While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 20, 2015

Fiat Lux

Featured Trade:

(A NOTE ON THE FRIDAY OPTIONS EXPIRATION),

(FXY), (GILD), (SPY), (VIX),

(TLT), (IWM), (QQQ), (SCTY), (USO), (GLD),

?(AN EVENING WITH TEXAS GOVERNOR RICK PERRY),

?(LNG), (UNG), (TSLA)

CurrencyShares Japanese Yen ETF (FXY)

Gilead Sciences Inc. (GILD)

SPDR S&P 500 ETF (SPY)

VOLATILITY S&P 500 (^VIX)

iShares 20+ Year Treasury Bond (TLT)

iShares Russell 2000 (IWM)

PowerShares QQQ Trust, Series 1 (QQQ)

SolarCity Corporation (SCTY)

United States Oil ETF (USO)

SPDR Gold Shares (GLD)

We have several options positions that expire on Friday, and I just want to explain to the newbies how to best maximize their profits.

These include:

The Currency Shares Japanese Yen Trust (FXY) February $84-$87 vertical bear put spread

The Gilead Sciences (GILD) February $87.50-$92.50 vertical bull call spread

The S&P 500 (SPY) February $199-$202 vertical bull call spread

My bets that (GILD) and the (SPY) would rise, and that the (FXY) would fall during January and February proved dead on accurate. We got a further kicker with the two stock positions in that we captured a dramatic plunge in volatility (VIX).

Provided that some 9/11 type event doesn?t occur today, all three positions should expire at their maximum profit point. In that case, your profits on these positions will amount to 13% for the (FXY), 19% for (GILD) and 20% for the (SPY).

This will bring us a fabulous 5.58% profit so far for February, and a market beating 6.11% for year-to-date 2015.

Many of you have already emailed me asking what to do with these winning positions. The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done. You don?t have to do anything.

Your broker (are they still called that?) will automatically use your long put position to cover the short put position, cancelling out the total holding. Ditto for the call spreads. The profit will be credited to your account on Monday morning, and he margin freed up.

If you don?t see the cash show up in you account on Monday, get on the blower immediately. Although the expiration process is now supposed to be fully automated, occasionally mistakes do occur. Better to sort out any confusion before losses ensue.

I don?t usually run positions into expiration like this, preferring to take profits two weeks ahead of time, as the risk reward is no longer that favorable.

But we have a ton of cash right now, and I don?t see any other great entry points for the moment. Better to keep the cash working and duck the double commissions. This time being a pig paid off handsomely.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. Keep in mind that the liquidity in the options market disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration. This is known in the trade as the ?expiration risk.?

One way or the other, I?m sure you?ll do OK, as long as I am looking over your shoulder, as I will be.

This expiration will leave me with a very rare 100% cash position. I am going to hang back and wait for good entry points before jumping back in. It?s all about getting that ?buy low, sell high? thing going again.

There are already interesting trades setting up in bonds (TLT), the (SPY), the Russell 2000 (IWM), NASDAQ (QQQ), solar stocks (SCTY), oil (USO), and gold (GLD).

The currencies seem to have gone dead for the time being, so I?ll stay away.

Well done, and on to the next trade.

Pat Yourself on the Back

Pat Yourself on the Back

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 19, 2015

Fiat Lux

Featured Trade:

(THE BEST IS YET TO COME IN CRUDE),

(USO), (XOM), (COP), (OXY),

(AN EVENING WITH DAVID TEPPER)

United States Oil ETF (USO)

Exxon Mobil Corporation (XOM)

ConocoPhillips (COP)

Occidental Petroleum Corporation (OXY)

For the last few months, I have leapt off my biweekly global strategy webinars to check the weekly crude inventories announced minutes before. This week?s figures absolutely blew me away.

The American Petroleum Institute reported that crude stocks rose a staggering 14.3 million barrels over the past week. This is the biggest weekly build that I can remember after covering the industry for 45 years.

This comes on the heels of a breathtaking build of 6.1 million barrels the previous week.

Will someone please text me when the numbers come out during my next webinar? I hate being in the dark, even when it is just for 20 minutes.

Needless to say, crude prices (USO) fell like a stone, giving up 5.5% in hours. Prices are still plunging as I write this. It confirms my suspicion, voiced assiduously in the earlier webinar, that Texas tea has another run to the downside in store.

The 500,000 barrels a day of new production coming on line over the next four months make this a virtual certainty.

The implications for your investment portfolio are legion.

It means that a new leg down in the oil collapse is now unfolding. We may be in the process of taking another shot at the $43 low in January. Best case, this sets up the double bottom where you should buy the entire energy and commodity sectors. Worse case, we break to a new low in the $30?s.

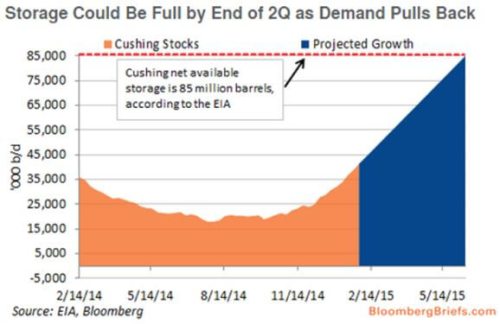

Industry experts are keeping a laser like focus on the storage facilities at Cushing, Oklahoma. They are rapidly filling up, and will be full at 85 million barrels by June. Today?s numbers bring that day dramatically forward.

Once topped up, the industry could be facing a price Armageddon, and newly produced crude will have nowhere to go.

That will bring widespread capping of producing wells, which are never able to recover production when restored. This will be a terrible outcome for the producing companies and oil lease investors.

Consumers aren?t the only ones who are celebrating.

Oil traders are enjoying their best year since 2009, cashing in on the sky high volatility. Front month volatility is gyrating around the 55% levels. This compares to only 15.45% for the S&P 500.

Traders, eat your hearts out.

Big players like Glencore, Gunvor and Mercuria are cashing in with lower prices vastly offset by much greater turnover. Specialized energy hedge funds are also doing well.

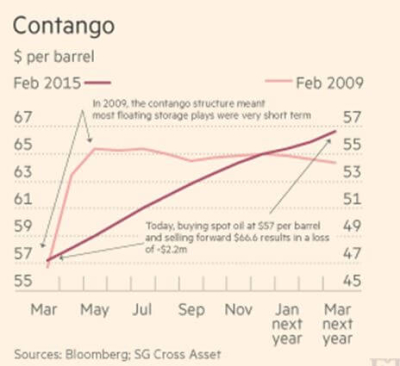

The contango, whereby futures contracts for far month delivery are trading at huge premiums to front month ones, is also generating enormous trading opportunities.

The last time I checked, oil one-year out was trading at a 25% premium. This means you can buy a few hundred thousand barrels, charter a rusted out old tanker, and store it for future sale.

Ultra low interest rates to finance the position provide an additional kicker. Hedge funds with the right credit lines are pouring into the field.

OK, so you?re not set up to borrow billions, charter ships, and swing around huge amounts of crude. Nor am I, for that matter. However, the next best thing is also setting up.

When oil completes its next swan dive, there will be great opportunities in the options market.

One year dated calls on oil majors like Exxon (XOM), Conoco Phillips (COP) and Occidental Petroleum (OXY) and the oil ETF (USO) should rise tenfold in the next recovery if you are able to buy anywhere close to the bottom.

I?ll send out a Trade Alert when I see it.

I Think I See a Spot Over There

I Think I See a Spot Over There

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.