While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

July 24, 2015

Fiat Lux

Featured Trade:

(JULY 31 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR)

(HOW TO USE YOUR CELL PHONE ABROAD)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

July 23, 2015

Fiat Lux

Featured Trade:

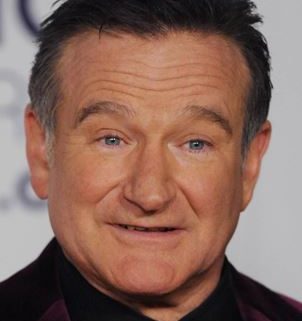

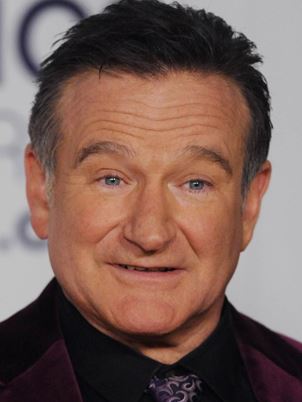

(A SAD FAREWELL TO ROBIN WILLIAMS),

(THE CASE AGAINST TREASURY BONDS),

(TBT), (TLT), (MUB), (LQD), (LINE),

(A NOTE ON THE FRIDAY OPTIONS EXPIRATION),

(SPY), (FXY)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares 20+ Year Treasury Bond (TLT)

iShares National AMT-Free Muni Bond (MUB)

iShares iBoxx $ Invst Grade Crp Bond (LQD)

Linn Energy, LLC (LINE)

SPDR S&P 500 ETF (SPY)

CurrencyShares Japanese Yen ETF (FXY)

Every time I watch a Robin Williams comedy sketch, I still feels the pangs of a lost friend.

His mother lived directly next door to my family for many years. A petite widow in her late seventies, we often looked in on her, and invited her into our community social group.

More than once, I came home to find my late wife chatting with her in the living room over a cup of tea.

Robin, ever the dutiful son, thanked me on many occasions. He volunteered to appear at fundraisers at my kids? schools. Needless to say, he was a huge hit and brought in buckets of money.

To describe Robin as a giant in his industry would be an understatement. No one could match his stream of consciousness outpouring of originality.

I know some Disney people who worked with him on the Aladdin animated film where Robin played the genie, and he drove them nuts.

The script was just a starting point for him. You just turned him on, and it was all peripatetic improvisation after that. This forced the ultra controlling producers to draw the animation around his monologue, no easy trick.

When I attended the London premier of Aladdin, the audience sat with their jaws dropped, trying to decode cultural references that were being fired at them a dozen a minute.

It was safe to say that Robin fought a lifetime battle with drug addiction. He only got out of rehab last year for the umpteenth time.

His depression had to be severe. People who knew him well believe that his comedy evolved as a way of dealing with it. He used jokes as weapons to keep the demons at bay. Perhaps that is the price of true genius. In the end, it was probably genetic.

This has been reaffirmed by the many comedians I have met during my life, including Groucho Marx, Bob Hope, George Burns, Jay Leno, Chris Rock, and many others (I?m seeing Jay again this weekend at the Pebble Beach Concourse d?Elegance vintage car show).

Robin was a very wealthy man, at one point owning a $25 million mansion in San Francisco?s tony Pacifica district. He leaves behind a wife and three adult children.

He was at the peak of career, with another movie coming out at Christmas, A Night at the Museum III, and a sequel to Mrs. Doubtfire in the works.

These are not normally the circumstances where one takes his own life. One can only assume that to do what he did he had to be suffering immense pain.

He will be missed.

My friend, Texan money manager Mike Robertson, asked me the other day if there was one asset class that I truly despised.

I didn?t hesitate: bonds.

In fact, fixed income investments are about to regain the nickname they earned during the 1980?s: ?certificates of wealth confiscation.?

That leaves me within a hair?s breadth of pulling the trigger on some new short positions in fixed income instruments. My hedge fund buddies are lining up varies short plays here, like clay ducks in a shooting match.

With the ten year Treasury bond yield at a microscopic 2.30%, and 3.06% for the 30 year, you have a classic ?heads I win, tales, you lose? trade. Best case, you break even over the next decade. Worst case, you lose half or more of your capital.

The US has no history of excessive debt, except during WWII, when it briefly exceeded 100% of GDP. That abruptly changed in 2001, when George W. Bush took office.

In short order, the new president implemented massive tax cuts, provided expanded Medicare benefits for seniors, and launched two wars, causing budgets deficits to explode at the fastest rate in history.

To accomplish this, strict 'pay as you go' rules enforced by the previous Clinton administration, were scrapped. The net net was to double the national debt to $10.5 trillion in a mere eight years.

Another $5 trillion in Keynesian reflationary deficit spending by President Obama since then has taken matters from bad to worse.

This year, the national debt just nudged past our GDP at $17 trillion. The Congressional Budget Office is now forecasting that, with the current spending trajectory, total debt will reach $23 trillion by 2020, or some 160% of today's GDP, 1.6 times the WWII peak.

By then, the Treasury will have to pay a staggering $5 trillion a year just to roll over maturing debt. What's more, these figures greatly understate the severity of the problem.

They do not include another $9 trillion in debts guaranteed by the federal government, such as bonds issued by home mortgage providers, Fannie Mae and Freddie Mac. State and local governments owe another $3 trillion. Double interest rates, which they inevitably will, and our debt service burden doubles as well.

It is unlikely that the warring parties in Congress will kiss and make up anytime soon. It is therefore likely that the capital markets will emerge as the sole source of any fiscal discipline, with the return of the bond vigilantes.

They have already made their predatory presence known in the profligate nations of Europe, and they are expected to arrive here eventually.

Such forces have not been at play in Washington since the early 1980's, when bond yields reached 13%, and homeowners (including me) paid 18% for mortgages.

Since foreign investors hold 50% of our debt, policy responses will not be dictated by the US, but by the Mandarins in Beijing and Tokyo. They could enforce a cut back in defense spending from the current annual $700 billion.

Personally, I think the US will never recover from the debt explosions engineered by Bush and by 'deficits don't count' Vice President Chaney. The outcome has permanently lowered standards of living for middle class Americans and reduced influence on the global stage.

But I'm not going to get mad, I'm going to get even. I am going to make a killing profiting from the coming collapse of the US Treasury market through buying the leveraged short Treasury bond ETF, the (TBT).

I am sticking to my short term forecast for this fund to rise from the current $58 to $100, then $150. And that is despite a hefty and rising cost of carry of nearly 0.5% a month.

Where?s My Social Security?

Where?s My Social Security?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.