As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 18, 2015

Fiat Lux

Featured Trade:

(WHY THE CHINESE YUAN IS DONE FALLING),

(CYB), (FXI), (EWH), (FXE), (EUO),

(PLEASE CHOOSE THE OCTOBER INCLINE VILLAGE, NEVADA? STRATEGY LUNCHEON DATE),

(THE PASSING OF A GREAT MAN)

WisdomTree Chinese Yuan Strategy ETF (CYB)

iShares China Large-Cap (FXI)

iShares MSCI Hong Kong (EWH)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

There is absolutely no doubt in my mind that the surprise five point spike up in the bond market last week is entirely due to the shocking devaluation of the Chinese Yuan.

Prior to that, fixed income markets were discounting the inevitable rise in US interest rates and fall in the bond market. It is really irrelevant whether Janet makes her move in September, December, or sometime in 2016. The writing is on the wall.

Bonds should start feeling the heat about now.

Yesterday, the Beijing government reduced support for the Yuan for a third time, and then swore on a stack of Chairman Mao?s Little Red Books that this was the last one.

I take them at their word, even though my Mandarin is sparse, to say the least, and I am not inclined to believe anyone.

To continue devaluating would risk importing substantial inflation into the Middle Kingdom. They can get away with this now because the price of their largest import, oil, is in free fall.

It would risk a real currency war with the United States, which is unhappy about seeing all of the past year?s Yuan appreciation undone in a heartbeat.

If China pushes any further, they may see the trading sanctions and anti dumping duties rain down upon them, like a summer typhoon. If you thought the kerfuffle over solar panels, tires, and chicken feet were bad, wait until you see the next batch.

They would also see what little credibility they still have in international markets fall into tatters. No one ever said building a domestic financial system was going to be easy.

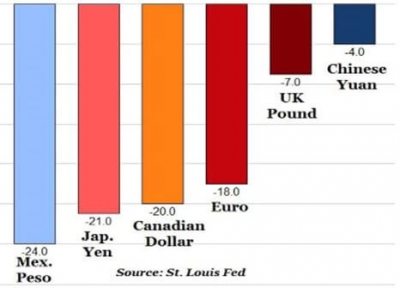

In any case, the Yuan drop we have seen so far is still small bear compared to the much more dramatic declines of other major currencies over the past year, most notably again the Euro (-18%) and the yen (-21%) (see chart below).

Better to keep it that way.

Keeping all this in mind, I am more than happy to take on a new short position in the Treasury bond market through buying the iShares Barclays 20+ Year Treasury Bond Fund (TLT) September, 2015 $128-$131 in-the-money vertical bear put spread.

You can pay up to $2.70 for the spread and still make a decent profit. If you can?t do options, then buy the ProShares Ultra Short 20+ Year Treasury 2X ETF (TBT) outright.

We can take four more points of upside heat if we have to, which would take ten year Treasury yields below 2.00%. I?m happy to bet that is not going to happen.

If the Yuan is truly bottoming out here, it also makes sense to renew my short position in the Euro.

That?s what I did on Monday, buying the Currency Shares Euro Trust (FXE) September, 2015 $112-$115 in-the-money vertical bear put spread at $2.55 or best. You should have gotten the text alert at the opening.

For more depth on the Chinese currency crisis, please click here for ?China?s Firecracker Surprise?.

Chairman Janet is Coming for You

Chairman Janet is Coming for You

A dozen or so of you expressed interest in attending my upcoming October Global Strategy luncheon in Incline Village Nevada.

This is when followers have a chance to meet with me personally, hook up with other readers, exchange trading and investment ideas, and tell a few jokes. Think of it as a ?Good old boys (and girls) club?.

It is an opportunity to grill me on matters that are too sensitive for me to go into depth in the daily newsletter. I?m assuming you are all patriots and know how to handle classified information.

I am always looking for new ways to improve my service, and the lunches have proven fertile ground for new ideas in the past.

I usually hold these on a Friday to give guests a chance to skip a day of work, and then return home that night.

However, I have noticed at recent lunches that not many of you need to work for a living anymore. Either you are already retired, or have made so much money from my Trade Alert service that you can afford not to.

So this time I am going to put the matter up for a vote. Send me an email at madhedgefundtrader@yahoo.com indicating whether you want to attend the lunch of Friday, October 23 or Saturday, October 24. Majority rules.

As for me, either day is fine. I basically work seven days a week, so it is neither here nor there which day you choose.

No rest for the wicked.

Can You Keep a Secret?

Can You Keep a Secret?

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, October 30, 2015. An excellent meal will be followed by a wide ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $208.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club in downtown San Francisco near Union Square that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, please click here.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.