Global Market Comments

September 28, 2016

Fiat Lux

Featured Trade:

(THE ELECTION IS OVER),

(HOW TO FIND A GREAT OPTIONS TRADE)

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 27, 2016

Fiat Lux

Featured Trade:

(SEPTEMBER 28TH GLOBAL STRATEGY WEBINAR),

(OCTOBER 21ST SAN FRANCISCO, CA GLOBAL STRATEGY LUNCHEON),

(WHY CHINA IS GOLD?S BEST FRIEND),

(GLD), (GDX), (TLT)

SPDR Gold Shares (GLD)

VanEck Vectors Gold Miners ETF (GDX)

iShares 20+ Year Treasury Bond (TLT)

The good news is that you don?t have to be crazy, paranoid, or delusional to own gold (GLD).

However, the ?hundreds of individual investors I know who absolutely love the barbarous relic may not know exactly why.

They originally filled safe deposit boxes with old jewelry, American Eagles, and bullion bars as a hedge against the return of the double-digit INFLATION we endured during the 1970s.

Then gold became a DEFLATION hedge, as yielding nothing outperforms the negative interest rates offered by paper currencies, still -0.35% for the Euro and the Swiss Franc.

They are joined by what I call the tin hat, black helicopter, conspiracy theorists who eternally believe in the collapse of the US dollar and a default of US Treasury debt.

After all, it's always handy to have a few krugerrands in your pocket to bribe the border guards and escape the country (I never understood to where).

Recently, a new crowd of gold buyers has emerged.

Investors are soaking up the yellow metal as a hedge against a Trump presidential win. He has promised a crash of both the debt and equity markets.

Gold should soar.

However, few are aware of the true fundamental reasons for the long-term appreciation of the barbarous relic.

That would be the unrelenting accumulation of gold as a reserve asset by emerging market central banks, especially China.

The Middle Kingdom has long kept any information regarding its gold holdings a state secret.

Individual gold ownership was punishable by death, originally by firing squad, and more recently through organ harvesting.

That changed in June, 2015 when Beijing reported that it owned 1,658 metric tonnes. That is 56.7% higher than the last figure reported in 2009.

Since then, it has added another 165 metric tonnes. Its total holdings are now 1,823 metric tonnes worth $78.6 billion. This compares to the 8,134 metric tonnes, or $350 billion worth of gold owned by the US Treasury.

From these numbers, it is safe to assume that China will continue to add at least another 120 tonnes of gold to its reserve annually for at least another decade.

This should exert upward pressure on prices until we see a serious spike upward in global interest rates.

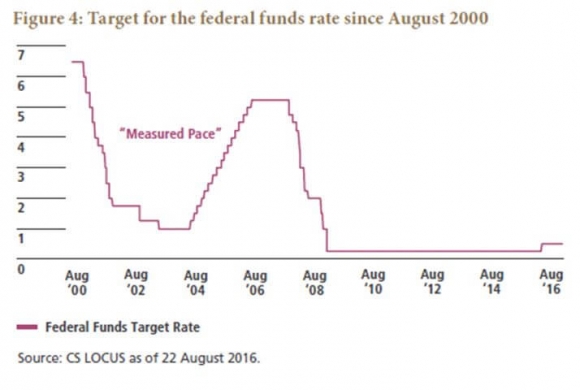

With ten year Treasury bonds (TLT) yielding 1.61% today, don?t hold your breath for that happening any time soon.

In addition, all of China?s domestic gold production is thought to go into a secret internal account not included in the nation?s central bank reserves.

Apparently, organ harvesting still applies to any release of statistics about THIS gold.

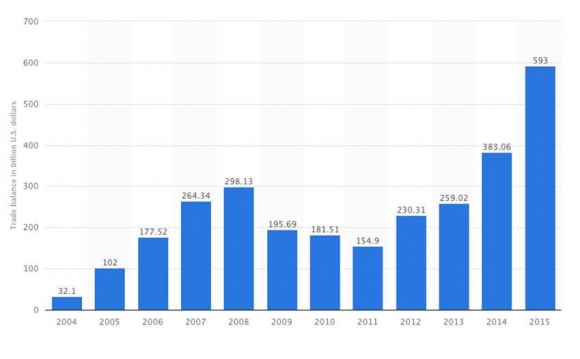

China?s gold buying is only part of an effort to recycle its massive trade surpluses back into the world economy, which last year ran a staggering $593 billion. Of this, $365.6 billion was with the United States.

Run a chart of China?s merchandise trade surpluses against the price of gold and you get an almost perfect match.

China isn?t loading up on gold because of any value or inflationary considerations. It is desperately attempting to diversify away from the US dollar, on which it has become overly reliant due to the massive size of its reserves.

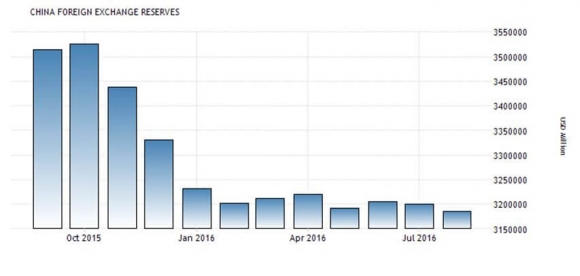

As of July, China?s foreign exchange reserves totaled $3.23 trillion (see table below). America?s only ran to $120 billion, putting it only 14th in the world after the United Kingdom.

China owns $1.4 trillion worth of US Treasury bonds, notes, and bills, making it the largest holder after the Federal Reserve (which still owns $3.4 trillion left over from its quantitative easing programs).

In addition China owns trillions more in dollar cash, banks deposits, and other cash equivalents.

As long as the world remains a gigantic love fest, this is all fine. But what happens if Trump captures the White House?

China isn?t the only country engaging in a gold strategy.

When Iran was subject to trade sanctions and was banned from dollar clearing, it transacted a significant port of its business through gold barter transactions. Russia has lately been very active in the gold market for the same reason.

Other countries running big trade surpluses, like Germany, Russia, South Korea, the Netherlands, Taiwan, and Singapore, are doing the same.

And here is the number that will blow your mind.

For China to raise its gold holdings to the 17.4% of total reserves typical for developed countries, it needs to buy an incredible 10,101 metric tonnes worth $471 billion.

Add in gold purchases by other high surplus nations, and the total amount of net buying to come is truly mind boggling.

It all sounds like a prolonged bull market in gold to me, especially if interest rates stay lower for longer as I expect. This explains why the gold miners (GDX) had such a hyperbolic move early in 2016.

So you really don?t have to be crazy to own gold.

Well ?. maybe it helps a little bit.

China Trade Surplus 2004-2015

China Foreign Exchange Reserves

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 26, 2016

Fiat Lux

Featured Trade:

(NOVEMBER 18TH LAS VEGAS, NV GLOBAL STRATEGY LUNCHEON),

(MARKET OUTLOOK FOR THE COMING WEEK),

(SPY), (VIX), (USO),

(BATTERY BREAKTHROUGH PROMISES BIG DIVIDENDS),

(TSLA)

SPDR S&P 500 ETF (SPY)

VOLATILITY S&P 500 (^VIX)

United States Oil (USO)

Tesla Motors, Inc. (TSLA)

There is only one event this week of any real consequence, and that is the first presidential debate on Monday, September 26 at 6:00 PM EST at Hoftsra University in New York City.

You don?t need to know the channel. It will be broadcast on all of them, as well as streamed live on multiple online platforms.

The venue is well chosen. Hillary Clinton was the US Senator representing the Big Apple for eight years, while Trump runs his global real estate empire from there.

With 100 million viewers expected, it will be the most watched presidential debate in history.

We are about to see the least watched NFL football game in history, the Atlanta Falcons versus the New Orleans Saints, as the? game is scheduled at the exactly the same time.

As Clinton is well ahead in the polls, Trump will have to play offense and take all the risks. A clear Trump win will deliver a 400 point plunge in the Dow Average (INDU) the next day, while a Clinton win might give us a 200 point rally.

Warning: One week after presidential debates, markets are historically down 83% of the time, by an average of 2%. Trading just short of an all time high, markets may give us a similar result.

It is a simple contest between the status quo and radical change, and markets absolutely hate change, uncertainty, and unpredictability.

The debate will tell us whether last week?s frenetic rally in stocks was simply a short covering rally to the top of the recent range at (SPX) of 2,180, or the beginning of a more substantial upside breakout.

One way or the other, I expect stocks to eventually rally to new all time highs by yearend, as I have been predicting all year.

I am going into the Monday evening event long the Volatility Index (VIX) which rallied smartly on Friday.

Watching the overnight futures trade real time during the debate should be one of the most interesting experiences of the year from a trader?s point of view. To do so, please click here.

To make this week interesting, no less than 11 Fed governors will be speaking. This speaking schedule should give us a more clear picture of how severe the voting split was on last week?s controversial interest rates decision.

So look for dueling governors every day for December rate hike insights.

On Monday, September 26 at 10:00 AM we get August New Home Sales that should show continued improvement. Also, today starts a three day emergency OPEC meeting in Algiers which no doubt will lead to palpitations in the oil market (USO). Expectations are low.

On Tuesday, September 27 at 9:00 AM EST we learn the June S&P Case Shiller Home Price Index, which should continue to bring us marginal gains at a seven year high.

On Wednesday, September 28 at 8:30 AM EST we get August Durable Goods. The latest round of macro data has shown a definite slowing trend which no doubt contributed to the Fed?s decision to hold on rates.

On Thursday, September 29 we get the third and final read on US Q2 GDP at 8:30 AM EST, with a consensus view at 2.3%. Also out then will be the Weekly Jobless Claims, which should confirm that employment remains at four decade highs.

Friday, September 30 delivers us the Consumer Sentiment at 10:00 AM EST, which should edge higher. We wind up with the Baker Hughes Rig Count on Friday at 1:00 PM EST. Worryingly, the trend has been up for 12 out of the past 13 weeks, to the eternal distress of oil prices.

All in all, I expect us to continue trading in narrow ranges with profits accruing only to the quick and the nimble.

Good luck and good trading. ? Keep your hard hat on.

John Thomas

The Mad Hedge Fund Trader

Get Your Information Here!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.