away:

Longs

JP Morgan (JPM)

Apple (AAPL)

Google (GOOG)

General Motors (GM)

Freeport McMoRan (FCX)

Corn (CORN)

Russell 2000 (IWM)

S&P 500 (SPY)

Shorts

Euro (FXE), (EUO)

Yen (FXE), (YCS)

No, Not This Time

No, Not This Time

The entire foreign exchange world has been on hold this week, waiting for ECB president Mario Draghi to announce a well-deserved cut in Euro (FXE), (EUO) interest rates.

The sanctions war with Russia is escalating by the day. Russia banned food imports from the US and Europe, a mere $1 billion trade hickey for us, but a $15 billion punch to the gut for the continentals. Some 350 McDonald franchises in Russia will be left with nothing to serve. Yikes!

Economists are paring expectations for European GDP growth for this year as fast as they can.

Italy announced a shocking dive in Q2 growth, and German data is deteriorating by the day, where some 300,000 jobs are dependent on trade with Russia.

The European bond market has certainly gotten the message. The yield on ten-year German bunds hit another all time low at a gob smacking 1.02%, while the return on two year paper fell below zero!

Throwing more fat on the Euro fire were the latest American weekly jobless claims, plunging by 14,000 to a new seven year low of 289,000. This augers for high US interest rates sooner, which is hugely dollar positive and Euro negative.

So given all this, Draghi?s announcement that there would be no interest rate cut whatsoever went over like a lead balloon. You would have expected the Euro to rocket a few cents on this news, thanks to the further yield support.

It didn?t, not even for a second.

Instead, another round of frustrated short sellers hit the market big time, who had been waiting for better prices at which to sell. I was one of those.

With the rapidly deteriorating fundamentals, selling short the Euro has become this year?s one way, ?free money? trade. It is a classic trading nostrum that if you throw good news on an asset and it fails to rally, you sell the hell out of it.

I will reiterate my long time targets for the beleaguered continental currency of $1.27, then $1.18, and possibly as low at $1.00. How quickly will we get to these low numbers?

Just ask Vladimir Putin.

Meet My New European Head Trader

Meet My New European Head Trader

Before I checked out of my hotel in Zermatt, Switzerland, I took the owner of my hotel out to dinner. I asked what he had learned after many years of hosting foreign guests. This is what he told me:

HEAVEN IS WHERE:

The police are British

The chefs are Italian

The mechanics are German

The lovers are French

And it is all organized by the Swiss

HELL IS WHERE:

The police are German

The chefs are British

The mechanics are French

The lovers are Swiss

And it is all organized by the Italians

Welcome Home!

Welcome Home!

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.