While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 10, 2016

Fiat Lux

Featured Trade:

(OIL: IS IT DIFFERENT THIS TIME?)

(USO), (LINE), (CHK), (FCX), (KOL),

(THE BIPOLAR ECONOMY),

(AAPL), (INTC), (ORCL), (CAT), (IBM),

(TESTIMONIAL)

United States Oil (USO)

Linn Energy, LLC (LINE)

Chesapeake Energy Corporation (CHK)

Freeport-McMoRan Inc. (FCX)

Market Vectors Coal ETF (KOL)

Apple Inc. (AAPL)

Intel Corporation (INTC)

Oracle Corporation (ORCL)

Caterpillar Inc. (CAT)

A reader emailed me yesterday to tell me that while visiting his daughter at a college in North Carolina, he refilled his rental car with gas for $1.39 a gallon.

So I got the idea that something really big is going on here that no one is yet seeing. I processed the possibilities in my snowshoe up to the 10,000-foot level above Lake Tahoe last night.

By the way, the view of the snow covered High Sierras under the moonlight was incredible.

For decades, I have dismissed the hopes of my environmentalist friends that alternatives will soon replace oil (USO) as our principal source of energy.

I have long agreed with the views of my fracking buddies in the Texas Barnett Shale that it will be decades before wind, solar, and biodiesel make any appreciable dent in our energy makeup.

It took 150 years to build our energy infrastructure, and you don?t replace that overnight. The current weakness in oil prices is a simple repeat of a predictable cycle that has continued for a century and a half. In a couple years, Texas tea will be posting triple digits once again.

I always thought that oil had one more super spike left in it. After that, it will fade into history, reduced to limited applications, like making plastics and asphalt, probably sometime in the 2030?s.

The price for a barrel of oil should then vaporize to $5.

But given the price action for energy and all other commodities I?m starting to wonder if this time I?m wrong.

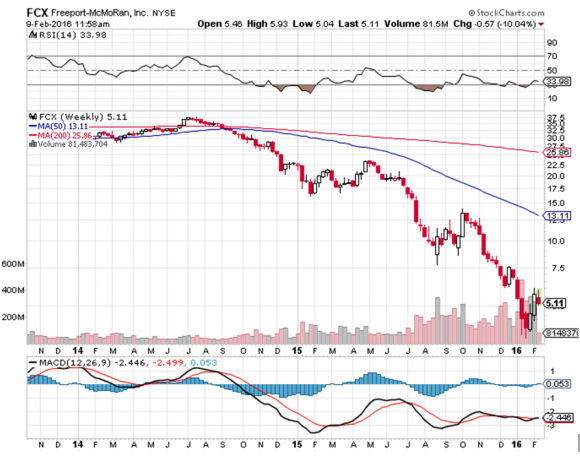

I have watched with utter amazement while Freeport McMoRan (FCX) plunged from $38 to $3. I was gob smacked to see Linn Energy (LINE), admittedly a leveraged play, crater from $32 to 30 cents.

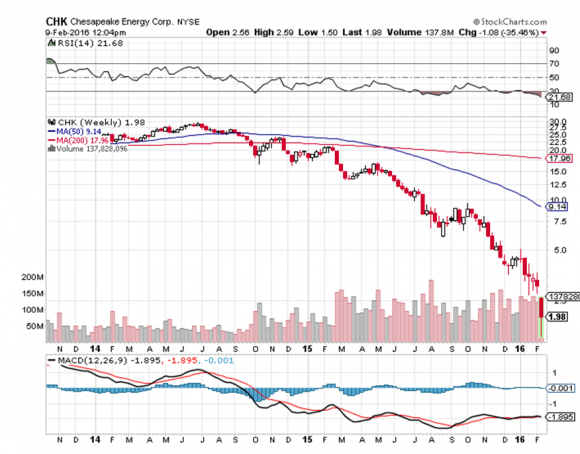

And I was totally befuddled to see gas major Chesapeake Energy (CHK) implode from $65 to $1.

Has the world gone mad?

When the data don?t match your view, it?s time to change your view.

Maybe there won?t be another spike in oil prices. Could its disappearance from the modern industrialized economy have already begun?

That would certainly explain a lot of the recent eye-popping price action in the markets. In five short years oil has dropped 82%. It did this while global GDP grew by 20% and auto sales, and therefore gasoline demand, has been booming.

Of course, you could just call all of this a big giant reversion to the mean.

Over the past 150 years, the average, inflation adjusted price of oil has been $35 a barrel. The price for gasoline has been $2.25 a gallon, exactly where it was in 1932, and where it now is in much of the country.

I know all of these numbers because I once did a study to see if oil prices are rigged (conclusion: they are). How can the price of a commodity stay the same for 150 years?

Wait, the naysayers announce. Things don?t happen that fast.

But they do, my friends, they do, especially in energy.

Until 1849, my ancestors were the largest producers of whale oil on Nantucket Island. (Our family name,? Coffin, was mentioned in ?Moby Dick? seven times, and was a focus of the just released film, ?In the Heart of the Sea.?)

Then this stuff called petroleum came along, wrested from the ground with new technology by men like Drake and Rockefeller. The whale oil market crashed, dropping in price by 90%, and virtually disappeared in two years.

My relatives were wiped out and moved to San Francisco, which they already knew from their whaling days, and where gold had just been found.

A half-century later, this thing called an ?automobile? came along meant to replace the ubiquitous horse and buggy. People laughed. It was loud, noisy, smelly, inefficient, and expensive. Only the rich could afford them.

You had to go to a drug store to buy high priced fuel in one-gallon tins. And it scared the horses. England passed a national automobile speed limit of 5 miles per hour, as cars were considered dangerous.

Then huge oil discoveries were made in Texas and California (watch ?There Will Be Blood?), the Hughes drill bit came along, and gasoline prices fell sharply. Suddenly cars were everywhere. The horse population declined from 100 million to only 1 million today.

All of this is a long-winded, history packed way of saving ?This time it may be different?.

I have on my desktop a Trade Alert already written up to buy the (USO) May, 2016 $9 calls. Today, they traded at $1.00. I?m just waiting for another melt down in oil to take a low risk punt on the long side.

If we rocket back up to $100, as many are predicting, these calls will be worth a fortune. But you know what, oil may only peak out at $44 this time. The trade will still make money, but not as much as in past cycles.

So, you better think hard about loading up on too many oil stocks at these distressed levels. Look what has already happened to the coal industry (KOL), which has essentially gone bankrupt.

You could well be buying into the buggy whip industry circa 1900.

There?s Got to Be a Better Way to Make a Living

There?s Got to Be a Better Way to Make a Living

Corporate earnings are up big! Great!

Buy!

No wait!

The economy is going down the toilet!

Sell! Buy! Sell! Buy! Sell!

Help!

Anyone would be forgiven for thinking that the stock market has become bipolar.

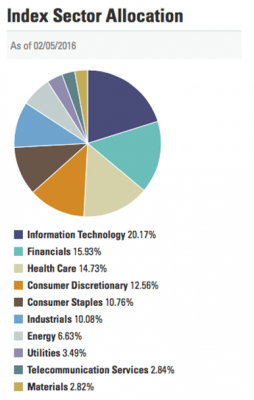

According to the Commerce Department?s Bureau of Economic Analysis, the answer is that corporate profits accounts for only a small part of the economy.

Using the income method of calculating GDP, corporate profits account for only 15% of the reported GDP figure. The remaining components are doing poorly, or are too small to have much of an impact.

Wages and salaries are in a three decade long decline. Interest and investment income is falling, because of the ultra low level of interest rates. Farm incomes are up, but are a tiny proportion of the total. Income from non-farm unincorporated business, mostly small business, is unimpressive.

It gets more complicated than that.

A disproportionate share of corporate profits is being earned overseas. So multinationals with a big foreign presence, like Apple (AAPL), Intel (INTC), Oracle (ORCL), Caterpillar (CAT), and IBM (IBM), have the most rapidly growing profits and pay the least amount in taxes.

They really get to have their cake, and eat it too. Many of their business activities are contributing to foreign GDP?s, like China?s, more than they are here. Those with large domestic businesses, like retailers, earn less, but pay more in tax, as they lack the offshore entities in which to park them.

The message here is to not put all your faith in the headlines, but to look at the numbers behind the numbers. Those who bought in anticipation of good corporate profits last month, got those earnings, and then got slaughtered in the marketplace.

Caveat emptor. Buyer beware.

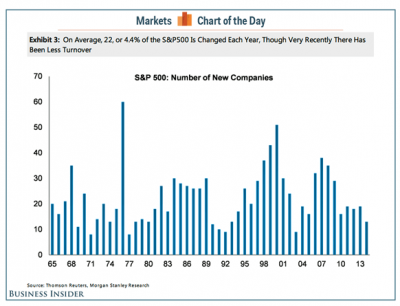

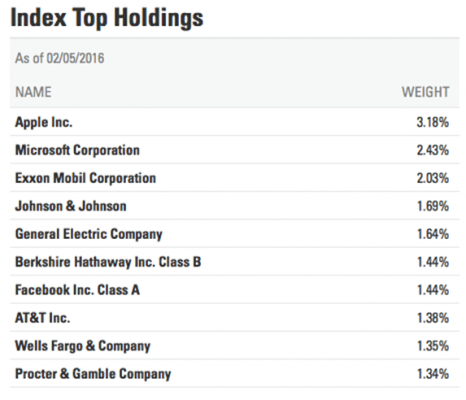

What?s In the S&P 500?

Has the Market Become Bipolar?

Has the Market Become Bipolar?

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 9, 2016

Fiat Lux

Featured Trade:

(THE 13 NEW TRADING RULES FOR 2016),

(AN ENVIRONMENTAL ACTIVIST'S TAKE ON THE MARKETS),

(DBA), (MOO), (PHO), (FIW)

(TESTIMONIAL)

PowerShares DB Agriculture ETF (DBA)

Market Vectors Agribusiness ETF (MOO)

PowerShares Water Resources ETF (PHO)

First Trust ISE Water ETF (FIW)

I?m sitting here at my Lake Tahoe lakefront mansion watching the Dow Average open down 700 points from its Friday intraday high.

It is one of those perfect, picture postcard days, with a blue sky and cobalt lake. The fields outside are covered with snow crystals sparkling in the sunshine.

After the close, I?m going to have to shovel off my outside decks to keep the weight of the ice from collapsing them.

Those (SPY) April $182 puts are looking pretty good this morning, up 50%. They?re hedging all of my remaining long side positions.

In these heart stopping trading conditions it is more important for me to teach you how to avoid doing the wrong thing than pursuing the right thing.

I am therefore going to reiterate my 13 Rules for Trading in 2016. Tape them to the top of your computer monitor, commit them to memory, and maintain iron discipline.

They will save your wealth, if not your health. Here they are:

1) Dump all hubris, pretentions, and stubbornness. It will only cost you money.

2) The market is always right, even if all the prices appear wrong.

3) Only buy the puke outs and sell the euphoria. Do anything in the middle, and you will get whipsawed.

4) Outright calls and puts are offering a far better risk/reward right now than vertical bull and bear call and put spreads, which have a built in short volatility element. It is also better to buy stocks and ETF?s outright with a tight stop loss. This won?t last forever.

5) If you do trade spreads, you can no longer run them into expiration. If you have a nice profit take it, don?t hang on to the last 30 basis points, even if it means paying more commission. The world could end three times, and then recover three times, before the monthly expiration date rolls around.

6) Tighten up your stop loss limits. Not losing money is the key to winning in this market. There is nothing worse than having to dig yourself out of a hole. Don?t run hemorrhaging losses, like the (TBT) from $57.56 down to $37. It will get easy again some day.

7) Buy every foreign crisis and sell every recovery. It really makes no difference to assets here in the US.

8) Several asset classes are becoming untradeable for long periods (bonds, oil, ags). Stay away and stick to the asset classes that are working (stocks and gold).

9) Keep positions small enough to sleep well at night. The doubled volatility will make up for your reduced risk. This is not the time to get greedy and bet the ranch.

10) Turn off the TV and just look at your screens and data. Public entertainers have no idea what the market is going to do, especially if their last job was sports reporting. Their job is to get you to watch the adds for General Motors and TD Ameritrade.

11) As the bull market in stocks enters its seventh year, too many traders, analysts, and strategists have become complacent. You are going to have to work for your crust of bread this year. This is an earnings, technology, and cash flow driven bull, not a QE driven momentum one.

12) It is clear that more money was allocated to high frequency traders this year. That is driving the new, breakneck volatility, increasing stop outs. A sneeze now generates a 500-point intraday move.

13) It is no accident these tempestuous conditions are occurring in an election year. Some $8 billion will be spent on media convincing you how terrible this are.

Better change your password from 12345 to DKFGGIDKFOKBJGELXPEVJBKDLKFBBJFCJCKVLBKGTY69!, and hope that the 69 doesn?t give you away.

Only The Meanest and Toughest are Prospering in This Market

Only The Meanest and Toughest are Prospering in This Market

I spent an evening with Lester Brown, president of the Earth Policy Institute and a winner of the coveted MacArthur Prize, for some long-term thinking about the environment and its investment implications.

Global warming is causing the melting of ice sheets in Greenland and Antarctica, glaciers in the Himalayas, and the Sierra snowpack.

Water tables are falling and fossil aquifers are depleting. In the coming decades this will cause severe shortages of fresh water that could lead to crop failures in India and China, where one billion people depend on mountain runoff to irrigate crops.

California, which delivers 80% of America?s vegetables, is currently suffering one of the worst droughts in history, sending food prices through the roof.?

My preference for local champagne and strawberries just got more expensive.

The fresh water inputs in one person?s food and materials consumption works out to some 2,000 liters a day. That is no typo.

As a result, all food prices will rise over the long term. To head off the greatest threat to the global food supply in human history, we need to cut carbon emissions by 80% before 2020, not 2050, as was discussed in Copenhagen.

This can only be accomplished by redefining food and the environment as national security issue and launching a wartime mobilization.

These difficult goals are achievable. Enough sunlight hits the earth in a day to power the global economy for 27 years. Texas alone has more than 20 gigawatts of wind power operating, under construction, or planned, enough to take 5% of our 250 coal fired power plants offline.

Electricity demand could be cut by 90% purely through greater efficiencies, like switching from incandescent bulbs to LED?s.

Europe could get its entire 300 gigawatt power supply from solar plants in North Africa at current market prices.

Cars powered by wind generated electricity would bring fuel costs down to an equivalent 75 cents a gallon, as electric motors are three times more efficient than internal combustion engines.

While Brown?s predictions are a little extreme for many, they mesh perfectly with my own long term bullish cases for food and water plays. Take another look at the food sector ETF?s, (DBA) and (MOO), and the water space ETF?s (PHO) and (FIW).

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.