While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

Global Market Comments

May 18, 2015

Fiat Lux

Featured Trade:

(JULY 2 LISBON, PORTUGAL GLOBAL STRATEGY LUNCHEON)

(WHY ARE THE MARKETS GOING CRAZY?),

(TLT), (FXE), (EUO),

(ANNOUNCING THE MAD HEDGE FUND TRADER VIDEO CHANNEL ON YOUTUBE)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

You would think that with US interest rates spiking up, as they have done for the past month, the US dollar would be strong. After all, interest rate differentials are the principal driver of foreign exchange rates.

But you would be wrong. The greenback has in fact pared 12% off its value against the Euro (FXE) during this period.

You also could be forgiven for thinking that weak economic growth, like the kind just confirmed by poor data in Q1, would deliver to us a rocketing bond market (TLT) and falling yields.

But you would be wrong again.

The harsh reality is that an entire range of financial markets have been trading the opposite of their fundamentals since April.

Have markets lost their moorings? Do fundamentals no longer account for anything?

Have the markets gone crazy?

It?s a little more complicated than that, as much as we would like to blame Mr. Market for all our failings.

Fundamentals are always the driver of assets prices over the long term. By this, I mean the earnings of companies, the GDP growth rates for the economies that back currencies, and the supply and demand for money in the bond market.

Geopolitics can have an influence as well, but only to the extent that they affect fundamentals. Usually, their impact is only psychological and brief (ISIS, the Ukraine, Syria, Libya, and Afghanistan).

However, and this is the big however, repositioning by big traders can overwhelm fundamentals and drive asset prices anywhere from seconds to months.

This is one of those times.

You see this in the simultaneous unwind of enormous one-way bets, that for a time, looked like everyone?s free lunch and rich uncle.

I?m talking about the historic longs accumulated in the bond markets over decades, not only in the US, but in Europe, Japan and emerging markets as well.

Treasury bonds have been going up for so long, some three decades, that the vast majority of bond portfolio managers and traders have never seen them go down.

A frighteningly vast number of investment strategies are based on the assumption that prices never fall for more than a few months at a time.

This is a problem, because bond prices can fall for more than a few months at a time, as they did like a lead balloon during the high inflation days from 1974 to 1982.

I traded Eurobonds during this time, and the free lunch then was to be short US Treasuries up the wazoo, especially low coupon paper. That trade will return someday, although not necessarily now.

What is making the price action even more dramatic this time around is the structural decline in market liquidity, which I out lined in glorious detail in my letter last week (The Liquidity Crisis Coming to a Market Near You).

You are seeing exactly the same type of repositioning moves occurring right now in the Euro/dollar trade.

I have been playing the Euro from the side for the past seven years, when it briefly touched $1.60.

All you had to do was spend time on the continent, and it was grotesquely obvious that the currency was wildly overvalued relative to the state of its horrendously weak currency.

Unfortunately, it took the European Central Bank nearly a decade to get the memo that the only way out of their economic problems was to collapse the value of the Euro with an aggressive program of quantitative easing.

This they figured out only last summer. By then, the Euro had already fallen to $1.40. After that, it quickly becomes a one-way bet, as every junior trader started unloading Euros with both hands. The result was to compress five years worth of depreciation into seven months.

Extreme moves in asset prices are always followed by long periods of digestion, or boring narrow range trading.

This is what you are getting now with the Euro. This is why I covered all my Euro shorts in April and went long, much to the satisfaction of my readers (click here for the Trade Alert). I have since taken profits on those longs, and am now short again (click here for that Trade Alert).

I think it could take six months of consolidation, or more, until we take another run at parity for the greenback.

The rally in the continental currency is taking place not because the economic fundamentals have improved, although they have modestly done so.

It has transpired because traders are taking profits on aged short positions, or stopping out of new positions at a loss because they were put on too late.

The Euro will remain strong only until this repositioning finishes, and the short term money is either flat on the Euro, or is long.

It will only be then that the fundamentals kick in, and we resume the downside once again.

I think it could take six months of consolidation, or more, until we take another run at parity for the greenback.

As I used to tell me staff at my hedge fund, if this were easy, everyone would be doing it, and it would pay peanuts. So quit complaining and get used to it.

One request I get more than any other, is to expand on my half century of international travel, provide a business, economic, and historical backdrop, and place it in today?s global context.

Shake up such a cocktail of experience and knowledge, and more than a few trading and investment ideas spill over the top. If it?s funny, that helps too.

It seems that I am one of a tiny handful of people still alive in the world today who can do this.

Therefore, I am launching the Mad Hedge Fund Trader Video Channel on YouTube. This will provide the opportunity to offer you informative and well-researched videos on my non-stop travels around the world.

This is not your normal travel show. Think of it as Lifestyles of the Rich and Famous meets The Economist and the History Channel, all couched in a language any trader will understand.

I am not going to tell you about the standard, top ten sights in every city. Any guidebook bought at Amazon or found on line can do a better job than me. Instead, I will take you to the out of the way, the quirky, and the unconventional.

These are places of interest I have accumulated over five decades of living out of backpacks and suitcases. The goal is for you to learn from every single segment.

One of the great advantages of spending so long on the road is that I can chronicle the momentous changes that civilization has endured over the past half century. And sometimes, what hasn?t changed is much more impressive than what has.

I will be the sole producer of content for this show, grinding out entertainment and education as easy and cheaply as possible. Like everything else on the Internet, I am looking to achieve zero cost and infinite distribution.

So, all of the audio will be shot on my iPhone 5s. A running audio commentary will be provided via the Audio Memos app. Since the 19th century broadband found in many foreign hotels makes it difficult for me to email content back to the head office, segments are limited to a minute each. Each program will run from 15-30 minutes in length.

Full disclosure: None of the people involved in the production of this program have the slightest idea of what they are doing. They include the producers, editors, website designers, researchers, and of course, myself, the presenter, writer, and cameraman.

However, as with the inception of the Diary of a Mad Hedge Fund Trader seven years ago, we shall push ourselves down the learning curve at hyper speed, or we shall perish. In a few months, these shows should get pretty good and might even make an appearance on a cable TV channel someday.

If you have any suggestions for how we might improve this service, or comments of any kind, positive or negative, please don?t hesitate to email me atsupport@madhedgefundtrader.com . Just put ?Video show? in the subject line and it will go straight to me.

You can?t beat the price. It?s free. The philosophy of this business has always been to charge people for the content that makes them money, like our market beatingTrade Alert service, and give everything else away for nothing.

In the online business world, this is known as the ?walled garden? strategy whereby the public gets a taste of the far greater delights to be found with an upgrade. I was one of the originators of this revolutionary concept, and it appears that much of the mass media are now copying me.

It is true that imitation is in sincerest for of flattery.

So please come join me on my never-ending adventures. The first one is to London, England, which you watch by clicking here.

Bon Voyage!

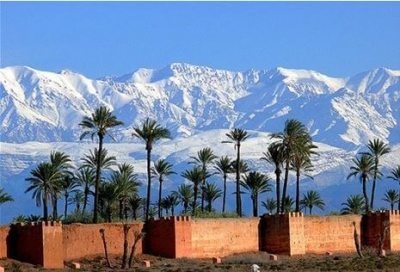

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy luncheon, which I will be conducting in Marrakesh, Morocco on Monday, July 13, 2015. A three-course lunch will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be tossing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $277.

I?ll be arriving at 11:30 AM and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive mud walled riad in the historic Medina district, an impenetrable maze of ancient souks and alleyways. Believe it or not, you can find this place with your Google mapping app. The precise location will be emailed with your purchase confirmation.

I have been assured that the air conditioning there works, as the temperatures can range up to 135 F degrees during the summer.

Marrakesh is a 1,000-year-old caravan stop on the edge of the Sahara Desert on the storied route to Timbuktu. During the 14th century, it was the seat of the early Moroccan kings.

It has long been an entrepot for the trading of gold, spices, dates, ivory, guns and slaves. With this trip we will be adding investment advice to that list.

The pink city, just east of the snow-capped Atlas Mountains is one of the most interesting cities in the world, and should be on everyone?s bucket list.

Every evening, snake charmers, magicians and acrobats put on a show for the customers of 100 open-air food stalls at the Djemaa el-Fna square. The event is listed as a United Nations World Heritage Site.

Palm oases dot the outside of the town. Today, many of the old shops have been converted to designer boutiques. Berber rugs and leather slippers are sought after items. I have been visiting here since 1968.

Morocco is one of the few Islamic countries that has so far been free of terrorist attacks. However, traffic is down from last year, as are prices, thanks to the ISIS invasion of Iraq. French is widely spoken, so be sure to have the app installed on your iPhone.

If you have extra time, be sure to visit the spectacularly ornate Koutoubia Mosque. Women are required to wear a scarf, and men trousers.

It is not advisable for women to travel alone in North Africa.

Marrakesh can be reached via Royal Air Maroc with a transfer in Casablanca (click here for their site at http://www.royalairmaroc.com/us-en), which will happily bill your credit card in Euros. Alternatively, you can take a sleeping compartment on the overnight Marrakesh Express from Tangier (yes, it really exists!).

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the luncheon, please click here.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.