My friend, Ian Bremmer of the Eurasia Group, a global risk analyst who I regularly follow, has published an outstanding book entitled The End of the Free Markets: Who Wins the War Between States and Corporations. I find this highly depressing, as it takes me as long to read one of Ian?s books as it takes him to write another one. To read a review of his highly insightful tome published in 2008, The Fat Tail: The Power of Political Knowledge for Strategic Investing, please click here. The world is reaching a tipping point. For the past 40 years, global multinationals with unfettered access to capital, consumer, and labor markets have driven the world economy. There is now a new competitor on the scene, the ?state capitalist,? where political considerations trump economic ones in the allocation of resources. Of course, China is the main player, joined by several other emerging nations. The Middle Kingdom has posted double-digit annual growth for the past 30 years without freedom of speech, economic rules of the road, and independent judiciary, and credible property rights. China?s leadership is clearly worried that Western style freedoms will enable wealth to be generated outside their control and be used to orchestrate their overthrow. Private Western companies can only engage in transactions, which stand on their own economically and deliver the short-term profits, which their shareholders demand. In China, long-term political goals enable them to pay through the nose to obtain stable supplies of oil, gas, minerals, and materials. That keeps the country?s massive work force employed, off the streets, and politically neutered. The bottom line is that there are now two competing forms of capitalism. The recent financial crisis has accelerated their entrance to the global stage, moving us from a G7 to a G20 dominated world. Globalization is not ending, but it is definitely entering a new chapter. For those of us who read tea leaves to ascertain major, market moving economic trends, this will be a must read. To buy the book at Amazon, please click here.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

May 6, 2014

Fiat Lux

SPECIAL ISSUE ABOUT THE FAR FUTURE

Featured Trade:

(LAS VEGAS WEDNESDAY MAY 14 GLOBAL STRAGEGY LUNCHEON)

(PEAKING INTO THE FUTURE WITH RAY KURZWEIL),

(GOOG), (INTC), (AAPL), (TXN)

Google Inc. (GOOG)

Intel Corporation (INTC)

Apple Inc. (AAPL)

Texas Instruments Inc. (TXN)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

May 5, 2014

Fiat Lux

SPECIAL ISSUE ABOUT THE FUTURE

Featured Trade:

(ORLANDO FLORIDA SATURDAY, MAY 17 GLOBAL STRAGEGY LUNCHEON),

(BEWARE THE ?SPINNING TOPS?),

(SPY), (TLT),

(THE HISTORY OF TECHNOLOGY)

SPDR S&P 500 (SPY)

iShares 20+ Year Treasury Bond (TLT)

Winter is definitely over here in Incline Village, Nevada. When I started my daily ten-mile hikes from the Tunnel Creek Caf? ten days ago, I had to don snowshoes in the parking lot. Yesterday, I had to climb for two hours to find snow at 8,000 feet.

It?s definitely time to put my winter equipment into storage. The aspen trees are budding and yellow crocuses are breaking out all over.

That was also the conclusion of the killer April nonfarm payroll report, which brought in an eye popping 288,000. March was revised up from 192,000 to 203,000. Even more stunning was the plunge in the headline unemployment rate from 6.7% to 6.3%. It was a perfect number. Almost. We?re almost back to normal again.

I thought we were home free on our iShares Barclay 20+ Year Treasury Bond Fund (TLT) May, 2014 $113-$116 in-the-money bear put spread.

The blockbuster release should have driven a stake through the heard of the bond market.

And fall it did?.for about 15 minutes. Then news of the White House press conference announcing a further ratcheting up of tensions with Russia over the Ukraine triggered one of those rip your face off short covering rallies that have become so common this year. Prices for the (TLT) jumped to new 2014 highs, just short of our near short strike at $113. Stocks sagged.

If you had a mole at the Department of Labor who leaked to you the April nonfarm payroll a day in advance, you would have loaded the boat with long stock/short bond positions. Instead, we got the opposite. Welcome to a trader?s dull, brutish, and short life in 2014.

Throw bad news on the market, and if it fails to go down, you buy the heck out of it. That is a valuable lesson that I have learned over the decades, and I think it applied to the Treasury (TLT) bond market on Friday.

This was not weekend I wanted to go into short of bonds so close to the money. Putin is on a roll and appears to be willing to toss the dice once again. Now, he?s calling for a United Nations Security Council Meeting. Better to talk than shoot, I always say. It?s cheaper. I?ve tried both, and definitely prefer the latter.

If there has been another valuable lesson this year, it has been to keep positions small, and stop out of losers fast. So, as much as I hate to, I pulled the ripcord on my short, taking another nick on my performance this year.

?Markets can remain irrational longer than you can remain liquid,? said the great economist and primordial hedge fund trader, John Maynard Keynes. So true, so true.

The goal here is to maintain iron discipline in risk control and be the last man still standing when trading conditions improve and markets become easy again later this year. Until then, I?ll be engaging in small, short term opportunistic trades. I?ll also be doing a ton of deep research, building short lists of positions to Hoover up when life gets better.

Mind you, yields at these levels make absolutely no sense. They are predicting that deflation is now a permanent aspect of our lives. (To understand how that might be possible, read my interview in tomorrow?s letter with Google engineering director, Ray Kurzweil). Bonds are also shouting at us that we will remain stuck at a subpar 2% economic growth rate for years to come.

The inverse of bad news is also true. If you shower good news on a stock market and it fails to rise, you sell it. This suggests that a big dump in stocks is imminent, which is long overdue.

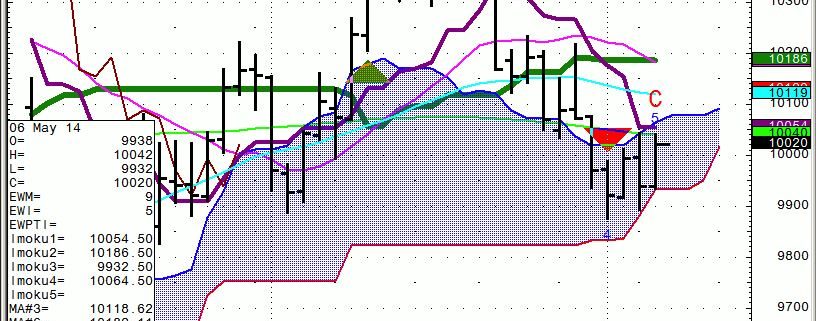

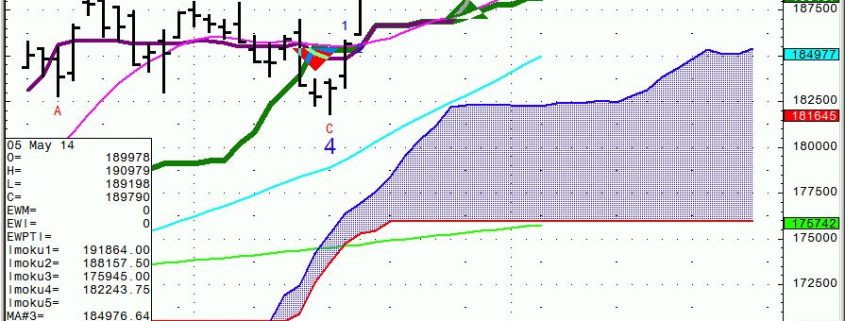

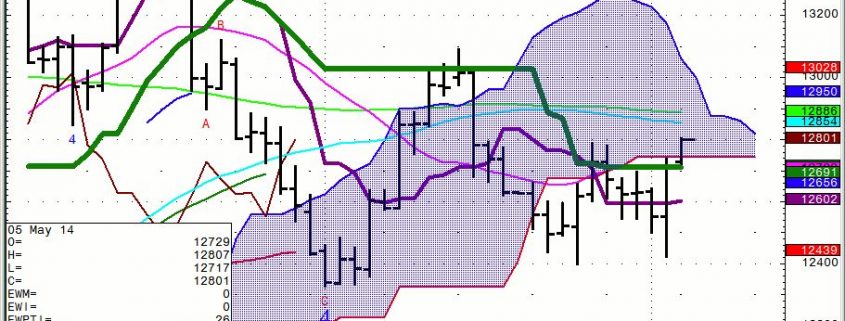

The markets certainly think this. Take a look at the chart below showing the ?spinning tops? in the S&P 500 in recent days, where shares trade across a wide range, but remain unchanged on the day. So named because the bar looks like a child?s toy, a spinning top suggests indecision among investors and a possible coming selloff. This is what happened in the beginning of March and April, opening the way for drops of 50 and 85 (SPY) handles.

This means that the ?head and shoulders? scenario I talked about a week ago is still on the table (click here for the article ?Watch Out for the Head and Shoulders?). That?s why I quickly knocked out a (SPY) June $193-$196 put spread.

In the meantime the media deluge for the upcoming midterm elections has already started, which are still five months away. Nevada governor Brian Sandoval is basing his entire campaign on his failed attempt to stop Obamacare in the courts. It is a strategy that will be repeated across the Midwest this year.

It sounds like this will be a good summer to stay out of the country. Sell in May and go away?

Going Into Storage

Going Into Storage

Beware the Spinning Tops

Beware the Spinning Tops

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.