While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 22, 2016

Fiat Lux

Featured Trade:

(CALIFORNIA UPS ITS GAME AGAINST GLOBAL WARNING),

(PCG), (AAPL),

(TEN REASONS WHY BONDS WON?T CRASH),

(TLT), (TBT), (ELD), (MUB)

Pacific Gas & Electric Co. (PCG)

Apple Inc. (AAPL)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

WisdomTree Emerging Markets Lcl Dbt ETF (ELD)

iShares National Muni Bond (MUB)

California has raised the bar again in its relentless war on greenhouses gases.

Last week Governor Jerry Brown signed SB32 mandating that the Golden State reduce greenhouse gas emissions to 40% below 1990 levels by 2020. It is far and away the most ambitious such program anywhere in the world today.

I mention this because California is often the leader in groundbreaking legislation and technologies.

You know the national requirements for catalytic converters, safety glass, and seat belts for Detroit- manufactured cars? They all started here in CA. Your state, or country, won?t be far behind.

The bill is only the latest in a long line of attempts to halt global warming, which our Latin-speaking governor has made a hallmark of his administration.

Greenhouse gases have fallen by 9.5% since peaking in 2004 at 487.6 million metric tons. This has been largely due to the state?s three public utility companies closing the last of their coal burning power plants and shifting to cleaner burning natural gas. Improved car emissions and the rise of hybrid and electric vehicles have also helped.

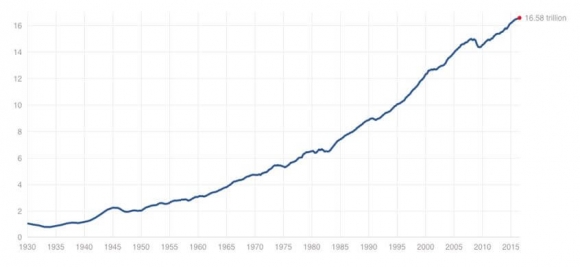

This reduction has been effected with minimal economic cost. The State?s GDP has risen by 19% over the same time period, and that includes the Great Recession of 2008-2009. US real GDP rose by 18.5% over the same period.

California also hosts the planet's strictest ?Cap and Trade? system, which was implemented in 2012. A carbon tax by any other name, Sacramento sets an annual limit on the amount of carbon dioxide that can be released into the atmosphere each year, which is cut annually.

It then requires businesses, like refineries and electric power utilities, to buy a permit for every ton of greenhouse gases they spew into the atmosphere. The floor price has most recently been set at $12.73 a ton. The money raised, some $4 billion so far, is then used to finance other greenhouse reduction policies.

A big beneficiary has been California?s troubled and long-delayed High Speed Rail project, a plan to build an electric bullet train from San Francisco to Los Angeles, and ultimately to San Diego and Las Vegas.

Who is the biggest buyer of these permits? My own local utility, Pacific Gas and Electric (PCG/PC), who I sell power to, generated by my own personal solar panel array. They get whatever my Tesla Model S-1 doesn?t use.

Permit sales ran smoothly for four years. However, the program has recently run into difficulties. In the spring of 2016, only 10.5% of the needed permits sold. Fears that the entire system might get upended in the courts caused buyers to back away.

The oil industry has cobbled together a coalition of carbon-based energy producers with the California Chamber of Commerce to end the program when it comes up for renewal in 2020. Brown has threatened to fight them by sponsoring a statewide initiative that would almost certainly pass in a future election.

California is the founder of the global anti emissions movement for good reason. During the 1960s, the smog in Los Angeles was so severe that you couldn?t see 100 yards.

It rivaled the choking smog found in Beijing today. ?Smog Alerts? were declared by health officials to keep children indoors, including me.

California also boasts the world?s most ambitious alternative energy targets, which must reach 33% of total power production by 2020, and 50% by 2030. Ample state and federal subsidies have been made available to make this happen.

Still, before you ask, they pale in comparison to the $55 billion a year in federal subsidies the oil industry received in the form of the oil depletion allowance.

It is no surprise then that San Francisco has become the epicenter of a global alternative energy industry, be it in solar, geothermal, batteries, other storage or biodiesel. Not only does the industry receive enthusiastic local support, but it knows it has an ample base of local consumers who will beta test and buy their new products and services.

Want an app that will locate the nearest charging station? No Problem!

Hardly a day goes by without a young Berkeley or Stanford engineering student asking me where to focus his career. My answer is always the same: stay away from biodiesel. It?s not scalable, and smells like you know what. The future is in solar.

Ultimately, it is energy consumers who end of footing the bill for all of this. It is estimated that Cap and Trade alone has added 11 cents to the cost of a gallon of gasoline for California drivers. It is financing an industry that, if successful, will ultimately put it out of business.

There are, in fact, so many conflicting and competing alternative energy and anti global warming programs and subsidies that it can get downright confusing.

So far, the state's weary taxpayers have been tolerant. But, if you are already driving a Tesla, Leaf, Bolt, BMWi, the soon-to-be Apple McLaren electric race car, or any of the other myriad low-end electric cars to come, who cares?

To read more on this topic, please read my exhaustive research by clicking here for ?How to Buy a Solar System? and here for ?The Ten Baggers in Solar Energy? .

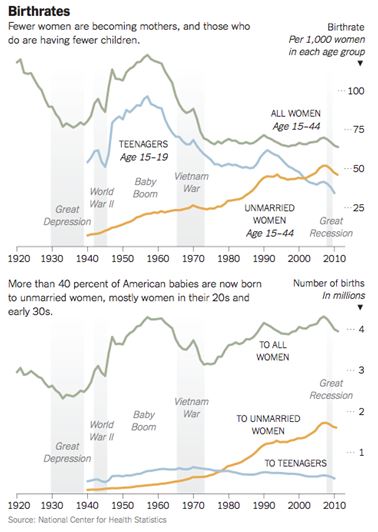

20 Years of California GDP Growth

Clean Power is the Way to Go

I have never been one to run with the pack.

I'm the guy who eternally marches to a different drummer, not in the next town, but the other hemisphere.

I would never want to join a club that would lower its standards so far that it would invite me as a member.

On those rare times when I do join the lemmings, I am punished severely.

Like everyone and his brother, his fraternity mate, and his long lost cousin, I thought bonds would fall this year and interest rates would rise.

After all, this is normally what you get in the seventh year of an economic recovery. This is usually when corporate America starts to expand capacity and borrow money with both hands, driving rates up.

Although I was wrong on the market direction, Treasury bonds have been one of my top performing asset classes this year. I used every spike in prices to buy (TLT) vertical put spreads $3-$5 in the money, and raked in profits almost every month.

Of course, looking back with laser-sharp 20/20 hindsight, it is so clear why fixed income securities of every description have been on a tear all year.

I will give you ten reasons why bonds won't crash. In fact, they may not reach a 3% yield for at least another five years.

?

1) The Federal Reserve is pushing on a string, attempting to force companies to increase hiring, keeping interest rates at artificially low levels.

My theory on why this isn?t working is that companies have become so efficient, thanks to hyper accelerating technology, that they don?t need humans anymore. They also don?t need to add capacity.

?2) The US Treasury wants low rates to finance America?s massive $19 trillion national debt. Move rates from 0% to 6% and you have an instant financial crisis.

3) With Japan and Europe in a currency price war and a race to the bottom, the world is sending its money to the US to chase higher interest rates. An appreciating greenback which is now at close to a five-year peak is also funneling more money into bonds.

The choices for ten-year government bonds are Japan at 0.4%, Germany at 0.0%,?Switzerland at a negative -0.48% and the US at 1.65%. It all makes our bonds look like a screaming bargain.

4) Since the 2009 peak, the US budget deficit has fallen the fastest in history, down 75% from $1.6 trillion to a mere $400 billion, and lower numbers beckon.

Obama?s tax hikes did a lot to shore up the nation?s balance sheet. A growing economy also throws off a ton more in tax revenues. As a result, the Treasury is issuing far fewer bonds, creating a shortage.

5) This recovery has been led by small ticket auto purchases, not big ticket home purchases. The last real estate crash is still too recent a memory for many traumatized buyers, at least for those few who can get a mortgage. This keeps loan demand weak, and interest rates at subterranean levels.

6) The Fed?s policy of using asset price inflation to spur the economy has been wildly successful. Bonds are included in these assets, and they have benefited the most.

7) New rules imposed by Dodd-Frank force institutional investors to hold much larger amounts of bonds than in the past.

8) The concentration of wealth with the top 1% also generates more bond purchases. It seems that once you become a billionaire, you become ultra conservative and only invest in safe fixed income products.

This is happening globally. For more on this, click here for ?The 1% and the Bond Market?.

9) Inflation? Come again? What?s that? Commodity, energy, precious metal, and food prices are disappearing up their own exhaust pipes. Industrial revolutions produce deflationary centuries, and we have just entered the third one in history (after no. 1, steam, and no. 2, electricity).

10) The psychological effects of the 2008-2009 crash were so frightening that many investors will never recover. That means more bond buying and less buying of all other assets. I can?t tell you how many investment advisors I know who have converted their practices to bond only ones.

Having said all of that, I am selling bonds short once again on the next substantial rally. Call me an ornery, stubborn, stupid old man.

But hey, even a blind squirrel finds an acorn sometimes.

Am I Stubborn or Just Plain Stupid?

Am I Stubborn or Just Plain Stupid?

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 21, 2016

Fiat Lux

Featured Trade:

(THE LEAGUE OF EXTRAORDINARY TRADERS),

(WFM), (COST),

(AMERICA?S DEMOGRAPHIC COLLAPSE AND YOUR STOCK PORTFOLIO),

(TESTIMONIAL)

Whole Foods Market, Inc. (WFM)

Costco Wholesale Corporation (COST)

I never cease to be impressed with the readers of this newsletter.

I was reminded of this once again at my luncheon in Portland, Oregon last week, held at the exclusive Ringside Fish House, a purveyor of the outstanding Pacific Northwest seafood for which the City of Roses is rightly proud.

Luncheon attendees seem to fall into three categories.

1) Entrepreneurs whose businesses have become so successful that they are throwing off plenty of excess cash to invest. This leads them to an online search (they are also technically very savvy) that brought them to my newsletter.

One of my Portland guests runs a manufacturing business that builds drones. In five years his gross revenues have rocketed from $400,000 a year to $40 million, and he says the best has yet to come. Two years ago, the Federal Aviation Administration predicted that there would be 1,500 drones in the air by 2020. Today, there are 220,000.

Interestingly, he says he is now besieged by constant foreign takeover offers. These are from European and Asian firms that have gone ex growth and are desperately searching for new profit streams at any cost. So far, he has rebuffed all comers.

2) Financial advisors who have been following my long-term macro and trading advice and who have also become very successful. Winning financial advisors always have new clients and cash coming which they need to know how to invest.

3) Young men and women in their twenties and thirties who dropped out of the mainstream economy and taught themselves to become professional full time traders. Perhaps several hundred earn a full time living just off of my own Trade Alerts. This business has taken a quantum leap with my introduction of the Mad Options Trader service.

My firsthand observations of the economy indicate that it is in no way performing at a suboptimal 2% GDP growth rate.

Airplanes going anywhere are all full. The airports are packed. The cost of overnight parking in San Francisco has risen by 50%. The free electric charging stations, of which there are now 50, are always full.

Mt favorite Pendleton store in Portland no longer has sales. It?s full price for everything everywhere now. People have plenty of money to spend.

Stores are stocking more expensive, higher margin profits, and offering imaginative displays.

Placing your goods on worn out industrial heavy machines is a popular approach in Portland. I spent more time analyzing the machines than the goods for sale.

The irony is rich.

Restaurants are more expensive too, and always full, and also making the grab for higher margins. They now offer food that is gluten free, locally grown, and ?artisanal?.

When I ordered a steak, I was informed that it was hormone and? preservative free. I asked if I could have one WITH hormones and preservatives, as they put hair on my chest and preserve me.

No wonder everyone thinks I?m weird.

Of course, the ultimate expression of this strategy can be found in Portland?s burgeoning marijuana industry.

Huge billboards along the freeways offer ?organic? pot by the kilo. It seems they too are seeking that 30% mark up that Whole Foods (WFM) and Costco (COST) reap from organic groceries.

Yet there is evidence too of the failed America, the people who got left behind. At one stoplight I encountered a family of four holding a big sign in the pouring rain pleading ?We need money?.

They had recently been evicted from their home. All had serious health problems and were morbidly obese. They looked legit. Maybe it was a health-care-induced bankruptcy?

I asked no questions, made no judgments and gave them $20. They reacted like they had won the lottery.

The country clearly is not perfect.

As a long term observer of America?s demographic picture, I was shocked to hear of a recent report from the US Census Bureau (click here for the website).

The US population grew by a scant 0.72% in 2012, the lowest since 1942.

You can?t start or expand a family when an essential partner in the process is off fighting WWII, and there were 17 million of them.

This is far below the 2.09% replacement rate that the country was holding on to only a few years ago.

At the end of 2012, there were 316,128,839 Americans. This accounts for 4.4% of the global population of 7,137,577,750, which was up 1.1%. If the growth rate remained the same, there are more than 317 million of us by now.

This places American population growth at the bottom of the international sweepstakes, down with Italy (0.32%), Germany (0.11%), and Poland (0.02%).

According to the World Bank, 22 countries suffered population declines, like Portugal (-0.29%) and Japan (-0.20%) (click here for the website).

The tiny Sultanate of Oman, one of my old stomping grounds as a military pilot, enjoys the planet?s highest growth rate at 9.13%.

The obvious cause here was the weakness of the US economy. There is a high correlation between economic health and fertility a year later.

So we can only hope that the modest improvement in the economy this year will send more to the maternity ward.

If it doesn?t, it could be great news for your investment portfolio. Fewer births today translate into a shortage of workers in 20 years. That brings rising wages, flying inflation, rapid price hikes, and a housing boom.

Corporate profits go through the roof, as does the stock market. It also produces fewer relying on government services in 40 years, which makes it easier for the government to balance the budget.

This Goldilocks scenario is already scheduled for the coming decade of the 2020s, when a 15-year demographic headwind flips to a tailwind, thanks to the coming demise of the ?baby boomer? generation, now a big cost to the economy.

The new data suggests that the next ?roaring twenties? could extend into the 2030?s and beyond.

California was the most populous state, with over 38 million, followed by Texas and New York. Two states saw population declines, Maine and West Virginia, where the collapse of the coal industry is sucking the life out of local businesses.

Parsing through the report, it is clear that prediction of population trends is becoming vastly more complicated, thanks to the increasingly minestrone-like makeup of the US people.

By 2040 no single group will be a majority. That is already the case in San Francisco, and will be true for the entire State of California by 2020.

America will come to resemble other, much smaller multiethnic societies, like Singapore, South Africa, England, Israel, and Switzerland. This explains much about the current state of politics in the US.

Texas saw the greatest increase in population, with a jump of 387,397, to 26,020,000, as people flock in to take advantage of the big increase in local government hiring there.

Some 80% of new Texans were Hispanic and Black, confirming my belief that the Lone Star State will become the next battleground in presidential elections.

This is why gerrymandering (redistricting) is such a big deal there, with the white establishment battling to hang on to power at any cost.

Further complicating any serious analysis is the rapid decline of the traditional American nuclear family where married parents live with their children.

With a vast concentration of wealth at the top, and a long-term decline of middle class standards of living, this is increasingly becoming a luxury reserved for a prosperous elite.

As a result, the country?s birthrate has declined by half since 1960.

Those who do procreate are having fewer kids, the average family size dropping from three to two. In 1964, the final year of the baby boom, 36% of Americans were under the age of 18.

Today, that figure is just 23.5%, and is expected to fall to 21% by 2050. Only 80% of women have children now, compared to 90% in the 1970s.

One possible explanation is that the cost of child rearing has soared to $241,080 per child now. Rocketing college costs are another barrier, with 70% of high school grads at least starting some higher education.

I was a bargain as a kid, costing my parents only a tenth of that. I went to Boy Scouts and Little League baseball, each of which cost $1 a month. A full scholarship covered by college expenses.

When I look at the checks I have written for my own children for ski lessons, soccer, youth sailing, braces, international travel and assorted masters degrees, I recoil in horror.

Fewer women are following that old adage of ?marriage before carriage.? Some 41% of children are born out of wedlock, up 400% in 40 years.

It is definitely an education and class driven divide. Only 10% of college-educated mothers are still single, compared to 57% for those with a high school education or less.

It is a truism in the science of demographics that educated women have fewer children. It makes possible careers that enable them to bring home paychecks instead of babies.

Blame Roe versus Wade, the Equal Rights Act, and Title Nine, but every social reform benefiting women of the past half century has helped send the birthrate plummeting.

More women wearing the pants in the family hurts the fertility rate as well, as they are unable, or unwilling, to bear the large families of yore. The share of families where women are the primary breadwinners has leapt from 11% to 40% since 1960.

When couples do marry, they are sometimes of the same sex, now that gay marriage is legal in 16 states, further muddying traditional data sources. Some 2 million children are now being raised by gay parents. In fact, there is a gay baby boom underway, which those in the community call the ?gayby? boom.?

All female couples have produced one million children over the last 30 years, 95% of whom select blond haired, blue eyed, Aryan sperm donors who are over six feet tall ($40 a shot for donors if you guys are interested and live walking distance from UC Berkeley. I?m told that water polo players are particularly favored).

The numbers are so large that it is impacting the makeup of the US population.

There was a time when I could usually identify the people standing next to me on San Francisco BART trains. That time has long passed. Now I don?t have a clue.

Whenever we go to war, we become our enemy to a modest degree, both as a people and a culture.

After WWII, 50,000 German and 50,000 Japanese wives were brought home as war brides. Sushi, hot tubs and Volkswagens quickly followed.

The problem is that the US has invaded another 20 countries since 1945, and is now maintaining a military presence in 140. That generates a hell of a lot of green cards.

This has spawned sizable Korean, and later, Iranian communities in Los Angeles, a Vietnamese one in Louisiana, a Somali enclave in Minneapolis, and a large minority of Afghans in San Jose.

The fall of the Soviet Union in 1992 unleashed another dozen Eastern European ethnic groups and languages on the US. Have you noticed the proliferation of Arab fast food restaurants in your neighborhood since we sent 20 divisions to the Middle East?

What all this means is that the grand experiment called the United States is entering a new phase.

Different ethnic, racial, religious, and even political groups are blending with each other to create a population unseen in the history of the world, with untold economic consequences. It is also setting up an example for other countries to follow.

Get

your investment portfolio out in front of it, and you could prosper mightily.

Ignore Demographics at Your Portfolio?s Peril

Ignore Demographics at Your Portfolio?s Peril

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.