While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 4, 2015

Fiat Lux

Featured Trade:

(SOLAR STOCKS GET A JOLT),

(SCTY), (SUNE), (SPWR), (TAN),

(IS THE REAL ESTATE MARKET CATCHING COLD?),

(ITB), (KBE)

SolarCity Corporation (SCTY)

SunEdison, Inc. (SUNE)

SunPower Corporation (SPWR)

Guggenheim Solar ETF (TAN)

iShares US Home Construction (ITB)

SPDR S&P Bank ETF (KBE)

The blockbuster for me in President Obama?s budget speech on Monday was his suggestion that the 30% alternative energy investment tax credit be made permanent. All solar stocks, including front-runners Solar City (SCTY), Sun Edison (SUNE), and SunPower (SPWR), rocketed on the news.

Now slated to expire at the end of 2017, the tax break is credited with igniting a solar building boom in recent years. Solar panels are becoming commonplace on roofs in better off residential neighborhoods across the country.

They are becoming so pervasive that they are changing the market for electricity beyond all recognition in lead states like California. The afternoon demand spike, once a regular feature of power management, is rapidly disappearing as consumers now sell excess peak electricity back to utilities at favorable rates.

Of course, this is all wishful thinking on the part of Obama, who couldn?t get a Republican led congress to agree with him on what day it is. Still, it has been outlined a priority with the administration, and could be a bargaining chip used in some broader tax compromise with the opposition.

And where President Obama mail fail, a future President Hillary may succeed.

Indeed, there has recently been an onslaught of good news showering the solar industry. China has announced a 43% increase in its installed solar base, an increase of 15 gigawatts. At the very least, this will divert cheap Chinese made panels from flooding the US market, the recent punitive import duty notwithstanding.

A 15% rally in the price of oil over the past three trading days has also provided a major assist. Solar actually has nothing to do with the price of oil. Its main competitor is the retail cost of electricity, which is driven by future capital spending budgets of local utilities. That has costs rising as far as the eye can see, as the industry replaces aging, 100 year old infrastructure.

The market sees it otherwise, which lumps all energy firms in the same category, be they oil, fracking, natural gas, coal, or even nuclear. Whether it makes sense or not, solar stocks are still tarred by the price of oil. Check out the charts below, and you find a correlation that is almost perfect.

The great irony in the president?s proposal is that solar is now profitable even without the tax breaks. They just provide the juice to accelerate widespread solar adoption.

I think solar is one of a handful of industries that could generate a tenfold return over the coming decade. Costs are plummeting, profit margins are expanding, and the overall market size is growing by leaps and bounds.

The fact that you can buy them now 40% off of their recent peaks is a gift. A $30 recovery in the price of oil could bring a 40% recovery in the shares of the oil majors. It could deliver a ten bagger for solar companies.

Let me pass on a little tidbit I picked up from Solar City a few weeks ago. By the end of this year, used Tesla Model S-1 batteries will become available in large numbers for the first time, including my own. (SCTY) plans to offer these for sale to their customers as backup batteries for home use. One battery can store three days worth of normal power consumption. This would make customers totally independent of the power grid.

No mention has been made of prices. My guess is that since these lithium ion batteries cost $30,000 new, a second hand one should come out at $10,000. These will still have 80% of their original capacity, not enough for a long-range car, but plenty for home storage.

For more depth on Solar City, please refer to my recent piece, ?Loading the Boat with Solar City? by clicking here.

Meet the New Bull Market

Meet the New Bull Market

I used to begin my pieces about residential real estate talking about the broker I found hanging from the showerhead at an open house.

That didn?t really happen. But from 2008-2012 conditions were so dire that it could have.

That is clearly not the case any more. The market has been on fire for the past three years. Private equity firms put a floor under the markets by pouring in massive amounts of cash. Once they chewed through a backlog of foreclosed homes, it was off to the races.

The gains in the lead markets have been nothing less than stunning. San Francisco saw prices rocket by 33% last year, floated by a tidal wave of technology IPO money. A home in Fog City is now 40% more expensive than the last peak in 2007.

If you want to work for a startup, you better count on spending some time in a garage, to live, not to work, as rents are now so stratospheric. Even the basket case states of Florida, Arizona, and Nevada have bounced back, although they are still well off their highs.

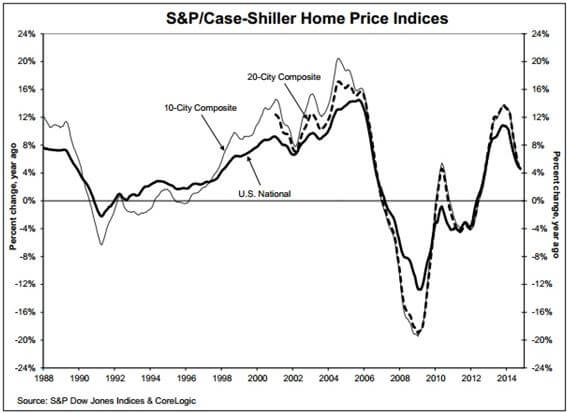

The S&P 500 Case Shiller Real Estate Index has been moving up in nearly a straight line since 2009. That is, until six months ago, when a noticeable softening began (it?s always published on a three month lag, as the market is so fragmented).

The most recent report said that homes were appreciating at a modest 4.7% year on year rate, a much slower rate than in the past. Given the onslaught of other negative data in recent months, you have to ask if the party is now over for homeowners.

It would be easy to blame the weather, last winter being one of the worst on record. My friends in Chicago threw empty beer cans at the TV sets whenever the weatherman appeared, for good reason. You can?t visit an open house if it is buried in snow and black ice has closed the roads.

However, you have to ask if there is more going on here. We also learned today that the national homeownership rate has fallen to 68.4%, a new 19 year low, according to the US Census Bureau. It would be easy to ascribe this as just one more effect of concentration of wealth at the top. But more thoughtful analysis is deserved here.

Talk to kids today, and it quickly becomes clear that homeownership is not the priority that it was for earlier generations. And who would blame them. For most of their lives, house prices have gone down, not up. For them, that cute little house with the white picket fence belies tales of financial distress, bankruptcy and foreclosure. So what?s the big rush?

A lot of twenty somethings would rather just spend their money and rent, not own. Many in the San Francisco Bay Area prefer to invest their savings in their own start-ups in the hope of making it big someday.

It?s not like banks want to lend to them anyway. In the aftermath of the Great Recession, banks now have far more stringent lending standards than in the past. You can blame both the new regulation in Dodd Frank and the banks? own desire to pare back risk.

Some 70% of graduating students today do so with outstanding student loan balances. Debts of $100,000 or more are common, and heaven help you if you want to go to graduate school. Needless to say, they don?t exactly make ideal mortgage candidates. We may b losing an entire generation of homebuyers.

I don?t think we are headed for another real estate crash. More likely, it will go to sleep for a while in a prolonged sideways move. Interest rates are still at ultra low levels and will remain so for a long time, providing a floor under current prices. The big killings are long gone. That was a 2012 trade.

The stock market has been telling us as much. The iShares Dow Jones US Home Construction ETF (ITB) has led the market retreat this year, paring back 12.7%. Banks have also taken it in the shorts, thanks to the drying up of new mortgage originations, the SPDR KBW Bank Index ETF (KBE), giving back 12% during the same time frame.

Happy days will return to housing once more. But we may have to wait until the 2020?s, when a gigantic demographic tail wind, returning inflation and rising wages all kick in at the same time.

Some of those nascent start-ups may also be going public by then, adding more fuel to the fire.

Is Housing Cooling Off?

Is Housing Cooling Off?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.