While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 30, 2015

Fiat Lux

Featured Trade:

(NOVEMBER 4 GLOBAL STRATEGY WEBINAR),

(BATTERY BREAKTROUGH PROMISES BIG DIVIDENDS),

(TSLA),

(BECOME MY FACEBOOK FRIEND)

Tesla Motors, Inc. (TSLA)

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 29, 2015

Fiat Lux

Featured Trade:

(CELGENE WILL MAKE A COMEBACK),

(CELG), (XLV), (IBB),

(REVISITING CHENIERE ENERGY),

(LNG), (USO), (UNG)

(TESTIMONIAL)

Celgene Corporation (CELG)

Health Care Select Sector SPDR ETF (XLV)

Health Care Select Sector SPDR ETF (XLV)

Cheniere Energy, Inc. (LNG)

United States Oil Fund LP (USO)

United States Natural Gas Fund, LP (UNG)

It was known as the ?Tweet that sank Wall Street.?

When presidential candidate Hillary Clinton attacked the drug industry last summer, the entire pharmaceutical and health care industries were taken out to the woodshed and beaten like the proverbial red headed stepchild (my apologies in advance to red heads).

One of the principal victims was cancer drug maker Celgene (CELG), which dropped some 24.6% from top to bottom.

Never mind that Clinton is unlikely to get what she wants, even if she wins the election.

For that, you need a congress in your pocket, a probability that is at least 5-9 years away.

That is, unless Donald Trump continues his campaign for the Republican nomination.

However, in this nervous, twitchy, gun shy trading environment, it is shoot first and ask questions latter. So Celgene shares sank, whether it was warranted or not.

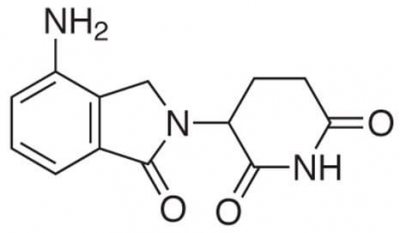

Celgene is really all about one drug, Revlimid, a blood cancer treatment that accounts for 75% of its sales. Last year, the company sold $7.6 billion worth of this complex molecule.

To wean itself off of its overdependence on a single drug it has embarked on a number of aggressive initiatives.

Since the spring of 2012, it has increased the use of its Abrazane drug to treat late stage pancreatic cancer, the disease that killed Steve Jobs. It has won regulatory approval for the psoriasis drug Otezla.

It has also pursued the mergers and acquisitions road to growth, picking up some two-dozen small drug makers in recent years. The $7.2 billion purchase of Receptos was a big one, which manufactures Ozanimod, a drug used to treat ulcerative colitis and multiple sclerosis.

Celgene also picked up Juno Therapeutics for $1 billion a few months ago, a maker of innovative cellular immunotherapies.

If this ambitious strategy works, Celgene?s net earnings should continue to grow at a 25% annual rate for the next five years. That means the shares should triple by 2020.

This is why the company?s shares command a lofty multiple of 18 times 2016 earnings, the higher end of the range for this industry.

So the next time Hillary opens her mouth, use the dip in (CELG) shares to load the boat. It would also be helpful if stock investors shift their focus from value back to growth.

Looks Like a ?BUY? To Me

Looks Like a ?BUY? To Me

Loose Lips Sink Ships

Loose Lips Sink Ships

I am constantly asked if there are any ways investors can take advantage of the current collapse in natural gas prices.

You don?t want to touch the gas producing companies, like Chesapeake (CHK) and Devon (DVN), because prices for natural gas are probably going to stay down for years.

Good firms that benefit from the increased volume of gas pumped are few and far between. Unless you are a large consumer of this despised molecule, such as an electric power company or a petrochemical plant, it is tough to find a profitable niche.

However, there is one company that delivers a narrow rifle shot that will do extremely well in coming years, and that is Cheniere Energy (LNG).

I first started following (LNG) two decades ago when I was still wildcatting for CH4 in the Texas Barnet Shale.

Back when natural gas was trading at a lofty $5/MBTU, Qatar invested $50 billion in developing its own massive gas resources.

The plan was to liquefy the gas at -256 degrees Fahrenheit in the Middle East, ship it to the US in a fleet of specialized LNG carriers, and have Cheniere convert it back into gas at its Sabine River plant for distribution to an energy hungry US market through the Creole Trail pipeline.

It all looked like a great plan, and (LNG) shares traded up to $45.

Then ?fracking? technology came along and blew up the entire model. The discovery of a new 100-year supply of gas under our feet caused gas prices to crash from a post Amaranth peak of $17/MMBTU down to $2/MMBTU.

Any plans to import LNG from the other side of the world were rendered utterly worthless. Qatar ended up selling its gas to Europe insteadto help offset that continent's over reliance on imports from Russia.

Chenier?s billion-dollar investment in a gasification plant was now worth only so much scrap metal. (LNG) shares plumbed to low single digits as the firm flirted with bankruptcy.

Enter China.

The Middle Kingdom?s voracious demand for energy in this recovery has caused the price of oil (USO) to soar from a 2008 low of $30 to $112.

Despite accounting for an overwhelming share of the world?s new energy purchases, Chinese cities are suffering from brown outs due to power shortages.

This is why China is resisting immense American pressure to quit buying Texas tea from Iran.

Enter the arbitrage. While oil has been plummeting, gas has been falling even more. Gas is now selling at 25% of the cost of oil on an adjusted BTU basis.

Another way of saying this is that you can buy oil for $12 a barrel instead of $48. It only takes a second with an abacus to understand the appeal of such a disparity.

Gas also has the additional benefits in that it is much cleaner burning than crude, lacks the sulfur and nitrogen dioxides, and produces half the carbon dioxide. That?s a big deal in Beijing where the air is so thick you can cut it with a knife on a bad day.

It is also important to know that many states, like California have decided to use natural gas as a bridge fuel until more economic and scalable alternatives are developed.

Enter the long-term contracts. During the 1960?s and 1970?s Japan entered into huge long term contracts to buy LNG from Australia and Indonesia to feed their own economic miracle of the day.

Because it is very expensive and hard to get, offshore supplies were tapped, the price was set at $16/MBTU. Those contracts are now expiring.

Do you think they?ll renew at the old price, or go to Cheniere for the $4 stuff? Gee, let me think about that one for a bit.

Enter Fukushima. The nuclear meltdown on March, 2011 prompted Japan to shut down 49 of 54 nuclear power plants that accounted for 25% of the country?s electric power generation. The brownouts that followed forced a sweltering summer on millions as the government urged consumers to shut off air conditioners to save juice.

Power companies there have been scrambling to obtain conventional energy supplies, and cheap gas supplies from the US would meet this demand nicely.

The trigger.

Cheniere obtained US government permission to export 2.2 billion cubic feet a day for 20 years. That would require it to convert the existing gasification plant to a liquefaction plant, something that can be done with some expensive re-engineering. A second plant is in the approval process.

It has already found several large international buyers to take delivery of the new end product. All that was missing was the money to finish the plant.

My hedge fund buddies have been accumulating this stock when it bottomed at $3, expecting an angel investor to appear. But it was one of those ?someday, it might happen? kind of stories better left to long-term players.

Then Blackstone jumped in with a beefy $2 billion investment in Cheniere. That will enable them to obtain an additional $3 billion in debt financing needed to finish the first of two export facilities. They are now expected to come online in 2016.

How does Cheniere stack up as an investment? Frankly, it is kind of scary. The market cap is only $11.3 billion, it has no earnings yet, and it pays no dividend. When the current spate of deals are done, it will have $5 billion in debt.

I first got followers into (LNG) at $5. We then had a great run all the way up to $85, and we took profits. In the current melt down, it has backed off all the way down to $45, a 47% hickey.

And these facilities are dangerous to operate. One blew up in Texas in 1937 and killed 300 schoolchildren.

As a result, local permits for these are very hard to come by. Anyone who thinks Texas is an unregulated paradise should try drilling for natural gas.

But as you can see a whole host of geopolitical, technology and economic strands reach a nexus in this one company, all of which are extremely positive for the share price.

If the story comes true, as Blackstone hopes, then there could be a double or triple in the shares for the patient. To learn more about Cheniere Energy, please go to their website: http://www.cheniere.com.

Did Somebody Light a Match?

Did Somebody Light a Match?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.